The artificial intelligence revolution is in full swing at the biggest US technology companies, fueling record capital expenditures as they race to build out the computing power and infrastructure required for the next era of innovation.

Investors are still worried that this massive growth will turn into a bubble, potentially taking down the entire market when it pops.

These massive AI investments are instilling a degree of volatility in the profitability of these tech giants as showcased in the latest quarterly earnings reports from Meta, Microsoft, Alphabet, and Tesla (TSLA).

So far, the AI market seems to be relatively safe for now. Microsoft and Alphabet, the tech titans behind industry-leading software and online businesses like Windows and Google respectively, saw their stocks surge after reporting blockbuster results that were primarily boosted by higher demand for their AI products and services.

Alongside their positive earnings, they reported record capital spending levels as they continue to pour billions into cutting-edge AI data centers, chips, and training costs.

This could become a liability in the future if demand for AI plateaus, but it seems like the best bet for the moment.

Key Takeaways: AI Investments by US Tech Giants

- Record Capital Expenditures: US tech giants like Microsoft, Alphabet, Meta, and Tesla are making historic investments in AI infrastructure, raising concerns about a potential bubble.

- Microsoft’s AI Dominance: Microsoft increased capital expenditures by $2.5 billion, primarily due to the growth of its Azure cloud services and AI applications like ChatGPT.

- Alphabet’s Focus: Alphabet spent $12 billion in Q1 2024, driven by AI-powered enhancements to its search, YouTube, and cloud services.

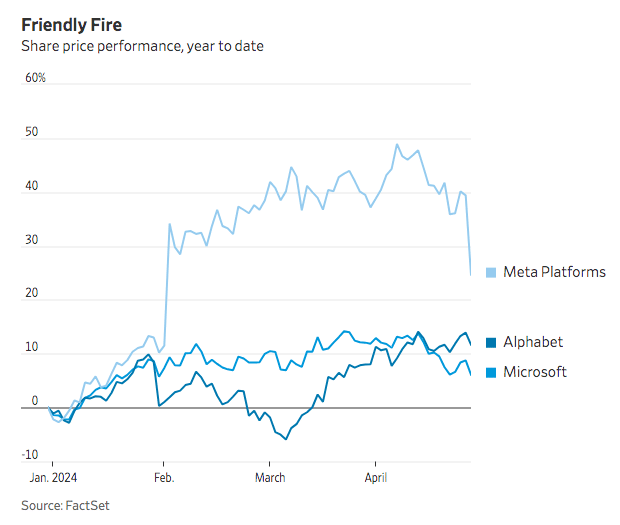

- Meta’s Skepticism: Meta raised its 2024 AI spending guidance, but investor skepticism persists, causing an 11% drop in stock prices due to unclear monetization strategies.

- Tesla’s AI Pivot: Tesla is investing heavily in AI to enhance self-driving technology, spending $1 billion in Q1 2024 and partnering with Baidu in China to gain regulatory approval for its Full Self-Driving (FSD) technology.

- Growing Investor Concerns: While AI investments are driving growth, some analysts warn of a possible bubble if these investments fail to deliver sustainable returns.

Microsoft Reports $2.5 Billion Boost to Its Capital Expenditures Amid AI Investments

Topping the list is the Redmond-based tech company behind Azure – a key platform used by AI companies to run their services by relying on its cloud infrastructure.

Microsoft reported $14 billion in quarterly capital expenditures resulting in a $2.5 billion boost compared to the same quarter a year ago.

“These expenditures over the course of the next year are dependent on demand signals and adoption of our services,” Hood explained on the earnings call, signaling that the company’s investments associated with artificial intelligence are only going to intensify in the future.

“That is partially why you see the capital investment in the shape it is… because right this minute, we do have demand that exceeds our supply by a bit,” commented Microsoft’s CFO Amy Hood, to justify these huge numbers.

She further noted that Microsoft’s Azure cloud AI services like the viral ChatGPT accounted for a robust 7% of Azure’s impressive 31% revenue growth in the quarter. The company is spending heavily to scale up its AI infrastructure to meet the insatiable demand coming from businesses and individuals who are finding new practical uses for AI every day.

Microsoft’s shares did not post any significant movement following the release of its earning report aside from a temporary drop that was rapidly overturned by investors who were eager to buy some shares at a discount.

Alphabet Also Pours $12 Billion to the AI Bonfire

At Alphabet, CFO Ruth Porat said that the company’s own capital expenditure of $12 billion in the first quarter was likely to remain “at or above that level” in the next few periods.

“The significant year-over-year growth in capex in recent quarters reflects our confidence in the opportunities offered by AI across our business,” Porat stated. She cited how AI is rapidly transforming Google’s search business, YouTube, its cloud offering, and other core products.

The enthusiastic reaction from investors to these results showcases how Wall Street is rewarding Big Tech’s early AI leaders who are delivering tangible returns and showing a clear commitment to stay profitable while also striving to maintain their competitive edges.

Alphabet’s blowout quarterly results, aided by accelerating ad revenue growth from AI-powered enhancements to search and YouTube recommendation engines, sent the stock soaring by more than 12% during the extended stock trading session while the price entered a new all-time high at $173.69 per share on 26 April, the day after the earnings report was released.

Meta’s Mixed Messaging on the Future of its Business Results in Big Hit to its Stock Price

In stark contrast, Facebook’s parent company Meta Platforms (META) saw its shares plummet by 11% the day after it announced that it will be raising its 2024 capital expenditure guidance by as much as $10 billion to fund its aggressive, multi-year AI technology roadmap.

The management team also warned investors that it could be “years of investment” before these AI bets start delivering substantial returns.

“I also expect to see a multi-year investment cycle before we fully scale Meta AI, business AIs, and more, into profitable services,” the firm’s well-known CEO Mark Zuckerberg cautioned on the earnings call.

He emphasized that his company is accustomed to seeing “a lot of volatility” in its stock price during the early stages of its product development cycles.

However, he tried to appease investors with this statement: “Historically, investing to build these new scaled experiences in our apps has been a very good long-term investment for us and for investors who have stuck with us.”

Despite these assurances, the market’s negative reaction shows that investors are skeptical about Meta’s ability to successfully monetize and generate profits from its current AI investments. A new adventure from Meta into the AI realm brings back memories from the company’s failed and costly metaverse gamble, which weighed heavily on results over the past year and has not yet delivered any tangible results that justify the billions of dollars poured into it.

“There is more scrutiny placed on what a company’s AI strategy actually is,” said analyst Rishi Jaluria of RBC Capital. “If you don’t have a strategy and are spending a lot, then there is going to be concern.”

Unlike Microsoft’s transparent pursuit of becoming the leader in the growing cloud-based AI services market with Azure or Alphabet’s ongoing AI-powered transformation of its internet services, Meta’s plans to transform its ads and consumer apps like Facebook and Instagram with this technology remain relatively unclear to investors.

The company is betting big but has yet to articulate a compelling strategy for generating new revenue streams from these expenditures.

Elon Musk’s Announces Massive AI Bets at Tesla to Jumpstart a New Era of AI-Powered Mobility

Tesla was the first major tech company to publish its earnings report during this latest season and its numbers sparked a surge of nearly 10% in its stock price after bombshell comments from its controversial CEO Elon Musk who said that they are now fully prioritizing a $10 billion per year investment program on artificial intelligence to ramp up the firm’s production capacity.

Tesla will spend around $10B this year in combined training and inference AI, the latter being primarily in car.

Any company not spending at this level, and doing so efficiently, cannot compete.

— Elon Musk (@elonmusk) April 28, 2024

“Any company not spending at this level, and doing so efficiently, cannot compete,” Musk boldly declared in a post on his social media platform X.

The electric automaker’s new strategic pivot marks Musk’s biggest gamble on AI yet – sacrificing near-term volume growth and cash flow to be the first in launching a potentially lucrative autonomous ride-hailing service that uses Tesla’s self-driving AI software.

In the first quarter alone, Tesla spent $1 billion to double its AI computing capacity to the equivalent of 35,000 top Nvidia AI chips. By year’s end, Musk says that the number will go up to 85,000 chips as Tesla goes all-in on its artificial intelligence plans.

Tesla investors have embraced the strategic shift toward AI for now and shares rallied by over 9% after the company announced a landmark deal that allowed its recently enhanced Full Self-Driving (FSD) software to potentially gain regulatory approval in the Chinese market.

The agreement involves that Tesla will integrate the mapping and navigation data provided by Chinese tech giant Baidu into its FSD system in exchange for a licensing fee. Analysts view Musk’s winning this FSD approval in the Asian country as a “watershed moment” that could unlock Tesla’s autonomous ride-hailing ambitions.

Musk could be loudly engaging in a full-blown transformation of his EV company into an AI-first mobility business and progressively moving away from being a traditional automaker. This pivot could be a short-term response to the company’s struggles to achieve its goal of producing a cheaper EV for the masses.

