Are you confused about how to measure the lifetime value (LTV) of your customers? You’re not alone. There are several different formulas you can use to calculate the amount of money a customer will bring in over their life span. The inputs for each calculation vary based on:

- How precise you want your number to be

- Your revenue model

- Whether or not you want to factor in variables such as the cost of customer acquisition, the time value of money, and negative churn

With so many options, it can be difficult to know which calculation is the best fit for your business needs. That’s why, in this blog post, I’ll break down four options for how to measure LTV and talk about appropriate use cases for each.

What Is Lifetime Value?

Before you can measure LTV, it’s important to understand how lifetime value is defined. In general, lifetime value is the total worth of a customer over the entire period of time they purchase your product or service. LTV can be measured as:

- The total revenue a customer brings in for the duration that they are a customer

- The total profit a customer generates for the duration that they are a customer

It’s important to note that if you plan to use LTV to determine the ROI of a customer, you should define lifetime value as the profit a user will bring in. This allows you to factor in the cost of acquiring your customers when measuring value.

In both definitions, the lifetime of the customer is the number of consecutive years a user spends money on the company’s product or service. Once a customer is deemed to have spent zero money with your company for a full calendar year, they are deemed “churned,” and their lifetime expires at the end of the final year they made a purchase.

How to Calculate Lifetime Value

To calculate the lifetime value of a customer, you must segment your database and then select the appropriate calculation method based on the variables you want to take into account.

Step 1: Segment Your Database

First, divide your customers into segments based on total purchases over a period of time. Separating your customers into high-, mid-, and low-frequency purchasers will help you determine the lifetime value of a good customer versus an average or below-average one. It will also help you measure the ROI of your customer segments so you can make more informed decisions about how to improve returns—whether that means increasing the average purchase frequency or average transaction value of your users.

Pro tip: You should avoid using your entire customer database to calculate lifetime value because customers on both purchasing frequency extremes could skew the result.

Step 2: Select Your LTV Calculation Method

There are four formulas you can use to measure LTV:

If you already know which of these formulas you’re looking for, select a method that matches your needs and start calculating! Not sure which you should choose? Keep reading below to learn about each of these four ways to measure LTV.

4 Ways to Measure the Lifetime Value of Your Customers

Let’s break down the factors that each of these methods takes into account and when you should use each of them.

1. Gross LTV

Gross LTV is the simplest way to measure LTV. It is best used by e-commerce companies just getting started with measuring and tracking customer insights. If you do not yet know what your e-commerce store’s profit margin or customer acquisition cost (CAC) is, this is the best formula to use to determine LTV.

Because gross LTV does not take into account the cost of customer acquisition, it reports LTV as a function of revenue, not profit. It also does not take inflation or deflation into account. Gross LTV cannot be used for subscription-based businesses that deliver monthly recurring revenue or businesses with a negative churn rate.

The variables in the gross LTV formula are defined as follows:

- Average order value: the average amount spent each time a customer places an order

- Purchase frequency: the number of purchases an average customer makes in a year

- Average customer life span: the number of years an average customer consecutively purchases products or services

Here is the gross LTV formula:

Let’s take a look at an example of how LTV would be calculated for an online T-shirt retailer.

Gross LTV Calculation Example

An online T-shirt retailer is just starting to report on customer insights. It knows that for its biggest customer segment, the average order value is $25.99, users typically purchase two shirts per year, and the average customer life span is three years.

Here is how these inputs would be applied to the gross LTV formula:

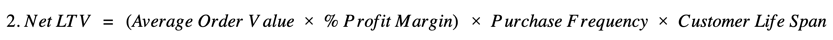

2. Net LTV

Net LTV reports on the total profit you can expect to make on a customer over their life span after all costs have been paid. In addition to the average order value, purchase frequency, and customer life span, net LTV takes profit margin into account. Profit margin is a percentage that indicates how many cents of profit the business can generate for each dollar of a sale. So, if it costs an e-commerce shoe store $30.00 to make one pair of shoes, and it sells that pair of shoes for $59.99, then it would make $29.99 for every pair of shoes sold. This figure amounts to a 50 percent profit margin, meaning that for each dollar of shoe sales, the company makes 50 cents.

