GameStop has once again made the headlines and, yet again, it is not because its business model is pivoting, changing, or improving in any meaningful way.

The reason GameStop (GME) is trending right now is that a well-known retail trader named Keith Gill, known as DeepF*ckingValue and Roaring Kitty, has made a huge bet on the company’s stock. This has led to another speculative surge for GME and has drawn criticism from institutional investors and industry experts who think his actions might be seen as market manipulation.

Roaring Kitty Reveals Massive Options Bet on GME

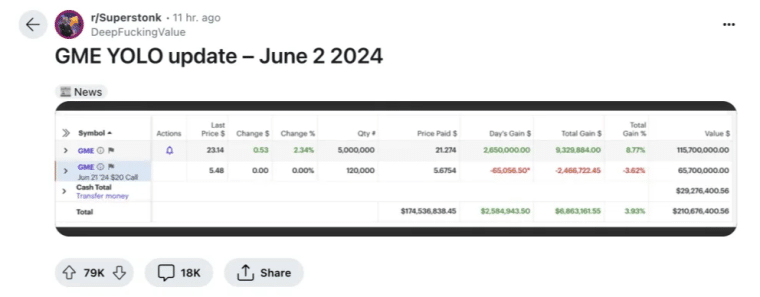

Last Sunday, Gill shared a screenshot of his E*Trade account revealing the positions he had in the well-known meme stock for the first time. Based on the information from his account on a Reddit forum called “Supestonk,” Gill is said to own around 5 million GME shares and 120,000 call options that expire in June 2021 with a strike price of $20.

The stock position was valued at the time of his screenshot (June 2) as much as $115.7 million including an accumulated gain of $9.33 million. Meanwhile, the options trade was worth $65.7 million including a $2.5 million temporary loss.

As expected, the day after Gill shared his position, GME stock skyrocketed to over $40 per share, although it ended up setting much lower at $28 apiece for a 21% single-day gain. For Gill, this uptick resulted in single-day profits exceeding $26 million on his stock holdings alone and in a staggering $36 million gain on the position.

Meanwhile, it also pushed the options contracts to in-the-money territory, meaning that they could exercised in exchange for 12 million GME stock that, if sold at $28 per share, would have produced total proceeds of $336 million.

Considering that Gill paid just $68.1 million for the 120,000 contracts he held, his net profits on these options would be more than $260 million.

Quite a handsome payoff for just posting cryptic images on social media, eh? However, for some, Gill’s actions can be considered plain-old market manipulation and he may have entered the crosshairs of regulators with his recent comments.

GME Stock is Behaving Erratically Based on Gill’s Comments – A 2021 Flashback?

This recent uptick can be compared to what happened to GME stock in 2021 when Gill shared his investment thesis on the popular Reddit forum WallStreetBets and managed to attract the support of thousands of retail traders who went on to speculative option trades that pushed the value of GME far beyond all-time highs.

Also read: Roaring Kitty is Back and Meme Stocks Are Surging

Gill’s initial position back then was worth around $50,000 but it was propelled to around $50 million just days after amid the short-squeeze that his comments – including the famous “I like the stock” remark – accomplished.

Allegations of Market Manipulation Start to Emerge

However, Gill’s triumphant return is not free of controversy. The Massachusetts Secretary of State’s Office confirmed on Tuesday that it has opened an investigation into Gill’s trading practices. This isn’t the first time that Gill has been under scrutiny as he was also investigated three years ago when he was working with Mass Mutual.

The investigation comes in response to concerns about potential market manipulation. On Monday, The Wall Street Journal reported that E-Trade, the Morgan Stanley-owned brokerage firm that Gill uses to hold his GME positions, is holding internal talks about whether to ban him from the platform. Their concern is that his posts, which can dramatically affect the GME stock price, might be considered market manipulation by regulators.

Steve Sosnick, Interactive Brokers chief strategist, warned investors against chasing the rally. “Is whoever controlling this account doing this in your best interest or in their best interest? And, really, you should think that one through because, to me, it [is] pretty obvious whose interest it’s in,” Sosnick told Yahoo Finance during an interview that took place yesterday.

“If you’re chasing the stock up here, you’re more likely than not the source of liquidity for whoever is controlling this account to sell into your enthusiasm.”

Meanwhile, the well-known short-seller Citron Research slammed Gill’s actions and said that they appeared to be “more like manipulation without a solid thesis.”

Short-Seller Firm Citron Research Clarifies that Gill’s Actions are Not Necessarily Illegal

Citron also commented that they believe Gill is operating in partnership with somebody else as they don’t think he has the financial resources to make a trade of that size alone. “His reported finances don’t support this trade. Investors will see through this roaring Icarus,” the firm posted on the social media platform X on Monday.

