Since taking to the skies in 1971, Southwest Airlines has shown unwavering commitment to its mission to connect people through friendly, reliable, low-cost air travel. As of September 2024, Southwest Airlines has a net worth of $17.93 billion, positioning it as a leader in the airline industry.

At Business2Community, we’ve pulled on multiple sources to provide a comprehensive overview of Southwest Airlines’ net worth and history. Keep reading to discover the airline’s key milestones, revenue, controversies, and more.

Southwest Airlines Key Company Data

Southwest Airlines Net Worth: $ 17.93 billion

Date Founded: March 1967

Founded By: Herb Kelleher and Rollin King

Current CEO: Robert E. Jordan

Southwest Airlines HQ: Dallas Texas

Industries: Airline, Transportation

Southwest Airlines Stock Ticker: NYSE: LUV

Dividend Yield: 2.48%

What is Southwest Airlines’ Net Worth?

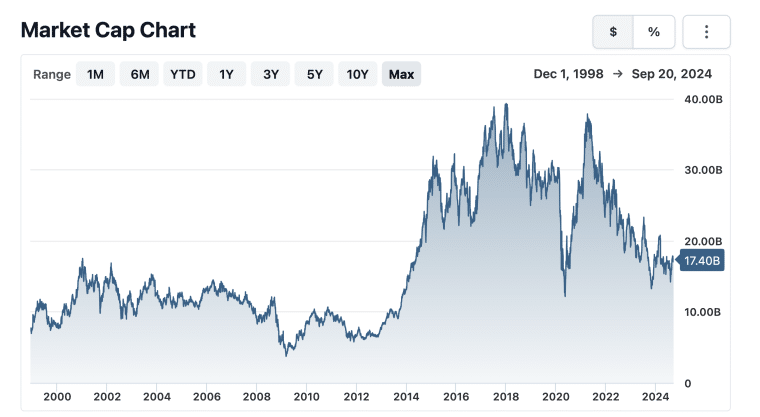

As of September 2024, Southwest Airlines had a market value, also called market capitalization or market cap, of $17.93 billion. This is based on a share price of $29.93 and 599 million shares available. The company is listed on the New York Stock Exchange with the ticker symbol LUV and has been trading shares since 1977.

Southwest Airlines’ fiscal year ends on December 31st and the company typically releases its annual financial results in late February or March of the following year.

Southwest Airlines went public in 1971, offering 650,000 shares at about $11 each and raising roughly $6.5 million. Since then, the company’s value has grown, showing its strength in the airline sector. From 1998, Southwest Airlines Co’s market cap rose from $7.44 billion to $17.4 billion, a significant increase of 133.74%.

In line with Southwest’s net worth, its shares have trended upward, highlighting growth and financial discipline in a highly competitive market.

The airline’s shares hit a peak of $61.95 in January 2018 and experienced their steepest decline in 2023, when they hit a low of $22.20, attributed to a steep decline in margin from 10.9% to 0.9% and lower earnings due to increases in jet fuel costs.

Since 2019, Southwest Airlines shares have underperformed the broader market, losing 49% of their value compared to the S&P 500’s 45% increase over the same period.

As of September 2024, Southwest Airlines’ stock price was $29.93, up from a 52-week low of $21.91 and down from a high of $35.18.

Southwest Airlines Revenue

Southwest Airlines’ revenue has increased significantly from a modest $6 million in 1972. Less than a decade after its inception, the company’s revenue stood at $213 million. By 1989, Southwest had achieved a significant milestone, surpassing $1 billion in annual revenue for the first time.

From $1.2 billion in 1990, Southwest’s revenue soared to $5.7 billion by the start of the 2000s. The upward trajectory continued, with revenues reaching a high of $22 billion in 2018.

