Bitcoin (BTC) has demonstrated unyielding defiance of U.S. economic woes and banking turbulence, as the digital currency giant confidently held its ground above the $29,000 mark on Thursday, but as the battle for $30,000 unfolds – could Bitcoin on-chain hold the clues?

In a rollercoaster of a week, Bitcoin shook off Wednesday’s dramatic price fluctuations, propelled by unfounded rumours and mass liquidation of positions, to surge briefly past $30,000.

As the crypto market showcases its remarkable resilience in the face of industry setbacks and macroeconomic uncertainty, U.S. and European equity markets experienced a mixed bag of results heading towards the weekend.

Tech titans like Microsoft, Google, and Meta stole the show with their robust earnings reports, overshadowing concerns about lagging Q1 GDP growth and the struggles of regional bank First Republic.

With an FOMC interest rate decision (priced in at 25bps) on the horizon and renewed banking sector jitters, markets remain on high alert, eagerly anticipating the market’s next big move.

Macro Releases – Friday, April 28 ️

Core PCE Price Index (MoM) (Mar)

Core PCE Price Index (YoY) (Mar)

PCE Price index (YoY) (Mar)

PCE price index (MoM) (Mar)

Chicago PMI (Apr)

Personal Spending (MoM) (Mar)

Michigan 1-Year Inflation Expectations$MACRO $SPY— BACH (@MortensenBach) April 28, 2023

Bitcoin (BTC) Price Analysis

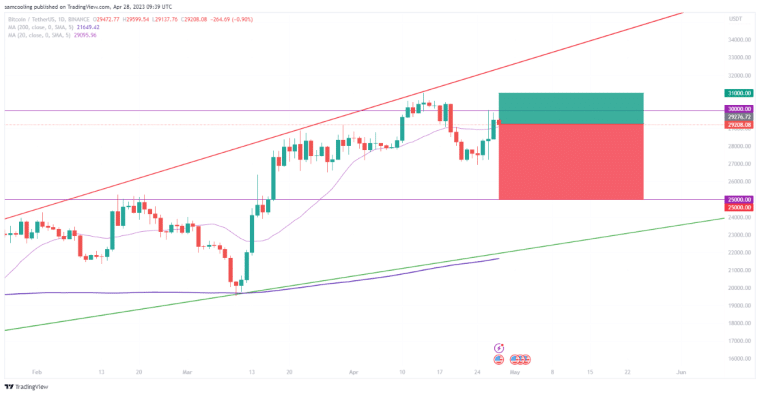

As the battle for $30,000 unfolds, Bitcoin (BTC) is currently trading at $29,217 (-0.88% 24 hour change, at the time of writing).

Markets wait with baited breath as BTC faces ironclad resistance from the 20 Day MA around the $30,000 zone.

Price action comes as Bitcoin posted a +8.47% rally over the past 3 days, in an attempted recovery from a -14.6% retracement following rejection at $31,000 on April 14.

With the critical fight to flip Bitcoin’s 20 Day MA back to support seemingly struggle, traders are eyeing up Core PCE Price Index MoM at 12:30 for confirmation (forecast 4.7%) with many anticipating positive numbers following comforting 1st Quarter Core PCE data yesterday.

However, prominent traders in the space have expressed their concern about an emerging lower high on the daily chart.

The bear case for $BTC is if we break down here. It's a lower high on 1D after making a deviation above $30k.

It's also a lower high on shorter time frames currently forming. In which case I think we can finally expect a lower low and $25k.

— VikingXBT (@VikingXBT) April 28, 2023

The bounce out of retracement, recovers Bitcoin’s April gains to a meagre but existent +2.77%.

However, this comes on the tail-end of a sensational rally out of crypto winter for BTC which is currently sat atop a +76% YTD gain.

The 20 Day MA has emerged as a critically supportive level for the technical structure of BTC’s impressive recovery rally, providing local support as price has pushed high above the slowly ascending 200 Day MA (sat down at $21,692).

In recent hours BTC price has sunk back below the 20 Day MA – removing key supportive feet – exposing BTC to significant risk of a tumbling away to the downside.

Indicators provide little reassurance, the RSI has been cooling off following a rapid heat-up with the bounce out of retracement, but still signals minor bearish divergence at 55.

This adds confirmation to the very bearish MACD showing worrying divergence at -102.

