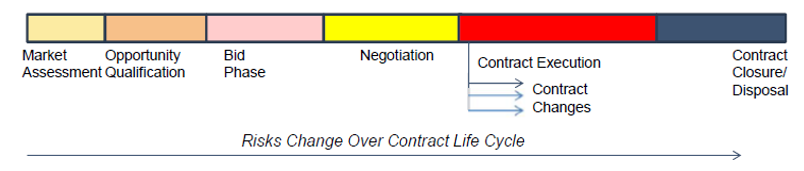

Contracts methodically move through their lifecycles—from initiation to signature to execution. Each stage has one or more stakeholders that review, approve, or complete a task. But what can often fall through the cracks is the amount of risk associated in each stage of the cycle. Risks can be hard to identify, harder to quantify, and hardest to eliminate. No one wants to be responsible for putting their organization in jeopardy.

Does your organization have systems in place to ensure that all i’s are dotted and t’s are crossed—literally and figuratively? Contract exposure puts organizations at risk, but there are some simple ways to identity and eliminate risk within your contracting process:

- Contract creation risk: Are current processes delaying revenue?

- Contract terms risk: Do unapproved contract terms make it to execution?

- Contract execution risk: Can you fully reconcile contract terms and obligations into accurate payments?

- Financial risk: Are your contracts going to end up costing you money?

One of the greatest challenges is determining how much risk your organization is willing to incur across the entire portfolio of agreements, and as you author and negotiate individual agreements, and engage subject matter experts to review and approve them. Risk certainly varies by company, industry, corporate philosophy, business model, and level of globalization.

Risk is often perceived as a secondary concern to contracting, only applicable to the lawyers in your organization. Of course, contracts can affect the entire organization. Contracts are legally binding, and there is the constant possibility of litigation. Regulatory compliance looms large in some industries. Poorly or loosely worded contracts can cost your business further opportunities or change relationships with key customers. They can also impact your organization’s forecasted or actual revenue, which might influence how your financial performance is perceived by corporate investors. Bad contracts or contracting processes can ultimately cause you to lose business and slow the growth of your organization.

Risk in the contract lifecycle

Contract creation risk

Poor contracts are a common result of poor contracting processes, including inappropriate initiation—Who to contact when creating a contract? How to search for existing contracts?—and poor workflows—Where is my contract currently? Who gets it next? What is my expected date of completion?

Manual processes and lack of automation can create communication gaps in negotiations. Inappropriate signature processes can cause the wrong people to sign or approve a contract.

Inefficient contracting processes can slow contract cycles and lead to a number of unfavorable outcomes, including contract back-logs, contract slippage from quarter to quarter, and contract slippage from year to year, which can result in delayed revenue or lost business.

Contract terms risk

Contract terms are the lifeblood of the agreement. Risk exists when contracts that contain old or outdated terms are created and in some cases even signed. The use of inappropriately standardized contracts across vendors and partners might cause excessive negotiations. Unapproved terms and terms edited by someone other than the legal department could result in rogue contracting without the proper approvals to ensure compliance. Poor contract terms can have long-lasting impacts on an organization. Once signed, contracts are legally binding whether you like them or not, and can cost you for years to come.

Contract execution risk

Since contracts are legally binding, you need to fulfill every obligation within the set terms. Milestones and events need to be accurately met and payments must match contracted terms and occur on time.

Contracts can be dangerous if they are in the wrong hands, particularly during contract creation or execution. Invalid claims might be paid without proper validation and adjudication. Missed deadlines and obligations could result in penalties. Poor communication between different departments might result in potential disconnect between corporate strategy and terms put in place.

Financial risk: Impacts to an organization

Contracts can make an organization a lot of money, but they can cost just as much if they’re not properly managed. Slow contract cycles delay organizations from recognizing revenue. There is the potential threat of contract litigation. If contracts aren’t executed accurately, they could cost your organization in the form of overpayments or late payments.

Improved processes and early engagement for risk mitigation

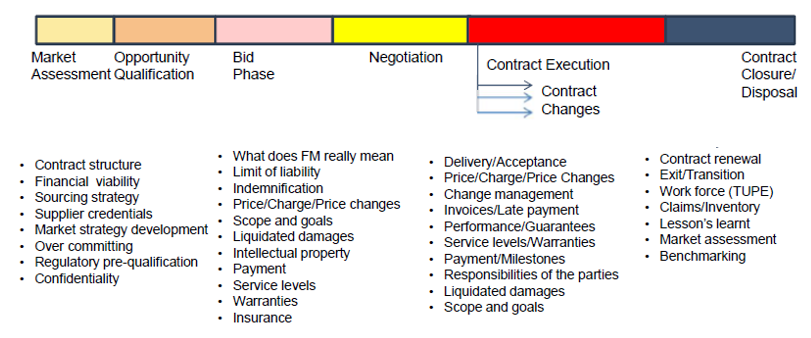

Commercial risk certainly affects business outcomes, and should be managed in the same way as program and technical risk. Commercial contracting teams manage the entire contract lifecycle, but they must also recognize risk and have tools and processes in place to manage it.

Within all the phases of the contract lifecycle — as you draft, review, approve, and activate your contracts — engagement with your subject matter experts is critical. One challenge many organizations face is engaging stakeholders with differing attitudes and levels of competence throughout the contract lifecycle. As the contract becomes a more popular mechanism to drive better business results, it is critical to engage the right stakeholders early in the process. Who undertakes market assessment? How do you identify the right contracting model, especially for complex transactions? The earlier subject matter experts are involved, the more they can tailor the contract model to create a less contentious bid and selection cycle, and thus reduce the time required during negotiations. From a functional risk perspective, closing the deal faster increases speed to market.

Another high-risk phase is the point of contract execution and the transition of contract responsibilities to the functional implementation team. This process is often poorly defined, and doesn’t offer a good understanding of the new obligations and responsibilities for both parties under the contract. The characteristics and skills of the group responsible for accurate delivery of a contract, once awarded, can have a huge impact on the risk throughout the life of the contract.

Finally, throughout the process, highly qualified organizations are increasingly trying to understand their partners’ level of competence when it comes to the contracting process. Contract risk is not only impacted by your own contract lifecycle, but by the contract lifecycle management of your partners. Effective and well-managed contracts depend on the capabilities of both organizations.