Few hedge fund managers can dream of having Christian Bale play them in a Hollywood blockbuster.

Then again, practically no one on Wall Street besides Michael Burry could predict the housing market crash that preceded the Great Recession, memorialized in 2015’s The Big Short. While this added a sizeable chunk to his wealth, this was just one of the many triumphant successes Burry has achieved as a hedge fund manager.

In 2024, Michael Burry’s net worth is estimated at around $300 million – and growing.

Burry’s rise to fame is remarkable. Known for his obsessive behavior, he made a name for himself in finance after leaving a career in medicine.

Let’s dive deeper!

How Much is Michael Burry Worth in 2024?

- Net Worth: Estimated at $300 million.

- Big Short Fame: Profited $100 million from the housing market crash.

- Scion Asset Management: Holds $94.5 million in assets under management.

- Investments: Known for value investing and contrarian strategies.

- Media Portrayal: Featured in “The Big Short” by Michael Lewis.

Michael Burry’s Net Worth Breakdown:

Michael Burry is a very private person, so he rarely discloses details about his personal life and investments, as well as the assets in his portfolio. The public doesn’t even know where exactly he and his family live, or what they own in real estate.

However, he has always been vocal about the investments made through his hedge fund, and, seeing how this is what makes the most of his net worth, we located sufficient data to make a full overview of his major assets and earnings over the years.

| Asset or Income Source | Contribution to Net Worth |

| Sub-prime mortgage crisis earnings | $100 million |

| Scion’s assets under management | $94.5 million |

| Investments and real estate | Unknown |

| Total Net Worth | $300 million |

5 Fun Facts about the “Big Short” Legend

- Medical Background: Holds an M.D. from Vanderbilt University.

- Scion Capital: Founded in 2001, gained fame for shorting the sub-prime market.

- Film Appearance: Portrayed by Christian Bale in “The Big Short”.

- Cryptic Tweets: Known for his cryptic and often deleted tweets on market predictions.

- Investments in Gold: Advocates for gold as a hedge against market downturns.

Latest News & Controversies

As of October 2024, Michael Burry remains active in the financial world, with his hedge fund, Scion Asset Management, delivering impressive returns.

The fund is up by around 39% so far in 2024, reflecting his continued success as a contrarian investor. Some of his key investments include Chinese companies like Alibaba, which saw a dip in early October but still represents a profitable position for Burry as he purchased it during a downturn in 2023. He also holds positions in Baidu and JD.com, which have rebounded strongly this year.

Additionally, Burry recently made headlines for his $1.6 billion bet against the U.S. stock market in mid-2023.

His fund placed significant put options on major indices like the Nasdaq-100 and the S&P 500, signaling his anticipation of a potential market crash. Although this dramatic move caught attention, as of now, his position hasn’t fully played out since the market has mostly moved upward.

Early Life and Education

Michael James Burry was born on June 19, 1971, in San Jose, California.

Aged two, he lost one eye due to retinoblastoma cancer and has had a prosthetic eye ever since. Born to a Rusyn family, he was a withdrawn child and lacked social skills during his childhood. He attended Santa Teresa High School in his teenage years and went on to enroll at the University of California in Los Angeles to study economics and pre-med.

Following his college graduation, young Burry decided to focus on medicine, so he enrolled in Vanderbilt University School of Medicine, where he earned his M.D. Following this success, he started a residency in pathology at Stanford University Medical Center but left school after his third year to focus on investing.

Why did a doctor choose an investment career, you wonder?

Unlike other famous investors, Burry chose finance as a hobby while studying medicine. He studied the ways of intelligent investing while off duty and at night. Interestingly, he still maintains his license as a physician despite not practicing, even though he is making hundreds of millions as an investor.

As for Michael Burry’s personal life, he is married and has two sons. One of his sons has been diagnosed with Asperger’s syndrome, prompting Burry to be diagnosed with the same at age 35.

