Bitcoin mining is one proven approach you can do to make a remarkable profit in your investment.

You can make money mining Bitcoin, but it is not a guaranteed return on investment.

Factors like mining hardware, electricity rate, Bitcoin’s price, and mining difficulty can determine profitability.

Although mining Bitcoins can be complicated and tedious, particularly for beginners, the end result will not disappoint you.

The process of mining Bitcoins involves the use of sophisticated machines.

Such machines consume a lot of electricity to enable it to solve mathematical algorithms in exchange for Bitcoins. Mining Bitcoins, as an individual, may be expensive.

It is, therefore, recommended that you join a mining pool.

In this way, working with other miners is a good idea because you will be able to pool together your resources. You share rewards together with other miners based on the individual contribution of Bitcoins generated.

Mining Bitcoin: Key Highlights

- Initial Investment: Requires significant investment in hardware and electricity.

- Profitability Factors: Influenced by Bitcoin’s price, mining difficulty, and energy costs.

- Pool Mining: Joining a mining pool can increase chances of profitability.

- Technical Knowledge: Requires a good understanding of Bitcoin and mining technology.

- Regulatory Environment: Subject to legal and regulatory changes.

Short Step-by-Step Guide to Bitcoin Mining

Before we dive into the details let’s have a quick look at the main steps you need to follow:

Step 1: Get Mining Hardware: The ASIC Miner is efficient and powerful for Bitcoin mining.

Step 2. Join a Mining Pool: Select a reputable pool and connect your miner.

Step 3. Install Mining Software: Use popular options like BFGMiner or CGMiner.

Step 4. Create a Bitcoin Wallet: Choose and secure your wallet to store mined Bitcoin.

Step 5. Start Mining: Launch your mining software and start mining.

Step 6. Stay Informed: Keep up with market trends and update your software regularly.

Step 1: Get the Best Bitcoin Mining Hardware

It was once possible to mine Bitcoin with your personal computer’s CPU or high-speed graphics cards, but that nowadays is no longer the case.

With the rise of increasingly sophisticated mining hardware, particularly application-specific integrated circuit (ASIC) chips designed for the sole purpose of Bitcoin mining, digging for digital gold through your desktop PC is gone and no longer existing.

You will need to buy mining hardware specifically designed for Bitcoin mining.

You can easily buy most Bitcoin mining hardware on Amazon. Bitcoin mining hardware such as graphic processing units (GPUs), field-programmable gate aray (FPGAs), and application-specific integrated circus (ASICs) are significantly essential.

The use of FPGAs and GPUs helps to increase mining power by as much as 100x, with less power usage hence saving on huge electricity bills.

The ASICs provide 100x more hashing power, specifically designed for the purpose of enhancing mining output.

Mining Bitcoin with anything less will consume more electricity than you are likely to earn.

Step 2: Join A Mining Pool

Once you are ready to mine the digital gold, it is recommended that you think of joining one of the best Bitcoin mining pools.

This would enable you to have a better chance of turning a profit and pool your resources with other miners in a mining pool.

Bitcoin mining pools involve a way in which groups of Bitcoin miners work together, pool their resources, share their hashing power, and split their rewards based on the amount of shares they contributed towards solving a block.

Without joining a Bitcoin mining pool, you might find yourself mining Bitcoins for over a year and never earn any Bitcoin.

It is much better to share the work and divide the reward with a group of Bitcoin miners.

Step 3: Download Free Bitcoin Mining Software

Once you have acquired your Bitcoin mining hardware, you will need to download a special program used for mining Bitcoin.

There are several programs out there, which can be used for mining Bitcoin.

The two most popular programs are BFGminer and CGminer which are command-line programs. But other programs provide a GUI (graphical user interface) for increased ease of use.

Important: some mining pools will provide their own software.

Step 4: Create A Bitcoin Wallet

The next step is to use an existing Bitcoin wallet or create a Bitcoin wallet to obtain the Bitcoins you mine.

Blockchain.com is a good Bitcoin wallet that functions on several different operating systems. You can obtain a Bitcoin wallet just by downloading it on your computer.

Bitcoins are sent to your Bitcoin wallet by using a unique address, which only belongs to you.

It would be helpful if you secure your Bitcoin wallet from potential threats by enabling two-factor authentication or keeping it offline so that it does not have access to the internet.

Step 5: Start Mining

Once you’ve set up your Bitcoin wallet, link it to your mining rig.

You can now begin mining Bitcoin and make money.

Bitcoin mining is achieved by running a double SHA256 hash function verification processes so that to validate Bitcoin transactions and provide the required security of the entire Bitcoin network.

To mine Bitcoin successfully, you should have a high hash rate that is measured in terms of the speed at hashes per second.

The Bitcoin network rewards miners for their effort by issuing Bitcoins to individuals who contribute to the required computational power.

This comes in terms of both newly released Bitcoins and from the transaction fees that are included in the transactions verified when mining Bitcoins.

The more computing power you contribute, the greater your share of the reward.

Step 6: Stay Up-to-Date with Bitcoin News

Make sure to stay up to date with mining difficulty adjustments and the Bitcoin price development to ensure that your Bitcoin mining setup remains profitable.

In June 2022 New York passed a bill to ban Bitcoin mining in some forms, although other US states are pro Bitcoin and encouraging miners to move there – such as Texas.

5 Pro Tips for Mining Bitcoin

- Research Hardware: Invest in efficient mining hardware to optimize performance and reduce costs.

- Join a Pool: Pool mining can increase your chances of earning consistent rewards.

- Monitor Market Trends: Stay updated on Bitcoin prices and mining difficulty levels.

- Energy Efficiency: Focus on reducing electricity costs to maximize profits.

- Secure Setup: Implement robust security measures to protect your mining operations.

Common Mistakes to Avoid When Bitcoin Mining

- Ignoring Hardware Quality: Investing in subpar mining equipment can lead to inefficient mining and higher electricity costs.

- Overlooking Electricity Costs: Failing to account for the high energy consumption of mining rigs can drastically reduce profitability.

- Skipping Pool Research: Joining the wrong mining pool can result in lower returns and wasted effort.

- Neglecting Software Updates: Outdated mining software can decrease efficiency and expose your system to security risks.

- Improper Cooling: Inadequate cooling solutions can lead to hardware overheating and failure.

- Lack of Security Measures: Not securing your wallet and mining setup can lead to loss of mined Bitcoin through hacks.

Best Alternative: Join a Crypto Mining Investment Ecosystem

Copium Investor Pass NFT Collection minting date: 09 November 2022

You can also skip all the steps listed above and invest in a crypto mining ecosystem instead. Even if you don’t have the time, skills, or resources to mine crypto on your own, you can still earn a passive income from crypto mining.

Sites like Bitcoin Minetrix and Copium Protocol are projects that bring passive income opportunities in crypto mining to the masses.

Copium Protocol is centered around Copium Mining, a cryptocurrency mining company registered in New Zealand.

As the company expands its crypto mining infrastructure, some exciting investment opportunities are made available to the public through an advanced Web3 ecosystem.

At the heart of Copium Protocol are Copium Coin and Copium Investor Pass. While Copium Coin is the ERC-20 token that fuels the Copium Protocol ecosystem, Copium Investor Pass is an NFT that gives holders an array of perks and privileges in the ecosystem.

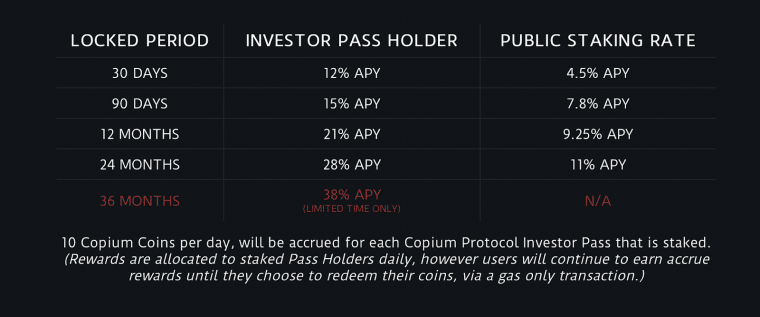

You can stake both Copium Coins and Copium Investor Pass in the Copium Staking Protocol for locked and unlocked periods at various high yield staking rates.

Copium Investor Pass comes with extra benefits like these:

- Exclusive airdrop of 10,000 Copium Coins

- Exclusive rates when staking Copium Coin holdings

- Eligibility for the draw to win 1 of 2 Bitcoin giveaways

- Automatic entry into monthly Copium giveaways

The daily income earned from crypto mining is utilized to purchase Copium Coins from the open market. These coins are subsequently burned to decrease the token supply, which helps increase its value. As a result, investors can confidently stake their tokens in the protocol, without concern for market fluctuations.

The minting of the collection of 10,000 Investor Pass is scheduled for 09 November this year.

Although the Dutch auction sale will begin with a price of 3.5 ETH, the first 2000 people to register for the event can get them for 3 ETH. The sales proceeds will be used to purchase new equipment and upgrade the infrastructure at the Copium Mining facility.

The public launch of Copium Coins and the release of the Copium Staking Protocol will also be held around the same time. Copium Coin will be first listed on Uniswap. But you can buy them early during the public presale at a discounted price. It will run for 60 days (or till the tokens sell out) before the official public launch.

Wrapping Up

If you want to dig for this digital gold and make money, then beware that Bitcoin mining is a costly and complicated process, and it is not possible for individual miners to compete with large mining firms and pools.

But with the right approach and setup, either by joining a mining pool as discussed above or using a cloud mining service, it is still possible to make a profit.

A solid alternative, especially if your investment budget is in the $500-3000 range, is to just buy some Bitcoin and keep it in a regulated and safe crypto exchange or even better in an offline wallet.

This way you are essentially betting that Bitcoin will gain in value as cryptocurrencies become mainstream.

The advantages of this method are that your equipment will not become obsolete, and all you have to do is to wait.

eToro - Top Crypto Platform

- Free Copy Trading of Professional Traders

- Free Demo Account, Crypto Wallet

- Open to US & Worldwide - Accepts Paypal

- Staking Rewards, Educational Courses