Temu and Shein, which are the most popular fast-fashion-focused apps in the US have been at loggerheads with each other, and in the most recent case, Temu has sued Shein over anticompetitive practices accusing it of threatening and intimidating suppliers.

“Shein has engaged in a campaign of threats, intimidation, false assertions of infringement, and attempts to impose baseless punitive fines and has forced exclusive dealing arrangements on clothing manufacturers,” said Temu’s complaint filed last week with the US District Court for the District of Massachusetts.

Temu has said that Shein has a humongous 75% market share of the US “ultra-fast-fashion” market.

Notably, since its US launch in 2017, Shein has been gaining market share at the expense of incumbents like H&M.

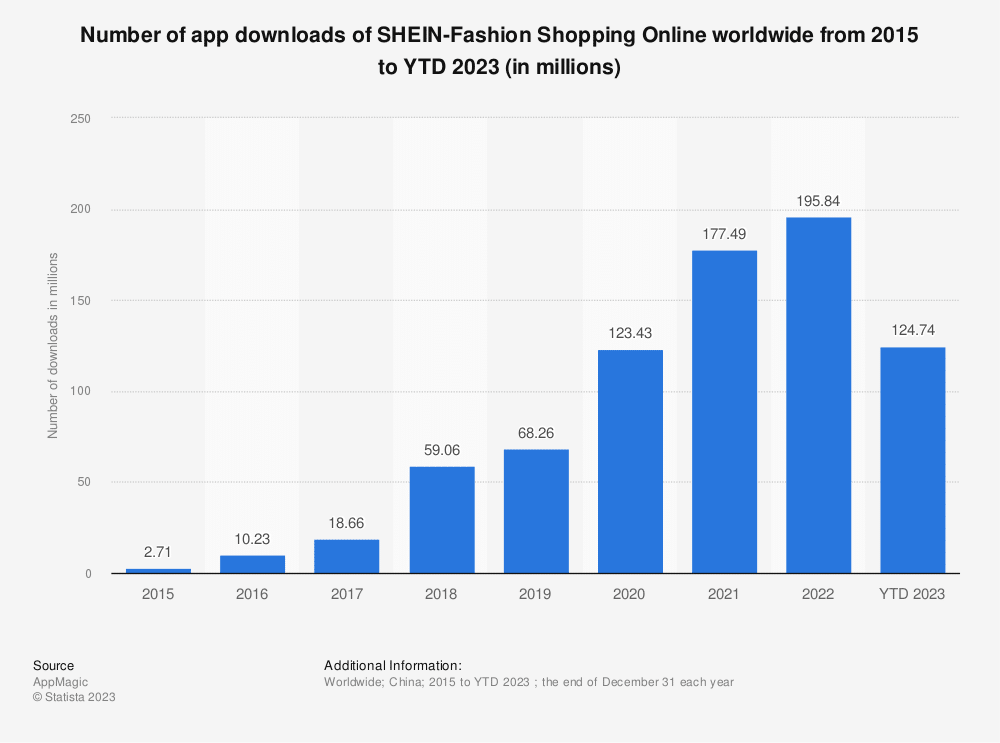

Shein’s global downloads hit almost 196 million in 2022 as compared to 177.5 million in 2021.

Temu alleges, “Shein has required all of the approximately 8,338 manufacturers supplying or selling on the Shein Platform to execute Exclusive-Dealing Agreements, which prevent those manufacturers from offering products on the Temu Platform or supplying products to sellers on the Temu Platform.”

Temu Accuses Shein of Intimidating Suppliers

It also stated that because of Shein’s actions, merchants removed 10,000 listings from its platform. It claims, “Shein knows that manufacturers rely on its volume and access to the U.S. market, which allows it to pressure manufacturers into agreements that prevent them from working with Temu.”

Shein has meanwhile said that the lawsuit lacks “merit” and it would “vigorously defend” itself.

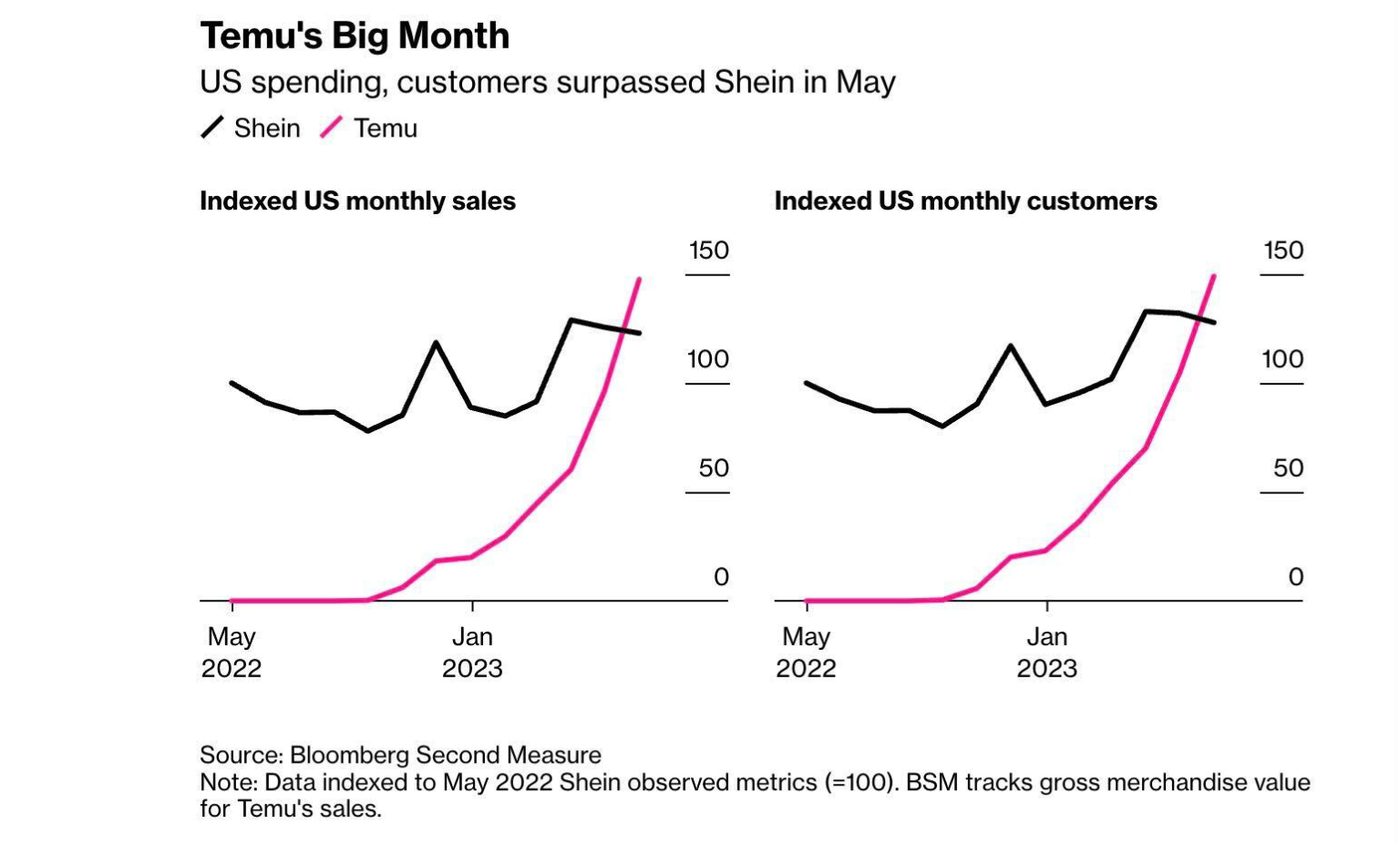

While Shein still leads the US market, Temu has been fast catching up and in May, spending on Temu was 20% higher than Shein according to Bloomberg Second Measure.

Notably, despite the US-China tensions amid the growing clamor for banning ByteDance-owned TikTok, Chinese apps are popular in the US and four of the top five apps in the country are Chinese, according to Apptopia.

Meanwhile, US regulators have intensified the scrutiny of both Shein and Temu as their business model revolves around the “de minimis” provision of Section 321 of the Tariff Act of 1930, which waives import tariffs if the value of imported shipment does not exceed $800.

US Regulators Intensify Their Scrutiny of Shein and Temu

A report released by the House Select Committee on the Chinese Communist Party found that Shein and Temu accounted for 30% of the shipments made under the de minims rule.

According to a New York Times report, the total number of shipments under the de minimis rule reached 720 million in 2021 – which is triple of 2016. Incidentally, the popularity of Shein also soared over the period which has contributed to the massive rise in these shipments.

Mike Gallagher, a Wisconsin Republican who heads the committee said, “Temu and Shein are building empires around the de minimis loophole in our import rules: dodging import taxes and evading scrutiny on the millions of goods they sell to Americans.”

Chinese apps appear to be avoiding import tariffs, while their competitors face high tariffs on imported goods. China is the largest clothing exporter in the world, having exported $176 billion in textiles in 2021. The US is the second largest importer, following the European Union.

