Companies across the spectrum are using artificial intelligence (AI) in their products and services. Joining the bandwagon is streaming giant Netflix (NYSE: NFLX), which plans to start showing AI-generated ads in 2026. While the move could help Netflix grow its advertising revenues, many fear that it could spoil the viewing experience.

Netflix plans to blend ads with the content that the viewer is watching, which would make them feel less like an ad and more like regular content. At Netflix’s recent Upfront event for its advertisers, Netflix’s president of advertising, Amy Reinhard, showcased the feature for interactive midroll and pause ads, which would use generative AI to make the ads customizable.

“When you compare us to our competitors, attention starts higher and ends much higher. Even more impressive, members pay as much attention to mid-roll ads as they do to the shows and movies themselves,” said Reinhard.

She added, “So, if you take away anything from today, I hope it’s this: the foundation of our ads business is in place,” while emphasizing, “And going forward, the pace of progress is going to be even faster.”

Netflix will introduce AI-generated interactive mid-roll and pause ads to its ad-supported plan in 2026.

It aims to create a “better, more relevant” experience for its members. pic.twitter.com/1kfwMdIiZy

— Pop Crave (@PopCrave) May 16, 2025

Netflix Sees Strong Growth in Its Ad Business

While ads are still not a big driver of Netflix’s profits, the company expects it to contribute significantly in coming years, predicting ad revenues to double this year. Netflix has been looking to customize its ads and during the Q1 2025 earnings call last month, an analyst asked whether the company has worked in making its ads as personalized as the content on its platform.

In response to that question, co-CEO Ted Sarandos said that while the company hasn’t yet solved that problem, it is working on it. He added, “We do have an ambition to achieve that same level of sophistication and maturity capability that we did on the personalized recommendations.” He added, “So that means, you know, matching the right ad, with the right audience, the right viewer, and the right title.” If Netflix is able to achieve such advanced personalization, its ad revenues could skyrocket.

According to Sarandos, “And we think putting those three things together drives superior campaign outcomes for advertisers. We think it is a better experience for members so it is win-win.”

Netflix Launched Ad Supported Plan in 2022

Netflix, which spoke against ads on streaming platforms for many years, launched an ad-supported tier at $6.99 in North America in November 2022, which it raised to $7.99 earlier this year. The launch of the ad-supported tier was quite a U-turn for the company but was preceded by a fall in streaming subscribers in the first half of 2022. Along with the launch of the ad-supported tier, Netflix also cracked down on password sharing in many regions.

The company estimated that around 100 million households viewed its content through borrowed passwords and gave them the option of paid sharing. These strategies worked wonders for Netflix, and it added more than 41 million subscribers in 2024, ending the year with over 300 million subscribers.

Going forward, Netflix won’t provide quarterly subscriber numbers, but earlier this month, the company disclosed that it has 94 million subscribers on the ad-supported plan, which is over twice what it had at the same time last year.

Most Streamers Now Offer Ad-Supported Plan

While streaming was once the bastion of ad-free TV and movies, it’s not anymore. Streamers across the board are adding ad-supported tiers to provide cheaper options and boost profits. Leading streaming platforms like Disney, Amazon, and Discovery have gradually added ad-supported tiers. Streaming companies offer these plans at a sharp discount to their ad-free plans, which helps them cater to those subscribers who might not otherwise buy the higher-priced ad-free tier.

Netflix, for instance rejigged its subscription tiers and its cheapest ad-free tier in the US is priced at $17.99 a month which is $10 higher than the ad-supported tier. While ads spoil the viewing experience and somewhat blur the line between streaming and linear TV, for streaming companies it is emerging as an attractive source of revenues especially as the penetration of streaming reaches near peak levels in many markets.

