BlackRock, Inc. is the biggest investment and wealth management firm in the world. Since it was set up in 1988, BlackRock has had a significant impact on the global investing sector and its value has grown rapidly. As of October 2024, BlackRock had a net worth of $151.99 billion, making it a great example of an organization that’s seized the opportunities presented to it within the financial sector.

At Business2Community, we’ve analyzed a wide range of sources to provide an in-depth look at BlackRock’s net worth, financial history, and key achievements. Read on as we explore the investment giant’s major milestones, revenue streams, controversies, and more.

BlackRock Key Company Data

BlackRock Net Worth: $151.99 billion

Date Founded: 1988

Founded By: Larry Fink, Robert S Kapito, Susan Wagner, Barbara Novick, Ben Golub, High Frater, Ralph Schlosstein, Keith Anderson

Current CEO: Larry Fink

Industries: Investment, wealth management

BlackRock Stock Ticker: NYSE: BLK

Dividend Yield: 2.18%

What is BlackRock’s Net Worth?

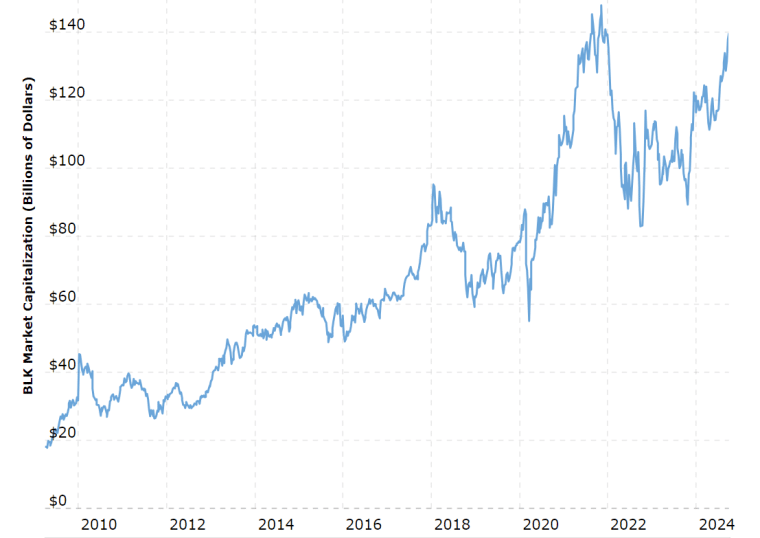

As of October 2024, BlackRock, Inc. had a net worth of $151.99 billion. This figure, also known as market cap, is calculated based on a share price of $949.19 and 148.13 million outstanding shares. The company is listed on the New York Stock Exchange under the ticker symbol BLK. BlackRock stock has been traded since its IPO in October 1999, with its shares selling for $14 each at the time.

As BlackRock grew its assets under management, its market cap gradually increased. It grew sharply between 2017 and 2018 moving from around $70 billion in July 2017 to $95 billion in January 2018. This was linked to the increasing popularity of exchange-traded funds (ETFs), which took BlackRock’s assets under management to more than $6 trillion for the first time by the end of 2017. This was a 22% increase on the prior year.

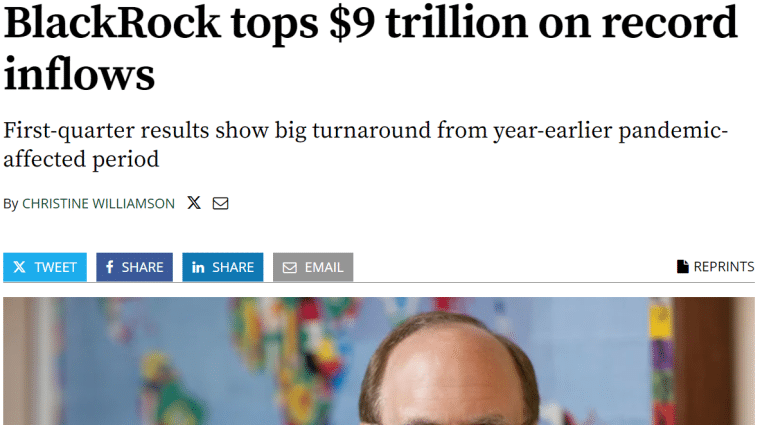

In November 2021, BlackRock’s net worth reached an all-time high of just under $148 billion as the firm beat expectations with its third-quarter financial statement. BlackRock announced increases in revenue, operating income, and EPS. This followed confirmation earlier in 2021 that the firm had exceeded $9 trillion in assets under management.

