Pendle Finance has rapidly emerged as a game-changer in the decentralized finance (DeFi) space, offering a novel approach to yield trading that is captivating investors and industry leaders alike.

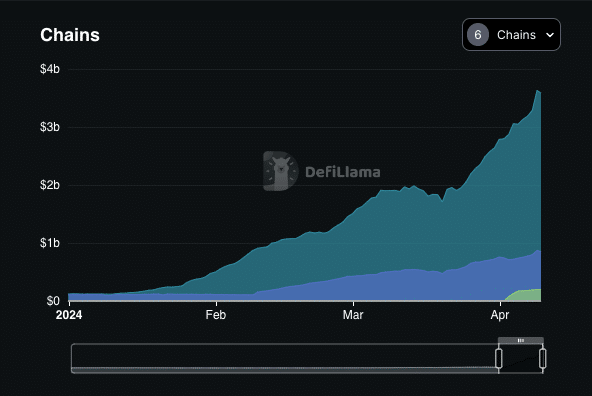

The Ethereum-based protocol has seen its total value locked (TVL) skyrocket by over 1,800% since the start of the year, now exceeding a staggering $4 billion according to the latest data from DeFi Llama.

At the heart of Pendle’s success is its unique yield tokenization model, which allows users to separate the ownership of yield-bearing assets from their future yields. This innovative approach has unlocked new opportunities for yield farming, speculation, and risk management that were previously unavailable in traditional DeFi protocols.

This may sound a bit confusing, and it certainly is, but don’t worry. We’ll get into the Pendle platform, how it works, and much more below.

Pendle Finance: A DeFi Innovator in Yield Tokenization

- Rapid Growth: Pendle Finance, known for its yield tokenization model, has seen its total value locked (TVL) grow over 1,800% in 2024, reaching more than $4 billion. This growth highlights the platform’s appeal in the DeFi space .

- Innovative Yield Model: The platform allows users to tokenize future yields, separating principal assets from their yield, enabling new strategies for risk management and yield trading. This has made Pendle a favored platform for yield farming .

- High Yields on USDe: Pendle’s partnership with Ethena’s USDe stablecoin offers yields over 60%, driving substantial interest and inflows into the platform.

- Key Challenges: Risks include the platform’s dependence on restaking protocols like EtherFi and Renzo, which could introduce vulnerabilities if the broader Ethereum ecosystem faces disruptions .

- Community & Industry Support: Influential figures, such as Arthur Hayes of BitMEX, have publicly supported Pendle’s potential, further fueling market confidence.

The PENDLE Token and Its Rising Popularity

Pendle’s native token, PENDLE, has been a major beneficiary of the protocol’s rapid growth.

The token’s price has surged by an impressive 225% in the past 22 days, drawing significant attention from the broader cryptocurrency community.

This price rally can be primarily attributed to the exponential rise in Pendle’s TVL, which has grown from just $240 million at the beginning of the year to $4.6 billion today.

The surge in TVL reflects the growing adoption and utilization of Pendle’s platform for the tokenization and trading of future yields. This trend is closely tied to the ongoing Ethereum restaking boom, where tokens from protocols like EtherFi and Renzo are contributing significantly to Pendle’s ecosystem.

It turns out that users really like Pendle’s system and it shouldn’t be much of a surprise.

It offers greater flexibility and security than most DeFi applications. It also tends to be quite profitable if you use it right.

50% boost in rewards = 2̵0̵x̵ 30x Sats/day per YT-USDe 👀

Note:

🔹1 YT-USDe = 1 USDe for the minimum $ENA requirement🔹In LP's case, every 1 SY-USDe portion of LP position will be treated as 1 USDe for the minimum $ENA requirement https://t.co/2j9rXNVuTx

— Pendle (@pendle_fi) April 9, 2024

Additionally, the recent launch of Ethena’s synthetic stablecoin, USDe, on the Pendle platform has massively bolstered investors’ interest as it presents opportunities to leverage the high yields offered by Ethena through Pendle’s yield trading pools.

Currently, Pendle’s yields on Ethena’s USDe stand at 61.28%.

This is nearly twice the current yield of USDe staking on Ethena’s platform so, naturally, it has attracted massive inflows of the token.

Pendle’s innovative approach to yield generation has not gone unnoticed by industry leaders, with figures such as Arthur Hayes, the co-founder of BitMEX, hailing the protocol as the “future” of decentralized finance (DeFi). Such endorsements from prominent figures serve to validate Pendle’s unique value proposition and its potential to reshape the DeFi landscape.

The Inner Workings of Pendle Finance

Pendle’s core innovation lies in its ability to tokenize future yields, allowing users to trade these yield tokens on its time-decaying automated market maker (AMM). This process begins with users depositing their yield-bearing assets, such as aUSDT, into Pendle’s smart contracts.

