Berkshire Hathaway, led by the legendary investor Warren Buffett, released its 13F for Q2 yesterday after the markets closed. Here we’ll discuss the various stocks that the conglomerate bought and sold in the quarter.

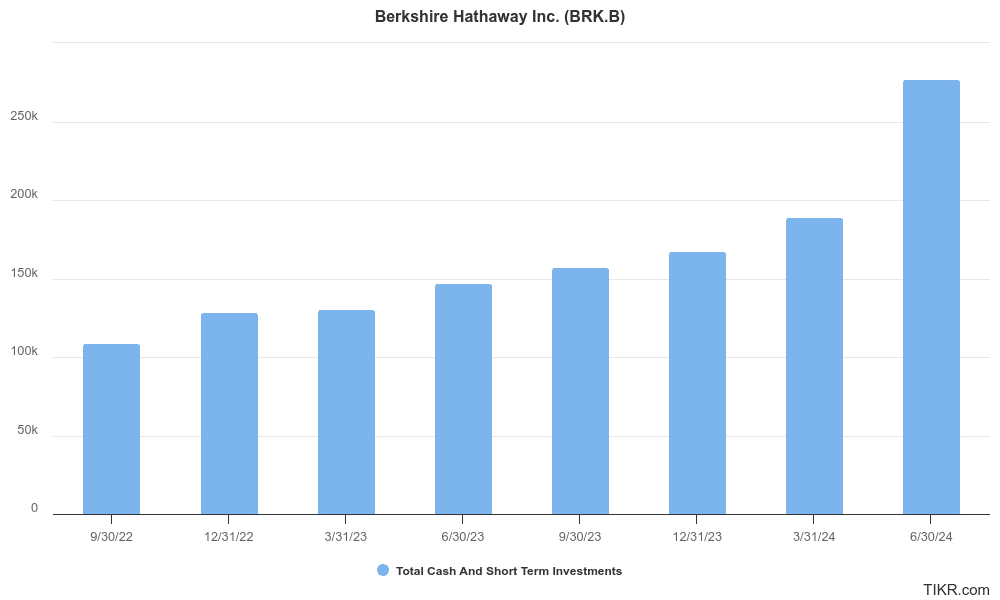

Berkshire’s Q2 13F filing would have been a lot more surprising if not for the previously disclosed selling of Apple shares. Buffett has been gradually selling Apple shares and cut its stake by almost half in Q2. The “Oracle of Omaha” has been a net seller of stocks for seven consecutive quarters and Berkshire is now sitting on a mammoth cash pile of $277 billion.

Warren Buffett’s Berkshire Bought Ulta Beauty and Heico Shares

Berkshire’s 13F filings showed that the conglomerate added more shares of Occidental Petroleum in Q2. In 2019, Buffett invested $10 billion in Occidental Petroleum to finance its acquisition of Anadarko Petroleum and has since been raising the stake in the company. Berkshire has the regulatory approval to increase its stake in Occidental to 50%. Berkshire also upped stakes in Sirius XM during the quarter.

Buffett increased its stake in property and casualty insurer Chubb by 4% too. With a stake worth $6.9 billion, it was the ninth biggest holding for Berkshire. Notably, Buffett was confidentially building a stake in the Bermuda-based company and only disclosed the stake in May 2024 when Berkshire released its 13F for Q1. It is usual for Buffett to gradually increase the stakes in companies after taking the initial position – just as he did with Apple, eventually making it Berkshire’s biggest holding by a wide margin.

🚨 BREAKING: Buffett just updated his holdings

Along with reducing his Apple $AAPL stake of almost 50%, he added two new positions:

Ultra Beauty $ULTA – $266M shares

Heico $HEI – $185M shares pic.twitter.com/zHSR1WvqFX— Warren Buffett Stock Tracker (@BuffetTracker) August 14, 2024

Meanwhile, the two big surprises in Berkshire’s Q2 13F were the new stakes in Ulta Beauty and Heico. However, the relatively small size of the stakes – $266 million in Ulta Beauty and $186 million in Heico – seems to suggest that the purchases were not made by Buffett but by a different asset manager.

Apart from Buffett and his now-deceased partner Charlie Munger, Ted Weschler and Todd Combs – who are collectively also known as “Ted & Todd” manage around $15 billion each at Berkshire.