According to CNBC, Gap paid $700 million in duties last year while the figure was $205 million for H&M. The de minimis rule helps Shein and Temu price their products quite competitively and the two are known to sell fashion products as low as $2.

The report also alleged that both these companies were doing little to keep their supply chain free from slave labor and Gallagher said in the report that “Temu is doing next to nothing to keep its supply chains free from slave labor.”

Representative Raja Krishnamoorthi, an Illinois Democrat and a co-author of the report said, “The initial findings of this report are concerning and reinforce the need for full transparency by companies potentially profiting from C.C.P. (Chinese Communist Party) forced labor.

Shein’s Valuation Has Come Down

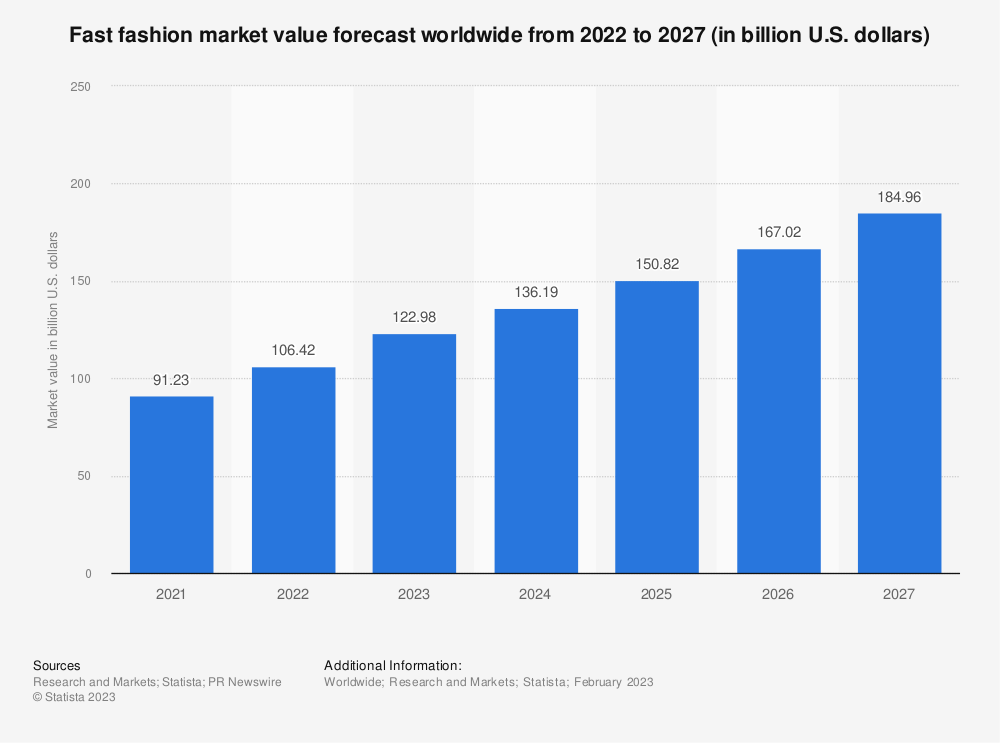

According to Statista, the global market for fast fashion was $106 billion in 2022 which is expected to rise to $185 billion by 2027.

Given the expected rise in the market for fast fashion, investors have been pouring money into privately-held companies in the industry.

However, the valuations in the space have come down in line with the slump in the startup industry. In the most recent funding round, Shein, which is headquartered in Singapore has cut the valuation to $66 billion which is only about two-thirds of its valuation in the previous funding round.

Shein reportedly held initial talks with investment bankers to select the bookrunners for the US IPO – the company, meanwhile, denied that it has any plans for an IPO yet.

Notably, the US IPO market has been dead for the last few quarters.

In 2021, there were over 1,000 IPOs in the US and many of these were of special purpose acquisition companies (SPAC), marking a record year for the US IPO market which broke the previous record that was set in 2020 only.

Shein had hoped inviting influencers to tour one of its warehouses would shift public sentiment. Instead, the junket has created another threat to the company's IPO plans https://t.co/CVGhFO3WX9

— Bloomberg (@business) July 13, 2023

In 2022, however, the total IPOs fell below 200 as the market soured. Shein is among the most awaited IPOs though as investors eye a slice of the fast-growing company.

Meanwhile, regulatory troubles for Shein and Temu look set to intensify as lawmakers target them for allegedly circumventing US tariffs while not doing enough to prevent forced labor. While we don’t yet know the future of Temu’s lawsuit against Shein, both companies are in a similar bracket when it comes to allegations of circumventing US laws.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops