The billionaire investor Warren Buffett, also known as the Oracle of Omaha, surprised the markets last week when his company’s filings revealed that he trimmed one of the most touted positions in Berkshire Hathaway’s portfolio of investments – a large stake in Apple.

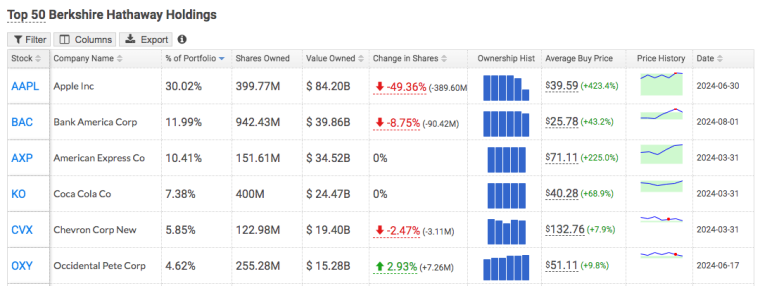

According to the 10-Q report, Berkshire reduced its Apple holdings by 49% in the second quarter of the year following a 13% reduction in the first quarter. As a result, the value of this position stood at $84.2 billion by the end of June.

Buffett referred to these transactions during the earnings conference but claimed that the company was selling only “a little Apple” to avoid paying excessive taxes on the position if the United States ultimately decides to raise its capital gains taxes to shrink its large budget deficit.

However, 49% is way more than “a little”, so there may be other factors in play that motivated Berkshire and its investment team, which include Buffett, Todd Combs, and Ted Weschler, to make that portfolio decision.

Buffett Reduces Position in Bank of America as Well

Aside from Apple (AAPL), the Oracle trimmed another major position in his portfolio – Bank of America. According to the company’s last filing, Berkshire cut its stake at BoFA by 8.8% and generated proceeds of $3.8 billion from the sale.

In total, second-quarter equity sales amounted to $75 billion and raised the conglomerate’s cash reserves to a staggering total of $277 billion, marking a record for the firm and triggering alarms among Warren’s die-hard followers that he may be anticipating a cliff ahead for either the US or the global economy.

“This could alarm the markets especially given the news from last week,” commented Jim Shanahan, an analyst at Edward Jones.

However, Dan Ives from Wedbush Securities claims that these portfolio changes should not be considered a warning signal.

“Buffett is a core believer in Apple and we do not view this as a smoke signal for bad news ahead,” he told AP News on Saturday.

Apple Still Positive for the Year Despite Sell-Off

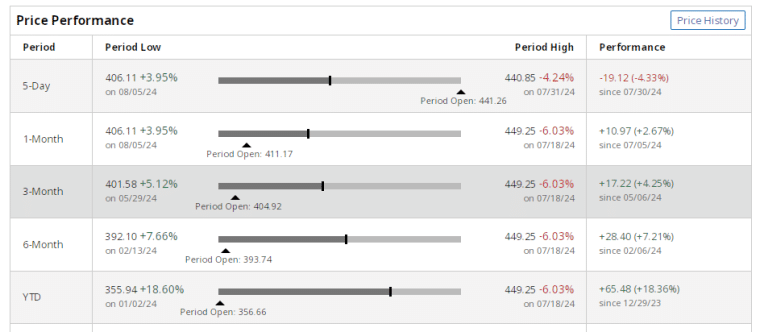

In the past week, Apple shares have declined 5.3% in line with the performance of other mega-cap tech stocks following the market sell-off that took place on both Friday and Monday. A scary jobs report in the US prompted investors to revisit their portfolio allocations and reduce risks amid fears that the economy could enter a recessionary cycle.

The Fed’s inaction during its late July meeting and a weak jobs report were considered the main catalyst for this correction although certain external variables including a historic decision from the Bank of Japan to raise its benchmark interest rate could have influenced the performance of US stocks in these past three share trading session.

Despite the market’s latest weakness and Buffett’s actions, Apple is still positive for the year, delivering gains of 7.6% as of yesterday. Surely, the iPhone maker is not the most notable winner this year among the so-called “Magnificent 7” group of mega-caps, which includes NVIDIA – a company that has seen its stock price skyrocket by nearly 111% since the year started.

Meanwhile, Meta Platforms (META) and Alphabet (GOOG) have produced year-to-date gains of 13.9% and 39.6% respectively while Amazon (AMZN) and Netflix (NFLX) have also rewarded investors with positive returns of 6.6% and 25.2% respectively.

Tesla is the obvious laggard of the group as the electric vehicle manufacturer has seen its share price slashed by 19.3% since the year started amid fears that a sluggish economy could take a toll on the demand for its pricy vehicles while financing conditions and high interest rates have also affected consumers’ buying power.

What is Berkshire Buying Now?

Aside from raising a stockpile of cash, Berkshire has also been buying one share in particular that could provide further evidence about what Grandpa Buffett believes is the way to go in the current economic environment.

According to the company’s quarterly earnings report, Berkshire spent $2.9 billion to repurchase its own stock during the first semester of 2024. Although this figure is lower than the $5.9 billion spent for this same purpose in the first half of last year, it is still considered a significant sum and points to the fact that Buffett believes that its company’s shares are currently undervalued.

So far this year, the price of Berkshire Hathaway’s Class B stock accumulates an 18.4% increase while its 5-day performance, considering the dramatic sell-off that took place, is not particularly bad as the stock shed only 4.3% of its value at a point when other incumbents were seen their equity prices being slashed by 10% or more.

Also read: Warren Buffet’s Investment Checklist – The Secret to His Success?

The diversified nature of Buffett’s conglomerate could play in its favor if the United States does enter a recession as some analysts and prominent voices in the financial markets seem to expect.

Utility companies, which account for a big chunk of Berkshire’s business, tend to fare quite positively during tough economic times. In the second quarter of 2024, Berkshire’s utilities produced total revenues exceeding $25 billion, accounting for roughly a quarter of the firm’s top-line results, and operating profits of $2.2 billion.

By the end of the second quarter, Berkshire’s 10-Q filing shows that five companies accounted for 72% of the aggregate fair value of its investment portfolio. These are American Express, Apple, Bank of America, The Coca-Cola Company, and Chevron Corporation.

The value of the firm’s Apple holdings was slashed from $174.3 billion as of the end of December 2023 to just $84.2 billion by the end of June while its Bank of America equity stake still increased in dollar terms, moving from $34.8 billion to $41.1 billion during this same period despite the recent share sales.

Is the US Heading to a Recession?

Last week’s weak jobs report showed that the American economy is still not out of the woods and that a ‘soft landing’ scenario is not yet certain.

On Friday, the Bureau of Labor Economics (BLS) published its July 2024 jobs report. According to the agency, the U.S. economy added only 114,000 jobs during the month compared to 206,000 that were added the month before.

Analysts were surprised by the report as they expected a total of 185,000 new positions created during this month.

Economists interpreted this as a sign that the Fed may have taken too long to slash rates and that its inaction could have tilted the economy in the wrong direction. Hence, Buffett’s moves coincide with the perception that the economy is weakening.

Cathy Seifert from CFRA Research believes that the Oracle’s decision could be killing two birds with one stone by trimming Berkshire’s Apple stake as they could reduce the size of this single portfolio holding to a more decent level while also protecting itself from a potential economic downturn that reduces its value in the short run.

“This is a company girding itself for a weaker economic climate,” Seifert commented.