Dividend stocks as an asset class have always been popular among those investors who seek regular and predictable income from their investments. We now have the 13F hedge fund filings for the first quarter which reveal which stocks leading fund managers bought and sold in the quarter. Here are the major investments that fund managers have made in high-yielding stocks of late.

To begin with, investors make money from stocks in two (main) ways. The first is capital appreciation (where the price increases) but one needs to sell the shares in order to realize the income. The second way is through dividends which are a regular payment that a company makes to their shareholders, typically on a quarterly basis, to incentivize investment.

Dividends Versus Coupon Payments

While dividends might sound similar to the interest/coupon payments on a bond, there are two vital differences. Firstly, unlike coupons which are either fixed or linked to a set benchmark, dividend payments are not fixed and companies declare them based on their reading of the financial situation. Naturally, if a company has a difficult quarter or year, it probably shouldn’t spend billions of dollars that it can’t afford on dividends. Likewise, companies sometimes increase dividends when business is booming.

Second, while coupons are contractual payments and companies are legally bound to pay them, dividends are discretionary payments and companies can suspend or initiate one based on the board’s assessment.

2020 was a case in point when several companies suspended their dividends as their earnings nosedived amid the COVID-19 pandemic.

https://x.com/DividendGrowth/status/1712198484420358633

Why Many Investors Prefer Passive Income From Dividends

Despite the potential volatility and other downsides of dividend stocks, many investors prefer them as it’s a more certain income stream, unlike betting on pure capital appreciation which depends on the vagaries of the market.

Tons of retirees add dividend stocks to their portfolios to take care of their monthly income needs. While selecting a dividend stock, one should look at the dividend yield which is simply the annual dividend divided by the stock price. As a rule of thumb, a higher dividend yield is better but should be read with other factors like the sustainability of the payouts and the stock’s fundamentals and volatility.

Usually, banks, utilities, consumer goods, and REITs (real estate investment trusts) have a healthy dividend yield. REITs in particular are devised to distribute the bulk of their income among shareholders. Franklin Templeton believes REITs could surprise on the upside in 2024 as the Fed pivots to rate cuts. Meanwhile, a Fed rate cut would eventually depend on curbing inflation which continues to remain stubbornly above the Fed’s 2% target.

Bank Stocks Are Popular Among Pro Dividend Investors

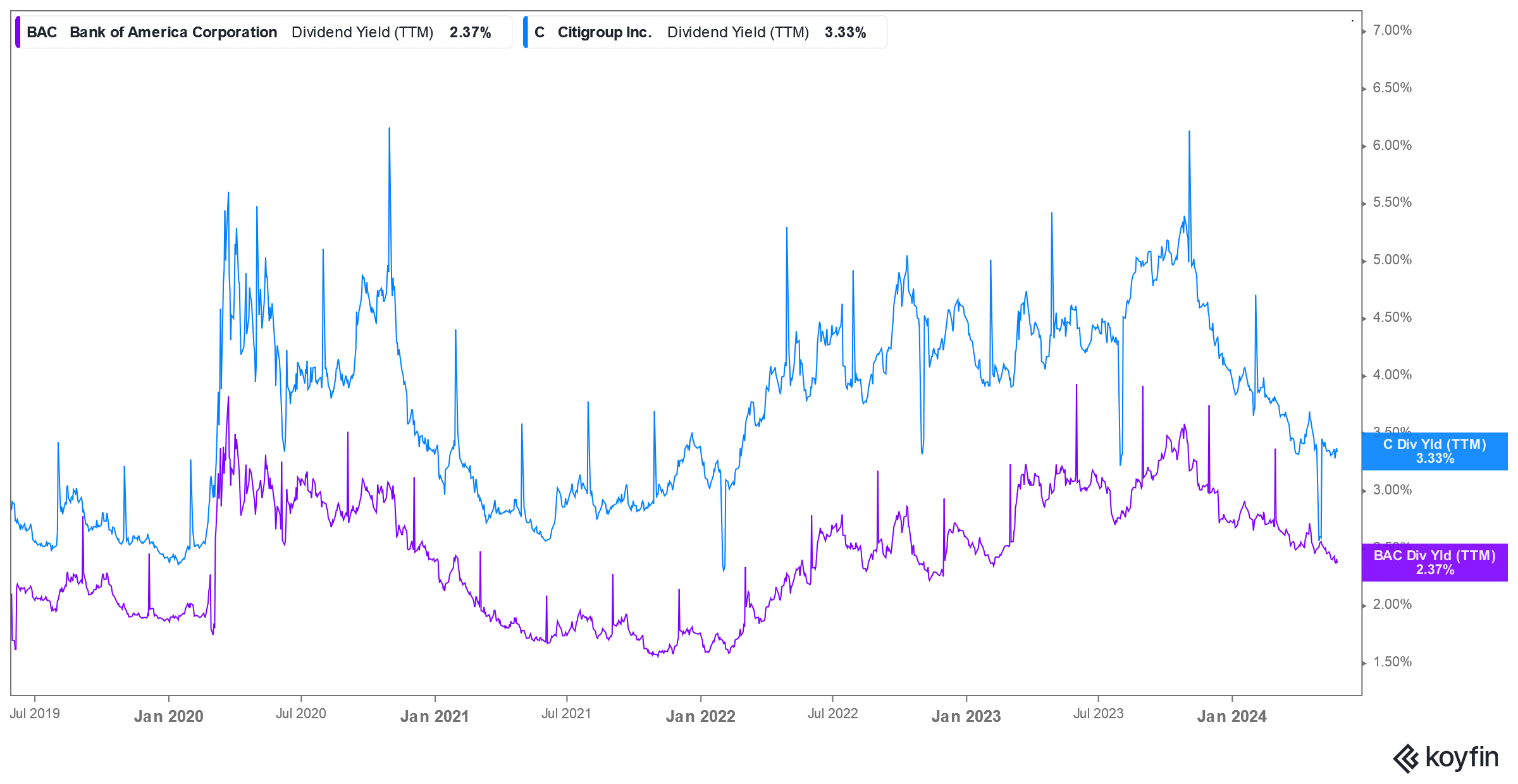

Ken Griffin, the CEO of the massive hedge fund Citadel, added 22.4 million shares of Bank of America in Q1. The stock has a dividend yield of 2.4% which compares favorably with the S&P 500’s yield of around 1.3%. Notably, Berkshire Hathaway is Bank of America’s biggest shareholder and Warren Buffett likes it so much that he has increased his stake beyond 10% (the largest stake he has in any bank).

While Bank of America’s dividend yield sounds enticing, some banks have an even higher yield. Citigroup, for instance, has a dividend yield of 3.3% and Berkshire owns quite a bit of the stock too.

Other funds also added banks with high payouts in Q1. For instance, Soros Fund Management which is the family office of billionaire George Soros added shares of JPMorgan Chase and Goldman Sachs which have a dividend yield of 2.3% and 2.4% respectively.

Consumer Staple Companies Are Usually High Yielding

Consumer staple companies are also known to pay the bulk of their profits as dividends. Coca-Cola for instance has increased its dividend for 62 consecutive years and is among the popular dividend aristocrats. It’s also among the top holdings for Berkshire Hathaway and Buffett has been holding the shares for decades.

However, fellow billionaire Ray Dalio of Bridgewater Associates cut his stake in the beverage company in Q1. Dalio however holds major stakes in Walmart and Proctor and Gamble which have a dividend yield of 1.3% and 2.4% respectively.

In the consumer space, PepsiCo is another popular name and has a yield of 3.1%. Kraft Heinz has an even higher dividend yield of almost 4.5%. Berkshire Hathaway is the company’s biggest shareholder but the stock has been a long-term underperformed as its brands have been found wanting amid competition from newer brands as well as cheaper private labels.

Energy and Utility Companies Have Attractive Payouts

Utility companies have always been known for their high yields. Of late, energy companies have also been rewarding shareholders with high payouts. Chevron and BP for instance have a yield of 4.1% and 4.75% and the former is among Buffett’s major holdings.

Looking at pharma companies, Pfizer boasts of a yield of almost 6% which is largely due to the slump in its share price following tepid sales of its COVID-19 portfolio. The beaten-down stock is however now popular among fund managers and in Q1, Steve Cohen and Point72 Asset Management bought over 1 million shares each.

Under the Radar Dividend Stocks

While large-cap dividend stocks are quite popular among investors, there are several under-the-radar names that have attractive yields. For instance, Ares Capital has a dividend yield of almost 9%. RBC Capital analyst Kenneth Lee is bullish on the company’s prospects and in a note said, “We maintain our Outperform rating, as we favor ARCC’s strong track record of managing risks through the cycle, well-supported dividends, and scale advantages.”

Earlier this month, Bank of America listed several under-the-radar dividend stocks. These include Essential Properties Realty Trust (yield of 4.1%), PNM Resources (yield of 4%), and Patterson Companies (yield of 4.2%).

Ford is another under-the-radar name and yields almost 5%. The legacy automaker’s share price has sagged amid slowing sales of electric vehicles (EVs). However, its internal combustion engine (ICE) and hybrid vehicle sales have been pretty strong and have enabled the company to not only absorb EV losses but also pay impressive dividends. It has also paid special dividends in both 2023 and 2024 which are a cherry on top of its already high yield.