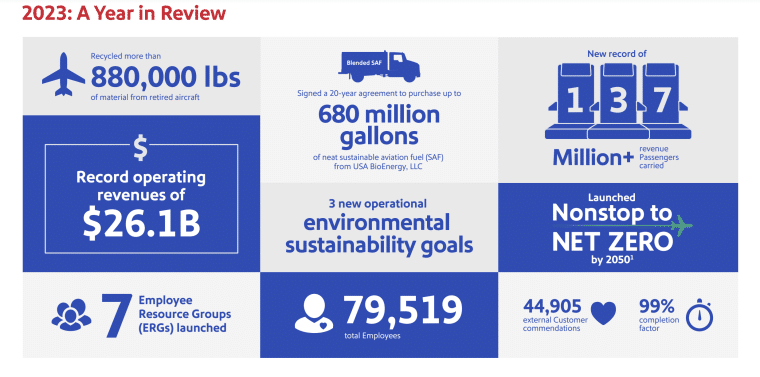

The next few years proved challenging for Southwest, with annual revenue dropping by 59% to $9 billion in 2020 in response to the COVID-19 pandemic. However, driven by post-pandemic travel demand, the company’s revenue quickly rebounded in 2021, increasing from $15.8 billion to $26.1 billion in 2023.

Southwest Airlines maintained profitability between 1973 and 2019. However, the company’s impressive 47-year streak was broken in 2020, when the airline experienced a loss of $3.1 billion due to the pandemic’s severe impact on the travel, tourism, and hospitality sectors.

While net income recovered to $977 million in 2021, the company’s profitability has since seen a massive decline, with profits falling to $539 million in 2022 and $465 million in 2023.

| Year | Revenue ($ billions) | Net Income ($ billions) |

|---|---|---|

| 2014 | 18.6 | 1.1 |

| 2015 | 19.8 | 2.2 |

| 2016 | 20.0 | 2.24 |

| 2017 | 21.2 | 3.5 |

| 2018 | 22.0 | 2.5 |

| 2019 | 22.4 | 2.3 |

| 2020 | 9.0 | -3.1 |

| 2021 | 15.8 | 0.977 |

| 2022 | 23.8 | 0.539 |

| 2023 | 26.1 | 0.465 |

Southwest Airlines Dividend History

Southwest Airlines declared its first dividend on August 10, 1976, and consistently paid quarterly dividends until the second quarter of 2020 due to payroll funding support agreements with the US Department of the Treasury. In 2022, Southwest Airlines reinstated dividends and has continued to pay them on a quarterly basis.

As of September 2024, Southwest Airlines (LUV) reported a trailing twelve-month (TTM) dividend payout of $0.72 and a dividend yield of 2.48%. Southwest Airlines has had 14 stock splits since 1977 and conducted stock buybacks worth $9.81 billion in the 6 years between 2014 and 2020.

Overall, Southwest has a long history of returning value to its shareholders. Since 2010, the company has returned more than $13.5 billion to shareholders through dividends and share repurchase programs.

| Date | Stock Price ($) | Dividend ($) | Yield (%) |

| 6/04/2019 | 46.28 | 0.32 | 0.69 |

| 8/20/2019 | 47.46 | 0.34 | 0.72 |

| 12/10/2020 | 57.27 | 0.51 | 0.98 |

| 03/03/2020 | 43.21 | 0.68 | 1.58 |

| 01/09/2023 | 34.21 | 0.17 | 0.51 |

| 03/07/2023 | 32.23 | 0.35 | 1.08 |

| 06/20/2023 | 33.46 | 0.52 | 1.56 |

| 09/05/2023 | 30.05 | 0.70 | 2.32 |

| 12/20/2023 | 28.56 | 0.87 | 3.06 |

| 03/05/2024 | 33.99 | 0.71 | 2.07 |

| 06/18/2024 | 28.26 | 0.71 | 2.51 |

| 09/04/2024 | 29.51 | 0.71 | 2.42 |

| 09/20/2024 | 33.99 | 0.71 | 2.46 |

Who Owns Southwest Airlines?

As a public company, Southwest Airlines is owned by various shareholders. With an 11.28% ownership stake as of September 2024, the Vanguard Group was the company’s largest shareholder. This was followed by Elliott Investment Management (10.2%) and Capital Research & Management (9.67%).

Southwest Airlines, based in Dallas Texas, was incorporated as Air Southwest on March 9, 1967, and later renamed to Southwest Airlines Co. in March 1971. The airline became fully operational in June 1971 after a protracted legal battle with other airlines in the market.

The company raised $1.25 million through the sale of promissory notes in March 1971 and a further $6.57 million through the sale of the company’s common stock in June of that year to fund its operations. In 1977, Southwestern’s stock was listed on the New York Stock Exchange under the ticker symbol LUV.

Southwest Airlines had its second public offering on February 10, 1992, selling 2.18 million shares of common stock at $36 per share. The company’s most recent public offering took place on April 28, 2020, when it sold 80.5 million shares of common stock at $28.50 per share.

As of September 2024, Southwest Airlines headquarters is located near Dallas Love Field Airport and has served as the center of the airline’s operations since its founding.

Who is the Southwest Airlines CEO?

The CEO of Southwest Airlines is Robert “Bob” Jordan. Following a 34-year career with the company, Jordan succeeded Gary C. Kelly as CEO, President, and Vice Chairman of the Board of Directors in 2022. With his leadership skills and deep knowledge of Southwest Airlines’ culture, Jordan has prioritized modernizing operations, technology, and increasing shareholder value.

In 2023, Jordan’s total compensation was $9.3 million, up $3.97 million from 2022. His salary consisted of a $700,000 base salary plus $4 million in bonuses and stock awards.

In February 2024, hedge fund Elliott Management acquired a major $1.9 billion stake in Southwest Airlines. The activist fund promptly launched a campaign against CEO Bob Jordan and Chairman Gary Kelly and sought to replace them with “immediate” effect.

Elliott Management argued that leadership changes were critical as the company’s once stellar performance lagged behind rival companies. The hedge fund asserted that Jordan and Kelly had “presided over a period of stunning underperformance” at Southwest.

Elliott further outlined plans to replace two-thirds of the board’s 15 directors and overhaul the company’s operations to enhance its competitiveness in the modern airline industry.

In June 2024, CEO Jordan reaffirmed that he had no plans to resign and emphasized that Southwest had a turnaround plan.

In response to the Elliott plan, he added that it was “fairly light” on proposed changes. Jordan specifically addressed rumors about introducing bag fees, stating that nearly 50% of Southwest customers choose the airline because of its no-fee policy.

“You’ve got to be very informed before proposing changes that impact the Southwest Airlines business model,” Jordan said. “Elliott is not directing the company.”

In August, after weeks of meeting and gathering feedback from investors to fend off Elliott’s advances, Jordan wrote in a staff memo, seen by Reuters:

“Don’t be fooled—this is a battle for the heart of our company and our future—your future.”

He made it clear that Southwest would not back down, adding:

If it’s a fight they want, it’s a fight they will get

A month later, in a partial concession to Elliot, Southwest Airlines announced a revamp of its board. It was revealed that Chairman Gary Kelly would retire in 2025, in line with Elliott Management’s suggestions. However, CEO Robert Jordan would retain his position.

The restructuring plan also included the planned departure of six directors in November 2024, and the appointment of four new, independent directors, potentially including candidates put forward by Elliott.

| Tenure | CEO Name |

|---|---|

| 1971 – 1981 | Marion Lamar Muse |

| 1982 – 2001 | Herb Kelleher |

| 2001 – 2004 | James Parker |

| 2004 – 2022 | Gary C. Kelly |

| 2022 – Present | Robert E Jordan |

Southwest Airlines’ Company History

Southwest Airlines is a major passenger airline that provides scheduled air travel in the US and other nearby international destinations. With a total of 817 Boeing 737 aircraft in its fleet, the airline serves 121 destinations across 42 US states, the District of Columbia, and 10 near-international markets including:

- Mexico

- Jamaica

- The Bahamas

- Aruba

- Dominican Republic

- Costa Rica

- Belize

- Cuba

- Cayman Islands

- Turks and Caicos

As of 2024, Southwest carried more nonstop domestic air travelers than any other airline in the United States.

Below, we explore Southwest’s journey to becoming a leader in the highly competitive airline industry.

