Masayoshi Son is the well-renowned chairman and chief executive officer of the SoftBank Group Corp. Softbank has a track record of getting in early on Chinese companies that go on to achieve unbelievable success, such as Alibaba.

With an estimated net worth of $30 billion, Masayoshi Son is among the richest people in the world.

Let’s lear more about his career, net worth, and life story to see what insights we can glean from Masayoshi Son, a man known for his bold bets on startup companies.

How Much is Masayoshi Son Worth in 2024?

- Net Worth: Estimated at $30 billion.

- SoftBank Stake: Holds a 29.2% stake in SoftBank, valued at $25 billion.

- Annual Dividend: Receives around $125 million annually from SoftBank.

- Real Estate: Owns $200 million worth of property, including a $117 million estate in California.

- Side Investments: Investments outside SoftBank amount to $5 billion.

Masayoshi Son’s Net Worth Breakdown:

Since most of Masayoshi Son’s personal wealth derives from his stake in SoftBank, which is publicly traded, his net worth is relatively easy to estimate.

Son holds a 29.2% stake in SoftBank Group, valued at nearly $25 billion. Notably, SoftBank’s stake in Arm Holdings PLC, a leading chip maker, bolsters Son’s net worth as the chip company’s stock has skyrocketed amid the artificial intelligence boom.

| Asset or Income Source | Contribution to Net Worth |

| SoftBank Group Corp stake | $25 billion |

| SoftBank annual dividend | $125 million |

| Real estate | $200 million |

| SoftBank side investments | $5 billion |

| Total Net Worth | $30 billion |

5 Interesting Facts About Masayoshi Son

- Son made his first million by selling a sound-translation device to Sharp while still in university.

- He met Steve Jobs in the 1980s and was one of the first to sell the iPhone in Japan.

- In 2000, Son invested $20 million in Alibaba, which turned into billions as the company grew.

- He lost $130 million in Bitcoin after buying at the 2017 peak.

- Son has a history of making bold investment bets, including his Vision Fund.

Latest News & Controversies

In 2024, Masayoshi Son’s wealth surged due to the strong performance of Arm Holdings, a chip company in which SoftBank holds a 90% stake.

AI technology is causing a big rise in chip demand, which has led to Arm’s stock more than doubling. This has directly helped Son, who is SoftBank’s largest shareholder. However, SoftBank is still handling the issues from its WeWork investment, which went bankrupt in late 2023. Son’s Vision Fund also saw losses over the past year because of falling tech values, but SoftBank reported its first quarterly profit in Q4 2023.

Early Life of the Startup Guru

Masayoshi Son was born on August 11, 1957, in Tosu, Saga, which is on Kyushu Island in Japan. Son is a third-generation Zainichi Korean – his grandfather, Son Jong-kyung, moved to the country during the colonial period.

Son had a difficult childhood, and his father raised pigs and chickens on land that didn’t legally belong to him but to Japan National Railways. Still, his father was able to save enough money to buy a car, becoming one of the first in town to do so.

The family eventually moved to a different neighborhood for better schooling for their children. Son worked at a McDonald’s and after multiple attempts, he managed to meet Den Fujita, the president of McDonald’s in Japan.

Fujita advised Son to study English and computer science. Son moved to the US for education and attended high school at Serramonte High and graduated in two weeks. He then studied economics and computer science at the University of California, Berkeley, and graduated with a BA in Economics in 1980.

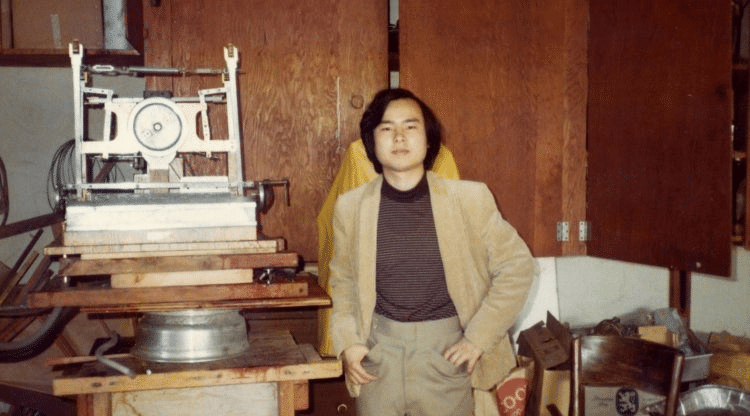

Son’s interest in entrepreneurship began while at university, where, along with other students, he developed a sound-translation device that could convert Japanese into English and German. Son sold the technology to Sharp for a cool $1.7 million.

Son also earned a lot of money by importing used video game machines from Japan and then installing them on college campuses and in restaurants.

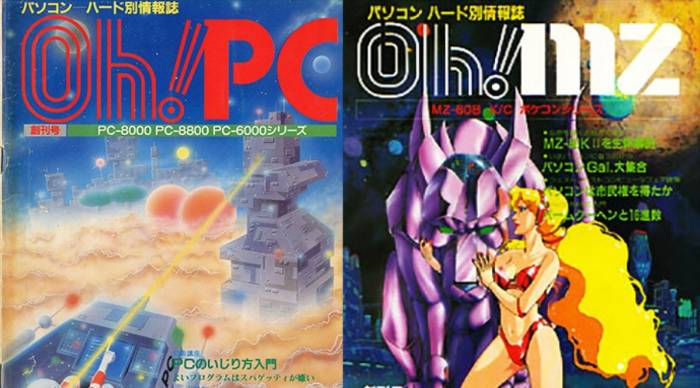

Son used this money to establish the predecessor to SoftBank, Nihon SoftBank, in Japan. The company started out as a software vendor but entered the publishing business with the launch of its “Oh! MZ” and “Oh! PC” magazines. In an interview with Harvard Business Review, Son said that he went with the magazine publishing business despite everybody advising him to the contrary.

The business struggled at first, losing money hand over fist. He decided against closing them to protect the reputation of SoftBank. Son instead decided to give it a final shot and said in the HBR interview that he was going to quit if the plan hadn’t succeeded in a month.

I spent all the rest of the money I had on TV advertisements, nationwide. I made the magazine twice as thick, I kept the price the same, I changed the entire layout, and I printed 100,000 copies, twice as many. The new, larger magazine sold out in three days. All 100,000 copies were sold out. After that, the magazine just took off.

Masayoshi Son Net Worth: Building SoftBank Group Corp.

Son renamed Nihon SoftBank to SoftBank Corp in July 1990 and established SoftBank Holdings Inc. in the US to identify investment opportunities in internet-related companies. In July 1994, SoftBank registered with the Japan Securities Dealers Association and started offering over-the-counter (OTC) shares to the public, raising 20 billion yen from the offering.

With this money, SoftBank acquired a computer trade show operator and a publisher in the US and expanded its global footprint.

Between 1996 and 2006, SoftBank invested in several internet companies and capitalized on the tech boom. Here are some of its successful investments:

- In January 1996, SoftBank established Yahoo Japan Corporation in collaboration with Yahoo!

- In 2000, SoftBank invested in Alibaba which went on to become Son’s most profitable investment.

- In September 2001, SoftBank launched Yahoo! BB in Japan, a comprehensive broadband commercial service.

- In July 2004, SoftBank acquired Japan Telecom Company, further expanding its telecommunications offerings in the country.

Between 2006 and 2014, SoftBank worked towards becoming a telecommunications leader, and in October 2006, it acquired Vodafone K.K. which it rebranded as SoftBank Mobile Corp. In July 2008, SoftBank released the iPhone 3G in Japan. Five years later, SoftBank acquired US-based Sprint and made it its subsidiary. Eventually, in 2020, Sprint merged with T-Mobile.

July 2015 saw SoftBank complete a corporate rebranding and renamed SoftBank Corp to SoftBank Group Corp. and changed the name of SoftBank Mobile Corp. to SoftBank Corp.

SoftBank Corp. also operates as a Japanese mobile phone company while Softbank Group Corp is the investment group of the conglomerate.

In September 2016, SoftBank Group invested in UK chip designer Arm Holdings and made it one of its subsidiaries. The company tried selling Arm to Nvidia, but the deal fell through over regulatory concerns, and SoftBank eventually listed the company on US markets.

Arm Holdings’ stock price has spiked this year and despite the recent correction, it’s trading at over twice its initial public offering price of $51. The company’s most recent financial results showed that AI spending is boosting sales and it saw a stellar three-day rally which was somewhat similar to what we have seen in Nvidia shares.

Son was one of the top 30 gainers on the Bloomberg Billionaires Index thanks to Arm’s rally on the markets. SoftBank owns 90% of Arm’s shares, and Son owns nearly 30% of SoftBank, so he is in a perfect position to profit from this market trend.

Masayoshi Son Net Worth: Making Billions With Vision Funds

Masayoshi Son is well known for his massive, intrepid investments in innovative companies. Many of these investments are made through Softbank’s Vision Fund.

In May 2017, SoftBank Group closed its first Vision Fund which intended to invest in innovative and disruptive technologies, including AI. The company launched its second Vision Fund in October 2019.

While Son gets the due credit for identifying gems like Alibaba early, his bet on the co-living company WeWork went bad and SoftBank lost billions of dollars on its investment. The company – an office-sharing startup – signed a range of long-term leases valued at over $13 billion but faced massive losses as demand for office space reduced dramatically during the pandemic. At its peak, WeWork was valued at $47 billion in January 2019, but this had shrunk to $44 million when the company filed for bankruptcy protection in late 2023.

Masayoshi Son Debts to SoftBank

According to estimates based on company disclosures, Son owes over $5.3 billion to SoftBank Group for the side deals he is offered. While some see these side deals as a conflict of interest, they are meant to boost his compensation as Son draws a meager salary from the company.

Son owns a 17.25% stake in a vehicle set up for unlisted holdings under SoftBank’s Vision Fund 2. The Japanese billionaire also owns a 17.25% stake in a unit in the company’s Latin America fund. In addition, he owns roughly a third of the shares in SB Northstar which is a vehicle set up at SoftBank to trade stocks and derivatives.

Masayoshi Son Net Worth: Softbank Crashes Alongside Tech

In 2022, the stocks of many top tech companies started to crash. Even many of SoftBank Group’s private companies had their valuations crater. As the company lost money on its investments, SoftBank shares plummeted along with it.

Despite the wave of tech woes, SoftBank Group was able to post a profit in the fourth quarter of 2023, which was its first quarterly profit after more than a year of straight losses. The earnings report showed that even the Vision Funds were profitable. Previously, Vision Funds had posted a loss of $32 billion in the fiscal year that ended in March 2023.

The rise in SoftBank Group shares in 2024 is personally benefiting Son, given his massive shareholding in the company. Son’s net worth has risen by around 50% in less than a year amid SoftBank’s surging stock price.

Masayoshi Son Net Worth: Real Estate and Other Investments

Masayoshi Son owns a three-story mansion in Tokyo which is valued at around $50 million. He also owns a 9-acre Woodside estate in California that was purchased for $117 million in 2013. He bought a home in Kansas but listed it for sale in 2018. Son owned the Tiffany Building in Ginza, Japan, but sold the property in 2020 for around $279 million.

It shouldn’t be too much of a surprise that innovation-obsessed Masayoshi Son is interested in cryptocurrencies. He reportedly bought Bitcoin near the 2017 peak, which would have been extremely profitable if he still held it. However, his bet went wrong and he reportedly lost $130 million on the transaction. Meanwhile, the crypto market has since rebounded and bitcoin is trading above $70,000 or over three times the levels at which Son bought them in 2017.

What Can We Learn from Masayoshi Son’s Life?

Masayoshi Son’s incredibly eventful life and his work founding a massive tech institution impart countless lessons for us to pick up on. Despite his humble beginnings, Son has gone on to create one of the biggest private equity companies in the world which should be an inspiration to many. The Japanese billionaire is known for his determination, conviction and thought-out risk-taking, showing that anyone can be successful if they put in the work.

Son’s SoftBank invested in Chinese companies at a time when they were not popular among foreign investors. For instance, SoftBank Group invested $20 million in Alibaba in 2000 when the company was in its infancy. In an interview, Son said that while Alibaba did not have any business plan, let alone revenues at that time, he was impressed by the company’s co-founder Jack Ma.

Alibaba went on to become one of the biggest tech companies in the world, netting SoftBank billions of dollars. Company disclosures earlier this year showed that in its fiscal year 2024, SoftBank was set to book another $8.5 billion gain as it continued to trim its stake in Alibaba.

Son has also been quite nimble about decision-making and last year famously shifted from a “defensive mode” to an “offensive mode” which seems to have played out well as is evident in SoftBank’s surging stock price. It ranks among the biggest Japanese companies by market capitalization.

Business leaders should learn to be flexible and change their approach to fit the changing environment, something that Son has brilliantly done over the years.