The investment firm typically reports its annual financial results in January for the previous year ending 31 December. The company also posts quarterly results.

BlackRock Revenue

BlackRock’s revenue has grown alongside its growth in assets. Following its sale by Blackstone a couple of years earlier, the firm posted revenue of $146.5 million in 1996. This had grown to more than $500 million by 2001. The firm exceeded $1 billion in revenue in 2005, just six years after its IPO.

In 2023, BlackRock reported revenue of $17.86 billion for the full year.

Alongside steady revenue growth, BlackRock has been consistently profitable. It made a profit in its first year and reported net income of $5.5 billion, up 6.26% from the previous year, in 2023.

BlackRock makes its money from fees for managing assets. It offers a range of exchange-traded funds, such as its iShares brand, and charges management fees on the assets under its control from institutional clients such as pension funds. The firm also offers investment advice services. For example, BlackRock may charge a fee of around 0.03%-0.40% of asset value. Revenue also comes through the company’s technology services, such as the Aladdin platform, which financial institutions use for risk management and trading.

Here’s a list of BlackRock’s revenue performance over the past decade:

| Year | Revenue ($ billions) | Net Income ($ billions) |

| 2014 | 11.08 | 3.29 |

| 2015 | 11.40 | 3.35 |

| 2016 | 12.26 | 3.17 |

| 2017 | 13.60 | 4.95 |

| 2018 | 14.20 | 4.31 |

| 2019 | 14.54 | 4.48 |

| 2020 | 16.21 | 4.93 |

| 2021 | 19.38 | 5.90 |

| 2022 | 17.87 | 5.18 |

| 2023 | 17.86 | 5.50 |

BlackRock Dividend History

Overall, BlackRock has a solid history of giving back value to its shareholders. BlackRock has consistently paid a dividend since 2003. The firm has increased its dividend payment every year since. They are usually paid every quarter.

As of October 2024, BlackRock reported a trailing twelve-month (TTM) dividend payout of $20.40 and a dividend yield of 2.18%.

BlackRock has a history of stock buybacks both of its own shares and those of its mutual funds. The firm returned $4.5 billion to shareholders in 2023, including $1.5 billion of share repurchases.

| Date | Stock Price ($) | Dividend ($) | Yield (%) |

| 03/04/2020 | 445.29 | 12.04 | 2.7 |

| 06/04/2020 | 494.30 | 12.42 | 2.51 |

| 09/03/2020 | 527.38 | 12.80 | 2.43 |

| 12/03/2020 | 654.81 | 13.18 | 2.01 |

| 03/04/2021 | 629.11 | 13.72 | 2.18 |

| 06/03/2021 | 815.05 | 14.25 | 1.75 |

| 09/03/2021 | 870.93 | 14.78 | 1.7 |

| 12/06/2021 | 837.06 | 15.32 | 1.83 |

| 03/04/2022 | 654.81 | 16.10 | 2.46 |

| 06/03/2022 | 636.04 | 16.90 | 2.66 |

| 09/06/2022 | 631.09 | 17.72 | 2.81 |

| 12/06/2022 | 682.16 | 18.55 | 2.72 |

| 03/06/2023 | 665.93 | 18.80 | 2.82 |

| 06/07/2023 | 660.93 | 19.05 | 2.88 |

| 09/07/2023 | 678.31 | 19.30 | 2.85 |

| 12/06/2023 | 734.27 | 19.56 | 2.66 |

| 03/06/2024 | 825.60 | 19.79 | 2.4 |

| 09/09/2024 | 877.94 | 20.02 | 2.28 |

Who Owns BlackRock?

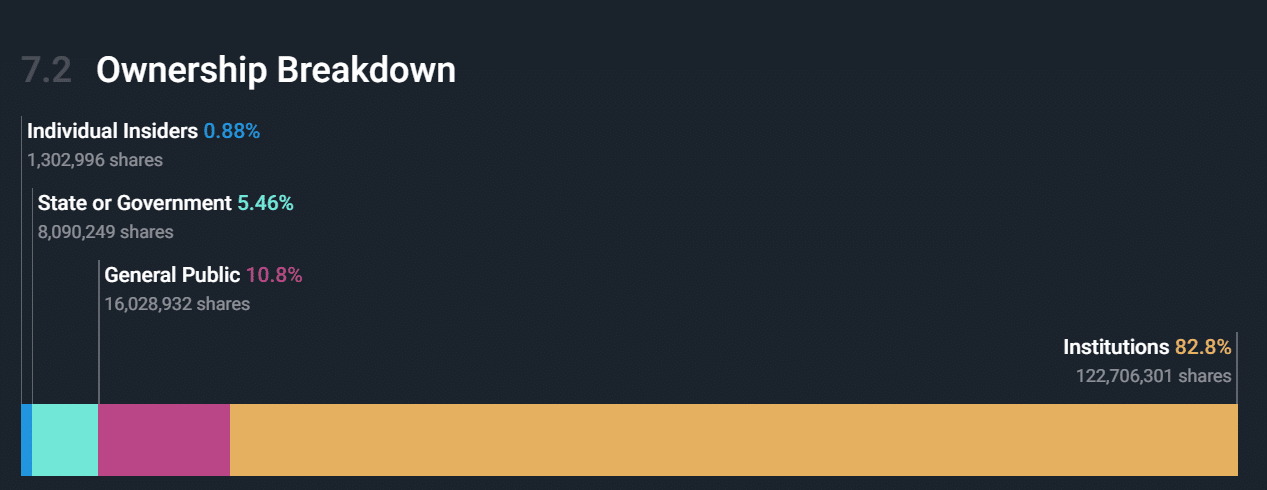

BlackRock is a publicly traded company with no majority shareholder. The company was listed on the NYSE in 1999. Around 80% of the investment firm’s stock is held by other institutional investors, such as the Vanguard Group (8.06%), Capital Group, and the Kuwait Investment Authority. BlackRock also holds just under 4% of its stock.

Larry Fink and seven partners set up BlackRock in 1988. Fink is BlackRock’s current chief executive.

Who is the BlackRock CEO?

Larry Fink has been CEO and chairman of BlackRock since he co-founded it in 1988. In September 2024, we estimated Larry Fink’s net worth to be around $1.2 billion. Fink began his career at First Boston, an investment bank in New York. As an influential leader in the financial industry, Fink also sits on the Boards of the Council on Foreign Relations and the World Economic Forum.

Fink is outspoken on the topic of social responsibility and environmental, social, and governance (ESG), but has faced some criticism from anti-war campaigners and climate change groups due to BlackRock’s investment in weapons manufacturing and the energy industry.

Fink is supported by BlackRocks’s diverse Board of Directors, including:

- Pamela Daley: Former Senior Vice President of Corporate Business Development at General Electric Company

- William E. Ford: Chairman and CEO of General Atlantic

- Fabrizio Freda: President and CEO of the Estée Lauder Companies Inc.

- Murry S. Gerber: Lead Independent Director, Former Chairman and CEO of EQT Corporation

- Margaret “Peggy” L. Johnson: CEO of Agility Robotics

- Robert S. Kapito: President of BlackRock

- Cheryl D. Mills: Founder and CEO of BlackIvy Group

- Amin H. Nasser: President and CEO of the Saudi Arabian Oil Company

- Gordon M. Nixon: Former President and CEO of Royal Bank of Canada

- Kristin Peck: CEO of Zoetis, Inc.