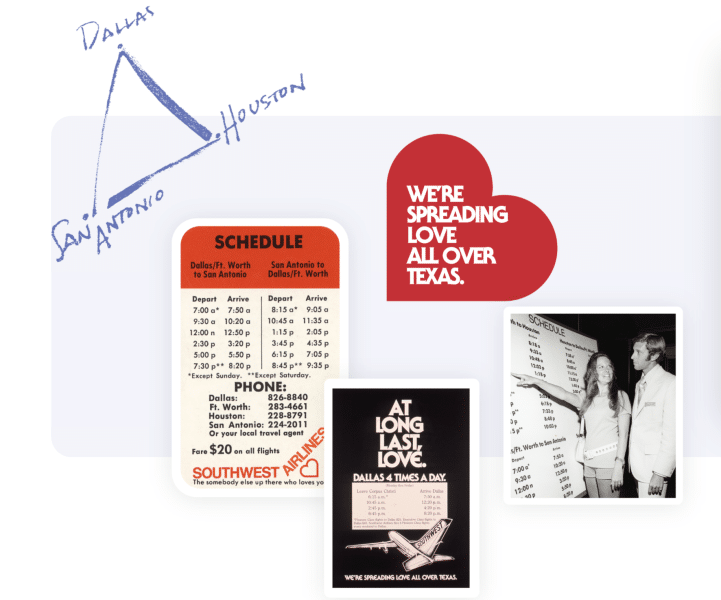

1967-1980: Southwest Takes to the Skies

Founded in 1967 by Herb Kelleher and Rollin King, Southwest Airlines became fully operational in 1971. With just three Boeing 737 aircraft serving Dallas, Houston, and San Antonio, or the “Texas Triangle”, Southwest set out to change the way America viewed air travel.

Offering low fares, a casual atmosphere, and a customer-first approach, Southwest’s fun-loving market offering was a stark contrast to other airlines, which, at the time, were more formal and catered primarily to wealthy travelers.

Southwest turned its first yearly profit in 1973, while still operating only three aircraft. By 1979, Southwest had expanded to 12 destinations, flying over 75,800 trips with 18 aircraft and serving close to 6 million passengers. This impressive growth was underscored by the airline’s delivery of an average annual return on stockholders’ equity of 37% for five consecutive years.

1980- 1999: Southwest Airlines Soars

Southwest Airlines entered the 1980s with the highest profit margin among domestic air carriers. By 1982, Southwest’s fleet had grown to 37 aircraft, and the airline added key destinations like Las Vegas (LAS), Phoenix (PHX), Los Angeles (LAX), and San Francisco (SFO).

In 1985, Southwest announced its acquisition of Muse Air and later rebranded it to TranStar. Unfortunately, due to operational challenges, in 1987, TranStar ceased operations and entered liquidation two years later.

To retain its growing customer base and encourage loyalty for total trips flown, Southwest launched campaigns like “The Company Plane” for business travelers and “The Company Club” for leisure travelers in 1987.

By 1989, Southwest Airlines served 30 destinations with 94 aircraft. That same year, the company achieved the significant milestone of over $1 billion in annual revenue.

As a result of successful promotional campaigns such as “Friends Fly Free”, which offered two tickets for the price of one unrestricted fare, Southwest experienced significant growth in the 90s. In fact, despite the recession of the early 1990s, which severely impacted many airlines, Southwest was one of the few carriers in the country to turn a profit, thanks to its efficient operations and customer-first approach.

Embracing the internet age, Southwest launched the airline industry’s first website in 1995 and began selling tickets online in 1996. The airline also revamped the Company Club loyalty program, renaming it to Rapid Rewards and introducing the Southwest Airlines Rapid Rewards Visa Card.

In 1997, Congress passed the Shelby Amendment. This update to the Wright Amendment allowed flights from Dallas Love Field to expand to Mississippi, Alabama, and Kansas. By the end of 1999, Southwest Airlines had grown significantly, operating 312 Boeing 737 aircraft and serving over 57 million customers across 54 destinations across the US.

2000-2015: Southwest Airlines Goes International

By 2000, Southwest had the lowest operating cost structure in the domestic airline industry and offered the lowest and simplest fares. The airline had also achieved its 9th consecutive year of profitability with close to 1 million trips flown — more than double the 382,752 trips flown at the start of the 1990s.

The next few years were challenging for the airline industry as a whole, but Southwest thrived due to its unique approach. For example, while many carriers faced layoffs and bankruptcies, Southwest put its employees and customers first. It introduced its “Bags Fly Free” policy, allowing customers to check two bags for free.

The 2010s saw Southwest undergo a much-needed digital transformation, including several updates to the airline’s mobile app and digital experience, as well as the launch of WiFi onboard its fleet.

In 2010, Southwest acquired AirTran Airways for $1.4 billion, moving Southwest into 37 new cities and adding approximately $2.6 billion in annual revenue to Southwest’s top line.

The next year, Southwest unveiled an updated version of its frequent flyer program — All-New Rapid Rewards — featuring no blackout dates or seat restrictions, and points that didn’t expire with any earning activity in a 24-month period.

Southwest also received permission from the Department of Transportation (DOT) to conduct international flights, eventually launching international service to Mexico and the Caribbean in July 2014.

By 2015, Southwest Airlines had increased its capacity by 43% in five years, achieved an all-time high pre-tax return on invested capital (ROIC) of 32.7%, and shareholder value had more than tripled. This growth was driven primarily by the AirTran acquisition, as well as the 2014 repeal of the Wright Amendment which encouraged greater expansion from Southwest’s Dallas Love Field base.

2016-2019: Southwest Faces Mounting Challenges

In 2016, Southwest seized new opportunities, including the availability of slots at Long Beach Airport in California and launched services to Long Beach, Varadero, and Havana (its 100th destination). By the end of the year, Southwest’s all-Boeing 737 fleet had grown to 723 aircraft.

On August 30, 2017, Southwest received its first Boeing 737 MAX 8, becoming the first airline in North America to add the aircraft to its fleet. Shortly after, the airline retired its last Boeing 737-300. That same year, Southwest deployed the Amadeus Altéa reservation system, a $250 million initiative marking the largest technology upgrade in the company’s history.

By 2019, Southwest had launched its long-anticipated service to Hawaii, connecting Californian cities to the Hawaiian islands.

However, the rest of the year proved challenging. Following two fatal crashes involving Lion Air and Ethiopian Airlines, the Federal Aviation Administration (FAA) grounded the Boeing 737 MAX. With 34 MAX 8 aircraft in its fleet at the time of grounding, Southwest faced significant service disruptions and took an $828 million knock in operating income.

2020-Present: Southwest Airlines Charts Recovery

In 2020, the pandemic severely impacted the airline industry, with social restrictions forcing carriers to suspend many flights. While Southwest Airlines entered the crisis with the strongest balance sheet in its history, including an adjusted debt-to-invested-capital ratio of just 24%, it lost $3.1 billion in 2020 — a first in 48 years.

Throughout the pandemic, Southwest added six new airports in 2020 — including two planned pre-pandemic — and 14 more in 2021. As leisure travel demand rebounded, the airline took delivery of 114 new Boeing aircraft and retired 28, for a record fleet of 814 planes. The company also reported a return to solid profitability in 2022, without any federal payroll support.

Overall, Southwest ended 2022 with strong liquidity of $13.3 billion, which included $9.5 billion in cash and cash equivalents, $2.8 billion in short-term investments, and a fully available $1 billion credit line. It was also the only US airline with investment-grade ratings from all three major credit agencies: Fitch (BBB+), Moody’s (Baa1), and Standard & Poor’s (BBB).

2023 saw Southwest launch digital bag tracking, upgrade its WiFi across the fleet, and introduce onboard enhancements like in-seat power and larger storage bins. The airline carried a new high of 137 million passengers, and generated a record $26.1 billion in revenue. However, despite these achievements, Southwest acknowledged that it had fallen short of its financial targets.

In the first quarter of 2024, Southwest reported operating revenues of $6.3 billion, but also posted a $231 million loss. In the second quarter, operating revenues increased to $7.4 billion and net income rose to $367 million, a notable 13% above expectations.

However, following pressure from an activist investor regarding the airline’s poor performance relative to competitors, Southwest announced significant initiatives to increase ticket sales and profitability. This included plans to assign seats, offer premium seating options, redesign its boarding model, and introduce red-eye flights.

Notably, the airline’s transition to assigned seating would end the open-seating policy it had used for over 50 years, sparking concerns about how this would affect customer accommodations, such as the “Customer of Size” policy (where the cost of a second seat is refunded for plus-sized travelers taking up more room than one seat).

Southwest Airlines Controversies

We cover some of Southwest’s most notable controversies below.

Southwest Airlines Holiday Meltdown

In late December 2022, as extreme winter weather swept across a significant portion of the US, Southwest Airlines experienced wide-scale operational disruptions that severely affected its flight schedules and systems.

The disruption and subsequent recovery efforts resulted in the airline canceling more than 16,900 flights between December 21-31 and left over two million passengers stranded during one of the busiest travel periods of the year.

In the aftermath, Southwest incurred over $750 million in payouts, with more than $600 million going towards refunds and reimbursements for affected passengers.

Following rigorous investigation by the US Department of Transportation (DOT), several failures in Southwest’s response were identified, including inadequate customer service, poor flight status notifications, and delays in processing refunds.

Subsequently, in December 2023, the DOT imposed a $140 million civil penalty on Southwest Airlines for consumer protection violations related to the holiday season meltdown — 30 times larger than any previous DOT fine for such violations.

Southwest Airlines Strike

In December 2023, Southwest Airlines faced potential disruption to its operations as its pilots threatened to strike following over three years of stalled contract negotiations.

The strike risked grounding flights during the busy New Year’s travel season, raising concerns about a repeat of Southwest’s 2022 holiday season meltdown which left thousands of passengers stranded.

However, the airline narrowly averted the strike, and in January 2024 after extensive talks, The Southwest Airlines Pilots Association (SWAPA) ratified a new contract that included a 50% pay increase for roughly 11,000 pilots by 2028, among other benefits.

Just a day after this announcement, Southwest Airlines faced another potential crisis when its flight attendants authorized their own strike following five years of failed contract negotiations and no pay raises.

However, before the strike action occurred, the Transport Workers Union announced that Southwest’s flight attendants had ratified a new four-year contract, securing a 22.3% raise effective May 1, 2024, and retroactive wages amounting to $364 million.

The contract further included 3% annual raises from 2025 to 2027 and improvements to the reserve system, ending the 24-hour on-call requirement to allow attendants more time to rest. This landmark agreement positioned Southwest flight attendants among the highest-paid in the industry.

What Can We Learn From Southwest Airlines?

By opening up air travel for the masses, Southwest Airlines revolutionized the airline industry. Its low fares and focus on friendly, reliable, service allowed the airline to differentiate itself, cultivating a reputable brand and deep loyalty.

A key driver of Southwest’s success has been its ability to keep operational expenses low, while expanding its network and fleet. In particular, the airline’s use of a single aircraft model, the Boeing 737, has allowed Southwest to offer a reliable customer experience, streamline operations, reduce maintenance costs, and standardize training and safety protocols.

However, this reliance on a single aircraft type has also proven risky, as seen during the grounding of the Boeing 737 MAX. As one of the largest operators of this model, Southwest’s net worth and reputation were significantly impacted by the grounding, highlighting the need for fleet diversification to mitigate operational risks.

For nearly five decades (excluding 2020), Southwest has achieved consistent profitability, reflecting the value of good financial management in volatile industries. The airline’s disciplined approach to asset management, maintaining low debt levels, and keeping a healthy balance sheet have helped it survive several economic downturns as well as the pandemic.

Despite facing macroeconomic challenges, Southwest Airlines has maintained its unprecedented record of no involuntary furloughs or layoffs and continues to value its workforce of over 74,000 employees. While Southwest has long prided itself on being an employee-first organization, recent challenges such as labor strikes and prolonged contract negotiations have tested this reputation. These issues emphasize the importance of proactively addressing labor concerns and resolving employee grievances.

While Southwest has since invested in the infrastructure and technology needed to cope with winter operations, the 2022 holiday season meltdown highlights the need for continuous investments in technology and agile systems. It also highlights the importance of having a robust crisis management plan, including better communication among teams and between service staff and customers.