While Tesla stock (NYSE: TSLA) has jumped sharply over the last month and has recouped most of its YTD losses, the company is still facing massive headwinds. The firm recently opened up trade-ins for its Cybertruck pickup, which shows depreciation rates as high as 45% for the model, even though deliveries began in late 2023.

Multiple Tesla Cybertruck owners have shared the shockingly low prices that the company is offering on trade-ins for the once-hyped model. It looks like yet another challenge for Tesla, whose stock price has skyrocketed over the last month despite crashing sales and profitability.

Tesla Cybertruck Trade-In Quotes Show Massive Depreciation

The accelerating depreciation of Cybertrucks is devastating for both Tesla and its owners. For instance, Business Insider spoke to two Cybertruck owners. One owner received a quote for $63,100 for the AWD model that ran for 19,623 miles, a 37% depreciation. The second owner purchased a top-of-the-line Cyberbeast for $127,000 in September 2024, whose trade-in price was quoted at a mere $78,200. While electric vehicles (EVs) generally depreciate faster than internal combustion engine (ICE) cars, the 38% depreciation in just 8 months is incredibly high even by those standards.

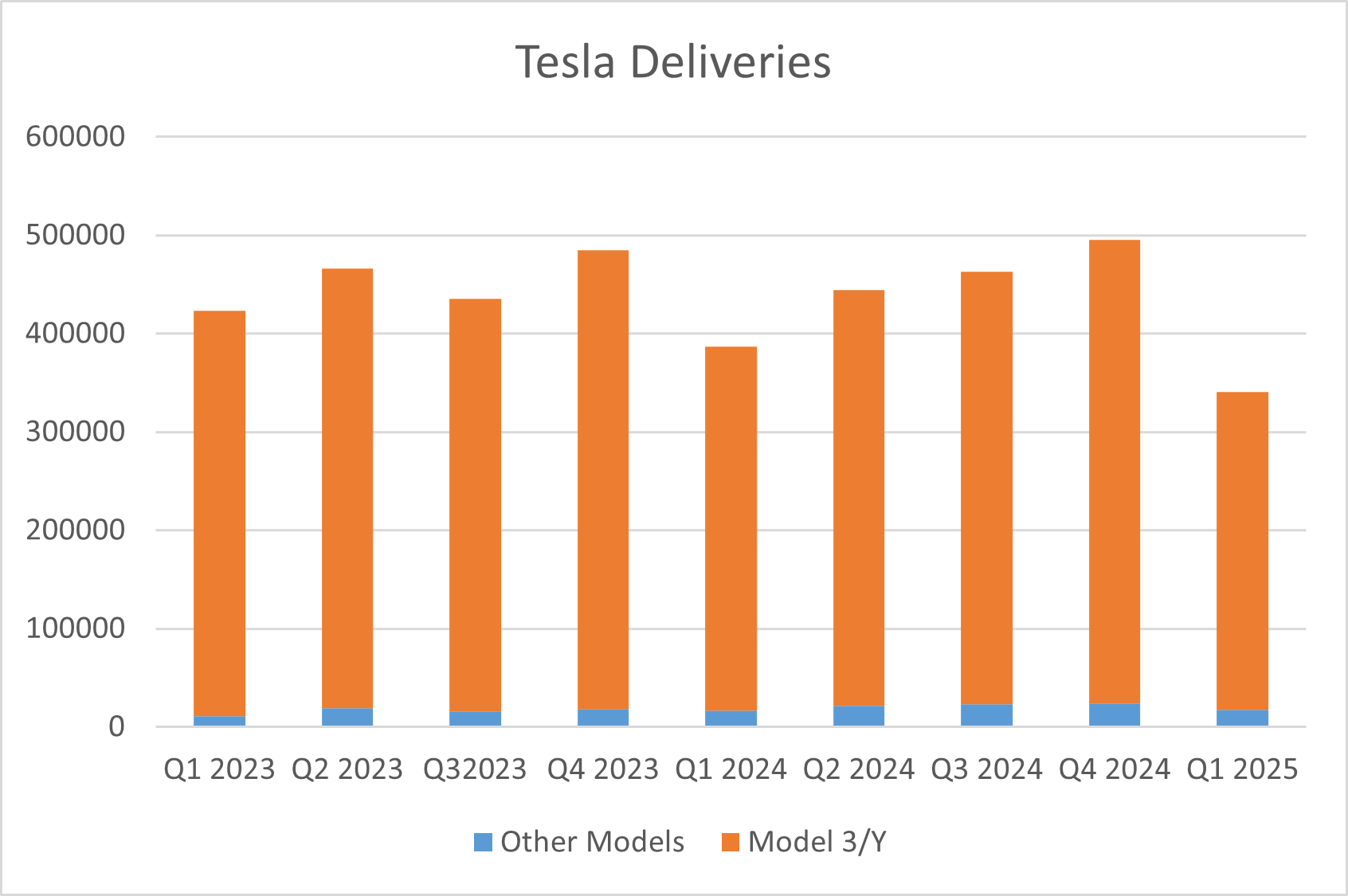

The high depreciation is yet another headwind for Cybertruck, whose sales never really took off. While the company does not break down the Cybertruck sales in its quarterly delivery numbers, they are part of “other models.” Along with the Cybertruck, that category includes the Model X SUV and Model S sedan. While the latter two were once the mainstay of Tesla’s sales, they have long been overtaken by the cheaper-priced Model 3 and Model Y. Model Y is now Tesla’s best-selling model, and last year, it was the highest-selling model globally, across not only EVs but also ICE cars.

Source: Tesla

Last year, Tesla reported deliveries of only 85,133 for its “other vehicles,” which is a tiny fraction of its total deliveries of 1.77 million. The Cybertruck has quite a unique design, which, like most things Tesla, is polarizing. Since the model is quite easy to spot, it became the face of the anti-Musk protests, and several Cybertrucks were damaged by those protesting Musk’s politics, especially over his association with the Department of Government Efficiency (DOGE) that he headed.

Musk Admits to “Blowback” Due to His Political Activities

Musk’s political activities are taking a toll on Tesla’s sales and Musk himself has admitted that it’s a problem. During the Q1 2025 earnings call last month, the billionaire acknowledged that there has been “blowback for the time that I’ve been spending in government.”

“The natural blowback from that is those who were receiving the wasteful dollars and the unfortunate dollars will try to attack me and the DOGE team and anything associated with me,” said Musk.

He, however, said that he chose to do the “right” thing and called the protests for being “paid.” According to Musk, the protestors were either receiving ‘fraudulent money or they’re the recipients of waste largesse.” There is absolutely no evidence to support these claims. His critics argue that the blowback is actually due to his destruction of important government agencies and major cuts to life-saving programs like AIDs and Ebola prevention. For example, Bill Gates claimed that his cuts would kill millions of people.

TSLA’s Deliveries Feel Last Year

Perhaps unsurprisingly, last year Tesla reported its first-ever annual decline in deliveries. The company’s deliveries rose even in 2020 and 2021, when the global automotive industry was battling a severe supply chain crisis.

Tesla’s dismal sales trajectory continued in the first quarter of 2025, and its shipments fell by a whopping 13% to 336,381 units, which was the lowest in nearly three years. The company attributed the tepid sales to the long-awaited model Y refresh, but recent data suggests that despite the refresh-related headwind being in the rearview, Tesla’s sales are not exactly booming, and it is facing increasingly intense competition, especially globally.

Last year, the Chinese EV giant BYD surpassed Tesla in terms of revenues and sold more battery electric vehicles than the US giant in Q1. BYD outsold Tesla in Europe last month despite entering the market just about two years ago. For reference, BYD’s market cap is less than 15% of Tesla’s, despite its booming sales and strong general outlook. Moreover, Tesla is also facing tariffs in the E.U., though it does produce some vehicles on the continent that aren’t subjected to them.

Musk’s embrace of far-right politicians has particularly dampened its sales in Europe, with sales plunging by almost half in April, continuing the trend that we have seen over the last few months. A recent survey of 100,000 Germans even found that 94% said that they won’t buy a Tesla vehicle.

Back to spending 24/7 at work and sleeping in conference/server/factory rooms.

I must be super focused on 𝕏/xAI and Tesla (plus Starship launch next week), as we have critical technologies rolling out.

As evidenced by the 𝕏 uptime issues this week, major operational…

— Elon Musk (@elonmusk) May 24, 2025

Musk To Focus More on Tesla

Despite the many major problems facing Tesla and Musk, retail investors seem to have a rosy view of the stock. This is likely partially due to Musk’s recent announcement during the Q1 earnings call, saying that he is taking a step back from his political activities. “So, I think I’ll continue to spend a day or 2 per week on government matters for as long as the President would like me to do so, and as long as it is useful,” stressed Musk during the earnings call.

He has since echoed such views on more than one occasion and, in a recent tweet, said, “Back to spending 24/7 at work and sleeping in conference/server/factory rooms. I must be super focused on 𝕏/xAI and Tesla (plus Starship launch next week), as we have critical technologies rolling out.”

While the fundamentals of Tesla’s automotive business have deteriorated over the last few months, and if not for the regulatory credits, it would have posted a net loss in Q1, Musk’s comments about his prioritizing Tesla over his political activities have helped spur a rally.

However, some analysts doubt if Musk spending more time at Tesla would be of much help given the serious headwinds that the company’s core automotive business is facing.

Tesla to Launch Robotaxi Service in June

There is also optimism over the launch of its robotaxi service in Austin, which Musk has said is on track to begin before the end of June. The company would compete with Alphabet-backed Waymo there, which is already offering its robotaxi service in partnership with Uber.

Musk has said the rides won’t have a safety driver but would be monitored remotely by Tesla employees. However, reports suggest that all is not well with the launch. In its letter to Tesla earlier this month, the National Highway Traffic Safety Administration (NHTSA) asked the company about how the vehicles will perform in bad weather. The letter added, “The agency would like to gather additional information about Tesla’s development of technologies for use in ‘robotaxi’ vehicles to understand how Tesla plans to evaluate its vehicles and driving automation technologies for use on public roads.”

The robotaxi launch would be yet another test for Tesla’s autonomous driving capabilities. Musk has promised countless delivery dates for fully autonomous driving and, so far, none have come to pass.