Most people consider setting up a business high risk.

Small businesses face a number of risks, but not all of them are necessarily bad. It’s all about planning and managing those risks to make sure a business can survive if things don’t go exactly as planned.

That is where a risk matrix comes in.

Risk Matrix: The Key Highlights

- A risk matrix helps businesses identify and prioritize potential risks based on their likelihood and impact.

- The process involves listing operational, financial, and governmental risks, then categorizing them by probability (probable, possible, improbable) and severity (acceptable, tolerable, unacceptable, intolerable).

- The matrix visually represents risks, aiding in decision-making and mitigation strategies.

- It emphasizes focusing efforts on the most severe risks and provides a starting point for risk management planning.

- Despite its reliance on subjective assessments, a risk matrix is a valuable tool for understanding and addressing business risks.

The Risk Matrix Development Process: Step-by-Step

There is a strong relationship between risk and reward. It is impossible to achieve business gains without taking on at least some risk. The purpose of risk management isn’t to eliminate risk, but to optimize the risk-reward ratio within the bounds of the business owners risk tolerance.

Avoiding risk is always a good idea whenever possible. However, some risk is necessary to ensure the survival and growth of any business. Therefore, the business owner must look at ways to mitigate their risk wherever possible. As they say- prepare for the worst and hope for the best.

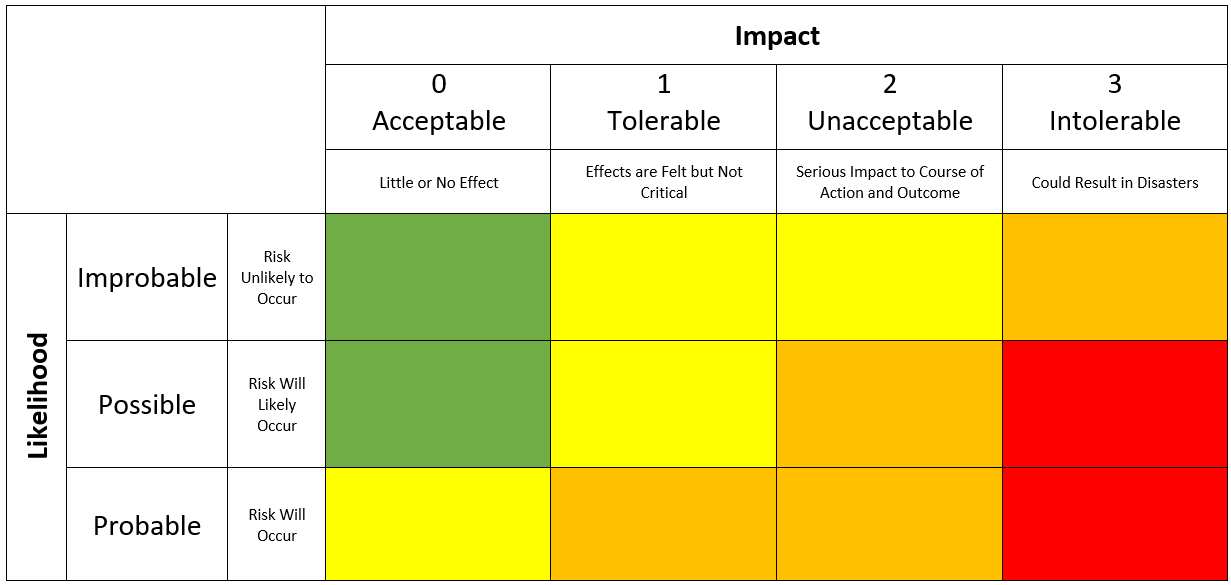

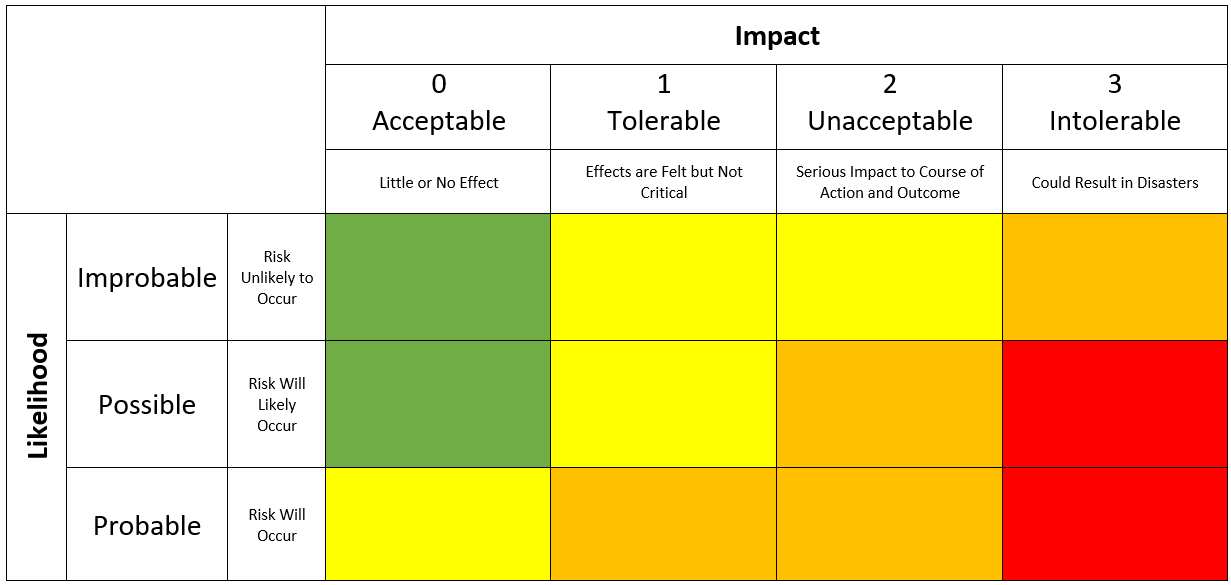

A risk matrix is a tool that is used during the risk assessment process. It defines the level of risk by considering the probability or likelihood of an event against the severity of the consequence to the business if it were to occur. A risk matrix is a visible representation of risks to assist a business in decision making and mitigation.

Step 1. The first step in developing a risk matrix is to make a list of all the operational business risks and financial and governmental business risks that we discussed in previous posts.

Step 2. The next step is to take the list of risks that you developed in the previous step and add the likelihood that the risk may occur to each one. Risk likelihood can be divided into three categories:

- Probable – Very likely to happen

- Possible – Some chance of happening

- Improbable – Small chance of happening

Step 3. Next, look and each risk and determine its impact to the business if it were to happen. Risk impact can be divided into four categories:

0 – Acceptable – little to no effect on the business

1 – Tolerable – effects are felt but do not seriously effect the business

2 – Unacceptable – causes major disruption to the business

3 – Intolerable – business may not recover

Step 4. Based on the likelihood and impact of each risk. place each risk into a Risk Matrix.

You can download a Small Business Risk Matrix Template or create your own.

The Key Advantages of Using a Risk Matrix

The advantages of using a risk matrix when it comes to risk assessment is that it helps the business to:

- Prioritize risks with their level of severity to the business

- Neutralize the possible consequences by helping to focus mitigation efforts

- Analyze potential risks with minimal effort

- Visually convey potential risks

It’s not easy to assess risks, let alone manage them. It’s important to understand that a risk matrix is only a tool, not a complete solution. Developing a risk matrix involves a lot of subjective assignments, and assigning arbitrary values to risks based on ambiguous information.

However, despite its shortcomings in terms of total accuracy, it is a great tool to give the business a place to start when it comes to risk management and developing a mitigation strategy.

Do you have a risk matrix for your business?