Revenue forecasting is an essential skill for agency leaders. Learn how to master it in this detailed guide.

Do you know how much money you’ll make next month, quarter, or year?

I’m not talking about a back-of-the-napkin estimate; I’m talking about a reliable forecast of your revenue and expenses.

If you’re like most agencies, your answer will likely be “no”.

Revenue forecasting, when done right, can ground your decision making in realistic fact instead of optimistic fantasy. It helps you understand what you currently make, what you need to make, and the resources you need to bridge the gap.

With better agency financial data and more integrated tools, it is easier than ever to forecast revenues.

This guide will show you how.

Revenue Forecasting 101

Let’s answer your most pressing questions first: what is revenue forecasting and why should you bother with it?

A revenue forecast is an estimate of your revenues over a fixed period of time. This time period can be anything, but is usually limited to a quarter or year.

A revenue forecast is based on several data points. Just as the weatherman looks at precipitation, wind speed, and local factors to forecast the weather, you’ll consider past financial performance, market sentiment, and sales pipelines to forecast revenues.

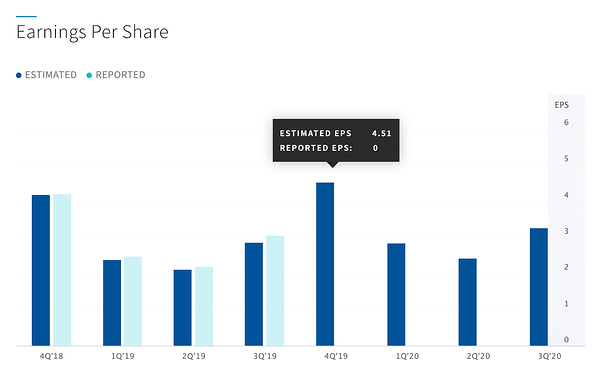

For instance, financial analysts consider Apple’s past sales, product line-up and consumer demand to forecast revenues for upcoming quarters. Investors can then rely on these forecasts to decide whether the stock is worth buying or not.

Analysts have already estimated Apple’s earnings per share for the next several quarters based on past data (Image source: Nasdaq)

While accuracy is desirable, it’s more important to get the direction of growth right. Is the business growing or contracting? Should you invest more or let employees go?

A revenue forecast should tell you that.

Most large businesses forecast their revenues every quarter, but for smaller businesses, it’s okay to do this exercise once or twice a year.

Why Revenue Forecasting Matters

The story of your business is essentially a story of your revenue.

It makes sense to forecast this figure – for obvious reasons.

But forecasting revenue requires resources, data, and knowledge – things smaller agencies don’t always have access to. Which often prompts the question: why bother with it?

Here are a few reasons why revenue forecasting pays off:

1. Better budgeting

The core purpose of any revenue forecasting exercise is to plan your future expenses better.

If you want to expand your business, either by adding additional staff or launching a new marketing campaign, revenue forecasting can help you make the decision whether to start now or wait until things look a bit more rosy for predicted revenue

Similarly, if you are anticipating a slow month, season, or year, you can plan ahead and start tightening the proverbial belt.

Even a semi-accurate forecast will prevent that dreaded situation where you’re overcommitted to projects but don’t have the money to complete them.

2. Better hiring

Agencies around the world grapple with a single question: to hire or not to hire.

A revenue forecast roots your hiring decisions in fact, not intuition. It tells you whether you can afford to hire someone new and how they will impact your bottom line.

For instance, your records might show that every new designer you hire helps you bring in 2.5x their annual salary in revenue. This can help you (or your boss) justify the upfront expense of hiring a new designer.

3. Better decision making

Who to hire and what to spend on are obviously important, but as an agency leader, you also need to decide where and when to allocate resources.

Should you buy that much-needed new 3D printer now or hold off until Q4 2020? Does buying new productivity software lead to any appreciable growth in revenue? Do you need to cut costs because of the prevailing market conditions?

A revenue forecast will help you answer all these questions and more.

The impact? Better decision making and healthier agency finances.

While revenue forecasting is important, the question remains – how do you go about it?

I’ll look at some answers in the next section.

How Revenue Forecasting Works

There are effectively two models of forecasting revenue:

- Judgment forecasting: This is where you use your intuition and experiences to estimate the business’ growth over a period of time. While you can and should use hard data (such as revenue numbers for the previous period), judgment forecasting is largely focused on qualitative, subjective insight.

- Quantitative forecasting: As the name suggests, this is where you use a scientific, numbers-focused process to forecast revenue. You’ll consider historical records, current pipeline, expenses, and market conditions to make a prediction.

Ideally, you’ll want to use both these approaches together. Rely on data to ground your results while supplying the intuition that data can’t really capture.

