As crypto assets once again regain investors’ favor, a specific category of digital assets is gaining traction lately – Real-World Asset (RWA) cryptocurrencies. The asset class has seen tremendous success recently following a world-changing announcement from the world’s largest asset manager, Blackrock.

Blackrock launched a massive tokenization fund called BUIDL built on the Ethereum network, home to the 2nd largest crypto.

The fund has already drawn in over $275 million since its launch last week.

Now, there are over $1 billion in US treasuries alone tokenized on-chain across various networks including Ethereum, Polygon, and Solana.

Because of the massive interest in tokenization, many of the top RWA-related cryptocurrencies have seen face-melting gains over the past week or so. According to data from CoinGecko, this segment of the crypto realm has a combined market capitalization of $8.6 billion and 24-hour trading volumes exceeding $1 billion.

These innovative tokens represent real-world assets, such as real estate, commodities, and financial instruments, bringing tangible value to the blockchain ecosystem.

Next up, we’ll explore the 3 most attractive RWA crypto projects that are leading the charge, revolutionizing the way we perceive and invest in traditional assets.

Key Takeaways: Real-World Asset (RWA) Cryptos Surge with BlackRock’s Entry

- BlackRock’s Tokenization Push: BlackRock’s recent launch of its tokenization fund “BUIDL” on Ethereum has driven massive interest in real-world asset (RWA) cryptos, bringing in over $275 million, with $1 billion in tokenized treasuries across networks like Ethereum, Polygon, and Solana

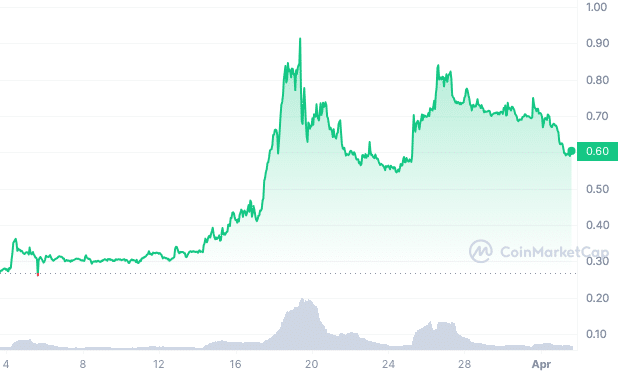

- RWA Tokens Popularity: Tokens like Ondo (ONDO), Polymesh (POLYX), and Centrifuge (CFG) have seen significant gains, driven by BlackRock’s involvement. Ondo Finance’s token surged 40% (

- Ondo Finance: Known for tokenizing US Treasuries, Ondo continues to expand with strategic partnerships, gaining investor confidence .

- Polymesh Growth: POLYX, backed by a strong governance model and tokenomics, rose by 80% following BlackRock’s RWA developments .

- Latest Update: Since BlackRock’s foray into RWA tokens, the sector has seen a surge in investment and token prices. Ondo Finance, Polymesh, and Centrifuge are leading the charge as key players in tokenizing traditional assets. BlackRock’s involvement has boosted confidence in RWA tokens.

What are RWA Tokens and Why Are They Trending?

Real-World Asset (RWA) tokens are blockchain-based digital tokens representing real-world assets such as money, commodities, stocks, bonds, credit, artwork, and intellectual property.

These tokens signify a pivotal change in the way these assets are accessed, traded, and controlled, opening up a plethora of new possibilities for blockchain-enabled financial services and a broad range of non-financial applications.

RWA tokens are trending for several reasons:

- Increased Liquidity: Tokenized RWAs facilitate improved market liquidity for assets that are traditionally hard to liquidate, offering globally accessible liquidity conditions through blockchain technology.

- Transparency and Audibility: The on-chain representation of tokenized assets ensures a high level of transparency and auditable asset management, reducing systemic risks and allowing for precise risk assessment.

- Accessibility and Fractional Ownership: RWA tokens make certain types of assets more accessible to a wider audience, enabling fractional ownership and democratizing investment opportunities.

- Cost Reduction: Eliminating intermediaries from transactions can significantly lower traditional fees associated with transactions and paperwork to reduce the overall cost of operating with RWAs.

- Streamlined Compliance: The use of smart contracts enables the automation of regulatory compliance, simplifying adherence to KYC, AML policies, and tax reporting requirements.

As institutions and investors recognize the benefits of RWA tokenization, the demand for these innovative assets is on the rise, producing growth and fueling the widespread adoption of RWA crypto projects.

Ondo Finance (ONDO) – Analysts’ Favorite RWA Crypto

Market cap: $1.16 billion

Spearheading the RWA tokenization movement is Ondo Finance, a pioneering platform that seamlessly intertwines traditional finance with the world of decentralized finance (DeFi).

Through groundbreaking products like OUSG, the inaugural tokenized US Treasuries product, and Flux Finance, a lending protocol that leverages tokenized Treasuries as collateral, Ondo Finance has positioned itself at the forefront of innovation in this growing field.

The ONDO token, the lifeblood of Ondo Finance’s ecosystem, serves as a governance token, empowering holders to shape the protocol’s future direction, development, and resource allocation through voting on proposals.

Ondo Finance’s recent strategic partnerships with Sui and Aptos networks underscore its ambition to extend the reach and utility of its tokenized products across multiple blockchain ecosystems, setting new standards for the seamless integration of real-world and on-chain assets.

With its cutting-edge approach, scalable solutions, and strategic collaborations, Ondo Finance stands as one of the most promising RWA crypto projects, poised to unlock new investment horizons and drive the widespread adoption of RWA tokenization, making it a frontrunner with substantial growth potential.

Analysts love this project for a few main reasons. It already has a major product launched in an area that is predicted to experience extreme growth and it has formed vital partnerships in both the Web3 and traditional finance spheres alike.

The consultants class, which deals with traditional finance day-in and day-out, clearly likes the project with McKinsey’s head of digital assets quitting to become Ondo’s Chief Strategy Officer. The move could be a massive help in forming even more partnerships with powerful partners in the finance space going forward.

CRYPTO HIRING: McKinsey’s head of digital assets joins RWA tokenization startup Ondo Financehttps://t.co/ORm3OWYw0C

— Blockworks (@Blockworks_) March 31, 2024

Polymesh (POLYX) – BCG’s Darling RWA Crypto?

Market cap: $612.22 million

Polymesh has emerged as a towering presence in the realm of RWA cryptocurrencies, offering a specialized, public permissioned layer 1 blockchain meticulously crafted to revolutionize the security token industry. Its robust architecture provides a seamless solution for tokenizing securities, expanding the vast securities market with significant real-world value.

At the core of Polymesh’s ecosystem lies the POLYX token, a multifaceted utility token that serves as the backbone for transaction fees, governance, staking, and the creation and management of security tokens.

With its unique tokenomics model, which approaches an asymptotic limit for token supply, and a robust governance framework, Polymesh has solidified its position as a reliable and secure platform for bringing real-world assets into the blockchain industry.

Polymesh’s unwavering focus on addressing the intrinsic challenges of governance, identity, compliance, confidentiality, and settlement within the securitization realm has cemented its reputation as a well-established and trusted player in the RWA crypto space, backed by a strong foundation and a proven track record of excellence.

Like Ondo, Polymesh has captured the attention of traditional finance and consulting giants already. Boston Consulting Group (BCG) and GFMA news released a report on the impact of distributed ledger technology (which includes blockchain tech) in global capital markets that honored Polymesh as a major innovator in the space.

New report from @GFMAnews, @BCG and others on the Impact of Distributed Ledger Technology in Global Capital Markets

Polymesh has defined the entire category of the public-permissioned blockchain.

Amazing to see Polymesh in a report from such reputable organizations! pic.twitter.com/C2mpT6A5JM

— Polymesh 🅿️ (@PolymeshNetwork) January 12, 2024

Mantra (OM) – An RWA Crypto with an Appealing Practical Utility

Market cap: $488.46 million

Mantra (OM) has captured the attention of the RWA tokenization space, emerging as a Layer 1 blockchain platform with a mission to democratize investments and promote economic growth, particularly in the Middle East and Asia regions.

By increasing market liquidity and fostering an inclusive financial ecosystem, Mantra aims to make investments more accessible to a broader audience.

Also read: Token vs Coin — What’s the Difference?

The OM token, serving as both a governance and utility token within the Mantra Chain, enables staking for passive yield earning and participation in governance decisions across various products.

Mantra’s innovative approach addresses the scalability challenges inherent to RWA tokenization, laying the foundation for the transformation of the global financial ecosystem.

With its regulatory-compliant infrastructure, developer-friendly tools for building RWA-centric protocols, and initiatives to expand the tokenization of real-world assets, Mantra offers unparalleled practical utility for investors, institutions, and enterprises seeking to explore the vast potential of RWAs.

Its commitment to streamlining asset transactions, opening new investment avenues, and nurturing entrepreneurship make Mantra a standout project in terms of practical utility within the RWA crypto realm.

Mantra is already quite popular in the global financial system as well, hosting major discussions with leaders from massive banks like Citibank and Bank of New York Mellon or BNY Mellon (America’s oldest running bank).

👨💻 Tune in to dig deeper into the asset tokenization space & learn how it is reshaping finance: https://t.co/q3OkdU8ulm

Watch MANTRA CEO & Co-Founder, @jp_mullin888’s panel discussion at #DASLondon 2024 alongside leaders from @Citibank, @AvaLabs, @BNYMellon, & @Blockworks_ #RWA

— MANTRA ✈️ Permissionless III #OMtober (@MANTRA_Chain) April 2, 2024

Risks of Investing in RWA Tokens

While RWA tokens offer exciting opportunities, it’s essential to be aware of the potential risks associated with investing in this emerging asset class:

- Regulatory Uncertainty: The regulatory landscape surrounding RWA tokenization is still evolving and countries may impose different rules and requirements to embrace these platforms creating uncertainties for investors and nascent projects.

- Technological Risks: As with any blockchain-based technology, there are inherent risks associated with smart contract vulnerabilities, security breaches, and potential network congestion or downtime.

- Liquidity Risks: Despite the promise of increased liquidity, the RWA token market is still relatively new, and some assets may face liquidity challenges, especially during market downturns and in the earliest stages of adoption.

- Valuation Challenges: Determining the fair value of tokenized real-world assets can be complex, particularly for unique or illiquid assets.

- Counterparty Risks: In some cases, RWA tokens may rely on third-party custodians or service providers, introducing counterparty risks that must be carefully evaluated.

Also read: Layer 1 vs Layer 2 — Differences Between Blockchain Layers

Investors are advised to perform thorough research to understand the risks involved when adding RWA crypto assets to their portfolios.

As the RWA token market continues to evolve, projects like Ondo Finance, Polymesh, and Mantra are leading the charge in unlocking new investment frontiers, democratizing access to real-world assets, and driving innovation in the cryptocurrency space.

With their unique offerings, robust infrastructures, and practical utilities, these projects are poised to shape the future of RWA tokenization and contribute to the broader adoption of blockchain technology in traditional finance.