Tesla (NYSE: TSLA) which is set to release its earnings for the first quarter of 2023 today after the bell has announced a price cut in the US – its sixth for the year.

The Elon Musk-run company previously slashed prices in other markets including China and Europe as well and the current US price cut is the second for April.

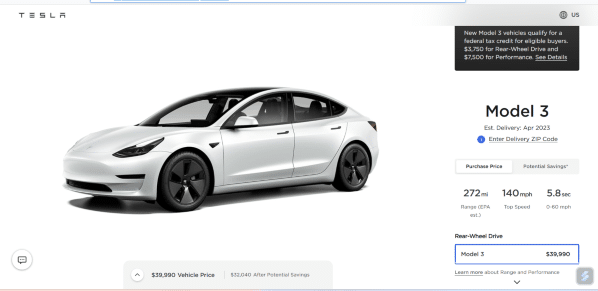

After the price cut, Tesla Model 3 Standard Range RWD – the cheapest model from the company – would start at just under $40,000.

It would be the first time ever when a Tesla would sell at less than $40,000 even as EV peers are working on models that can cost as low as $25,000.

Tesla’s price cuts come shortly after the US Treasury Department updated the list of EVs that are eligible for the tax credit.

Tesla Model 3 Standard Range Rear Wheel Drive would now be eligible for a $3,750 credit – instead of $7,500.

The other Tesla models – Model 3 performance, and all Model Y variants – would be eligible for the $7,500 credit.

After the new rules, electric models from Rivian, Nissan, Volkswagen, BMW, Audi, Hyundai Genesis, and Volvo would lose the EV tax credit.

Tesla Cuts Vehicle Prices Yet Again

So far in 2023, Tesla has cut the base price for Model Y and Model 3 by 20% and 11% respectively. It has slashed the prices for the higher-priced Model S/X as well.

However, the combined share of Model S/X in Tesla’s sales mix has been falling gradually, and together they accounted for only 2.5% of its first-quarter deliveries.

Tesla delivered 422,875 cars in the first quarter of 2023 – which is 36% higher YoY and slightly higher than the fourth quarter.

The deliveries meanwhile fell short of analysts’ estimates making it the third consecutive quarter of below-par deliveries.

Also, Tesla’s production surpassed deliveries by almost 18,000 in the quarter. Last year also, it delivered 1.31 million cars which were below the 1.37 million that it produced in the year.

Tesla Escalates EV Price War Amid Mounting Competition

Tesla has set a goal of producing 1.8 million cars this year – which Musk said could rise to 2 million if everything goes right.

- Read our guide on buying Tesla stock

By the end of this decade, the company is targeting an annual production capacity of 20 million. One of the ways Tesla can boost the demand for its vehicles is through aggressive price cuts.

As Musk said during the company’s investor day last month, “Demand is a function of affordability not desire.”

Meanwhile, the price cuts would be invariably negative for margins – as Tesla also admitted.

Analysts polled by TIKR expect Tesla’s pre-tax margins to fall to 12.4% in the first quarter – as compared to 16% in the previous quarter.

Notably, Tesla still has quite healthy margins as both Ford and General Motors have single-digit pre-tax margins.

EV Companies Are Struggling to Post Profits

Also, the EV business of both these companies is posting losses. Ford – which would start reporting the results of its EV business separately this year – expects the segment to post a loss of $3 billion in 2023.

Notably, Ford was the second-largest EV seller in the US last year but fell to the fifth rank in the first quarter due to production-related issues. By the end of 2023, Ford is targeting an EV production capacity of 600,000.

- Read our guide on buying Ford stock

While EV companies are under pressure to cut prices after Tesla’s price war, NIO has said that it won’t join the price war – and instead, work on improving its services.

Like almost all other startup EV companies, NIO is also posting losses and in Q4 2022 its gross margins tumbled to low single digits.

A price war would be the last thing that EV companies would want especially as many are facing a cash crunch.

Related stock news and analysis

- How to Buy Rivian Stock in 2023

- How to Buy C+Charge ($CCHG) Tokens – A Beginner’s Guide

- BYD Says Fully Autonomous Cars Are “Impossible” but Musk Might Disagree

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops