“Roaring Kitty,” the world-famous investor whose legal name is Keith Gill, has been all over news headlines ever since the recent spike in meme stocks began in May. Gill has disclosed massive positions in GameStop (NYSE: GME) and Chewy (NYSE: CHWY) which showed that he held significant stakes in both publicly traded companies and is currently the third biggest shareholder of Chewy.

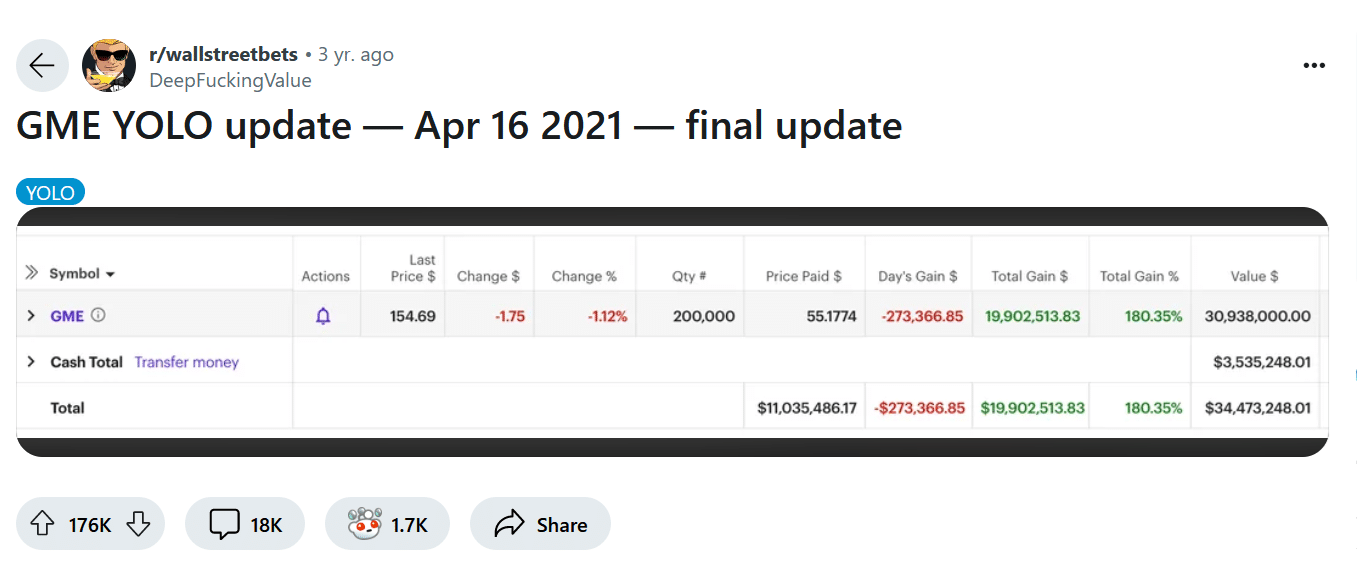

Keith previously worked as the director of education and wellness at a subsidiary of MassMutual and publicly disclosed a $53,000 stake in GameStop in September 2019. GME shares took off over the next two years year and the value of Gill’s holdings swelled to $34 million in April 2021, per the screenshots shared on Reddit.

We don’t know for sure whether he sold his shares in April 2021, but even if he held those shares until June when GME stock peaked, their value would be around $60 million.

Roaring Kitty’s Net Worth Has Exploded

Roaring Kitty’s net worth has exploded and the Chewy stake is valued at around $230 million. The steep rise in Roaring Kitty’s stock holdings has left some analysts scratching their heads over the source of Roaring Kitty’s funds.

Veteran short-seller CarsonBlock perhaps best summed up in his podcast last month, “The question is, where did that guy get that money from?”

For instance, even if he sold GameStop shares at their 2021 peak, he would have needed to quadruple the money to buy the Chewy stake. According to Block, while it is possible, “It sort of defies the odds.”

Roaring Kitty Provides Irregular Updates On His Portfolio

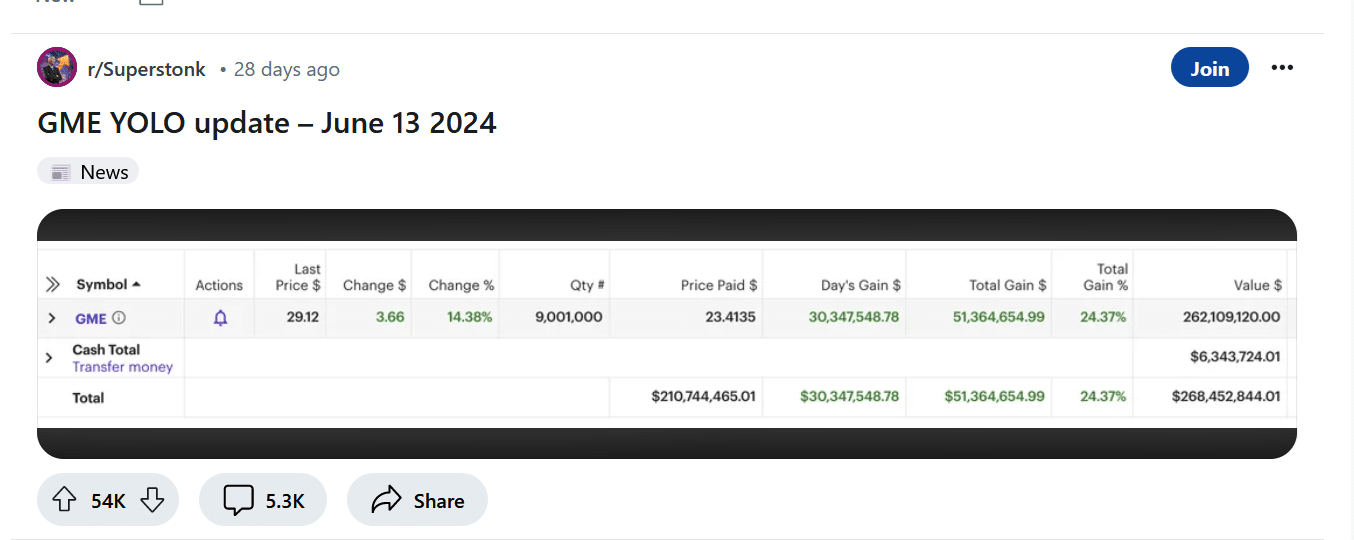

We don’t have a lot of information about Roaring Kitty’s financials. He provides irregular updates about his portfolio to his followers on Reddit and the most recent update in mid-June showed that he held $268 million in his account, aided by the rise in GameStop shares.

He hasn’t updated his followers on whether he continues to hold GameStop shares or not. However, most believe that he liquidated his holdings in GameStop to buy a 6.6% stake in Chewy which made him the largest individual shareholder in the pet care company.

Incidentally, he disclosed owning 9,001,000 shares of Chewy which is the same number of shares that he held in GameStop.

Where Did Roaring Kitty Get So Much Money?

Since we don’t know the source of Roaring Kitty’s funds, we can only build some hypotheses on how he has built a portfolio of at least $250 million.

- Smart Trading: Roaring Kitty publicly disclosed holdings worth $34 million in GameStop in April. He could have managed to grow his wealth through smart trading in any of the asset classes including stocks and cryptocurrencies. Both these asset classes have been quite volatile since then providing ample profit-making opportunities for traders. However, he would have needed luck on his side to grow his money at least fourfold – assuming he sold GameStop at the peak in 2021.

- Borrowed Money: Despite the Fed raising rates to multi-year highs, there is still no dearth of liquidity in financial markets and Roaring Kitty could have borrowed these funds from a non-bank institution as getting them through banks looks nearly impossible. As Peter W. Atwater, an economics professor at William & Mary in Williamsburg, Virginia said, “It wouldn’t surprise me that there are people eager to give him capital.”

- Financing By an Individual or Group: Some individuals or a group might also have financed Roaring Kitty’s portfolio. Block believes it could be a possibility and said, “There’s something on the back end here that enabled him to access that kind of cash.” In his podcast, he said, that there is “speculation that somehow or another Ryan Cohen was able to provide money to him.” Notably, Cohen is linked to both GameStop and Chewy. While his RC Ventures is the biggest shareholder of GameStop and Cohen is the company’s CEO, he co-founded and later sold Chewy.

- A Combination: There could also be a combination of the above and Roaring Kitty might have pooled his own funds with borrowed money to build a multi-million stake in Chewy.

Was the Rally in GameStop Stock Organic?

To be sure, some analysts doubt whether the rally in GameStop was organic after all. As investors would recall the rally in GameStop shares began after a cryptic tweet from “Roaring Kitty,” which seemed to suggest he’s again getting active in the stock.

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

In his note, Interactive Brokers market strategist Steve Sosnick highlighted that prior to Roaring Kitty’s tweet, there was a massive open interest build-up in deep out-of-the-money call options on GME.

While the volumes in deep out-of-the-money options are typically low, Sosnick’s analysis shows that towards the end of April, there was a massive buying in $25 and $30 calls on GME which were set to expire on May 17.

The only way anyone buying these calls would have made money was if GME stock – which was trading at just above $11 towards the end of April – rose steeply.

Clearly, someone made an extremely risky bet that GME was set to explode before May 17, and that’s exactly what happened.

In his note, Sosnick said, “A suspicious person might wonder why “Roaring Kitty” chose to return to social media today. Given my past experience in analyzing the periodic bouts of meme stock activity, consider me suspicious.”

GameStop Has Capitalized on the Rally

Meanwhile, even as markets debate how Roaring Kitty got the money to build his massive Chewy stake and whether the rally in GameStop was organic – we know for sure that the biggest beneficiary of the rally in GameStop was the company itself.

GameStop has raised over $3.1 billion through two at-the-market stock offerings amid the rally this year. Notably, GameStop did not have any real requirement to raise money, and it has negative net debt (more cash than debt) on its balance sheet – thanks to its stock sales during the meme stock mania of 2020-2021.

GameStop raked in billions selling its seemingly overpriced shares even as it had no stated need. But we shouldn’t be blaming the company as it’s quite prudent to sell shares at inflated prices – just as it is a good strategy to repurchase them when they trade at depressed levels.