Banking has evolved at a rapid pace over the course of the 21st Century so far. The days where you would find yourself queuing at your local bank in order to open an account, make a deposit, transfer money or cash a cheque are long gone. With digital banking’s continued rise leading to more industry disruption, is there a place in the future for brick and mortar banks?

The emergence of online banking has led to vastly improved levels of access to financial services while significantly reducing the need for account holders to physically visit their local banking branches. As new technology entered the industry, many banks have acted fairly quickly to accommodate new digital approaches and upgrade their services accordingly.

(Image: American Banker)

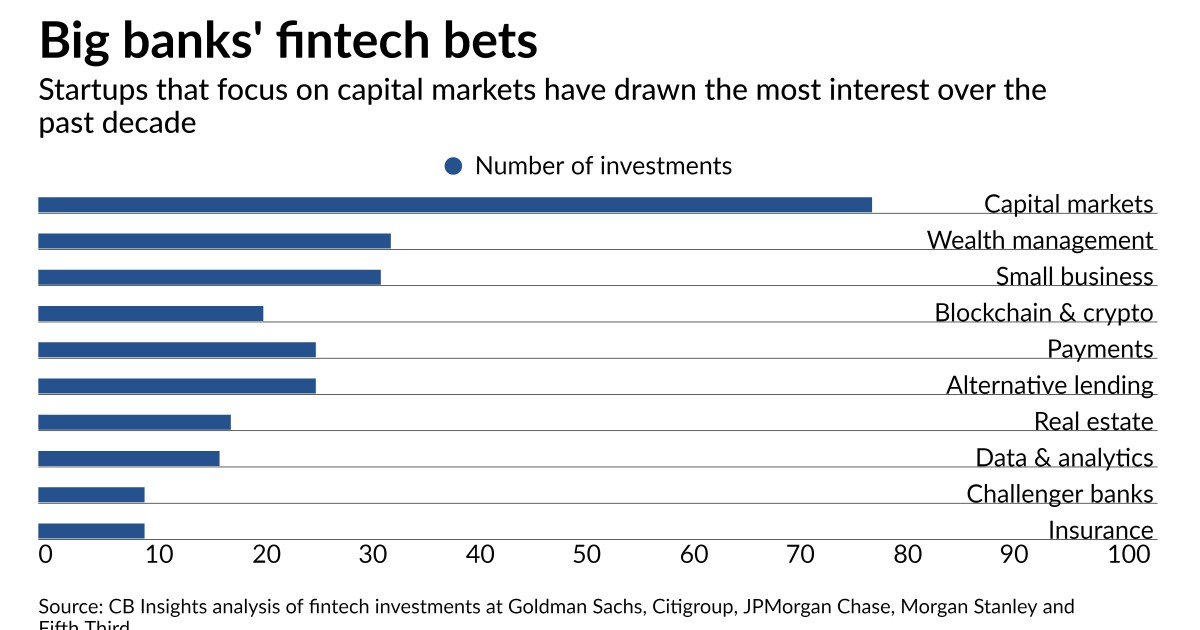

With more established names in finance investing big in terms of capital markets and wealth management among other forms of fintech, there’s little sign that the wave of innovation is going to be slowing down. With more digital approaches to banking being developed and rolled out, could major banks soon go entirely digital?

The potential that fintech holds for the future has been heavily showcased over the course of 2020, as the COVID-19 pandemic introduced citizens around the world to a financial landscape where physical access to banks was further limited.

Maxim Manturov, Head of Investment Research at Freedom Finance Europe, says: “To support the economy, most countries adopted stimulating policies, which brought both the loan and deposit interest rates to the historic lows. As an alternative to low-rate deposits, many started investing their savings into stock markets, which posted significant gains last year despite the lockdown and the production slump.”

Let’s take a deeper look into how fintech’s swift evolution may disrupt the brick and mortar banking landscape:

Fintech Driving Change

The term ‘fintech’ refers to technologies that have been developed to rationalise, digitalise and optimise traditional financial services filling the gap in traditional payment systems. Fintech has the power to facilitate services provided by payment systems as it enables more transparent and accurate transactions owing to vast technology opportunities.

It’s worth noting that due to being entirely digital, fintech services tend to be delivered at a lower price, which enables users to access cheaper, more affordable and unified services.

Oftentimes, banks have been considered as major players in payment transactions, but today traditional banking systems are increasingly giving way to fintech in terms of the high cost of conducting transactions and because of system inconsistencies.

Fintech companies aim to organise the payment process not only from the point of view of cheapness and profitability but also from the point of view of convenience and unification. Particularly taking into account that traditional banking services happen to have shortcomings in the new technology sphere, the notion of fintech integrating with banks helps to offer a solution where a bank provides fintech services through cooperation. This integration of banking services is vital for this – while banking services can offer real-time financial management on a regular basis, fintech brings innovation and disruptive technology to the table.

For instance, there are still unbanked areas where access to brick and mortar financial institutions is still challenging for individuals. Fintech can act as a door to banking services for areas of the world that are deprived of sufficient banking infrastructures and can connect users with services like digital wallets, cashless transaction and wealth management. One such example can be found in an initiative by the World Food Programme where Syrian refugees have been set up with a cashless payment network to help them buy the necessary food for their families.

Fintech can also help financial institutions to better embrace digital currencies like cryptocurrencies, and to facilitate more payments being made through non-fiat denominations of finance. With the recent listing of Coinbase on the New York Stock Exchange, the world of crypto has enjoyed a period of further validity and perceived acceptance within more traditional banking. With payment giants like PayPal and Stripe incorporating the likes of Bitcoin into its fintech functions, we can see further indications of how much more powerful fintech can be compared to brick and mortar banking – but is there still room for local banks on the high street?

Does Fintech Spell the End for Brick and Mortar Banking?

Industry insiders have long been concerned about the role fintech have been playing in the world of banking and whether or not they will ultimately replace traditional financial institutions. This fear was exacerbated by the recent introduction of the People’s Bank of China Fintech Development Plan which looked to accelerate the accommodation of digital financial services in the country. But could fintechs actually spell the end of traditional banking?

To address this properly, let’s address what finance actually is. The purpose of finance is to realise the optimal distribution of capital across time and space amid uncertainties and to serve the real economy and maximise social utility.

One big barrier to this can be found in adverse selection through a lack of information and the emergence of ethical issues. Finance should exist to identify and price risks. All technologies that are developed should be intent on helping to better understand customers and their willingness, and ability, to pay – while pricing them accurately.

With this in mind, traditional banks have an advantage in terms of capital costs, while fintechs are competitive in terms of operating costs. While some may believe that the cost of customer acquisition online was low, there’s evidence that the process is actually regularly more expensive than offline acquisition.

Fintechs are naturally innovative and in tune with the development of the internet. They have regulatory arbitrage to leverage and enjoy first-mover advantages. Their ability to offer standardised financial products while utilising long-tail marketing gives them something of a competitive advantage. However, brick and mortar financial institutions can offer a more natural monopoly over in-person finance, as well as much greater levels of expertise and capital strength – they also boast stronger and more loyal customer bases. With this in mind, their strengths lie in the creation and sale of bespoke financial products to a sprawling customer base. With this in mind, we may ultimately see a more adaptive relationship between the two approaches to finance in the future – with fintech innovations complementing brick and mortar banking.

The Road Ahead for Fintech

It’s difficult to gauge exactly what the future holds for technology-led banking. At the turn of the century, it would’ve been almost impossible to predict how internet banking would leverage contactless payments within the space of 20 years.

It’s clear to see that banking branches have a future, although they may become fewer and far between – and they’re likely to take on a different physical appearance than the branches of the past. Alongside other brick and mortar retail stores, it’s likely that customers will crave experience as much as functionality. When most financial transactions are carried out digitally, there needs to be fresh reasons to make visiting branches worthwhile.

Times are changing at a quick pace, and it’s difficult to confidently look into the future. While the road ahead for fintech may come with more twists and turns, it’s clear that this level of innovation will continue to make a positive impact on the world of finance, and this will help to complement the world of brick and mortar banking.