Temu has established itself as a dominant force in the e-commerce market, offering a unique blend of trendy fashion, extremely affordable prices, and personalized shopping experiences.

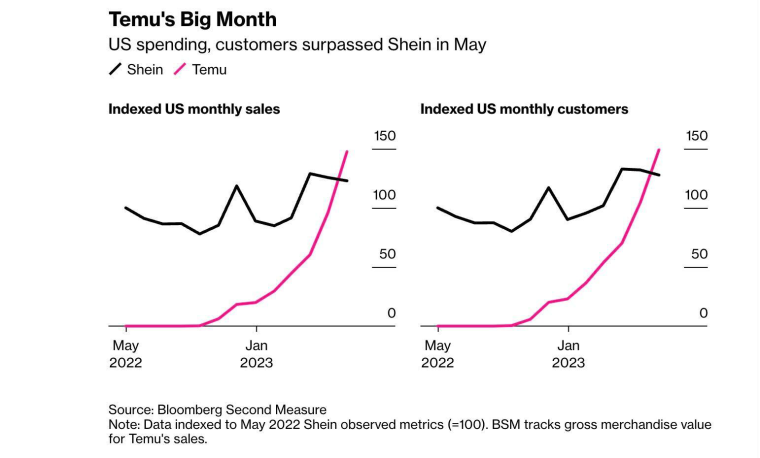

In May 2023, spending on the e-commerce marketplace surpassed rival fast-fashion brand Shein by a staggering 20%.

The company’s successful foray into the e-commerce industry in the United States can be attributed to strategic marketing initiatives such as a high-profile Super Bowl ad, effective social media marketing, and their incredibly low prices.

Industry analysts firmly believe the online marketplace business model is well-positioned to potentially challenge the dominance of Amazon and TikTok.

Key Takeaways:

- Temu’s Rapid Growth: Temu has outpaced Shein in the U.S. market by 20% through affordable pricing, unique marketing strategies, and discovery-based shopping.

- Strategic Positioning: Temu capitalized on challenges faced by price-conscious American consumers during inflation, combining entertainment with e-commerce.

- Influencer and Social Media Leverage: Collaborations with influencers and active social media campaigns have bolstered Temu’s visibility and credibility among younger demographics.

- Competitive Tactics: Temu strategically hired Shein employees and suppliers, even leading to legal disputes, to strengthen its market position.

- Massive Marketing Investments: Temu aired two high-profile Super Bowl ads in 2023, which significantly boosted its app downloads and user engagement.

- Sustainability Concerns: Despite the trend toward sustainable fashion, Temu’s success underscores the enduring popularity of fast fashion due to its affordability and accessibility.

- Broader Aspirations: Temu’s ultimate goal is to compete with giants like Amazon and TikTok, opening markets for Chinese manufacturers and expanding globally.

The Rise of Temu

Temu’s ascent to success lies in its ability to tap into the demands of the modern consumer.

By curating a vast selection of fashionable clothing items and accessories, the company ensures that it caters to everyone, regardless of age or style preference.

Temu, the widely popular online shopping application in the United States, is keeping its customer base engaged through competitive pricing and a unique e-commerce approach that combines online shopping with entertainment, referred to as “discovery-based shopping.”

The platform’s dedication to affordability also appeals to price-conscious shoppers looking for value without sacrificing quality.

These marketing strategies have propelled Temu’s growth in the last year, especially in the United States, surpassing the sales of its competitor, Shein.

One of the app’s favorite marketing slogans, “shop like a billionaire” hits home with Americans who want a little excitement in their lives.

You can buy 10-20 items on Temu without spending more than $20-30. They may not be the best quality items by any means but the sheer quantity is novel enough to attract millions of customers.

Notably, Temu’s popularity has been fueled by the challenges American consumers face with rising inflation.

As reported by Bloomberg, spending on Temu’s in May surpassed that of the well-established fast-fashion brand Shein by an impressive margin of 20% in the United States.

So, how did Temu manage to outshine its established competitor, Shein, in such a short time?

Temu began its operation by adopting Shein’s basic strategy as its starting point.

In May 2022, Pinduoduo, Temu’s parent company, took a bold step by establishing an office opposite Shein’s headquarters in Guangzhou, China.

Temu invested heavily in acquiring specific business divisions of Shein’s organizational structure to entice Shein’s employees.

The company also offered higher salaries – more than triple what employees earned at Shein. Temu also employed headhunters who were generously compensated with commissions.

In its efforts to poach Shein’s suppliers, Temu’s business development team meticulously visited clothing factories in a massive search for potential suppliers.

Furthermore, Temu’s marketing strategy, which utilizes influencer collaborations and social media campaigns, has been instrumental in creating buzz and driving sales.

Through partnerships with popular influencers and active customer engagement on social platforms like Instagram and TikTok, Temu has successfully built a strong online presence.

This solidified the platform’s reputation as the go-to destination for fashion-forward individuals.

Temu Creates a New Path

Pinduoduo, a Chinese company specializing in data and software, initially began as an online platform for selling fresh produce.

The company rebranded as PDD Holdings and expanded its operations by establishing an office in Boston’s Back Bay. In September 2022, it introduced a new platform called Temu.

The company is listed on the Nasdaq and reported a revenue of $14.7 billion in 2022.

To promote the presence of Temu, the company aired two Super Bowl ads in early 2023, investing $14 million in the campaign.

The advertisements ran with the tagline, “Shop like a billionaire.” Since its launch, Temu has experienced a surge in popularity among younger Americans, becoming the most downloaded app on both Apple and Google in December 2022.

By January 2023, it had already amassed over 50 million installations.

According to Sensor Tower data analyzed by ModernRetail, Temu experienced a substantial surge in downloads and daily active users on the day of the Super Bowl.

Compared to the previous day, Temu experienced a remarkable 45% increase in downloads and a 20% rise in daily active users.

Temu’s marketing strategy involves optimizing consumer data to manufacture products tailored to their desires and timing.

Despite the increasing focus on sustainable fashion, the advertisement highlights the continued dominance of fast fashion in the consumer market, characterized by its rapid production and affordability of trendy items.

Temu Aspires for More Than Just Surpassing Shein

Since its debut in the United States in September 2022, Temu has drawn numerous comparisons to Shein.

However, this rivalry is not mere media speculation. Temu has actively been recruiting talents from Shein, leading to legal action being taken.

In December 2022, Shein filed a lawsuit in the United States Federal Court, alleging that Temu paid influencers to post negative remarks about its company.

Shein, Temu in fierce fight over US market for $10 dresses https://t.co/gQbhioF4Cn pic.twitter.com/MZHCkfKe44

— ShopAndSave (@BUYNBULK_US) March 10, 2023

Nevertheless, Temu’s objective extends beyond triumphing in fashionable tops or evening dresses. The company aspires to become a major player in China’s online shopping sector.

According to Jerry Liu, UBS’ head of China Internet research, Temu has the potential to open new markets for Chinese manufacturers and merchants. It can also serve as an alternative platform for those already selling their products in the United States, particularly through Amazon and Shein.

In a Business of Fashion report, Liu stated that “if Temu continues to gain traction, then its ultimate competitors would be Amazon and TikTok.” However, Temu faces challenges in maintaining its dominance amid the intensifying competition in the e-commerce landscape.

Popular fashion players like Shein and other emerging platforms strive to establish dominance in the online fashion market.

To stay ahead, Temu must continue to innovate, expand its product offerings, and employ targeted marketing strategies to engage with its customer base.

Conclusion

Temu’s explosive rise in the U.S. e-commerce market demonstrates its strategic acumen in targeting price-conscious consumers and implementing innovative marketing approaches.

By combining competitive pricing with discovery-based shopping, Temu has disrupted the dominance of fast-fashion giants like Shein. However, sustaining this growth amid legal battles, evolving consumer preferences, and competition from industry leaders like Amazon and TikTok requires continuous innovation.

As Temu continues to expand its influence, it is poised to reshape the global e-commerce landscape.

Related News

- Cheap Goods Marketplaces Temu and Shein Dominated Q1 US App Download Charts

- 10 Reasons Smart Small Business Owners Opt for Ecommerce

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops