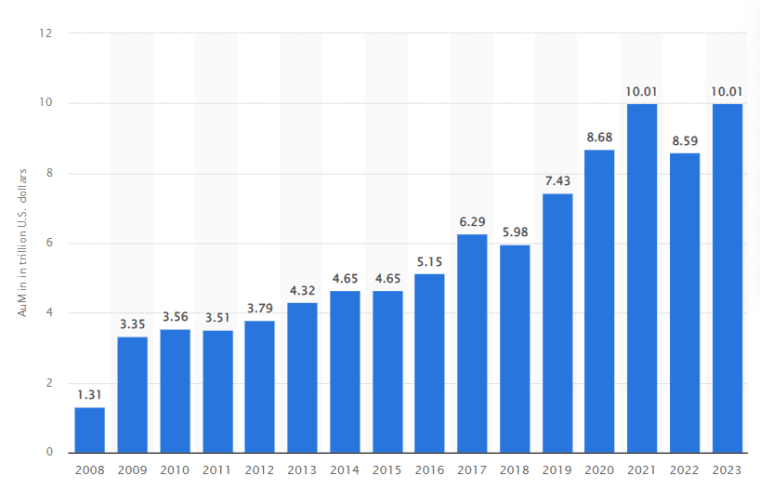

The world’s top investment companies are responsible for managing trillions of dollars of investments every year, and the largest investment firm alone holds over $10 trillion of client assets.

They hold stakes in some of the most successful companies in the world, earning big returns for their investors.

At Business2Community, we’ve compiled this curated list of the top 10 investment companies in the world, according to assets under management (AUM) to be your guide to navigating these investment giants.

Discover when they were founded, where they are based, and how they have grown to become the giants they are today.

The 10 Largest Investment Companies Worldwide

- BlackRock: Manages over $10.65 trillion, specializing in global investment services and ETFs.

- Charles Schwab: With $9.74 trillion in assets, offers comprehensive financial services and wealth management.

- Vanguard Group: Handles $9.3 trillion, known for low-cost index funds and client-centric approach.

- Fidelity Investments: Manages $4.9 trillion, offering diverse investment services and crypto trading.

- State Street Global Advisors: Oversees $4.13 trillion, renowned for introducing the first US-listed ETF.

- JPMorgan Chase & Co.: With $2.9 trillion, offers self-directed investing and personalized financial advisory.

- Goldman Sachs Group: Manages $2.8 trillion, provides innovative investment strategies and banking services.

- Allianz SE: Handles $2.39 trillion, specializing in diversified portfolio options and wealth management.

- Capital Group Companies: Manages $2.3 trillion, focuses on long-term investment strategies globally.

- Edward D. Jones & Co., L.P.: Oversees $1.92 trillion, emphasizes personalized financial advisory services.

The World’s 10 Biggest Investment Companies

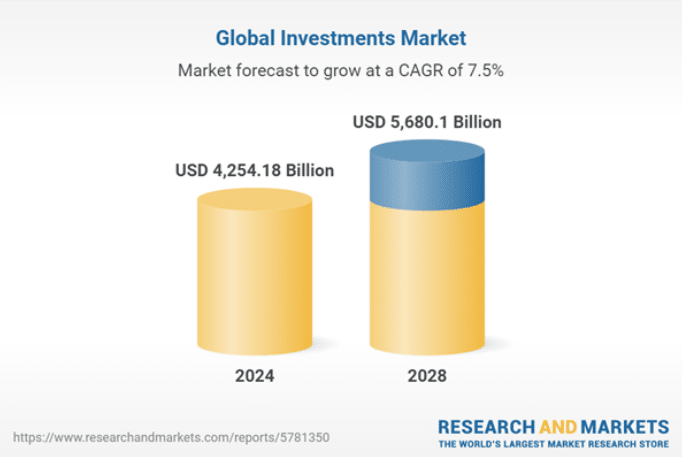

The global investments market was worth $3.96 trillion in 2023 and is expected to reach $4.25 trillion in 2024, according to Research and Markets. By 2028, the market will be worth $5.68 trillion; a CAGR of 7.5%.

Over the past decade, the S&P 500 index, which measures the performance of 500 top US companies and is seen as a representation of the general US stock market, grew by 10.2% annually,

The top 10 investment companies listed here have combined assets under management of over $48 trillion.

1. BlackRock – $10.65 Trillion

BlackRock is the world’s largest investment company, with over $10 trillion of assets under management as of Q4 2023, up from $9.1 trillion the previous quarter. This is the second time BlackRock’s AUM has topped $10 trillion; the first time was in Q4 2021, but the value fell again in 2022.

BlackRock reported revenue of $17.85 billion in 2023, a slight decrease from $17.87 billion in 2022 which was “primarily driven by the negative impact of markets on average AUM, partially offset by higher technology services revenue”, the company’s earnings release stated.

Listen to this podcast for an interview with BlackRock CEO Larry Fink:

The investment firm manages assets for clients in over 100 countries, offering a range of investment services including risk management and financial advice.

BlackRock has become particularly well-known for exchange-traded funds (ETFs); 35% ($3.5 trillion) of its total assets are held in this way through iShares, a business acquired in 2010 from a deal with Barclays. iShares now offers over 1,400 exchange-traded funds to investors of all sizes.

A total of $6.6 trillion is held in index funds and ETFs, and $2.6 trillion in active funds.

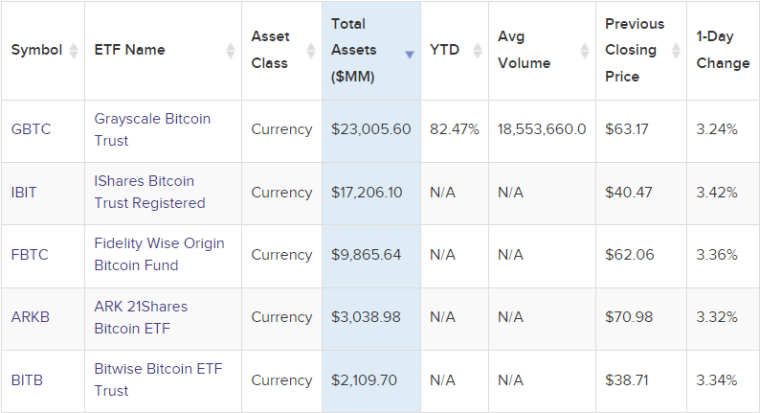

In January 2024 the Securities and Exchange Commission (SEC) approved the first ever applications for spot Bitcoin ETFs. BlackRock’s fund, iShares Bitcoin Trust (IBIT), reached an asset value of $1 billion in the first four days of trading, and was the first of these funds to do so.

It now has a value of over $17 billion but has been surpassed by Grayscale Bitcoin Trust, which holds over $23 billion, according to data from VettaFi.

| Company Name | BlackRock, Inc. (BLK) |

| Founded | 1988 |

| Headquarters | New York, USA |

| Assets Under Management | $10 trillion |

2. The Charles Schwab Corporation – $9.74 Trillion

Charles Schwab is the third-largest provider of index mutual funds and the fifth-largest provider of ETFs according to AUM, and has a market cap of $132.03 billion. It is named after its founder, Charles R. Schwab, who formed the company in 1971 to offer traditional brokerage services and publish an investment newsletter.

Now, the company offers a comprehensive range of financial services including regular banking services. Its investing services include:

- Mutual funds

- Exchange-traded funds

- Money market funds

- Wealth management advisory services

- Research and investment tools

In June 2020, the firm announced that it would begin offering fractional shares under the name Schwab Stock Slices™. These would allow customers to invest in S&P 500 companies for as little as $5 each, making stock ownership in a diversified portfolio more accessible.

Schwab acquired TD Ameritrade later in 2020 for $26 billion. The integration of the two investment companies was completed in 2023, giving Schwab investors access to TD Ameritrade’s popular thinkorswim® trading platforms which offer real-time insights to guide trading strategies.

In 2022, Schwab was the subject of an SEC investigation that alleged that the investment company had misled its robo-advisor clients to believe there were no hidden fees for the service when there was a cash drag on these portfolios. Schwab paid $187 million to settle the charges, while neither admitting nor denying the claims.

| Company Name | The Charles Schwab Corporation (SCHW) |

| Founded | 1971 |

| Headquarters | Texas, USA |

| Assets Under Management | $8.5 trillion |

3. The Vanguard Group, Inc. – $9.3 Trillion

The Vanguard Group was founded in 1975 by John C. Bogle, an American investor from New Jersey. The following year, Bogle launched the First Index Investment Trust, the first index fund available to individual investors. This later became the Vanguard 500 Index Fund.

Ever since then, Vanguard has positioned itself to offer low-cost index funds that are managed solely in the interests of its clients.

Vanguard’s structure is different from that of other investment companies in that the company is owned by its funds, and the funds are owned by its shareholders.

Vanguard offers three classes of shares:

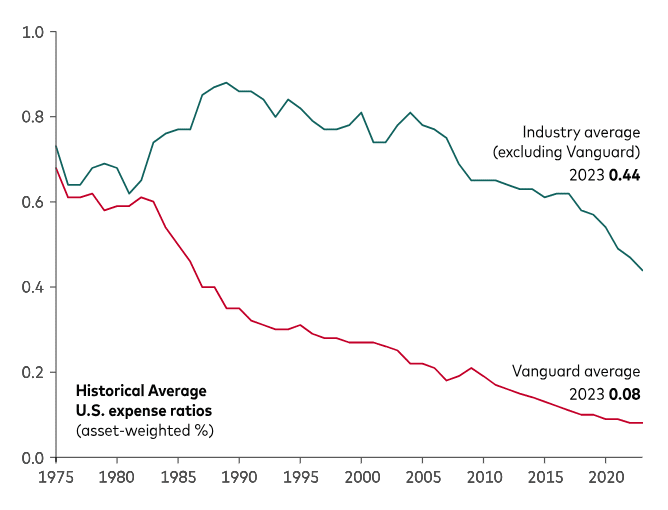

- Investor Shares: Minimum investment of $1,000 – $3,000 with an average expense ratio of 0.28%

- Admiral™ Shares: Minimum investment of $3,000 – $100,000 with an average expense ratio of 0.14%

- Institutional Shares: Minimum investment of $5 million with an average expense ratio of 0.07%

Vanguard’s expense ratios are significantly lower than the industry average.

As of 2023, Vanguard offers 203 funds in the US, and 227 funds in other countries globally.

| Company Name | The Vanguard Group, Inc. |

| Founded | 1975 |

| Headquarters | Pennsylvania, USA |

| Assets Under Management | $8.2 trillion |

4. Fidelity Investments – $4.9 Trillion

Fidelity Investments is the largest privately held investment company, with $4.9 trillion of assets under management as of December 31, 2023.

This is broken down as:

- Equity assets: $2.783 trillion

- Money market assets: $1.19 trillion

- Investment grade bond assets: $672.2 billion

- Hybrid assets: $151.1 billion

- High-income assets: $83 billion

In 2023, Fidelity recorded $28.2 billion in revenue, up 12% year-on-year. Its operating income was $8.5 billion, up 6% year-on-year.

The company offers a wide range of investment services including retirement accounts, mutual funds, ETFs, fractional shares, crypto trading, and financial planning. Many of their products have zero transaction fees, and Fidelity ZERO funds come with no minimum investment and a 0% expense ratio.

Edward C. Johnson II founded this investment company as Fidelity Management & Research in 1946 with the motto “Take intelligent risks rather than follow the crowd”. Although its name has changed since then, Fidelity maintains this ethos of innovating in the investment industry to bring new opportunities to its customers. The company is now led by Johnson’s granddaughter Abigail Johnson, one of the richest people in the world.

| Company Name | Fidelity Investments |

| Founded | 1946 |

| Headquarters | Massachusetts, USA |

| Assets Under Management | $4.9 trillion |

5. State Street Global Advisors – $4.13 Trillion

State Street Global Advisors is the asset management division of State Street Corporation and one of the world’s largest investment companies. State Street had $4.13 trillion AUM as of December 31, 2023, $2.8 trillion of which is with institutional clients.

In 1993, State Street launched the first US-listed ETF, the SPDR S&P 500 ETF Trust (SPY). This is now the world’s oldest and largest ETF, with over $532 million AUM.

The company has introduced several other ETF “firsts”, including the industry’s first sector-specific ETFs in 1998 and the first gold-backed ETF in the US in 2004.

In July 2016, State Street Corporation acquired GE Asset Management, the investment management business of General Electric.

State Street offers investment management services to clients around the world, including retail investors, governments, and financial advisors and intermediaries.

| Company Name | State Street Global Advisors |

| Founded | 1978 |

| Headquarters | Massachusetts, USA |

| Assets Under Management | $4.13 trillion |

6. JPMorgan Chase & Co. – $2.9 Trillion

JPMorgan Chase is the largest bank in the world by market cap and also the largest investment bank in the world, with $5.87 billion in revenue from investment banking in 2023.

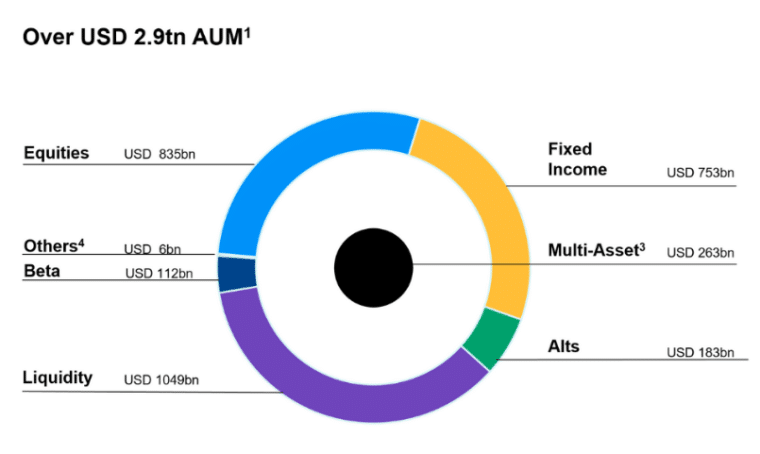

The bank’s asset and wealth management division, JPMorgan Asset Management, holds $2.9 trillion of AUM, predominantly split between liquidity, equities, and fixed-income financial assets.

The CEO of JPMorgan Chase, Jamie Dimon, has been in place since 2005 and has an estimated personal net worth of over $2 billion. He is an influential businessman who is also publicly involved with politics and has served as a presidential policy advisor.

As an investment management firm, JPMorgan Chase offers both self-directed investing and a personal financial advisor service, backed by cutting-edge technology to optimize investment strategies.

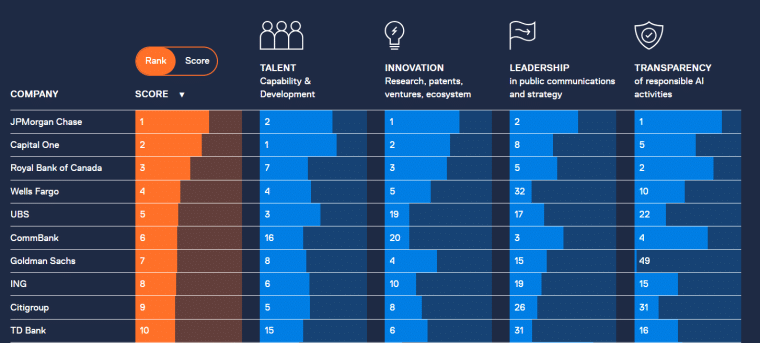

In November 2023, the bank topped the first-ever Evident AI Index for banks, which assesses how financial institutions are readying themselves to use AI in 4 key areas.