Michael Burry Net Worth: How a Doctor Became a Millionaire Hedge Fund Manager

Although he studied medicine in his youth, Michael Burry has always been an investor at heart. After he finished medical school, he spent some time working as a neurology resident at Stanford Hospital. He consequently worked as a pathology resident but decided to leave this career to start his own hedge fund.

This marked a major turning point in Burry’s life though it would take a few years before he would become a big name in the financial world.

Scion Capital LLC

In 2001, Michael Burry started his hedge fund called Scion Capital LLC. His reputation preceded him – he had already built experience and a reputation as an investor through active participation in message board conversations on discussion sites like Silicon Investor. His stock picking was often accurate, and so this attracted the interest of major businesses like Vanguard and White Mountains Insurance Group, as well as investors like Joel Greenblatt.

Using some inheritance and loans from family members, he founded a hedge fund named after The Scions of Shannara, one of Terry Brooks’ novels. In his first full year, the S&P 500 fell 11.88%, but Scion’s fund saw a 55% return. This marked him out as a very promising investor in the industry from the very beginning.

In 2002, two years after he founded the business, the S&P 500 fell once again, this time by 22.1%. However, Burry’s hedge fund Scion Capital beat the market by a massive margin and ended up 16% once again. When the stock market finally got back on its feet in 2003 and rose by 28.69%, Burry brought home returns of 50%.

In 2004, the company was already managing $600 million. Burry managed to achieve such great success because he was shorting overvalued tech stocks during the peak of the internet bubble, among other moves.

Burry’s Focus on the Sub-prime Mortgage Market

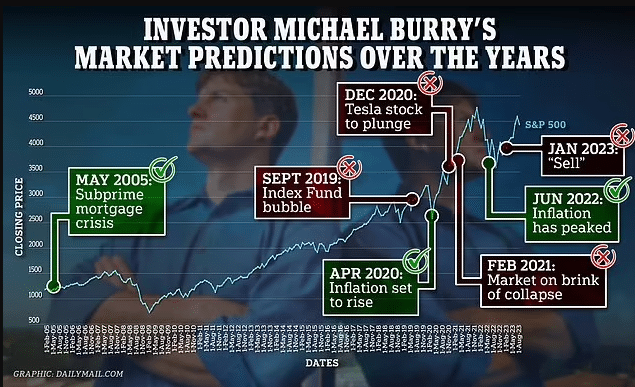

Starting in 2005, Burry’s focus transferred to the sub-prime market. He analyzed mortgage lending practices from the years prior and predicted that the real estate bubble would collapse by 2007.

His research showed him that subprime mortgages and the bonds based on them would start losing value when the original rates were replaced by higher rates, which would occur around two years after initiation. He predicted that these rate changes would spur a wave of defaults that would make the market crumble.

Based on this prediction, Burry decided to short the market, and even persuaded investment firms like Goldman Sachs to sell him credit default swaps against the sub-prime deals he believed were vulnerable.

In the beginning, his prediction about the financial crisis in the housing market revolted investors, especially since he was making payments toward the credit default swaps. Some of the investors decided to withdraw their capital from Scion, concerned that Burry’s predictions were inaccurate.

Those who succeeded in doing so regretted it deeply later. Thanks to his accurate prediction of the sub-prime mortgage crisis that lasted from 2007 to 2010, and his idea to short the mortgage bond market, Michael Burry added $100 million to his personal net worth and made a profit for the remaining investors of at least $700 million.

The idea to swap collateralized debt obligations ultimately helped Scion Capital see returns of 489.34%, net, fees included, from its inception in 2000 to June 2008. In comparison, the S&P 500 returned just under 3%. This is impressive considering that the S&P 500 is the general benchmark for the US market.

Following this major success, he decided to shut down Scion Capital in 2008 to focus on his family and his personal investments.

Scion Asset Management

Fast forward to 2013, and Burry reopened his hedge fund, but this time he gave it the name Scion Asset Management. He filed reports as an exempt reporting adviser active in the state of California, and his idea and business were approved by the SEC.

Even though he reopened his business, the investment strategies in the newly-titled fund differed from before. His main focus at this point was on investments in water, farmland, and gold.

By 2019, Scion Asset Management filed a 13F quarterly report that showed that the company had over $103 million in assets under management.

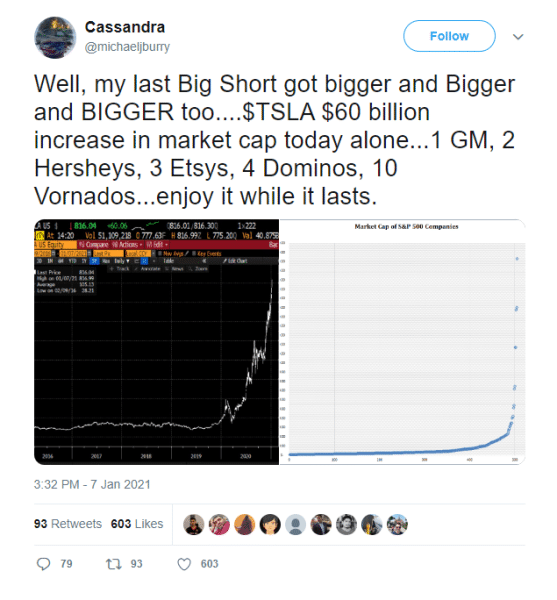

The following year, the fund made two major investments in Alphabet Inc., investing $121 million, and in Facebook, where it invested $24.4 million. Burry also reportedly initiated short positions on Tesla in December 2020, sharing his thoughts in a now-deleted tweet. He actually predicted that Tesla stock would collapse similarly to the housing market, stating that: “my last Big Short got bigger and Bigger and BIGGER” and taunted Tesla bulls to “enjoy it while it lasts”.

As you would expect, not all of his investment strategies have yielded a positive result. Some were completely wrong while others were simply poorly timed. Burry and his firm initiated GameStop‘s short squeeze in 2021, for instance, but they missed out on the bulk of the gains.

In 2020, the firm had around 5.3% of GameStop’s shares, believing that the stock was heavily undervalued. If they held the position just a little longer until the stock’s peak rather than selling it in late 2020, the profits would have reached around $1 billion for the company, causing Michael Burry’s net worth to skyrocket as well. Burry sold the firm’s stake when GameStop traded at around $10-$20 per share and made around $100 million instead.

Latest Major Prediction

In August 2023, Michael Burry’s firm made a $1.6 billion bet on a stock market crash in the US. Burry held put options on the Nasdaq-100 and S&P 500 at the end of 2023. This amounts to over 90% of his company’s portfolio.

However, the number is most likely misleading since this figure is based on the maximum possible value that the put options can rise to. The firm’s assets under management are lower than $1.6 billion, meaning that the number is most likely lower – though still big. So far, he is likely down on the investment as the S&P 500 has mostly moved up since August.

Scion Asset Management Today

Today, Burry still owns and manages the private investment company, with $94.5 million in assets under management as of December 2023. The firm’s top holdings are in:

- Alibaba Group Holding – 6.1%

- HCA Healthcare – 5.7%

- JD.com – 6.1%

- Oracle – 5.6%

- CVS Health – 5.4%

- Citigroup – 5.4%

- NextStar Media Group – 5.4%

- Amazon.com – 4.8%

- Star Bulk Carriers – 4.9%

- MGM Resorts International – 4.7%

- Warner Bros. Discovery – 4.5%

- Booking Holdings – 4.7%

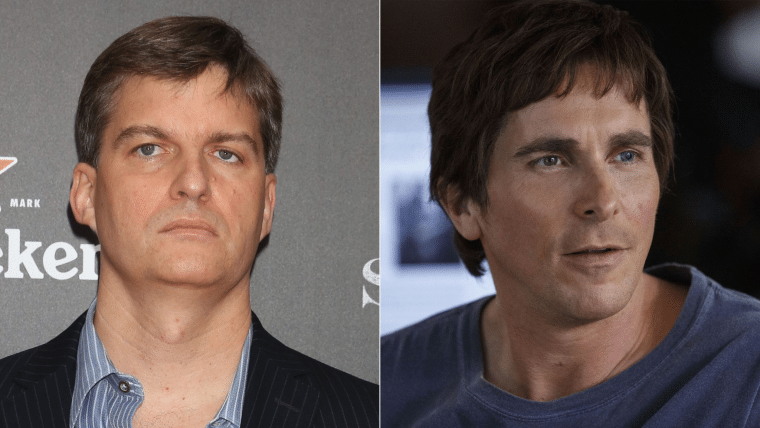

“The Big Short”