For instance, you know that there is a prevailing positive business sentiment in the market. The vertical you cater to has seen rapid growth in the last couple of years.

Armed with this knowledge, you can revise your forecast to be more optimistic. If your revenue increased by 20% last year, it might grow by 40% this year.

At a granular level, here are some steps you need to follow for forecasting revenue:

1. Establish Timelines

Before you delve too deep, it’s important to know that establishing timelines is the first step in forecasting your revenue.

A quarterly forecast might be unnecessary for a smaller agency. The resources required to put the forecast together at such frequent intervals can outweigh its benefits.

Rather, consider the cadence of your agency. How long does each project usually last? What is the average length of each campaign? How long is an average sales cycle?

These will help you establish timelines. If your business tends to close campaigns and deals within 6 months, it might be smarter to adopt a semi-annual forecasting model. If it takes longer, opt for an annual timeline.

2. Forecast Your Expenses

Predicting your expenses is a relatively straightforward process, and it’s important to have accurate estimates.

No matter the age of your agency, you’ll most likely have data to supplement your estimates: past expense reports if you’re an existing business; detailed forecasts if you’re a new business or startup.

Generally speaking, there are two primary expense categories:

Fixed Costs: Commonly referred to as overhead, these are expenses that remain unchanged each month. Below are some common fixed costs:

- Rent and utilities

- Phone bills/communication costs

- Accounting/bookkeeping

- Legal/insurance/licensing fees

- Technology products

- Salaries

Variable costs: These expenses fluctuate over time, based on demand, economy, sales volume or other factors. Some common variable costs include:

- Goods sold (materials, supplies, and packaging)

- Labor costs (customer service, sales, and marketing)

It’s usually easy to predict fixed expenses – since you make the same payments month after month.

But variable costs can be hard to estimate, especially if the market is turbulent or if you rely on expenses that vary a lot.

In such situations, a guesstimate will do. Just make sure to err on the side of overestimation than underestimation when it comes to forecasting expenses.

3. Forecast Your Sales

Forecasting sales can be a daunting task – there are far too many moving parts to accurately predict how much you’ll sell over a year.

But in reality, forecasting sales is essentially an act of analyzing raw data and making logical assumptions. If you make an average of $100,000 per client, convert 10% of your pipeline, and have 40 promising leads, you can reliably forecast an additional $500,000 in sales.

What’s important here is access to reliable and up-to-date data. Visibility into your sales process and financials can help a great deal in predicting what’s to come next.