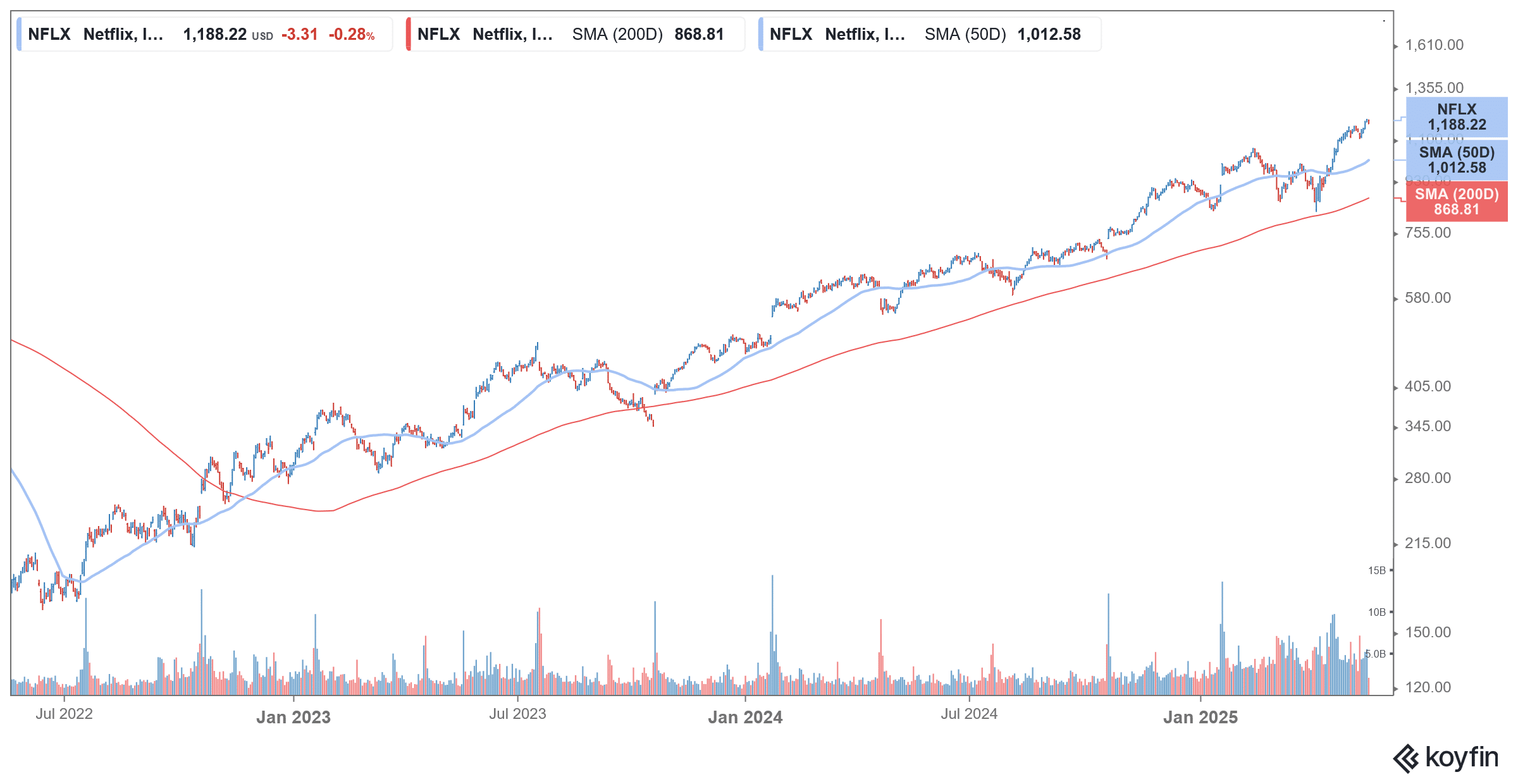

NFLX Stock Has Soared in 2025

Meanwhile, while the broader markets have whipsawed in 2025, and at one point, all constituents of the so-called “Magnificent 7” were in the red for the year, Netflix has been a steady performer and is outperforming the S&P 500 Index.

The company beat on both the topline and bottomline in Q1 2025 and gave quite an upbeat commentary on its outlook. During the earnings call, responding to queries on whether the uncertain macro environment has impacted Netflix, co-CEO Greg Peters said, “based on what we are seeing by actually operating the business right now, there is nothing really significant to note.”

He added, “Stepping back, we also take some comfort in the fact that entertainment historically has been pretty resilient in tougher economic times. Netflix specifically has also been generally quite resilient, and we have not seen any major impacts during those tougher times, albeit, of course, over a much shorter history.”

Peters stressed that its low-cost ad-supported plans make it even immune to economic downturn.

JPMorgan Downgrades Netflix Stock

However, after Netflix’s strong YTD performance, some analysts are turning cautious. Today, JPMorgan downgraded NFLX from “overweight” to “neutral” while raising its target price from $1,150 to $1,220. While the brokerage is constructive on Netflix’s long-term outlook, it sees the near-term risk-reward as quite balanced.

Notably, after the stellar rally over the last couple of years, Netflix’s valuation multiples have expanded and it now trades at a next 12-month (NTM) P/E multiple of around 45x which is much higher than other streaming companies.