The Big Short is a film adaptation of Michael Lewis’s book of the same name. The book, The Big Short: Inside the Doomsday Machine was a sequel to Lewis’ best-selling novel Liar’s Poker, a novel about his experiences at Salomon Brothers.

The movie was co-written and directed by Adam McKay and focuses on the lives and stories of several American finance experts, including Burry. As the movie shows, Burry, portrayed by actor Christian Bale, was one of the very few investors worldwide who profited from the collapse of the housing bubble in 2007/8.

Burry hasn’t commented publicly on how he way portrayed in the movie. The final edit wasn’t generous to Burry and his unemotional attitude to the realities of the mortgage crisis – yet he did spend time working on his character with Bale and even attended the premiere.

Other Assets, Income Sources, and Investments of Michael Burry

The American investor has made significant profits through his hedge fund thanks to his value investing strategy and unique investment style.

While this makes for the biggest part of his net worth, Burry most likely earns a significant sum from his personal investments as well. Even though the details aren’t publicly disclosed, as can be expected, we have some ideas of what else contributes to his fortune.

Social Media Activity

Burry is a fierce proponent of fundamental analysis as a value investor who often tweets cryptic warnings about the market conditions and future. Interestingly, he seems to delete his Tweets after some period has passed, prompting Twitter users to create a Michael Burry archive where we can see all of his predictions over the years.

Even though he is active on Twitter and often shares posts, he doesn’t exactly take on the role of influencer or publicly do sponsorships, so this most likely isn’t adding substantial profits to his net worth.

Other Investments

We estimated Michael Burry’s net worth based on his public investments through the fund. As for his personal investments, he hasn’t publicly disclosed any details on what he is putting money into, though we can make some assumptions based on his public statements.

For instance, Burry is a public proponent of gold as an investment. While he has never shared how much gold he owns, he often speaks of the precious metal and states it is a hedge against the crypto bear market and a winner amid a potential crypto meltdown.

He is notoriously skeptical about crypto, including tweeting in November 2022, “The problem with #crypto, as in most things, is the leverage. If you don’t know how much leverage is in crypto, you don’t know anything about crypto, no matter how much else you think you know.”

Another possible investment in Burry’s portfolio is farmland. He started investing in farmland through his firm around 2010, and while don’t know if he still invests in land or how much he already has in his portfolio, he most likely allocates some of his portfolio to this asset category.

What Can We Learn from Michael Burry’s Story?

Michael Burry’s story is one of a successful investor, but it’s also much more than that. His tale is a testament to the power of strategic thinking, fundamental analysis, perseverance, and a contrarian approach in navigating the complexities of the financial markets.

Burry’s journey underscores the potential of finding undervalued assets and capitalizing on them, which he has done using his investment acumen, as well as the importance of doing meticulous research.

From his early days as a medical student to becoming a millionaire investor, Burry’s financial journey is marked by a relentless pursuit of his passion for making investments.

He decided to make a transition from a field he spent years studying for, all to pursue his true calling in the investment world.

His investment prowess became evident once he founded Scion Capital. Through his smart stock picking and a deep understanding of the market conditions and dynamics, he consistently outperformed the broader market.

He demonstrated an ability to identify overvalued tech stocks during the dot-com bubble, and later even foresaw the collapse of the subprime mortgage market.

Finally, Burry’s story serves as a reminder of the importance of maintaining a diverse investment portfolio and adapting to changing market conditions.

Not all of his investment strategies have been successful, as can be expected, but Burry’s willingness to learn from failures underscores the resilience one needs in the financial markets.