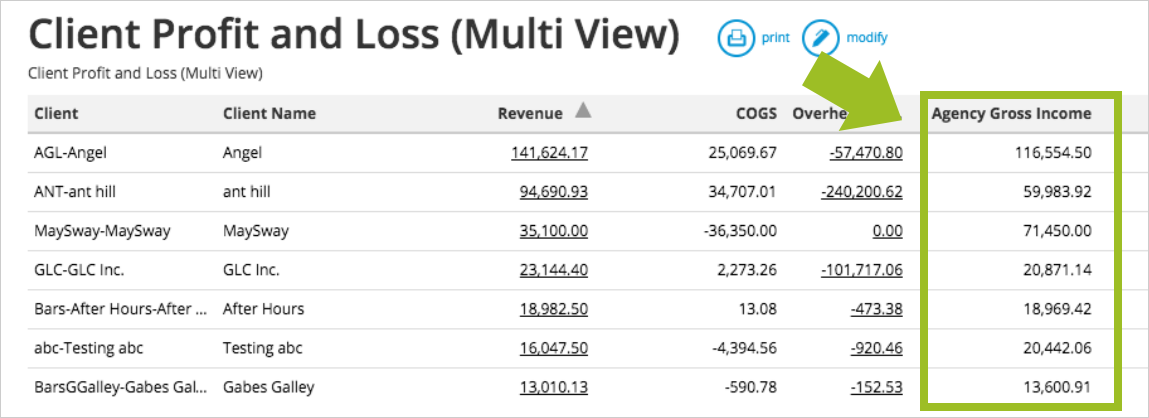

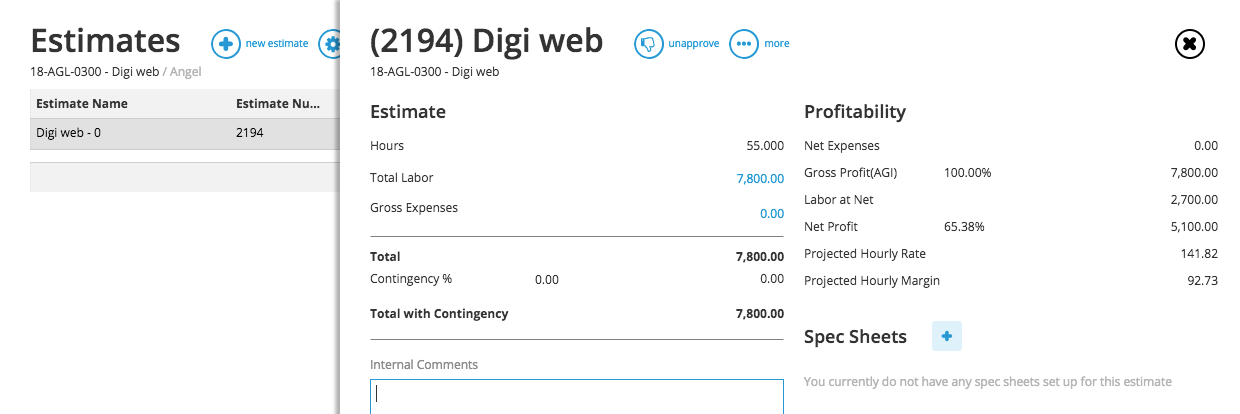

For instance, a tool like Workamajig can tell you at a glance how much money you made off each client within a time period. This can give you an estimate of the money your current pipeline can bring in.

Some of the factors you need to consider when forecasting sales include:

- Sales cycle length

- Current sales pipeline

- Lead generation metrics and approach – is it scalable and predictable?

- Total number of new business devs, their average close rates, and productivity

- Lead-to-client conversion rate

- Average revenue for each client-type

- Client-types in existing pipeline

It is inherently difficult to predict sales in the agency business. You might land a “whale” that gives you 2x your revenue from all other clients combined. But getting such clients can be difficult to predict.

Just go with the numbers you already have, then pepper in your own estimates based on market conditions and your agency’s direction.

4. Consider the market

The three steps above are all inward-focused. The next step is to look outward for shifts that could affect the demand for your services or the ability of customers to pay.

Your revenue-forecasting technique should account for changes to competitors or customers. Are you competing with more agencies? Or fewer? Or perhaps a competitor is aggressively seeking business with lower prices. Any of these scenarios could affect your ability to land clients.

Similarly, are customers dealing with trends in their markets that could affect how much they can or will pay you? Or are they particularly satisfied or dissatisfied with your services to the point that they will increase or decrease the business they do with you?

Incorporating an evaluation of customer satisfaction and market conditions into your forecasts will help you increase their accuracy.

9 Tips for More Accurate Revenue Forecasts

The above steps form the foundation of any revenue forecasting exercise. However, if you want more accurate results, there are a few additional factors you should consider:

1. Available resource bandwidth

In our people-focused industry, your revenue is directly tied to the “busyness” of your resources. If you have ample available bandwidth, it means that you’re not truly maximizing your revenue potential.

Mapping your resource bandwidth, thus, can give you insight into your revenue forecasts. Overtaxed resources can imply a revenue dip (since you need to hire new resources). Underutilized resources can mean that there is headroom for growth.

2. Past project revenue

Your past projects will help define future ones. Not just from a project planning standpoint, but also from the task of helping to forecast the next project’s earnings. Whether your project was a dud or a stud, it has a certain value to it when analyzing the revenue and resource utilization for the next project.

Avoid the temptation to look at the highest performing project and dismiss all of the others as ones that are not indicative of your team’s ability. And on the other side of the coin, don’t solely rely on your low performing projects to define a revenue forecast either.

Take an educated glance at prior work and remove anything from the field that seems to be an outlier. Then use that average for your baseline with revenue forecasting.

Workamajig’s built-in project forecasting tools help you analyze the revenue from each new project

In this way, if your next project over- or under-performs, you can anticipate the following work to be on the other side of the line and things will even out.

3. Recent changes

Did you just start work with a new client or multiple clients? How about adding more creative staff that might need some time to get used to the way your team works.

These can both impact the bottom line of a project, increasing the hours spent while not always increasing the value of the project.

On the other hand, maybe you have a seasoned team of creatives that are working with a longstanding client. You can expect that things may exceed the historical average.

With either situation, be sure to take your revenue forecasting with a grain of salt.

4. Cast a wide net

Don’t just rely on one project, or the past month’s worth of work. Instead, look back at least a full quarter to see what has and has not worked.

Often, if you base your project budget off a small historic window, you can have a lot of variability that might come back to bite you. If you’re looking at a larger window, there will still be variability, but you can see the range and have a baseline of what you’ll need to plan for.

6. Learn from previous projects

Are there trends to learn from? Your project budget should follow a pattern, so figure out what has been successful and what you can learn from and change in the future.

If there is no pattern that you can see, then that can be helpful on it’s own. Knowing that you’ll need to be prepared for a wide range of possibilities is worthwhile in and of itself.

7. Give yourself some breathing room

Unless you’re always hitting the same numbers in a specific project budget area, you can’t accurately predict what the next project might hold. Even if your numbers are tight, it doesn’t mean that the historical budget amounts will hold true for the future.

If you give yourself enough wiggle room to absorb any fluctuations, you’ll be able to handle anything that’s out of your control.

Use former projects to help you decide how much wiggle room is truly necessary. A history of similar budget amounts indicates you might be able to get away with slightly less breathing room than an area that’s all over the map.

8. Staff experience

How many combined years of experience does your project team have?

If you have a bunch of rookies, you can’t expect them to accomplish the same amount of work in the same amount of time as a team full of seasoned veterans.

Likewise, you can assume that the experienced team can get through a project with less billable hours than the one that has mostly novices.

When looking at your revenue forecasts, take the experience of each project team into account. This way, you’ll avoid completely missing the mark on how many hours each deliverable will require. Even if you can’t give an absolutely precise number for revenue forecasting, as long as you can account for personnel changes from one project to the next, you’ll be able to get a close estimate.

9. Review your forecasts regularly

Lastly, your revenue forecast isn’t meant to be a one-and-done affair. Rather, it is a living document that should be updated frequently.

Revisit the forecast regularly, especially if something about the business has changed. Maybe you added a new $500,000 client. Or maybe a new legislation just passed that would help you win more clients.

Aim for neither irrational exuberance nor extreme conservatism. Instead, opt for the sweet spot in between for highly impactful forecasts.

Despite your best intentions, problems can and do crop up in most forecasts.

Here are a few such problems you need to watch out for.

5 Common Revenue Forecasting Mistakes (and How to Fix Them)

To help your agency properly forecast your finances, try to avoid making these five common revenue forecasting mistakes:

1. Relying on qualitative assumptions

In the creative realm—where many campaigns are dictated by intangible metrics—it’s easy to speculate using qualitative data.

The truth is that assuming conditions and outcomes only leads to false hopes. And while it’s completely normal to make assumptions in the thick of a project, it’s important to never rely on vague qualitative metrics.

The fix: Rely on quantitative data—cold, hard facts. Whether you use internal research or third-party data, make sure that your assumptions are backed up by verifiable, reliable sources.

2. Ignoring cost assumptions

Average cost flow assumption is a calculation used to monitor inventory goods by determining the cost of your services or products sold against ending inventory. And any revenue project is based on cost assumption.

The biggest mistake for most businesses? Ignoring these cost assumptions completely.

Without an understanding of your assumptions, no one will know what your projects are based on.

The fix: Have a clear understanding of all your agency’s cost assumptions, such as market conditions, production costs, overhead estimates, and resource costs. Make sure you are able to explain these assumptions within your revenue projection documents. Also, make sure you can explain what they each entail.

3. Bad math

On the surface, this one seems simple to avoid. But you’d be surprised how many revenue projections are botched because of simple math.

It’s not rocket science – make sure every column and row adds up and makes sense. Bad math simply implies a lack of attention to detail.b

The fix: Double-check your work as you work. Don’t wait until the entire project is completed to cross-reference your totals. Have a trusted coworker triple-check your work as well.

4. Failing to adapt

Whether you’re forecasting annually, quarterly, monthly, or even by the project, traditional forecasts are usually out of date.

Think about it: a month-old snapshot inevitably ignores changing variables of your business or industry. And failing to adapt your projections—or simply running a campaign based on old metrics—can lead to disaster.

The fix: Utilize an automated accounting software platform to keep updates in real-time. Not only will collaborative software allow team members to stay on the same page, it clearly displays all vital signs of your business and enables you to track changes and update your forecasts.

5. Being Too Conservative

Like most creative firms, you’ve probably been in a situation where conservative reality trumped an otherwise aggressive dream state. And when it comes to finances, it is easy to err on the side of caution.

Rather than completely ignoring optimism, however, we’re here to say that you should embrace a middle ground and create revenue projections that cater to both sides of the equation.

The fix: Build two sets of revenue projections: one aggressive, one conservative. This will force your agency to make the necessary conservative assumptions, but also unleash the undeniable power of thinking big.

These ambitious forecasts may not always come to fruition, but you’re more likely to generate breakthrough ideas that will ultimately grow your company.

Over to You

Revenue forecasting is an essential skill for any agency leader. It gives you insight into your growth and helps you predict the direction of your agency.

The biggest impediment to accurate forecasting is the lack of financial data. Integrated agency management software like Workamajig makes this data accessible at your fingertips. By bringing together your sales, accounting, and project management tools under a single platform, Workamajig helps you forecast your revenues much better.