However, a maybe upon reflecting a little bit more on Gill’s actions, Citron Research analysts acknowledge that they don’t believe his actions are illegal. They emphasize that, as long as Gill “does not have MNPI”, which is an acronym for “Material Nonpublic Information”, he has the right “to make a large bet and tell everyone.”

For the record, I don't think anything Kitty did was illegal. However, I believe he and his associates overstate their importance in the market and overlook that the market dynamics and structure of $GME have changed since January 2021.

Back then, he bought the stock at $2 when…

— Citron Research (@CitronResearch) June 4, 2024

Citron and other short-seller firms like Hindenburg Research operate similarly to Roaring Kitty and often do things that are perhaps closer to market manipulation that Gill’s tweets. The general strategy is to publish research reports that always happen to be extremely scathing about companies that they believe are grossly overvalued and take short positions on them before posting their analyses.

They have made millions out of exposing businesses whose practices and claims are either false or misleading. For example, Hindenburg exposed the deceits used by the Nikola Corporation and its infamous Chief Executive Officer, Trevor Milton, to mislead investors back in 2020.

Also read: Was This GME Rally Organic? Suspicious Options Trades Suggest Big Money Involvement

As a result, the stock price of Nikola fell from $50 to $20 in just a matter of weeks shortly after Hindenburg’s reports were publicized and the company cashed in on this drop.

The Scale of Gill’s Position Complicates Things

Market analysts have highlighted that Gill’s trade is quite reckless and that these are the kind of moves that the most successful players in the investment field make to build their wealth.

According to Michael Khouw, co-founder and chief strategist at OpenInterest.PRO, Gill’s millionaire options trade is something that only people who are “out of their minds” do.

“You have to be made of something different to trade like that. You would never see a professional trader make those kinds of numbers,” he stressed.

Meanwhile, CC Lagator, the co-founder of Options AI, emphasized that Roaring Kitty may face difficulties offloading his sizable options trade as the size of the positions may single-handedly depress the price of GME stock.

“The issue on a position of that size is, it would be very apparent to other market participants that those calls or stock versus those calls was being sold, putting a lot of pressure on the stock,” he told CNBC on Tuesday.

Gill Has a Few Decisions to Make Down the Road to Cash In On His Position

— Roaring Kitty (@TheRoaringKitty) June 3, 2024

If Gill exercises his call options, he would own an additional 12 million shares, bringing his total GME equity holdings to 17 million common shares.

This would make him the fourth-biggest shareholder in GameStop behind only Vanguard, BlackRock, and Ryan Cohen’s RC Ventures. Based on yesterday’s closing price of $26.5 per share, his GME holdings – including the shares that he would get if he exercised the options – are worth over $450 million.

However, if GME stock keeps rising to its most recent peak of nearly $65 per share, those same holdings would instantly make Keith Gill a billionaire as his GME position would be worth $1.1 billion.

Gill could also choose to roll his call options to a further expiration date, buying more time. However, this strategy comes with its own risks.

“The problem with that is he’s going to be wasting money on new option premium each time he does that,” Lagator explained.

Roaring Kitty has some tough choices ahead if he wants to make the most out of this life-changing investment as he cannot put the market against the wall and prompt a sell-off by dumping all of his shares and options at once.

Is Somebody Pulling the Strings and Reaping the Rewards of the GME Rally?

Throughout this saga, GameStop has been more than just a passive player. The company has actively capitalized on the renewed interest in its stock. Last month, following the rally sparked by Gill’s return to social media platforms, GameStop sold 45 million shares in the open market, raising approximately $930 million in proceeds.

Typically, when a company issues new shares, it dilutes the value of current holdings, often leading to a decline in its stock price. However, in the case of GameStop and other meme stocks like AMC, the opposite has occurred. Even after diluting their shares, these companies have seen their stock prices continue to rise.

Citron alleges that someone is backing Keith Gill, saying that he does not have the financial power to pull this off. Let’s say that’s the case. Could GameStop or Ryan Cohen be behind the curtains pulling the strings and using Gill’s influence to prop up the share price to cash in on the hype? Or is it perhaps a totally separate institution or investor just trying to make a life-changing gamble?

This is all just mere speculation, but GameStop was certainly prepared to dump millions of shares right after the stock hit a ceiling. With hundreds of millions on the table, a lot may be going on behind the scenes that we are not aware of.

Only time and regulators’ investigations may eventually tell the whole story.