What do Analysts Say About Berkshire’s Latest Purchases?

Ulta Beauty stock has underperformed the markets in 2024 and has lost almost a third in value YTD based on yesterday’s closing prices. The company’s CEO Dave Kimbell warned of a slowdown earlier this year. Ulta Beauty’s comparable sales growth rose a mere 1.6% YoY in the fiscal first quarter which is reflective of the slowdown and higher competition that the company is battling with.

“We are not satisfied with our market share trends and we’re taking actions to reinforce our leadership position and accelerate growth,” said Kimbell as Ulta Beauty lowered its full-year earnings forecast after tepid Q1 earnings. Piper Sandler analyst Korrine Wolfmeyer believes that rising competition would hit Ulta Beauty’s margins.

Ulta Beauty stock has a “buy” or equivalent rating from only 10 of the 18 analysts covering the stock but its average target price of $467.82 is 42% higher than yesterday’s closing prices. The stock trades at a next 12-month (NTM) PE multiple of only 12.5x which could have attracted Berkshire towards the beauty product company.

As for Heico, it has a “buy” rating from nine of the 11 analysts covering the stock but its average target price of $239.64 is only 1.2% higher than yesterday’s closing prices. While Ulta Beauty stock is up sharply today, Heico’s price action is relatively muted.

The company makes products for aircraft, spacecraft, and defense equipment. Incidentally, in 2016, Buffett acquired aircraft component maker Precision Castparts for a whopping $32.1 billion. However, in 2021, Berkshire wrote down the company’s valuation by $10 billion.

Berkshire Trimmed Stakes in Many Companies

Meanwhile, Berkshire trimmed stakes in several companies apart from Apple which has got outsized attention to the sheer size of the stake sake.

At the shareholder meeting earlier this year, Buffett hinted that he is selling Apple shares for tax reasons. Notably, the company made massive gains on its Apple investment and would need to foot a big tax bill while selling the shares.

Buffett implied that he wants to avoid a higher tax bill in the future if tax rates go up to fund the ballooning US fiscal deficit. The country’s national debt has surpassed $35 trillion in absolute terms and is almost 123% of the GDP. Another grim milestone is that annual interest payments on this debt have surpassed $1 trillion.

Buffett also trimmed stakes in energy giant Chevron, which is something that he has been gradually doing in previous quarters. Berkshire also lowered its stakes in Capital One Financial, T-Mobile, Louisana Pacific, and Floor and Decor Holdings during Q2.

Other Key Takeaways From 13F Filings

Institutional investors who manage over $100 million in assets have to disclose their holdings within 45 days after a quarter ends. The 13Fs of major fund managers have some interesting takeaways. For instance, Michael Burry of “Big Short” fame raised stakes in Chinese tech giants like Alibaba and Baidu and the former is now the biggest holding for his Scion Asset Management.

Bill Ackman of Pershing Square took a new position in Nike which tumbled during Q2 while David Tepper of Appaloosa cut stakes in Nvidia and other big tech giants like Meta Platforms, Alphabet, Amazon, and Alphabet.

Valuations of big tech companies have been a burning issue and while a section of the market believes that these names deserve a rerating due to the artificial intelligence (AI) boom – others see a bubble building as we saw during the dot com days in the 1990s.

Notably, while Buffett has alluded that Apple stock sales were due to tax-related reasons, some analysts believe that the company’s valuations are no longer comfortable – especially for a value investor like Buffett. For instance, Bernstein analyst Toni Sacconaghi who otherwise rates Apple stock as a buy-equivalent said, “While he (Buffett) continues to publicly sing the praises of Apple as a business, Buffett has historically been fairly valuation sensitive.”

Buffett Has Been on a Stock Selling Spree

Meanwhile, Buffett has been on a stock-selling spree and net sold over $75 billion worth of shares in Q2 which was a record. His massive stock selling has led to an increase in Berkshire’s cash pile which stood at a record $277 billion at the end of June.

While we still don’t know publically about Berkshire’s stock buying in selling activity in Q3, the company has disclosed selling Bank of America shares which is the conglomerate’s second biggest holding after Apple. If the aggressive selling of Apple is any indication, Buffett might be selling Bank of America shares in large quantities.