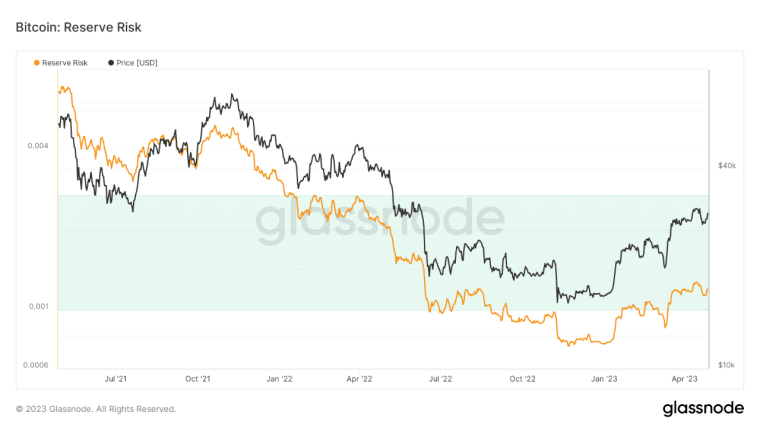

Bitcoin’s Reserve Risk leaves room for desire, as the technical rally since March 15 has pushed BTC firmly out of the lucrative accumulation zone.

While Reserve Risk is still riding relatively low in a macro-view, an increasingly likely return to $25,000 would likely see a return to attractive accumulative levels.

As low prices and high conviction invite the opportunity for those blindsided and side-lined by the 2023 market recovery to join in.

Bitcoin (BTC) On-Chain Analysis

Bitcoin on-chain data paints a unique picture of current market conditions, with a duality as the bigger fish in the pond accumulate against holder supply distribution.

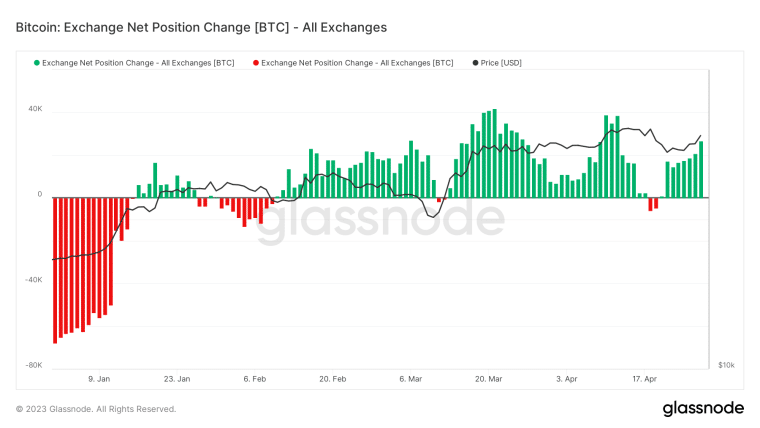

Looking at the 30D change of supply on exchanges (Exchange Net Position Change), there is a significant and growing inflow of BTC out of cold storage into exchange wallets, as holders are seemingly poising themselves to lock-in the first serious profits in over a year in the event BTC is rejected from $30,000.

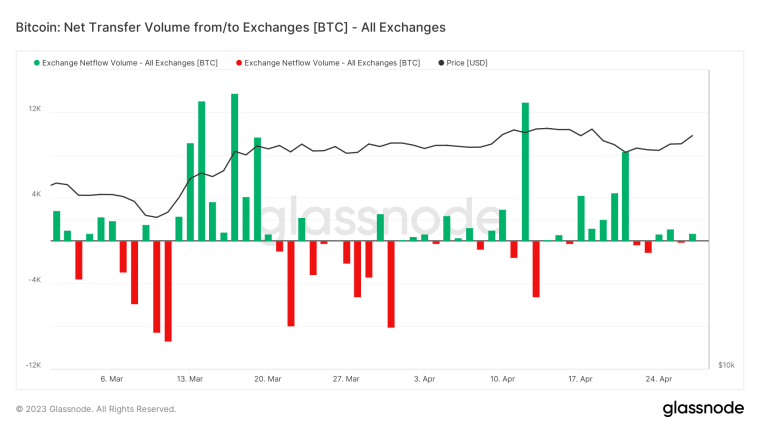

A closer glance at Bitcoin On-chain through the Netflow From/To Exchanges reveals that the past 3-4 days have fluttered between in and outflow, with only marginal divergence either way.

This is indicative of sideways ranging action, with only a relatively meagre net inflow of +2,326 BTC into exchange wallets since Monday – suggesting the majority of the stacked up BTC shown in the 30D change of supply was moved last week, not in relation to current price action (regardless it remains poised to sell!).

Indeed, recent price action has provided much needed relief to holders after a winter period that tested the conviction of even the most diamond-handed holders.

