President Donald Trump has warned smartphone companies like Apple and Samsung of a 25% tariff on imports. Trump’s warning could be another major hurdle for Apple, which had diversified its supply chain from China amid the worsening US-China rivalry.

In a post on Truth Social last week, Trump said, “I have long ago informed Tim Cook of Apple that I expect their iPhone’s that will be sold in the United States of America will be manufactured and built in the United States, not India, or anyplace else. If that is not the case, a Tariff of at least 25% must be paid by Apple to the U.S.”

Later, speaking with reporters at the White House, the U.S. President said, “It would be also Samsung and anybody that makes that product, otherwise it wouldn’t be fair.”

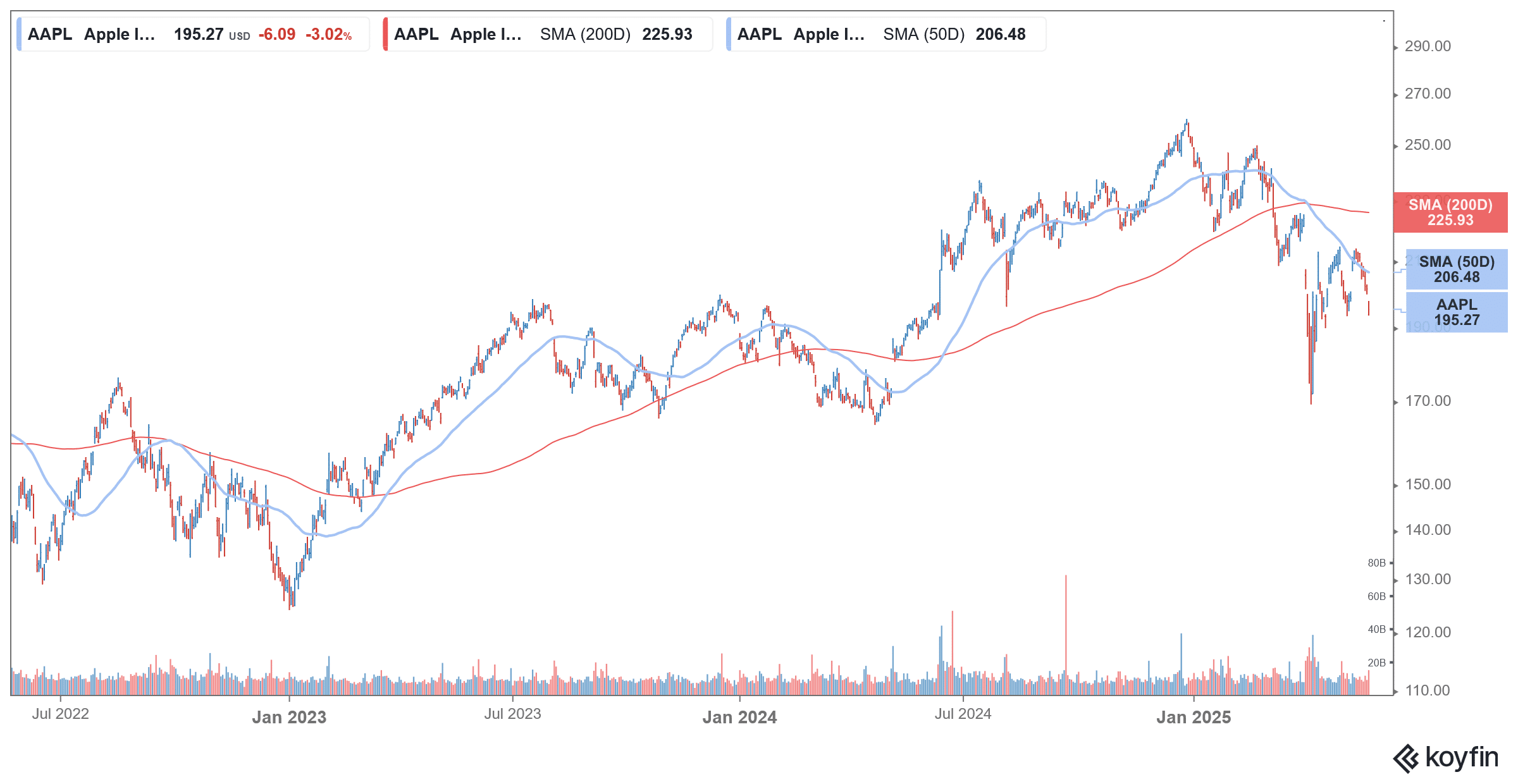

As expected, Apple stock fell over 3% on Friday and extended its YTD losses to over 22%, which makes it the worst-performing constituent of the so-called “Magnificent 7,” which includes the likes of Meta Platforms and Alphabet. It even failed to outperform Tesla, which reported bleak earnings with terrible sales and multiple other flashing red warning signs barely a month ago.

Thanks to Apple’s underperformance, its market cap has fallen below $3 trillion, and it has lost its position as the world’s most valuable enterprise. Currently, Microsoft, which has been relatively immune to President Trump’s tariffs, is the biggest company in the world, followed by Nvidia.

Apple Has Been Battling Tariff Threat

Apple, like most other American companies, has been facing tariff uncertainty for the many months. In February, Trump announced a 10% tariff on imports from China for the country’s alleged role in the US fentanyl crisis. The President then doubled the tariffs to 20% in March making it expensive to import goods from the country, which is a key sourcing hub for companies like Apple.