In regard to these latest announcements Christiaan Hetzner from Fortune magazine writes that Musk “seems to view his cars more as an iPhone on wheels, a premium device for delivering high-margin software, that can be sold at lower profit since revenue will be recouped by offering services around the vehicle.”

AI Gold Rush Leads to Historic Spending Spree for Tech Titans

The diverging performances of the stocks of the four companies mentioned above – two winners, one loser, and one relatively muted – illustrate how artificial intelligence has rapidly emerged as the key battleground that can separate the incumbents of the next era from past successes.

Capital expenditure budgets are being blown wide open as companies double down on building the required infrastructure and computing power needed to stay at the forefront of the AI race.

This spending spree shows no signs of slowing down as the elite of Silicon Valley engages in an AI arms race to be the first to successfully commercialize and monetize generative AI for enterprises and consumers at scale.

These record investments and a surge in AI-fueled stock valuations have stoked fears that an AI bubble could be forming or may have already formed.

However, these four tech giants have demonstrated that they can produce tangible returns, revenue growth, and viable pathways to AI-driven profits and are being richly rewarded by investors for now. That said, those struggling to articulate clear AI strategies like Meta will continue to face potential drops in their valuations as investors want concise roadmaps that can lead to true monetization rather than idealistic remarks.

Analysts at investment banks are projecting that Microsoft’s capex for AI and cloud infrastructure alone could approach a total of around $47 billion for the full fiscal year. Just five years ago, that entire sum would have covered Microsoft’s spending for an entire year across all budget categories.

At Alphabet, its current spending trajectory could result in overall annual capital expenditures approaching or even exceeding $50 billion in 2024, up over 50% from just $32 billion in each of the prior two years. Alphabet offset the surge in costs through deep cost-cutting measures in other areas of its business including dramatic headcount reductions.

“We are very cognizant of the increasing headwind we have from higher depreciation and expenses associated with the higher capex,” Porat said during Alphabet’s latest earnings call.

Latest News & Updates on Big Tech’s AI Race

- Microsoft: The company has significantly increased its capital expenditures, with $14 billion spent in the latest quarter, reflecting a $2.5 billion boost. This is mainly driven by investments in AI, particularly for its Azure cloud platform and AI services like ChatGPT. Demand for AI-driven solutions remains high, and Microsoft expects these investments to continue growing .

- Alphabet (Google): Alphabet reported a $12 billion capital expenditure in the first quarter, and it expects this level to remain or increase as AI continues to drive its core businesses, including search and YouTube. AI enhancements have boosted ad revenue, and the company’s aggressive investment in AI infrastructure is paying off with a 12% stock price surge .

- Meta: Unlike its peers, Meta has faced some skepticism from investors due to unclear paths to AI monetization. While Meta raised its capital expenditure guidance by $10 billion to fund its AI ambitions, the stock fell by 11%. Investors remain concerned due to the mixed messaging and memories of the costly metaverse investment .

- Tesla: Tesla is focusing heavily on AI for its self-driving and autonomous vehicle ambitions. Elon Musk announced a $10 billion annual AI investment plan, including a partnership with Baidu to integrate AI for its Full Self-Driving software in China. This strategic shift has bolstered investor confidence, with Tesla’s stock rising 9% after the announcement.

The Fork in the Road for Future AI Spending

As tech’s brightest minds and deepest pockets collide in the AI arms race, companies are rapidly approaching an inevitable fork in the road – either double down further on yet-to-pay-off AI investments with relatively uncertain timelines or start tapping the brakes to rein in spending if monetization roadmaps disappoint.

Tesla’s breakneck capital deployment on AI training appears to be paying off early for Elon Musk as the company’s stock leaped after the announcement regarding its partnership with Baidu in China to win FSD approval.

If Tesla’s autonomous ride-hailing ambitions begin gaining traction, it could embolden other automakers and transportation companies to dramatically increase spending to stay competitive. Analysts already estimate that GM, Ford (F), and others have accelerated the programs for self-driving R&D and data centers.

However, Big Tech’s obsession with all things AI does raise some yellow flags. At the end of the day, these remain profit-driven public companies that will eventually face investors’ reckoning if their AI visions flounder or timelines for revenue generation remain elusive.

For now, the AI revolution shows no signs of slowing down its blistering pace. The race to develop and commercialize the next generation of transformative AI technologies at scale has taken on a fierce and frenzied competitive dynamic that resembles the dynamics of the dot-com boom.

The first viable AGI company on the market may very well be one of this bunch. Grab some popcorn, because this saga is just getting started.