JPMorgan Chase made many financial advisors uneasy in May 2023 when it announced its plans to develop an AI-powered investing tool to help investors with the “selection of financial securities and financial assets”.

The company filed a trademark application for “IndexGPT”, with the tool expected to launch in 2026-7, pending trademark approval.

This podcast discusses how JPMorgan Chase has thrived in what has seemed like a shaky sector recently:

| Company Name | JPMorgan Chase & Co. (JPM) |

| Founded | 1871 |

| Headquarters | New York, USA |

| Assets Under Management | $2.9 trillion |

7. The Goldman Sachs Group, Inc. – $2.8 Trillion (Assets Under Supervision)

Goldman Sachs is the oldest of the investment firms listed here, having been founded in 1869. The company joined the New York Stock Exchange in 1896 with partner Harry Sachs taking a seat on the Exchange. It is currently led by millionaire trader David Solomon, who had initially been rejected for a job at GS, twice.

Goldman Sachs holds $2.8 trillion of assets under supervision, which includes assets under management and other client assets on which the bank earns fees for advisory services.

This is broken down into the following asset classes:

- Fixed income: $1.122 trillion

- Liquidity products: $749 billion

- Equity: $610 billion

- Alternative investments: $269 billion

The bank’s $4.9 billion of revenue from investment banking in 2023 makes it the world’s second-largest investment bank, behind JPMorgan Chase.

Goldman Sachs was one of the banks that contributed to the subprime mortgage crisis, primarily through its involvement in the creation and sale of mortgage-backed securities (MBS) and collateralized debt obligations (CDOs). It received a $10 billion bailout from the government through the Troubled Asset Relief Program (TARP). It later repaid this loan, with $1.1 billion interest, in July 2009.

In July 2010, Goldman Sachs paid a settlement of $550 million to the SEC over claims that it had provided incomplete information to investors. This was the largest penalty dealt to a financial services firm at the time.

The investment company agreed to a further settlement of $5.06 billion in April 2016, which included a $2.385 billion civil monetary penalty and $1.8 billion in consumer relief to address the harm caused by its unlawful conduct.

| Company Name | The Goldman Sachs Group, Inc. (GS) |

| Founded | 1869 |

| Headquarters | New York, USA |

| Assets Under Management | $2.8 trillion |

8. Allianz SE – $2.39 Trillion

Allianz SE is the only one of these top 10 investment companies headquartered outside of the US. Based in Munich, Germany, Allianz is the largest insurance company in the world and the largest finance company in Europe.

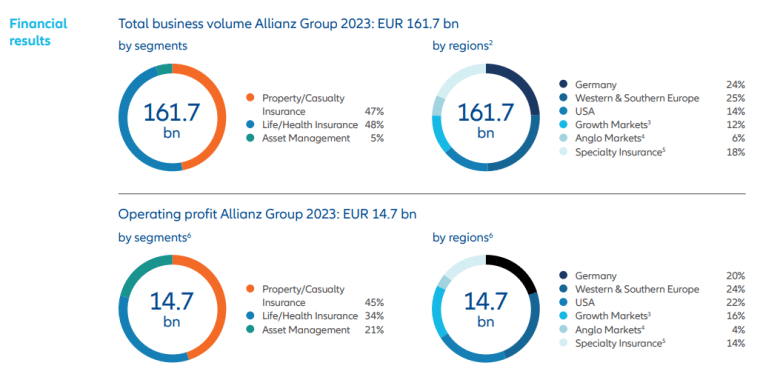

At the end of 2023, Allianz reported AUM of €2.224 trillion ($2.4 trillion), up €82 billion ($89 billion) from the previous year. The investment firm also announced a record operating profit of €14.7 billion ($15.9 billion) and shareholders’ core net income of €9.1 billion ($9.9 billion) in 2023.

Asset management only accounts for 5% of the company’s business volume and 21% of its operating profit.

Under the brand Allianz Global Investors, Allianz offers diversified portfolio options including developed and emerging markets, public and private markets, and single-country and global investment strategies.

It specializes in clients who want a wealth management plan that will preserve their investment portfolio into retirement and for future generations.

| Company Name | Allianz SE (ALV.DE) |

| Founded | 1890 |

| Headquarters | Munich, Germany |

| Assets Under Management | $2.4 trillion (€2.22 trillion) |

9. The Capital Group Companies, Inc. – $2.3 Trillion

Capital Group is an American investment company with an international presence. The firm has over 9,000 associates in 31 offices around the world, including Sydney, Hong Kong, Tokyo, Geneva, Madrid, Milan, and London. As of December 31, 2023, Capital Group had $2.5 trillion of assets under management, including $847.9 billion in institutional retirement assets.

Capital Group operates its investment management services in a distinct way known as The Capital System. Under this system, every investment portfolio has multiple managers, each responsible for their own segment of investments. The result is a diversified portfolio that represents the various managers’ ideas and perspectives.

According to The Wealth Advisor, most portfolio managers have a significant personal investment of at least $1 million in their own funds.

The investment firm also sets itself apart by adopting a long-term investment strategy and refusing to simply follow market trends. It typically holds its investments for 4.3 years on average, compared to the industry average of 1.9 years.

The Capital Group is privately owned by over 450 partners.

| Company Name | The Capital Group Companies, Inc. |

| Founded | 1931 |

| Headquarters | California, USA |

| Assets Under Management | $2.5 trillion |

10. Edward D. Jones & Co., L.P. – $1.92 Trillion

Last on our list of the biggest investment companies in the world is Edward Jones. This investment management firm serves clients in the US and Canada, with over 19,000 financial advisors in 15,000 branch locations. This structure means that clients with brokerage accounts can speak directly to their local financial advisor and build a lasting relationship with them.

Edward Jones held $1.92 trillion of AUM as of December 2023, up 17% from the previous year. These investment accounts are spread over 8 million clients.

For the 2023 FY, the investment firm recorded $13.8 billion net revenue and $1.6 billion net income. This represented a 12% and 15% increase year-on-year, respectively.

Edward Jones has appeared on the Fortune 500 list for 11 consecutive years and is currently in position 333. It also consistently appears on the Fortune 100 Best Companies to Work For list; as high as position 5 in 2017 and 2018 but more recently in position 31 for 2024.

| Company Name | Edward D. Jones & Co., L.P. |

| Founded | 1922 |

| Headquarters | Missouri, USA |

| Assets Under Management | $1.92 trillion |

Learning From the Biggest Investment Companies in the World

For better or worse, the biggest and best investment companies in the world play a vital role in the global economy, responsible for trillions of dollars of investment capital from millions of clients around the world.

Some are innovating with ETFs and fractional shares to help a broader range of investors reach their financial goals such as Blackrock and State Street, while others are making use of robo-advisors and other automated investment strategies including Schwab.

The companies have grown their assets under management based on strong returns for their customers and a range of innovative products. While there are some notable acquisitions in this list like those made by Blackrock and Schwab, the main driver for growth has been astute investing strategies. There are also some notable leaders in this list, showing that having the right team at the top can push a company to achieve its goals.

There have been mistakes over the years, most notably from several investment companies involved in the subprime mortgage crisis which contributed to the global financial crisis. Still, lessons have been learned, and the investment firms that survived are part of a market that is experiencing steady growth.