Finally, on April 2, Trump announced his “reciprocal tariffs” on almost all countries and slapped China with a 34% tariff. It’s important to note that they were not reciprocal tariffs. They were based on trade deficits, not tariffs. Over the next few days, the two countries gradually raised tariffs, with the US tariffs reaching 145% (125% reciprocal tariffs plus 20% fentanyl-related tariffs).

However, on April 13, shortly after meeting the CEO of Nvidia, Jensen Huang, in a $1 million dinner at Mar-a-Lago, Trump exempted tech goods like smartphones and chips from the reciprocal tariffs. White House deputy press secretary Kush Desai said in a statement, “At the direction of the President, these companies are hustling to onshore their manufacturing in the United States as soon as possible.”

Meanwhile, after a meeting between the representatives of the two countries in Geneva earlier this month, the US lowered tariffs on China to a mere 10%, which Trump has said would be the base for all countries. However, the fentanyl tariffs are still in place, which means imports from China attract a 30% tariff.

Apple Shifted iPhone Production to India

Over the last couple of years, Apple has been diversifying its supply chain to other Asian countries, especially India and Vietnam. During their most recent earnings call, Apple said that it is tweaking its supply chain amid the tariffs. “For the June quarter, we do expect the majority of iPhones sold in the US will have India as their country of origin and Vietnam to be the country of origin for almost all iPad, Mac, Apple Watch, and AirPods,” said CEO Tim Cook during the earnings call.

The company also warned of a hit of $900 million from the tariffs in the current quarter, as while Trump delayed his reciprocal tariffs, the 10% base tariff on all countries is still in place.

President Trump posted on social media on Friday with a message to Apple CEO Tim Cook:

“I have long ago informed Tim Cook of Apple that I expect their iPhone’s that will be sold in the United States of America will be manufactured and built in the United States, not India, or… pic.twitter.com/69KOiUKG9y

— Schwab Network (@SchwabNetwork) May 23, 2025

On May 15, which was just about two weeks after Apple’s earnings, where the company confirmed reports of it shifting iPhone Production to India, Trump said, “I had a little problem with Tim Cook yesterday.”

He added, “I said to him, ‘my friend, I treated you very good. You’re coming here with $500 billion, but now I hear you’re building all over India.’ I don’t want you building in India.” The President was referring to the $500 billion investment that Apple has promised in the US.

Reacting to Trump’s threat, Wedbush Securities analyst Dan Ives said, “It puts Apple with their back against the wall a little because India was going to be the go-to to navigate the China tariffs.” He added, “This is putting Apple in an almost impossible spot.”

Would Smartphone Companies Start Manufacturing in the US?

As far as 2011, Steve Jobs reportedly told then-U.S. President Barack Obama that the manufacturing jobs “aren’t coming back.” In April, Bloomberg’s Mark Gurman aptly summed up why made-in-USA iPhones remain a pipe dream.

In his article for Bloomberg, Gurman wrote, “Apple is unlikely to move iPhone production to the US in the foreseeable future for a variety of reasons, including the shortage of facilities and labor needed to produce the devices. Moreover, the country lacks the rich ecosystem of suppliers, manufacturing and engineering know-how that — for now — can only be found in Asia.”

The report adds that Apple’s final assembly, test, and pack-out (FATP) facilities are mammoth and are unheard of in the US. For instance, a Foxconn facility in in Zhengzhou has been dubbed iPhone City for its mammoth size and reportedly employs over 200,000 people. While manufacturing wages in China are indeed growing, they are still significantly lower than they would be in most of the U.S.

“What city in America is going to put everything down and build only iPhones? Because there are millions of people employed by the Apple supply chain in China,” said Matthew Moore, a former Apple manufacturing engineer.

He added, “Boston is over 500,000 people. The whole city would need to stop everything and start assembling iPhones.” It seems like everyone, save Donald Trump, believes that U.S.-built iPhones are little more than a pipe dream.

The Cost of Apple iPhones Would Skyrocket

Apart from the logistics issue, moving the iPhone production stateside would have significant repercussions for its production costs. In his note, Ives wrote, “We believe the concept of Apple producing iPhones in the U.S. is a fairy tale that is not feasible.” The note added, “This would result in an iPhone price point that is a non-starter for Cupertino,” while projecting the cost of an iPhone sold in the US to rise to as high as $3,500. Naturally, this should be taken with a grain of salt as Apple has a massive incentive to keep its lower wage jobs in foreign countries. However, it’s certain that prices would have to increase by some margin.

Meanwhile, Trump has flip-flopped on tariffs multiple times since his “Liberation Day” tariffs on April 2. Most recently, he delayed the 50% tariff on the EU shortly after announcing it. Trump even walked back on his opposition to Japan’s Nippon Steel acquiring U.S. Steel Corporation and gave his nod to the merger.

The threat of a 25% tariff on iPhone imports could be yet another bluff from the President. However, Apple stock continues to get punished for the tariff uncertainty at a time when it is anyways facing intense competition from Chinese smartphone companies, especially Huawei. The company’s hugely profitable Services business is also facing serious headwinds after a US judge ruled that the company should allow third party payment mechanisms on its App store.