Over recent decades, Japan has evolved into a global economic powerhouse, boasting the third-largest economy in the world.

The rapid growth and innovation within the country has catapulted several of the biggest Japanese companies like Toyota Motors into the international spotlight, underscoring Japan’s importance in the global market.

This guide, prepared by our experts at Business2Community, dives into the world of Japanese giants, evaluating their market capitalization to gauge their scale and sway.

For entrepreneurs and business magnates, a deeper understanding of the largest Japanese companies offers a window into their strategic approaches, business ethos, and their substantial influence as the world’s third-largest economy.

Top 10 Japanese Companies (Quick Overview)

- Toyota: World’s leading car manufacturer by global sales, with a market cap of $344.22 billion and annual revenue of $237.9 billion.

- Mitsubishi UFJ Financial: Japan’s largest financial group, holding assets in over 50 countries, with a market cap of $124.82 billion and revenue of $30.79 billion.

- Tokyo Electron: Specializes in semiconductor and display manufacturing equipment, with a market cap of $118.27 billion and revenue of $12.17 billion.

- Keyence: Leader in automation sensors and vision systems, with a market cap of $114.87 billion and revenue nearing $6.27 billion.

- Sony: Renowned for electronics, gaming, and entertainment, with a market cap of $105.48 billion and revenue of $88.88 billion.

- Nippon Telegraph and Telephone Corporation (NTT): Telecommunications giant with a market cap of $101.60 billion and revenue of $87.79 billion.

- Mitsubishi Corporation: Diverse investments, including natural resources and infrastructure, with a market cap of $97.16 billion and revenue of $132.08 billion.

- Fast Retailing: Known for its Uniqlo brand, the largest Japanese clothing company with a market cap of $93.92 billion and revenue of $20.12 billion.

- Shin-Etsu Chemical: Major supplier of semiconductor silicon, with a market cap of $90.25 billion and revenue of $17.42 billion.

- SoftBank: Prominent technology investor with a market cap of $89.76 billion and revenue of $44.24 billion.

The World’s 10 Biggest Japanese Companies

Although Japan’s annual GDP is sluggish at 1.2%, with a low unemployment rate of 2.4% and a positive balance of trade, the economy is generally strong.

The biggest Japanese companies have weathered economic storms and have emerged strong with a global presence, providing a compelling testament to their global influence and the dynamic nature of the nation’s industrial landscape.

1. Toyota – $344.22 Billion

Founded in 1937, automaker Toyota has risen to become not only the top car manufacturer in Japan but also the largest global leader in the automotive industry. In 2020, Toyota became the world’s leading motor vehicle manufacturer by global sales, surpassing the Volkswagen Group.

Toyota ranks as the 26th most valuable company by market cap in the world. In the 2023 financial year, it reported an annual revenue of $237.9 billion.

The company is headquartered in Toyota City, Japan, a city named after the company itself with a population of nearly half a million.

Toyota is one of the companies in Japan renowned for its commitment to sustainability and pioneering the first widely available hybrid electric vehicle, the Prius. Hybrid options have extended to other models like the Camry and Corolla, reflecting Toyota’s commitment to hybrid technology.

Despite advancements in hybrid vehicles, Toyota still trailed in the plug-in electric vehicle sector, not ranking among the top five of the world’s largest electric vehicle manufacturers in 2023.

@toyota The new 2025 #Camry is 100% #Hybrid and 100% ready for the adventure ahead. #Toyota #CarTok #LetsGoPlaces

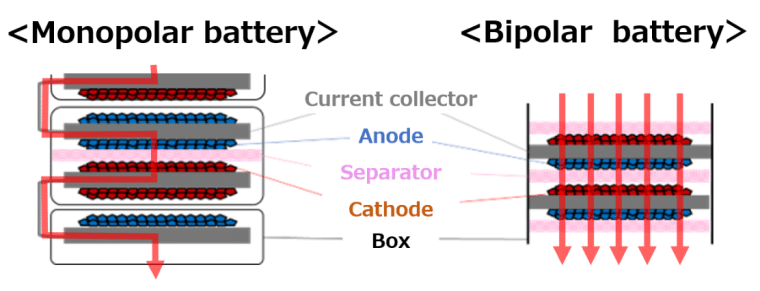

Toyota initially generated excitement with the prospect of groundbreaking solid-state batteries for electric vehicles but later clarified that mass production would be limited.

The company’s cautious approach in the EV market reflects strategic maneuvering amid uncertainties about the global EV pace, such as the slow rollout of charging infrastructure in the US and varying consumer preferences. This has prompted Toyota to adopt a “portfolio approach” encompassing both EVs and hybrids. So far, this strategy has become a resounding success, making it a leader in hybrid vehicle sales.

Toyota is unveiling new technologies, focusing on battery electric vehicle (BEV) technology and the hydrogen business.

Collaboration between Toyota and Mitsubishi Corporation, two of the top companies in Japan, will include establishing a hydrogen factory in July 2024, focusing on advancing BEVs with new battery technologies to achieve a cruising range of up to 1,000km by 2026.

Further solidifying its footprint in the automotive tech space, Toyota has also ventured into autonomous driving technologies, including the Mobility Teammate Concept and the Chauffeur and Guardian.

The company’s commitment is underpinned by investments in robotics and AI, aiming to integrate these innovations into future vehicle models for enhanced safety and efficiency.

| Company Name | Toyota Motor Corporation |

| Headquartered In | Toyota City, Japan |

| Market Cap USD (Billion) | 344.22 |

| Founded In | 1937 |

| Stock Symbol | TM |

| Investments | 33 |

| Acquisitions | 3 |

2. Mitsubishi UFJ Financial – $124.82 Billion

Mitsubishi UFJ Financial Group, based in Tokyo, Japan, is the largest bank in Japan with a rich history dating back to 1880. The group reported a revenue of over $30.79 billion in the twelve months ending March 31, 2023.

Mitsubishi stands as Japan’s largest financial group and holds a strong presence across the world, with operations and assets in over 50 countries. MUFG is involved in banking, trust banking, finance, securities, and credit card businesses, showcasing a diversified financial service offering.

In 2020, Mitsubishi UFJ Financial Group faced scrutiny for its financing of coal-fired power plants, pipelines, and palm oil projects contributing to climate change and biodiversity loss. Despite public pledges, MUFG continues to fund destructive projects in a range of countries, undermining its commitment to sustainability and the Paris Climate Agreement.

Also in 2020, Mitsubishi UFJ Financial Group Inc (MUFG) collaborated with SoftBank Group Corp-backed Grab by agreeing to invest $706 million in the ride-hailing firm, aiming to combine Grab’s advanced technologies and data management expertise with MUFG’s financial experience to drive digital transformation.

MUFG has entered a multiyear global agreement with AWS to accelerate its digital transformation, leveraging generative AI and machine learning capabilities to enhance customer experiences, automate processes, and reduce IT operating costs in the company by 20%.

This collaboration reflects MUFG’s commitment to leveraging cutting-edge technologies to innovate rapidly and provide secure, industry-leading solutions to its customers at a reduced cost.

Mitsubishi UFJ Financial Group has also made inroads into fintech through partnerships with brands such as Akulaku, implementing blockchain technology to enhance banking security and efficiency.

| Company Name | Mitsubishi UFJ Financial |

| Headquartered In | Tokyo, Japan |

| Market Cap USD (Billion) | 124.82 |

| Founded In | 1880 |

| Stock Symbol | MUFG |

| Investments | 46 |

| Acquisitions | 2 |

3. Tokyo Electron – $118.27 Billion

Tokyo Electron, founded in 1963, is a company based in Tokyo, Japan, and ranks as one of the biggest companies in Japan. It carved a niche for itself in semiconductor and display manufacturing equipment. The tech giant reported a revenue of around $12.17 billion in 2023.

Tokyo Electron is lauded for its innovation in manufacturing nanotechnology processing equipment, essential for electronic device production.

In 2024, Tokyo Electron became Japan’s third-most valuable company, surpassing giant brands like Keyence and Sony.

Fueled by heightened interest in companies like NVIDIA and artificial intelligence in general, its stock has increased by 45% in 2024, contributing to the rise of the Nikkei Stock Average and demonstrating strong growth prospects despite projected net profit declines.

Beyond its core semiconductor operations, Tokyo Electron has announced a strategic expansion into renewable energy.

Tokyo Electron has established medium-term environmental objectives, aiming to reduce total CO₂ emissions at its plants and offices by 70% compared to the levels in fiscal year 2019 and to achieve 100% renewable energy usage at its plants and offices by fiscal year 2031.

| Company Name | Tokyo Electron |

| Headquartered In | Tokyo, Japan |

| Market Cap USD (Billion) | 118.27 |

| Founded In | 1963 |

| Stock Symbol | TOELY |

| Investments | 2 |

| Acquisitions | 5 |

4. Keyence – $114.87 Billion

Established in 1974, Keyence is one of the largest companies in Japan and a world leader in the development and manufacturing of automation sensors and vision systems.

The Osaka-headquartered company announced revenue nearing $6.27 billion in 2023.

Keyence has made its mark in the manufacturing industry with its innovative products, ranging from sensors that can detect microscopic defects to barcode readers that can scan any code within milliseconds.

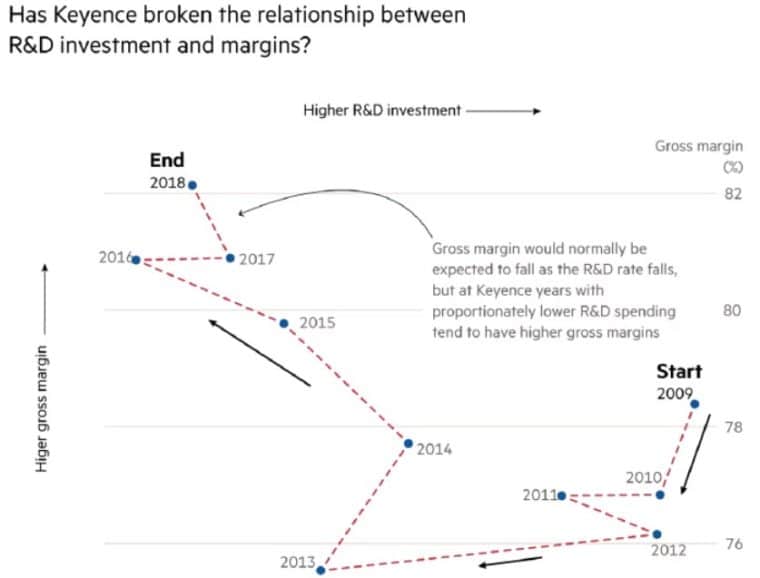

Keyence has invested minimally in R&D despite its profitability and growth has raised questions about its sustainability, especially compared to competitors that are investing more. This has prompted doubts about Keyence’s ability to maintain dominance in the industry without substantial innovation efforts.

Despite skepticism over its R&D operation spending, Keyence has continued to demonstrate resilience and innovation, particularly in the realm of artificial intelligence and deep learning for industrial applications.

Recent developments have seen the company introduce AI-powered vision systems that reduce setup times and enhance detection accuracy, addressing critical industry challenges.

| Company Name | Keyence |

| Headquartered In | Osaka, Japan |

| Market Cap USD (Billion) | 114.87 |

| Founded In | 1974 |

| Stock Symbol | KYCCF |

| Investments | 1 |

| Acquisitions | None |

5. Sony – $105.48 Billion

Next on our list of the largest companies in Japan is Sony, with its headquarters in Tokyo’s Minato district. The company has been operating since 1946. Since then, the company became one of the world’s largest brands, celebrated for its development and manufacturing of electronics, gaming consoles, and entertainment products.

Sony reported revenue of approximately $88.88 billion in 2023, with about a third of its income coming from its gaming and network segment.

Despite stable revenue, Sony has experienced a decrease in its workforce over the past decade, with employee numbers dropping from over 160,000 in 2007 to approximately 109,000 in 2023.

The holding company has had an impact on music, movies, and even financial services, sustaining its world reputation as one of the most diverse and innovative conglomerates.

Sony even ventured into being an automaker when it unveiled a prototype for an electric vehicle, the Vision-S, at the Consumer Electronics Show (CES) in 2020.

More recently in 2023, Sony and Honda have jointly revealed their new electric car brand, Afeela, with plans to start selling an EV for the North American market by 2026. Afeela supplants the Vision-S concept previously introduced by Sony at CES, signifying a shift in their joint venture’s electric vehicle branding.

Leveraging Sony’s expertise in AI and entertainment, the Afeela brand prototype showcased advanced sensor technology, aiming to compete as a premium automaker in terms of pricing and features.

View this post on Instagram

Also in 2023, the company faced a mass lawsuit worth up to $7.9 billion over claims of abusing its dominant position, leading to unfair prices for customers on the PlayStation Store.

The lawsuit, brought on behalf of nearly 9 million UK consumers, alleged that Sony’s requirement for digital games and add-ons selling exclusively through its store resulted in higher prices for customers.

| Company Name | Sony Group Corporation |

| Headquartered In | Tokyo, Japan |

| Market Cap USD (Billion) | 105.48 |

| Founded In | 1946 |

| Stock Symbol | SONY |

| Investments | 57 |

| Acquisitions | 28 |

6. Nippon Telegraph and Telephone Corporation – $101.60 Billion

Nippon Telegraph and Telephone Corporation, or NTT, is a telecommunications company that has its beginning in 1952. It ranks as one of the largest companies in Japan and is headquartered in Tokyo, Japan.

NTT operates as a global telecommunications powerhouse and reported a revenue of over $87.79 billion in 2023, and is valued at $101.6 billion by market cap.

With a rich history, NTT was originally a state monopoly before being privatized in 1985, marking a shift in Japan’s telecommunications landscape.

In 2023, around 9 million sets of customer information, including names, addresses, and phone numbers, were illegally leaked from a unit of NTT West by a former temporary worker who had access to a call center system server. Credit card information was also included in 81 cases.

In a move toward sustainability, NTT has announced its plans to achieve net-zero emissions by 2040. This ambitious goal underscores the company’s commitment to environmental stewardship.

NTT is investing in renewable energy sources and innovating in energy-efficient technologies. Additionally, the corporation is exploring ways to reduce operating emissions across its operations and supply chain, setting a precedent for the telecommunications industry worldwide.

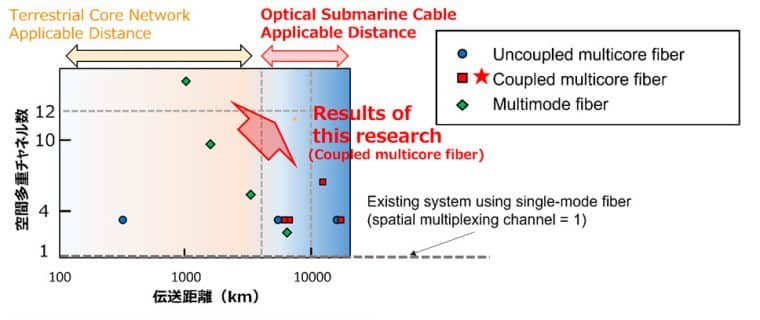

In 2024, NTT and NEC Corporation successfully conducted a long-distance transmission experiment over 7,000km using a 12-core optical fiber, marking progress in enhancing the capacity of transoceanic optical submarine cables.

The engineering collaboration between the two tech giants aims to advance innovative technologies to resolve issues such as crosstalk and non-uniform delays when transmitting data between countries.

| Company Name | Nippon Telegraph and Telephone Corporation |

| Headquartered In | Tokyo, Japan |

| Market Cap USD (Billion) | 101.60 |

| Founded In | 1952 |

| Stock Symbol | NTTYY |

| Investments | 17 |

| Acquisitions | 3 |

7. Mitsubishi Corporation – $97.16 Billion

Mitsubishi Corporation, with its origins dating back to 1950, operates from Tokyo, Japan. The company owns a diverse portfolio of investments under the brand, including natural resources, infrastructure, and financial services.

In 2023, Mitsubishi reported a revenue of $132.08 billion.

Mitsubishi Corp. is intensifying its commitment to renewable energy, aiming to align with Japan’s 2050 net-zero emissions target, with CEO Katsuya Nakanishi emphasizing the importance of raising Japan’s energy self-sufficiency.

The company plans to invest engineering efforts in renewables and nuclear power, while also exploring cleaner alternatives like liquefied natural gas and hydrogen. To achieve these efforts, Mitsubishi Corporation has partnered with Kaluza to develop an AI platform to promote the transition to responsible energy suppliers and electric vehicles.

The Mitsubishi Corporation aims to double the capacity of renewable energy sources by fiscal year 2030, increasing it from the levels recorded in fiscal 2019 to 6.6 million kilowatts.

| Company Name | Mitsubishi Corporation |

| Headquartered In | Tokyo, Japan |

| Market Cap USD (Billion) | 97.16 |

| Founded In | 1950 |

| Stock Symbol | MSBHF |

| Investments | 83 |

| Acquisitions | 2 |

8. Fast Retailing – $93.92 Billion

Founded in 1963 and headquartered in Yamaguchi, Japan, Fast Retailing is known worldwide for its Uniqlo clothing brand. It ranks as the world’s largest Japanese clothing company and operates over 2,400 stores.

In 2023, it reported revenue of approximately $20.12 billion.

This company represents Japan’s innovative approach to global fashion, offering high-quality, functional, and affordable clothing.

Fast Retailing has collaborated with UNHCR since 2006 to donate clothing to refugees worldwide through its All-Product Recycling Initiative, extending to Africa, Asia, and the Middle East.

The company is also committed to reducing greenhouse gas emissions across its operations and supply chain, setting ambitious targets approved by the Science Based Targets initiative.

Initiatives include promoting energy savings at stores through LED lighting installation and energy-efficient air conditioning systems, with the aim of achieving net zero emissions by 2050.

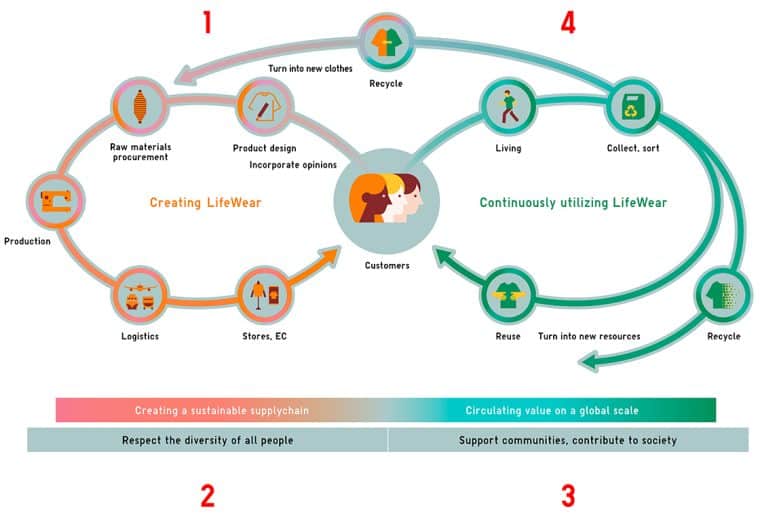

Fast Retailing is committed to advancing its LifeWear concept by integrating sustainability into its business model, with company targets to reduce greenhouse gas emissions, increase the use of recycled materials, and promote waste reduction.

The company aims to create a better society by protecting human rights in its supply chain, conducting social contribution activities globally, and fostering diversity and inclusion within its workforce.

| Company Name | Fast Retailing |

| Headquartered In | Yamaguchi, Japan |

| Market Cap USD (Billion) | 93.92 |

| Founded In | 1963 |

| Stock Symbol | FRCOY |

| Investments | 1 |

| Acquisitions | 1 |

9. Shin-Etsu Chemical – $90.25 Billion

Shin-Etsu Chemical, headquartered in Tokyo, Japan, was founded in 1926. It is a large supplier of semiconductor silicon, essential for computer chips and solar panels.

In 2020, the company reported revenue exceeding $17.42 billion. In addition to its core chemical business, Shin-Etsu has expanded into pharmaceutical products, electronics materials, and synthetic resins.

Shin-Etsu Chemical intends to invest $694 million to ramp up production of high-performance silicon for electric vehicles, aiming to strengthen its position in a growing market driven by the shift to a low-carbon economy.

This strategic move reflects Shin-Etsu’s commitment to meet the rising demand for silicon in EVs and capitalize on opportunities in the evolving automotive industry landscape.

The Shin-Etsu Group‘s main focus is solving various social issues through its business principle of creating value with key materials and technologies, contributing to the UN’s Sustainable Development Goals (SDGs).

Their products, including PVC, silicones, specialty chemicals, and semiconductor silicon, play a role in addressing multiple SDGs such as clean water and sanitation, affordable and clean energy, climate action, and industry, innovation, and infrastructure.

| Company Name | Shin-Etsu Chemical |

| Headquartered In | Tokyo, Japan |

| Market Cap USD (Billion) | 90.25 |

| Founded In | 1926 |

| Stock Symbol | SHECY |

| Investments | 1 |

| Acquisitions | Unknown |

10. SoftBank – $89.76 Billion

SoftBank, one of the most prominent technology investors globally, was founded in 1981 and has its company headquarters in Tokyo, Japan.

It reported revenue close to $44.24 billion in 2023.

Softbank operates investments across various industries, including ecommerce, the media, fintech, healthtech, and other disruptive technologies. The company has invested billions in companies such as Alibaba, Uber, Slack, and WeWork.

In 2023, SoftBank announced the launch of its Vision Fund 2, worth $108 billion, with a focus on investing in artificial intelligence, robotics, and other emerging technologies. SoftBank’s aggressive investment strategy has put Japan on the global tech map and continues to finance innovation and growth in the industry.

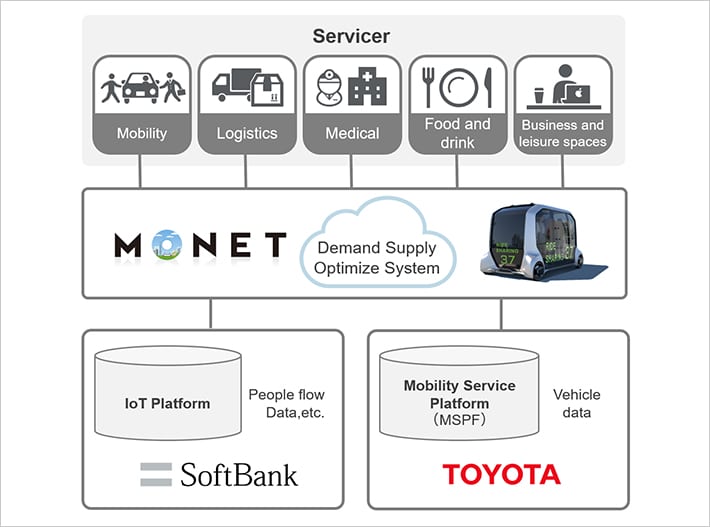

Toyota and SoftBank have formed a strategic partnership to establish MONET Technologies, a holding company aimed at creating new mobility services by combining Toyota’s Mobility Services Platform (MSPF) with SoftBank’s IoT platform.

MONET aims to optimize transportation supply and demand, launching Mobility-as-a-Service (MaaS) businesses starting with just-in-time vehicle dispatch services and eventually expanding to Autono-MaaS businesses using Toyota’s e-Palette vehicles for various purposes, including meal deliveries and mobile offices.

| Company Name | SoftBank Group Corp. |

| Headquartered In | Tokyo, Japan |

| Market Cap USD (Billion) | 89.76 |

| Founded In | 1981 |

| Stock Symbol | SFTBY |

| Investments | 326 |

| Acquisitions | 11 |

Learning From the Biggest Japanese Companies in the World

The narrative of Japan’s largest companies offers insightful lessons into the strategies and philosophies behind becoming a global powerhouse in the business world.

These conglomerates, ranging from telecommunications and media giants to leading consumer electronics brands, have demonstrated that factors like innovation, leadership, strategic acquisitions, and resilience in the face of failure are key drivers of success and increasing sales figures.

Firstly, innovation is evidently the backbone of these companies’ achievements.

Giants like SoftBank and Shin-Etsu Chemical have positioned themselves at the forefront of technological advancements and emerging markets, such as artificial intelligence and high-performance silicon for electric vehicles. Their commitment to research and development illustrates how constant innovation keeps them relevant and competitive on a global scale.

Leadership with a clear vision has also played a crucial role.

For instance, Fast Retailing’s success is partly attributed to its simple yet innovative approach to global fashion and social responsibility, showing that impactful and valued leadership goes beyond profit margins to include social contributions.

Similarly, Mitsubishi Corporation’s focus on renewable energy and sustainability reflects a leadership approach that aligns business goals with global environmental needs.

Mergers and acquisitions are another facet of these companies’ strategies.

Through strategic partnerships and acquisitions, a company can quickly gain new capabilities, assets, and access to new markets. The comprehensive investment and acquisition portfolios of firms like SoftBank illuminate how acquisitions can propel companies to new heights and diversify their business operations.

Learning from failure and resilience is perhaps one of the most universal lessons.

The path to becoming one of the world’s largest companies is fraught with challenges and setbacks. The history of these companies shows that setbacks are not final but provide valuable lessons that contribute to a company’s resilience and adaptability.

For budding entrepreneurs and business leaders, the stories of Japan’s largest companies are a rich source of inspiration and learning.

While the scale of these corporations may seem out of reach, the principles that guided their journeys — innovation, effective leadership, strategic acquisitions, and resilience — are universally applicable.

By focusing on these core values, upcoming businesses can aspire not just to succeed, but to leave a lasting impact in their industries.