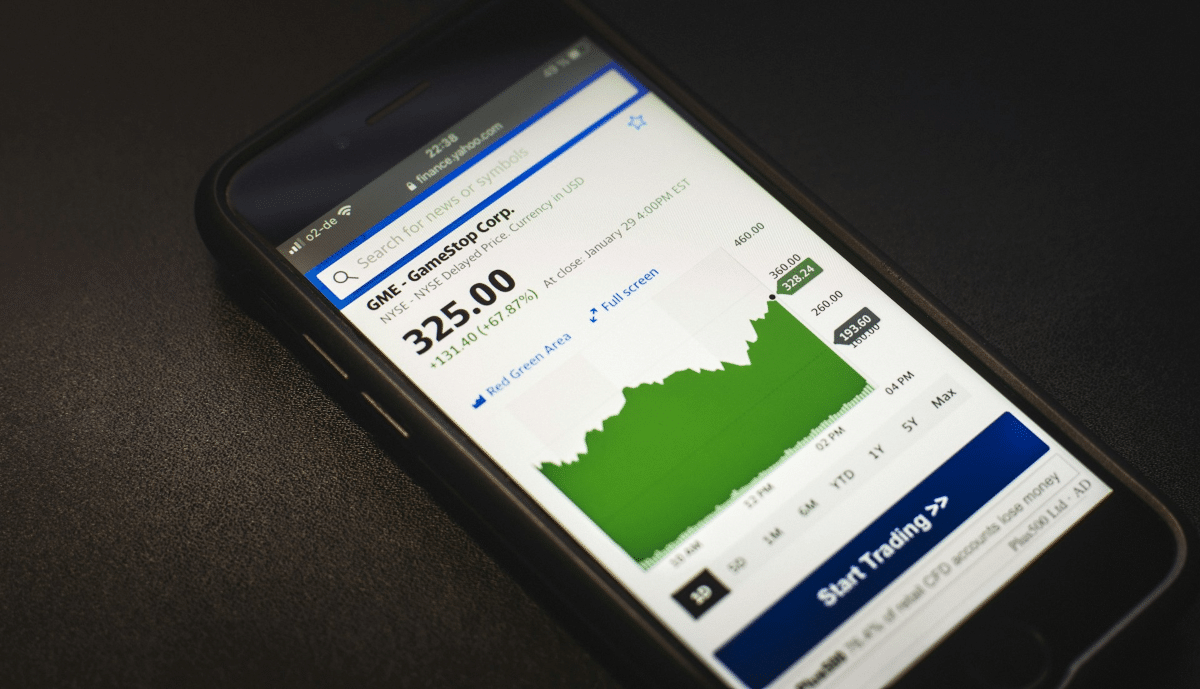

While GameStop stock (NYSE: GME) fell nearly 2% yesterday, the popular meme stock rose for the previous seven consecutive trading sessions. It was the best seven-day stretch for GME since June and the stock rose to the highest price level in a month.

Meme stocks like GameStop often trade based on sentiments and market rumors rather than fundamental factors. Here’s what’s been happening with GME and other meme stocks and what Keith Gill, the former Reddit trader known as “Roaring Kitty” and “DeepFu*kingValue is up to.

Roaring Kitty Might Have Sold GameStop Shares to Buy Chewy

Gill provides irregular updates about his portfolio to his followers on Reddit and the most recent update in mid-June showed that he held $268 million in his account, aided by the rise in GameStop shares.

He latest disclosed owning 9,001,000 shares of Chewy in a regulatory filing which is the same number of shares that he held in GameStop. Most believe that he liquidated his holdings in GameStop to buy a 6.6% stake in Chewy which made him the largest individual shareholder in the ecommerce pet care company.

As expected, Chewy stock soared after Roaring Kitty tweeted about the stock. The rise in Chewy stock turned into a boon for the company’s biggest shareholder BC Partners which sold 17.6 million shares to Chewy for $500 million in June, at $28.49 per share.

The company has also sold shares in the open market amid the rally following the disclosure of Roaring Kitty’s stake. Notably, GameStop’s CEO Ryan Cohen founded Chewy and sold it to PetSmart for $3.35 billion in 2017. However, BC Partners, which is the company’s biggest shareholder, split them in 2020.

Chewy stock peaked at nearly $30 towards the end of June a few days after Roaring Kitty posted a picture of a puppy on X (formerly Twitter) and has since come off its highs. The stock fell subsequently but it has since rebounded amid the rally in meme shares.

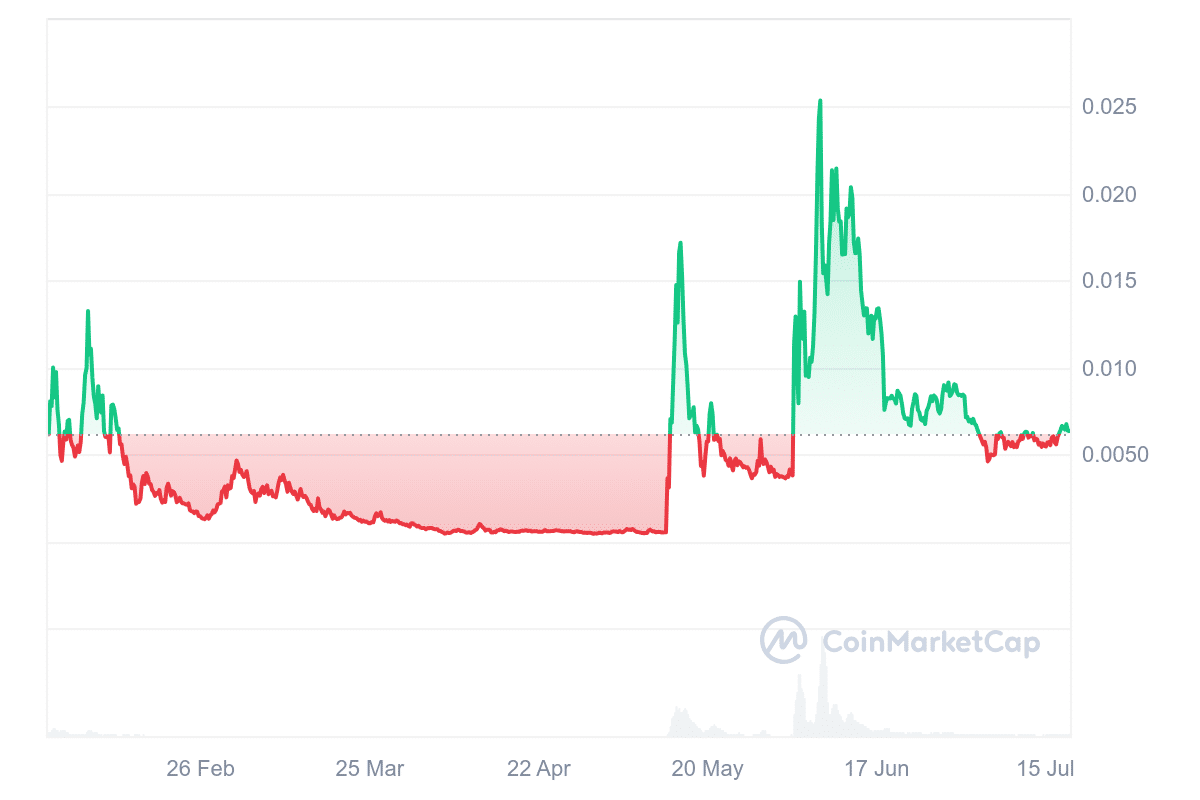

GameStop Crypto Has Also Seen Brief Rallies

Meanwhile, GameStop crypto, which is not officially linked to the company, has not mimicked GameStop’s returns and has lost nearly a fifth of its value over the last month.

The GameStop meme coin was launched in January 2024, amid the Solana meme coin mania and was one of the most successful meme coin launches. While it pared gains subsequently it saw rallies in May and June which coincided with the euphoria in GME stock.

https://twitter.com/ryancohen/status/1812259501665648873

What’s Driving the Rally in GME Stock?

There looks a renewed interest in meme stocks amid growing optimism towards a September Fed rate cut. Also, traders now seem increasingly confident of Donald Trump’s return to the White House. Incidentally, Cohen endorsed the former President after the assassination attempt earlier this month.

Notably, Trump’s TMTG (Trump Media and Technology Group), the parent company of Truth Social, is among the leading meme stocks now and the company which makes little revenue but loses millions of dollars every quarter also soared after the assignation attempt. It could also be possible that Roaring Kitty is again getting active in the stock. Finally, some retail traders might be finding it worthwhile to buy the dip in GME – especially those who missed out on the previous meme stock rallies.

All said, while some retail traders (and perhaps Cohen) find value in GameStop stock, the analyst community is not convinced.

Analysts Are Quite Bearish on GME Stock

GME’s core gaming retail business is facing structural headwinds and while Cohen hired several tech executives – some of whom have either quit or have been asked to leave – GME is far from becoming a true tech company (and attracting those valuations.)

Many if not analysts don’t even try to put a price target on stocks like GameStop, simply because they are too volatile and influenced by so many outside factors. The apathy is mutual as GameStop has also stopped taking analyst questions during the earnings calls. Wedbush, one of the only firms to rate GME, has a “sell” rating on the gaming retailer.

https://Twitter.com/mukund/status/1800898709603185015

Wedbush in fact recently cut GameStop’s target price from $13.50 to $11. Analyst Michael Pachter doubts the company would be able to turn profitable, citing its $6 million loss last year.

In his note, Pachter said, “We expect them to lose $100 million a year going forward. It’s a race to see if they can close stores fast enough to limit losses, but they have no plan that would suggest they can grow revenues or profits, and their core business is in decline.”

To be sure, there is little denying GameStop’s precarious financials. The company reported a net loss of $32.3 million in the first quarter of 2024 while its revenues fell nearly 29% to $882 million.

It Is Tough to Justify GME’s Valuations

It is hard to justify GameStop’s nearly $10 billion valuation in light of its financials and the bearish forecast for its core gaming retail business. However, when sentiments take precedence over fundamentals, stock prices can trade considerably higher (as well as lower) than their intrinsic value.

GameStop meanwhile seems to be making the most of the rally and has raised over $3.1 billion through two at-the-market stock offerings amid the rally this year. Notably, GameStop did not have any real requirement to raise money, and it has negative net debt (more cash than debt) on its balance sheet – thanks to its stock sales during the meme stock mania of 2020-2021.

GameStop raked in billions selling its seemingly overpriced shares even as it had no stated need. But we shouldn’t be blaming the company as it’s quite prudent to sell shares at inflated prices – just as it is a good strategy to repurchase them when they trade at depressed levels.

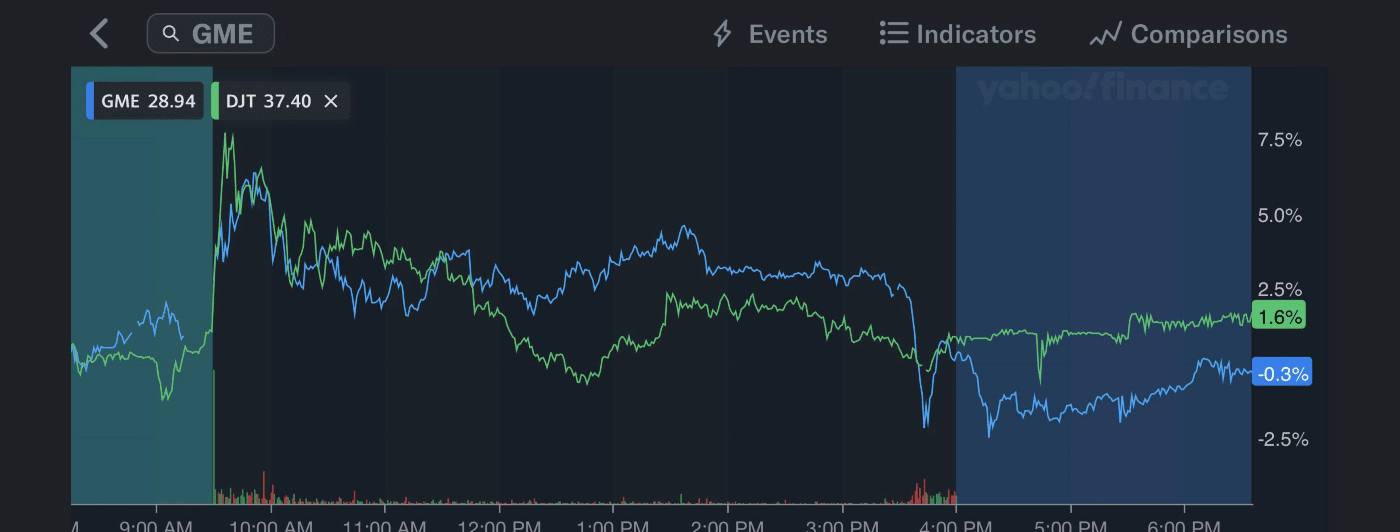

Reddit Traders See GameStop Stock Running Higher

Meanwhile, Reddit traders see the rally in GameStop shares continuing and many predict the stock will hit $30 this week. Traders also discussed Cohen endorsing Trump and one even shared the price action of Trump’s TMTG (NYSE: DJT) and GME which seem to mimic each other. GameStop stock however opened in the red today as the meme stock rally seems to be fading away once again.