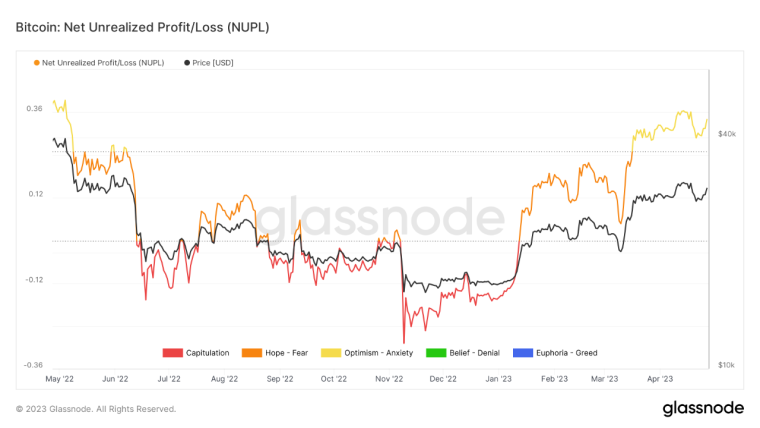

Net Unrealized Profit Loss (NUPL) remains on a strong bounce out of deep capitulation territory, with the push up to current levels bringing large swathes of supply (likely accumulated in 2021) back into profit leaving market sentiment in a state of optimistic anxiety.

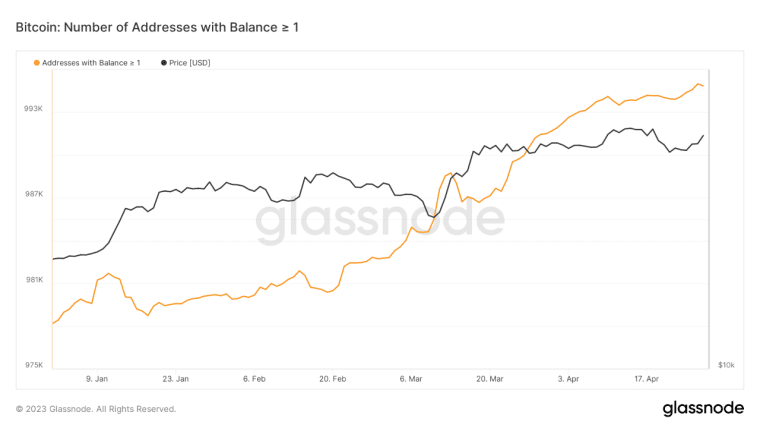

And the bigger players are clearly taking note, as the number of ‘wholecoiner’ BTC wallet addresses is still focused on accumulation as shown by the slowly progressive grind up to a million 1> BTC wallets (now standing at 994,474 addresses).

Market Open Interest Analysis

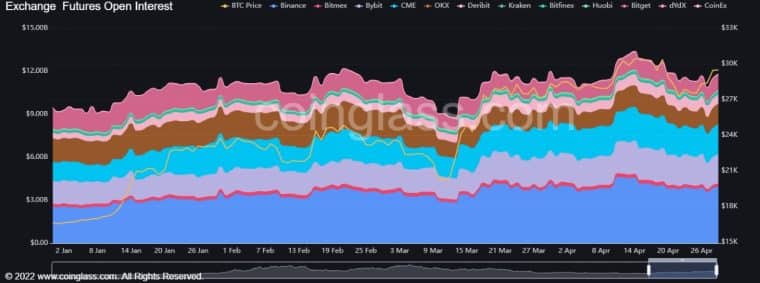

Open Interest (OI – the number of standing derivatives contracts) remains on the fence after the retracement move swept many traders off the table.

Looking at OI across all exchanges, a trickle of OI is driving a slight build up that is worth monitoring with an uptick of +$934m over the past 24 hours.

Although rising, currently OI levels don’t seem high enough to induce waves from market makers.

The OI levels on Binance’s BTC Futures market is building up to potentially worrying levels, as an additional +$380m was added to the pot overnight.

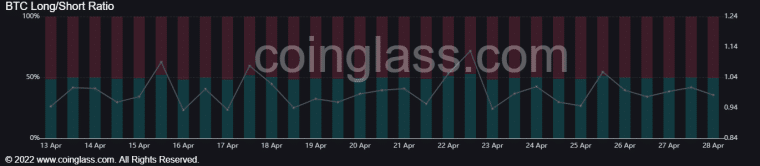

However, OI remains pretty evenly split with the Long Short ratio (0.98) suggesting traders are largely on the fence, with minor divergence as 50.44% of traders move short (taker sell).

Bitcoin (BTC) Price Prediction

Overall, the picture for Bitcoin (BTC) looks bleak heading into the weekend – the battle for $30,000 will make-or-break this rally and could see Bitcoin move to the downside for months.

The slip below the 20 Day MA and Bitcoin on-chain revealing exchange wallets laden with BTC provides real reasons to worry, and a decisive move will likely result from US economic data this afternoon.

If Bitcoin is able to crack $30,000 successfully then longs should target $31,100 as a critical level (representing a +5.9% move).

However, if BTC rejects here it is likely that price action will plummet to $25,000 creating a great opportunity for bear traders (a potential -14.6% move).

Upside targets and downside risk leave Bitcoin with a Risk: Reward ratio of 0.4.

A terrible entry for a long, with more than double the downside risk to reward – hold on to your seats.

RELATED:

Meme Coins Are Down Almost Across the Board – Discover Why Here

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens