Ray Dalio, one of the most widely known players in the hedge fund industry, has been pioneering the financial sector since 1985. The American investor has introduced groundbreaking investment strategies such as portable alpha, risk parity, and currency overlay.

Thanks to his stake in Bridgewater Associates, Ray Dalio’s net worth in 2024 is estimated at over $17 billion, making him one of the richest people in his industry.

Back in 2013, Dalio’s company Bridgewater Associates was named the largest hedge fund in the world. However, while this business makes up the largest portion of his estimated net worth, Dalio has earned millions from other investments, as well as quite the profit from his bestselling book.

In this article, we’ll discuss how Dalio’s investment strategies and his smart business acumen have made him a multibillionaire.

How Much is Ray Dalio Worth in 2024?

- Founder of Bridgewater Associates: Established in 1975, it has become one of the world’s largest hedge funds with over $124 billion in assets under management as of 2023.

- Net Worth: Estimated at $17 billion in 2024, primarily from his stake in Bridgewater Associates and other investments.

- Pioneering Strategies: Introduced innovative investment approaches like portable alpha, risk parity, and currency overlay.

- Published Author: His book “Principles: Life & Work” is a New York Times Bestseller, and he has authored other influential works on economics and investment.

- Philanthropy: Committed to the Giving Pledge, founded the Dalio Foundation, and supports numerous charitable initiatives including the Dalio Center for Health Justice and OceanX.

- Educational Background: Holds a Bachelor’s degree in finance from C.W. Post College and an MBA from Harvard Business School.

- Career Highlights: Known for successfully dealing with the 1987 stock market crash successfully and making significant long-term investments in the financial sector.

Ray Dalio’s Net Worth Breakdown:

As the founder of one of the largest hedge funds in the world, Ray Dalio consistently shares his opinions and advice about investment opportunities.

Even so, he is very private when it comes to what he invests in privately, so we could only find limited information on his assets like real estate, cars, and more.

Considering this and his known stake and earnings from Bridgewater Associates, the hedge fund manager has accumulated over $17 billion into his net worth. Here is a breakdown of what contributes to his fortune.

| Asset or Income Source | Contribution to Net Worth |

| Bridgewater Associates earnings, 2010-20 | $15 billion |

| Bridgewater Associates earnings, 2005-9 | $1.5 billion |

| Greenwich property sale | $138.8 million |

| Real estate | Unknown |

| Car collection | $700,000 |

| Total Net Worth | $17 billion |

5 Fun Facts about Ray Dalio

- Dalio began investing at the age of 12, buying shares of Northeast Airlines.

- His book “Principles: Life & Work” became a New York Times Bestseller.

- Dalio appeared on The Oprah Winfrey Show after successfully navigating the 1987 stock market crash.

- He’s a member of The Giving Pledge, committing to donate more than half of his wealth to charitable causes.

- Dalio initiated OceanX, an oceanic research project.

Latest News & Controversies about Ray Dalio

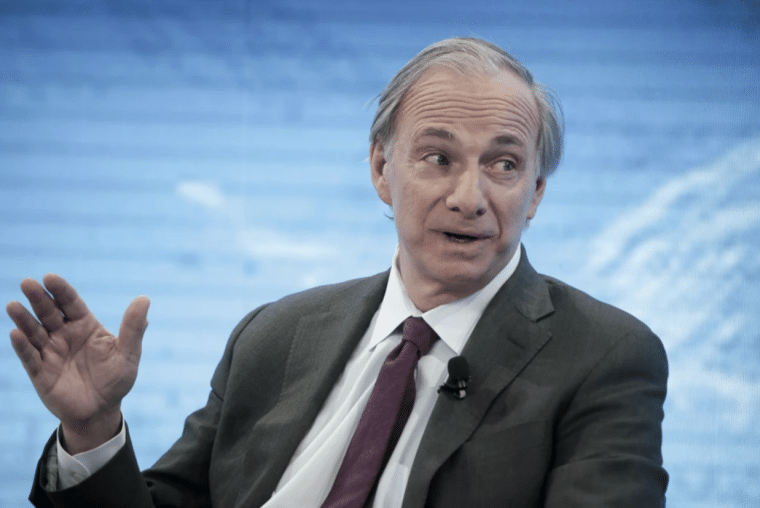

Ray Dalio has been actively sharing his thoughts on the global economy, political risks, and the shifting balance of power in 2024. He recently discussed what he calls the “Five Big Forces” shaping the world today.

These include massive debt levels, internal social conflicts, global geopolitical tensions (particularly involving the U.S. and China), the impact of climate change, and revolutionary technologies like AI.

Dalio has stressed the interconnected nature of these forces and how they will influence economic stability and global leadership in the coming years.

On a political note, Dalio has expressed concern about the growing polarization in the U.S., particularly regarding the upcoming 2024 elections.

He warned that there is a significant chance of a civil conflict if election results are not widely accepted, highlighting the potential for social unrest. Despite his concerns, Dalio has also emphasized the importance of adaptability and innovation in navigating these turbulent times.

In terms of controversies, Dalio remains a vocal figure with some critiques on capitalism and wealth inequality.

Some of his ideas about managing political and economic crises have been seen as controversial, especially his critiques of both left-wing and right-wing populism

Early Life and Education of an Investing Legend

Raymond Thomas Dalio was born on August 8, 1949, in the Jackson Heights neighborhood of Queens, New York City. His father, Marino Dalio, was a jazz musician while his mother Ann was a homemaker.

When young Ray Dalio was only eight years old, the family relocated to Manhasset, Long Island.

To support his family and make some money, he spent his youth doing different odd jobs, including snow shoveling and lawn mowing. While he was a caddy at the Links Golf Club, Dalio met many Wall Street professionals, which sparked his interest in making investments.

During his time as a caddy, the talented Ray Dalio became friends with George Leib, a Wall Street veteran who taught him about trading. This connection would be crucial for his future success and helped him land a job at Leib’s son’s trading firm.

Ray Dalio’s story is even more impressive when you hear that he had an investment portfolio worth thousands of dollars before he even reached high school! For instance, he invested $300 into Northeast Airlines, buying shares at $5 per share.

He tripled this investment within a year when the company merged with another business.

After high school, Dalio enrolled in C.W. Post College, a campus at Long Island University where he obtained his Bachelor’s degree in finance.

During his college years, he continued to dabble in the stock market, but he also uncovered a new passion – commodity futures. He realized that this had the potential to give him bigger profits compared to simple stocks.

After graduating from C.W. Post College, Ray Dalio took a job as a clerk on the New York Stock Exchange during his free summer. When the summer ended, he enrolled in Harvard Business School and completed his MBA in 1973.

A couple of years after his Harvard graduation, Dalio and his friends founded a company that would later become the popular Bridgewater Associates.

What started as a small entity with the simple goal of trading commodities became one of the world’s largest hedge funds, and at one point – the largest hedge fund of them all!

After his graduation from Harvard, Ray Dalio married his wife Barbara Dalio, and started a family.

The newly formed family moved to Wilton, Connecticut, where Dalio pursued his new career in the trade market.

Ray Dalio Net Worth: Punchy Beginnings to a Hedge Fund Empire

Dalio honed exceptional investment skills through a lengthy career in trading. Let’s see how the billionaire hedge fund manager created his fortune in the financial markets.

Professional Beginnings in Trading

When Dalio and his wife moved to Wilton, they lived in a converted barn, which he also used as a trading spot. Not long after, he traded commodity futures on the floor of the New York Stock Exchange.

It was during his time at the New York Stock Exchange that he came upon his idea for the hedge fund that he founded with friends a year later.

He witnessed the Nixon’s decision to take the US off the gold standard as a response to rising inflation, which set in motion the Great Inflation of the 1970s (but also allowed for drastically accelerated economic growth later on).

Ray Dalio’s professional beginnings were quite colorful before he founded Bridgewater Associates. He worked an array of different jobs right out of university, starting with his work in the commodities division of Merrill Lynch in 1972.

After Merrill Lynch, he worked as the Director of Commodities at Dominick & Dominick LLC. He also worked as a trader and broker at a securities firm run by Sandy Weil, called Shearson Hayden Stone.

At the company, his job was to advise grain producers and cattle ranchers on how to hedge risks with futures.

However, Ray Dalio wasn’t exactly happy with the hierarchical structure at Shearson Hayden Stone and after a heated disagreement with his superior during a New Year party in 1974 where he punched his boss in the face, Dalio was fired from his job at the company.

The Founding and Success of Bridgewater Associates

Despite having a rather unique, aggressive behavior in trading while in Shearson Hayden Stone, many of his clients were very trusting of Ray Dalio and relied on him to manage their money.

He gathered capital from his time at the company, which helped him start his asset management fund.

Ray Dalio’s breakthrough was in 1975 when he started Bridgewater Associates, a hedge fund that now counted over $124 billion in assets under management at the end of 2023.

In 2012, his company was first named as the world’s biggest hedge fund with approximately $120 billion in assets under management.

However, the key moment for Bridgewater Associates came when they landed McDonald’s as a client. From this point forward, the hedge fund was propelled into a phase of rapid expansion. They signed large clients like Eastman Kodak and the World Bank, among others.

In 1981, Bridgewater Associates opened a new office in Westport, Connecticut. Thanks to Ray Dalio’s investment strategies and eye for detail, he successfully navigated the stock market crash in 1987.

This brought him on The Oprah Winfrey Show for a notable interview with Oprah a year later, marking the trader’s strength in the industry.

In 1991, Dalio introduced a flagship financial strategy called Pure Alpha, which defined the company’s trajectory. In 1996, he launched All Weather, the fund that pioneered the low-risk strategy we now know as “risk parity”.

Fast forward two decades from the founding of Bridgewater Associates, and the hedge fund claimed the title of the Largest Hedge Fund in 2005.

At this point, Ray Dalio was managing funds for everyone from the California Public Employees’ Retirement Systems to the National Australia Bank and Pennsylvania State Employees’ Retirement System.

Two years later, the company had $50 billion in assets under management, which was $17 billion more than seven years prior.

Stepping Down from CEO at Bridgewater Associates

Dalio controlled Bridgewater Associates alongside the co-founders and investment officers Bob Prince and Greg Jensen since the fund’s inception.

He was the co-CEO of the company for 10 months before announcing in March 2017 that he was stepping down from his position as part of a company-wide shakeup. Jon Rubinstein, the co-CEO was also announced to step down but retained an advisory role.

Stake and Earnings from Bridgewater Associates

Today, Ray Dalio is said to control 79% of Bridgewater Associates Intermediate Holdings. In over a decade between 2010 and 2020, he has generated over $15 billion from the hedge fund. Between 2005 and 2009, he generated around $1.5 billion.

Written Works of Ray Dalio

Ray Dalio isn’t just an incredible investor. He’s a fantastic investing educator who loves to share his ideas and strategies with the world.

In 2007, Ray Dalio published How the Economic Machine Works: A Template for Understanding What Is Happening Now.

He followed up with his second book Principles: Life & Work a decade later. His second authored book became a New York Times Bestseller and was named Amazon’s #1 Business Book in 2017.

Dalio’s third book, Principles for Navigating Big Debt Crises was published in 2018 and analyzed 48 historical examples of debt crises in different economies.

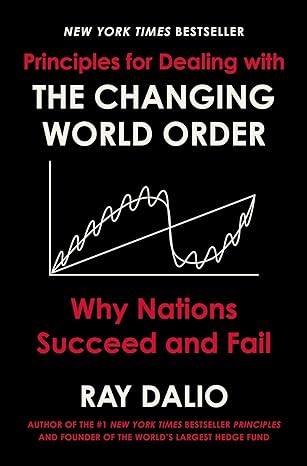

Finally, in November 2021, he published his most recent book titled The Changing World Order: Why Nations Succeed and Fail.

In the highly lauded book, Dalio details hundreds of years of history of the global economy, detailing all of the major shifts of power since the 16th century starting with the inventors of capitalism: the Dutch.

He notes the similarities that each cycle of global power share and draws conclusions to inform readers about the present and future.

Soon after the book was released he published a YouTube video detailing the thesis of the book in a great explainer video and it went viral, reaching nearly 47 million views.

You can watch the video below to find out what Ray Dalio thinks is next for the global economy (hint: it’s not great).

Philanthropic Initiatives

Ray Dalio has been known to contribute a lot to charitable causes.

He and his wife are also part of the Giving Pledge, a group of wealthy people who pledge to contribute more than half of their wealth to charitable causes during their lifetime.

Some of the people who are part of the Giving Pledge are Richard Branson, Bill Gates, Larry Page, and Tim Cook.

In addition to this major commitment, Dalio has also established the Dalio Foundation, an organization that he uses to contribute millions of dollars to organizations such as the National Philanthropic Trust and the David Lynch Foundation.

By the end of 2012, the Dalio Foundation had built up assets of $590 million. A year later, Dalio himself contributed $400 million to boost the foundation’s assets.

Some of the investments he has made through the foundation include:

- $10 million donation to support China’s recovery efforts in response to the coronavirus pandemic

- $4 million donation to the state of Connecticut to fund nutrition and healthcare in 2020

- $50 million donation to the Dalio Center for Health Justice

- Support of the Fund for Teachers

- Part of several foundations that supported the 2018 launch of the Audacious Project by TED

Since 2020, Dalio has been a member of the board of trustees at New York-Presbyterian Hospital. The year he joined the board, the hospital inaugurated the Dalio Center for Health Justice, which aims to advance equal access to quality healthcare for people of color.

Ray Dalio is also the initiator of the oceanic research project OceanX. This project is dedicated to exploring the oceans and safeguarding them from human-induced threats.

Awards and Accolades

As a major philanthropist and a giant in the financial industry, Ray Dalio has been nominated for and received numerous awards over the years. He also had many honorable mentions.

Here is a short list of some of his major accolades:

- 2020: Bloomberg ranked him the 79th wealthiest person in the world

- 2012: Appeared on the annual Time 100 list of 100 most influential people in the world

- 2012: Received the Golden Plate Award of the American Academy of Achievement in Washington D.C.

- Magazines AiCIO and Wired call Dalio the “Steve Jobs of Investing”

- 2012: His hedge fund is listed as the largest in the world

Ray Dalio Net Worth: Investments, Strategies, and Assets

For many years now, Dalio has been recognized for his innovative investment strategies.

To begin with, he categorizes his holdings into alpha and beta investments and uses quantitative methods to find the most lucrative opportunities on the market. He also translates market insights into algorithms and uses technology to make his investment decisions.

One of the key aspects of his investment approach is the use of “risk parity“, a strategy that allows for the use of short selling and leverage and facilitates external diversification.

Now, for the most part, Ray Dalio’s net worth comes from his stake in Bridgewater Associates and his investments in the business. However, he does have some assets in other fields, too, including real estate and gold.

Even though he is a professional investor, there’s very little information online about what assets Ray Dalio has in his own portfolio. What we know is that he prefers cash over bonds (and often gold over cash), though.

Real Estate

Ray Dalio’s primary residence was in Greenwich, Connecticut for many years.

However, the waterfront estate that the family bought back in 2014 for $120 million was listed for sale in February 2023 for $150 million.

While the details are not yet disclosed, the Copper Beach Farm in Greenwich was reportedly purchased by an anonymous buyer for $138.8 million.

While we don’t know where he currently lives, Ray Dalio reportedly owns a New York property of an unknown value.

Car Collection

The hedge fund manager has had several luxury vehicles over the years, including:

- BMW 440i worth around $80,000

- Lexus RC 350 worth around $75,000

- Mercedes-Benz AMG worth around $325,000

- Porsche Panamera worth around $190,000

- Audi S5 worth around $53,000

- Genesis G70 worth around $40,000

What Can We Learn From Ray Dalio’s Story?

Ray Dalio, one of the master investors in the financial industry, has a story with plenty of valuable insights we can learn from.

Throughout his highly successful career, Dalio has left a mark on the financial industry as well as droves of retail traders.

His data-driven decision-making and innovative investment strategies have propelled him to fame and fortune and made him one of the most influential figures in the field.

We can gain insights not just from his story, but also from the numerous lessons the billionaire investor has shared with everyone over time. Dalio has openly taught people how to discover and take advantage of the best investment opportunities, which is likely a key reason for his successful investment career.

Even though he was fired from a job post, Dalio impressed many of his clients who later supported him in his new business venture, Bridgewater Associates.

The investor demonstrates that courage mixed with talent can be turned into an impressive net worth if you believe in yourself. Forming a new company after being fired probably wasn’t very easy, but it most definitely panned out for Dalio.

While Dalio is retired from his role at Bridgewater Associates, his legacy lives on because of his authorship and his philanthropic efforts.

Dalio recognizes the importance of helping others, especially when you have the funds and the power to influence the community to make a real change.

Through his work via the Dalio Foundation and other programs, his dedication to making a positive impact on society is a great lesson that we need to focus on making the world a better place.