Net LTV is best used by e-commerce websites that want more insight into the return on investment that they’re generating from each customer segment.

Here is the net LTV formula:

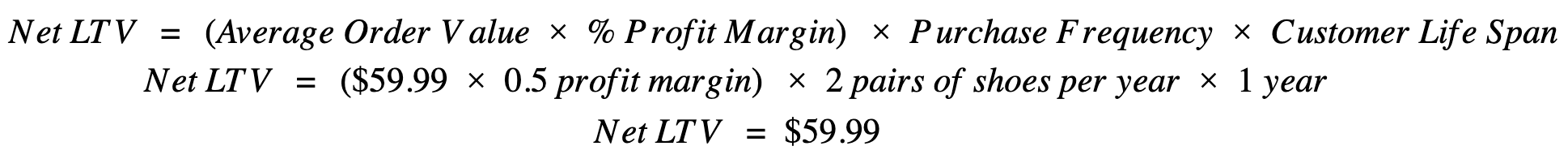

Net LTV Calculation Example

Using the same shoe store example and variables above, let’s calculate the net LTV of a customer segment that buys, on average, two pairs of shoes per purchase, makes that purchase once per year, and remains a customer for one year.

3. Traditional LTV

The traditional LTV formula is a bit more complex than the ones used for gross and net LTV. Just like net LTV, traditional LTV uses average customer order value, purchase frequency, customer life span, and profit margin to determine the worth of a customer segment. However, it also takes into account:

- Customer retention rate: the percentage of customers who repurchase within a given time period when compared to the preceding time period

- Rate of discount: the interest rate used to determine the present value of future cash flows

Here is the traditional LTV formula:

If your business frequently upsells customers or you know that a single customer’s revenue can easily fluctuate from one year to the next, you should use traditional lifetime value to determine the worth of your customer segments.

An example of a business that would be a good fit for the traditional LTV calculation would be an inbound marketing and sales software-as-a-service (SaaS) company that charges its customers monthly based on the number of contacts in their database. A customer who buys the most basic level of the software as the owner of a startup that is growing rapidly will pay less in their first year than in their second. And chances are that the same customer will pay more every year as they outgrow the basic service and purchase a service level that offers more advanced features.

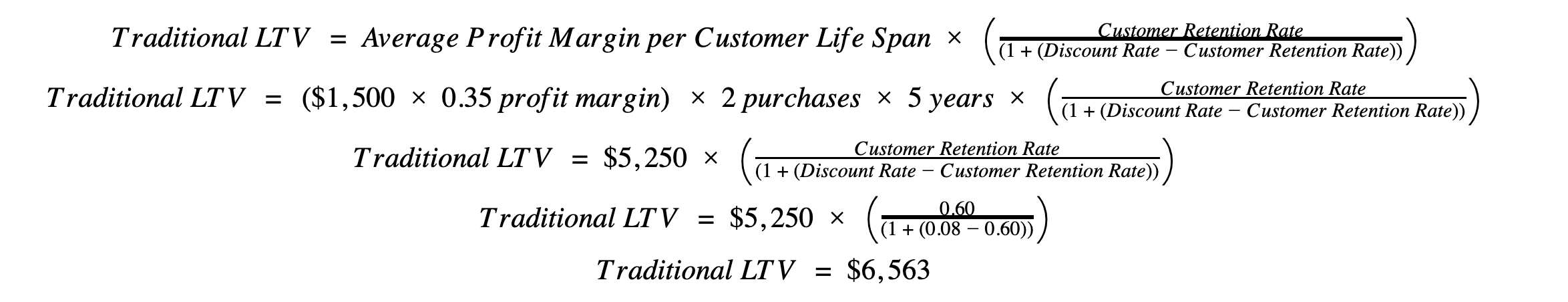

Traditional LTV Calculation Example

Let’s take a look at how to calculate traditional LTV for an inbound marketing and sales SaaS company that offers three service levels: a starter service for $50 per month, a mid-level service for $1,500 per month, and an enterprise service for $4,200 per month.

The average customer purchases its enterprise service for $1,500 in the initial transaction. On average, the customer will make two purchases within a one-year period. The average customer life span is five years. The company’s profit margin is 35 percent. The customer retention rate is 60 percent. The present value of future cash flows (discount rate) is 8 percent.

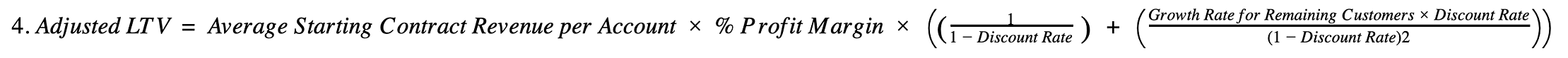

4. Traditional LTV Adjusted for Negative Churn Rate

If your business expands revenue from retained customers at a greater rate than it loses revenue from churn and your revenue-per-customer figure fluctuates easily from one year to the next, then you’ll want to use the traditional LTV formula adjusted for a negative churn rate.

This LTV formula takes into account the same variables as traditional LTV, plus the:

- Growth rate for retained customers: the rate at which customer revenue is expanded within a period of time (example: 16 percent of all customers expand their revenue within one year)

Here is the traditional LTV formula adjusted for negative churn:

High-growth SaaS companies that are essential to their customers are typically best suited to use traditional LTV adjusted for negative churn. Let’s take a look at an example of how this type of LTV can be calculated.

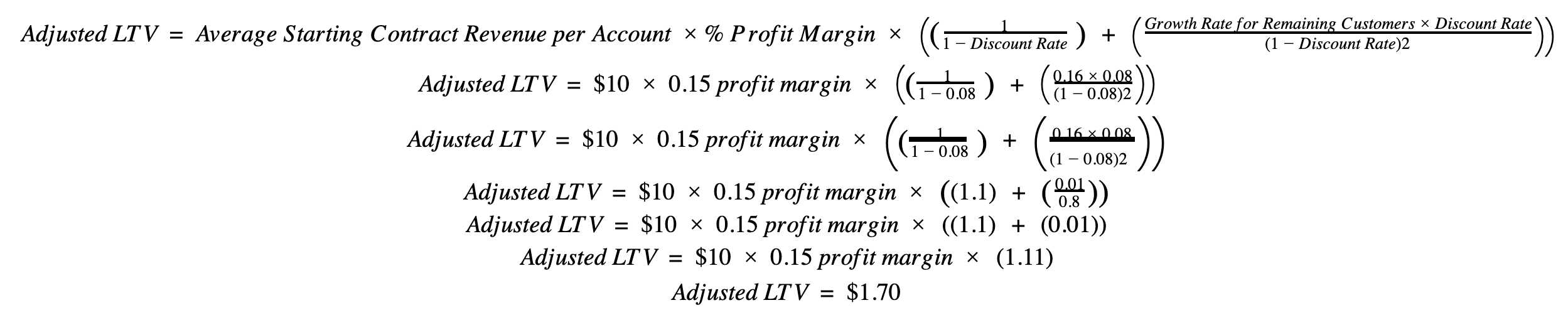

Adjusted Traditional LTV Calculation Example

A software startup that sells a personal finance budgeting app has four levels of service. Its lowest level is a free trial, followed by a $25.99-per-month service, a $125.00-per-month service, and a $525.00-per-month service. Most customers start with the free trial, so the average starting contract value is $10.00.

The profit margin on this initial contract value is 15 percent. The average customer upgrades their service three times per year. The average life span of a customer is 10 years. The discount rate is 8 percent. The growth rate for remaining customers is 16 percent (or a churn rate of minus 16 percent).

Here is how to apply this example to the formula:

Using LTV and Other Customer Insights to Drive Sales

Each of the four ways to measure customer lifetime value can be valuable to your marketing and sales departments. You’ll want to be sure to evaluate your revenue model and know which data points you have access to before selecting an LTV calculation method.

Once you determine the average lifetime value of your customer segments, you can determine the highest amount of money you can spend on acquiring and retaining customers to make a profit. You can also determine the overall ROI of your customer segments by dividing LTV by the cost of customer acquisition.

Want to learn more about how to leverage customer insights like LTV to drive sales? Download our free guide: The Power of Psychology in Sales Enablement.