In return, the protocol mints two distinct tokens: the Principal Token (PT), which represents the underlying asset, and the Yield Token (YT), which represents the future yield of the asset.

Also read: Yield Farming vs Staking in March 2024

The separation of principal and yield creates new opportunities for users to manage their exposure and engage in various yield strategies.

For example, users can sell their YT tokens to lock in a fixed yield or they can hold onto the YT tokens and continue to receive the accrued yield. Alternatively, users can also speculate on future yield movements by trading YT tokens on Pendle’s AMM.

Pendle’s AMM is designed to account for the time decay of YT tokens, preventing potential losses due to mispriced financial assets. This innovative approach to market making ensures that the liquidity pools remain robust and accurately priced, optimizing capital efficiency and increasing exposure to future yields.

The PENDLE token plays a crucial role in Pendle’s ecosystem, serving as both an incentive and a governance mechanism.

Users who provide liquidity to the platform are rewarded with PENDLE tokens and a portion of the trading fees generated on the protocol are distributed to PENDLE holders.

Additionally, users can lock up their PENDLE tokens to receive vote-escrowed PENDLE (vePENDLE), which grants them voting power and enhanced rewards.

Pendle Finance Becomes 7th Largest DeFi Protocol

Pendle’s meteoric rise has been nothing short of remarkable. The outstanding growth of its TVL to more than $4 billion in just a year goes to show how eager investors are to test and benefit from its innovative yield tokenization model. This growth trajectory has firmly established Pendle as the 7th largest DeFi protocol in the industry according to DeFi Llama rankings.

As more users deposit their yield-bearing assets into Pendle’s platform, the TVL continues to climb, attracting further attention and investment. Currently, the protocol supports 6 chains – Ethereum, Arbitrum, Mantle, BSC, Optimism, and Avalanche.

Additionally, the recent integration of Ethena’s synthetic stablecoin, USDe, on the Pendle platform has been a significant catalyst for the protocol’s growth. Investors are increasingly recognizing the opportunities presented by Ethena’s high yields and are leveraging Pendle’s pools to amplify their earnings.

The surge in Pendle’s trading volume and fee generation further underscores the growing demand for its yield trading services. According to Dune Analytics, Pendle’s trading volume has crossed the $10 billion mark while its trading fees have increased by more than 600% in the past few days.

The Risks and Challenges Facing this DeFi Protocol

While Pendle’s rapid growth and innovative approach have captured the attention of the crypto community, the protocol is not without its risks and challenges. One of the primary concerns raised by industry analysts, such as those at Coinbase, is the potential risks associated with the overreliance on restaking protocols.

The influx of tokens from restaking protocols like EtherFi and Renzo has been a significant driver of Pendle’s TVL growth. However, this dependence on restaking could potentially expose the protocol to vulnerabilities if there are disruptions or issues within the broader Ethereum restaking ecosystem.

Also read: RWA Crypto Returns Are Crushing the Market

Additionally, the high yields offered by Pendle’s platform, particularly through its integration with Ethena’s USDe, may raise concerns about the sustainability of these returns. As with any DeFi protocol, investors are advised to perform thorough due diligence and understand the potential risks before engaging in Pendle’s yield-trading activities.

Another challenge facing Pendle is the need to maintain the robustness and accuracy of its time-decaying AMM. As the protocol continues to scale and attract more users, ensuring the proper pricing and liquidity of the YT tokens will be crucial to preserving the integrity of the yield trading platform.

Wrapping Up

Pendle Finance has emerged as a true innovator in the DeFi space, revolutionizing the way investors can generate and trade yields.

Its novel approach to tokenizing future yields has unlocked new opportunities for yield farming, speculation, and risk management, captivating both investors and industry leaders.

The protocol’s exponential growth in TVL, trading volume, and fee generation underscores the growing demand for its yield trading services, particularly as the Ethereum restaking boom and the integration of high-yielding assets like Ethena’s USDe continue to drive adoption.

Also read: How to Invest in DeFi in 2024: A Step-by-Step Guide

While Pendle faces risks and challenges, such as the potential vulnerabilities associated with restaking protocols and the need to maintain the efficacy and accuracy of its time-decaying AMM, the protocol’s innovative spirit and the support of prominent figures in the crypto space like Arthur Hayes suggest that it is well-positioned to play a leading role in shaping the future of decentralized finance.

As Pendle continues to evolve and expand its offerings, it will be crucial for investors to stay informed and vigilant, conducting thorough due diligence to navigate the opportunities and risks presented by this groundbreaking DeFi protocol.