- Charles H. Robbins: Chairman and CEO of Cisco Systems, Inc.

- Marco Antonio Slim Domit: Chairman of Grupo Financiero Inbursa, S.A.B. de C.V

- Hans E. Vestberg: Chairman and CEO of Verizon Communications, Inc.

- Susan L. Wagner: Former Vice Chairman of BlackRock

- Mark Wilson: Former CEO of Aviva plc and former President and CEO of AIA

BlackRock’s Company History

BlackRock began in 1988 when eight colleagues set about creating an enterprise risk and fixed-income asset management firm for institutional clients. They believed that there was a better way to manage assets, making use of their collective passion for understanding and managing risk.

BlackRock’s headquarters are in New York and it is the largest investment company in the world. Alongside the Vanguard Group and State Street, BlackRock is considered one of the “Big Three” investment managers and has a significant influence in the US economy. The company employs over 19,000 people worldwide, and, more importantly, manages over $9 trillion.

It offers a range of different investment options, such as ETFs, mutual funds, and money market funds. The firm’s advice services are also designed to help investors maximize their cash management strategies.

Here, we run through some key milestones in the asset manager’s history:

1988-2004: BlackRock Starts to Disrupt the Asset Management World

Led by Larry Fink, the founders gained the funding they needed to get off the ground from the Blackstone Group which initially took a 50% stake in the firm. The entrepreneurs achieved rapid success, and by 1989 the group had assets under management of $2.7 billion.

Fink and his partners gradually cut away at Blackstone’s stake reducing it to about 36% by 1992. It was around this time that the name BlackRock was chosen. By the end of 1992, the firm had $17 billion in assets under management which more than tripled to $53 billion by the end of 1994.

In 1994, after a difference in opinion over employee compensation and equity, Blackstone sold its stake in BlackRock. This was a decision that Blackstone chief executive Stephen Schwarzman would later refer to as a “heroic mistake”.

BlackRock’s IPO on the New York Stock Exchange began selling its shares on the New York Stock Exchange in 1999 at $14 each. By the end of that year, the firm was managing $165 billion in assets.

In 1999, Fink and his team also launched their own innovative portfolio management software, known as Aladdin. Aladdin is considered to be unique in how it integrates portfolio management, analysis of risks, trading, and operational tools in a single system. It was initially intended for internal use but has since been adopted by many other financial institutions.

Aladdin provides data on global markets, predictive analytics, and advanced risk modeling, helping firms to manage their investment portfolios more effectively. From the Aladdin system, BlackRock developed an analytics and risk management division, BlackRock Solutions which also marked the firm’s move into technology provision.

2004-2020: Acquisitions and the Global Financial Crisis

In a bid to grow the business, BlackRock embarked on a period of acquisitions in 2004. Its first major acquisition was SSRM Holdings, Inc. which it bought for $375 million, including $50 million in equity. The move took BlackRock’s assets under management up to $325 billion. Other key acquisitions included:

- In 2006, the firm merged with Merrill Lynch Investment Management.

- In 2007, the organization acquired business from Quellos Capital Management.

- In 2009, it acquired R3 Capital Management and its $1.5 billion fund.

Following the 2008 financial crisis, the Federal Reserve asked BlackRock to assess, unwind, and price the mortgage-backed securities assets of Bear Stearns. The organization was heavily involved in advising affected institutions worldwide as they navigated the crisis.

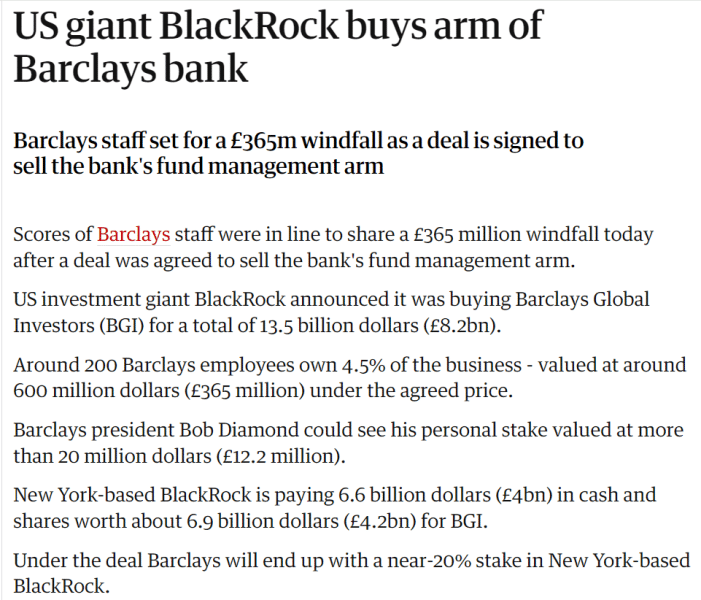

In 2010, BlackRock acquired the global investment arm of Barclays Bank, which included iShares, its exchange-traded funds, for $13.5 billion. As a result, Barclays acquired an almost 20% stake in BlackRock, which turned out to be an incredible bet as the latter quickly became the world’s largest asset manager. BlackRock also took the opportunity to bring alpha and index strategies together to provide a wider range of products and solutions to its clients.

In 2014, BlackRock achieved $4 trillion in assets under management, making it the biggest asset manager in the world. In 2015, BlackRock announced that it planned to wind down its oldest hedge fund, the Global Ascent fund, following poor performance. The fund had fallen by around 9% that year, its worst performance since it had begun in 2003.

In March 2017, BlackRock entered into a period of restructuring for its traditional actively-managed fund business to improve its product offerings. The company announced plans to launch a series of core products, lower fees, cut jobs, and change its asset mix. It led to a $25 million charge in the second quarter for severance and compensation to laid-off employees.

To speed up its adoption of artificial intelligence (AI), BlackRock launched an AI Lab in Palo Alto to help it make better use of techniques such as machine learning, data science, and natural language processing.

2020-Present: Stepping into Bitcoin and Chinese Operations

In March 2020, the Federal Reserve once again turned to BlackRock, this time to manage corporate bond-buying programs aimed at supporting the economy in the wake of the COVID-19 pandemic. Later that year, BlackRock was granted approval from the Chinese government to set up a mutual fund operation. BlackRock was the first of the world’s asset managers to receive permission to operate in the country.

Against an ongoing backdrop of the war between Russia and Ukraine, BlackRock announced that it would be supporting the Ukrainian president in the reconstruction of the country.

In 2022, BlackRock headquarters moved from midtown Manhattan to a trendy new office tower in the Hudson Yards district on New York’s West Side. The company took over 15 floors of the 58-story tower.

In 2023, BlackRock filed applications with the Securities and Exchange Commission to launch Bitcoin and Ethereum ETFs. The application was approved in January 2024 and BlackRock’s iShares Bitcoin Trust ETF was the first Bitcoin ETF to hit $1 billion. Also in 2023, BlackRock made a deal with the government of New Zealand to launch an investment fund for renewable energy projects as part of meeting its target of 100% renewable energy by 2030.

In early 2024, the firm acquired Global Infrastructure Partners for $12.5 billion, made up of $3 billion in cash and 12 million in BlackRock shares. A few months later, BlackRock announced the launch of its first tokenized fund on the Ethereum network. Known as the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), it drew in $245 million in assets in its first week.

In mid-2024, BlackRock expanded its HQ at 50 Hudson Yards, New York.

What Companies Does BlackRock Own?

With more than $10 trillion in assets under management, BlackRock holds a significant stake in thousands of publicly traded companies worldwide. Due to its size, BlackRock is the biggest shareholder of many large, global corporations. Below is a list of some of BlackRock’s biggest holdings as of June 2024:

How Much Bitcoin Does BlackRock Own?

Despite an initial hesitance to get involved in cryptocurrency in the early days, BlackRock now manages the largest Bitcoin exchange-traded fund in the world with over $21 billion in total assets. As of September 2024, BlackRock held around 358,000 BTC.

Following increased client demand, BlackRock began to seriously consider how it could provide access to Bitcoin. In 2021, BlackRock invested over $380 million in Bitcoin mining companies, such as Marathon Digital Holdings and Riot Blockchain. In 2022, BlackRock partnered with the cryptocurrency exchange Coinbase to give its clients access to cryptocurrency.

The firm filed for a bitcoin exchange-traded fund in 2023 to give investors exposure to the cryptocurrency. Known as the BlackRock iShares Bitcoin Trust (IBIT), the fund has taken in more than $21 billion since its launch in January 2024.

Aside from Bitcoin, BlackRock also holds 349,970 Ethereum, worth around $910 million.

BlackRock Controversies

Due to the enormous scope of BlackRock’s assets and operations, it has drawn criticism from many angles. Here’s a summary of some of the key controversies in BlackRock’s history:

- Chinese investments: BlackRock set up its first mutual fund in China in 2021. Since then, the firm’s relationship with China and the Chinese government has been criticized. In 2023, the US government launched an investigation into BlackRock’s investments in Chinese companies accused of human rights violations and links to the People’s Liberation Army.

- Conspiracy theories: BlackRock has been at the center of a number of conspiracy theories, such as claims that it owns Fox News and Dominion Voting Systems and that one of its founders is part of a group that brought about the COVID-19 pandemic to assume a new world order. Conspiracies around the first attempted assassination of former President Donald Trump in July 2024 started circulating because the shooter Thomas Crooks had previously appeared in a BlackRock promotional video filmed at his school years before.

- Excessive power: BlackRock invests its clients’ funds into publicly traded companies and, due to the size of BlackRock’s funds, the company is often among the top shareholders at large corporations. As such, it is often argued that BlackRock has a significant say in the way these businesses operate and has too much power over the business world (particularly its refusal to stop destroying the climate). However, BlackRock is quick to remind us that the shares are owned by its clients.

- Investment in the energy industry: In 2018, BlackRock was the biggest investor in coal-fired power stations and many environmental groups campaigned against it. In 2019 climate activists glued themselves to the doors of the company’s London office and, in 2020, the Paris offices were vandalized. In 2020, the company began to make environmental sustainability a key goal of its investment decisions. It sold millions of dollars of coal-related assets and launched new funds that would not invest in companies profiting from fossil fuels. However, several US states, including West Virginia, Florida, and Louisiana, have since blocked BlackRock from doing business with them because of its perceived boycott of the energy sector. Despite its rhetoric shift, BlackRock almost always votes against pro-climate measures in shareholder votes.

- Shadow banking: BlackRock has been repeatedly accused of being a shadow bank. Shadow banking is a term used to describe non-bank financial intermediaries that provide similar services to traditional banks but, legally, work outside of the standard banking regulations. Because it’s an asset manager and not a bank, BlackRock doesn’t have to follow the same rules on capital requirements, oversight, consumer protections, and more.

You can read a detailed rundown of all of BlackRock’s controversies and scandals here.

What Can We Learn From BlackRock?

BlackRock’s success offers several key lessons. Firstly, it has used innovation and technology to help it make the best use of data and risk management tools in investment decisions. This has helped BlackRock to stand out in the market and build trust and loyalty among its many clients.

Secondly, BlackRock’s fairly rapid global growth is a strong lesson in the value of strategic acquisitions and partnerships to help an organization diversify its products and reach new markets. By adapting to changing market needs and expanding its product line, BlackRock has consistently stayed ahead of its competitors across the globe.

Larry Fink’s leadership has emphasized sustainable investing and corporate responsibility since the very beginning, aligning business goals with social and environmental considerations. This long-term vision has been central to BlackRock’s success.

However, we can also learn about challenges of scale when looking into BlackRock’s story. As it has grown, the firm has faced increasing scrutiny over its influence and environmental policies, which once again reinforces the need for transparency and balance to ensure business success.