The Chief Financial Officer (CFO) has an increasingly important role within any company. In the past, the finance department had been in charge of keeping the books, managing the budget and looking after cash and capital.

Still today, when it comes to working with data beyond accounting postings, many CFOs and their teams mostly use Excel to collect data manually and store it rather than studying and understanding it. The result is disconnected and inconsistent data silos.

However, as our global economy becomes increasingly competitive, it becomes even more essential for every member of an organization to add direct value. The potential is there for CFOs to do so much more.

CEOs and Boards are demanding more from the typical CFO, counting on them to offer insight, advice and strategy for the company. That’s why this role is in a perfect position to make the most of the data Business Intelligence can offer.

Business Intelligence defined

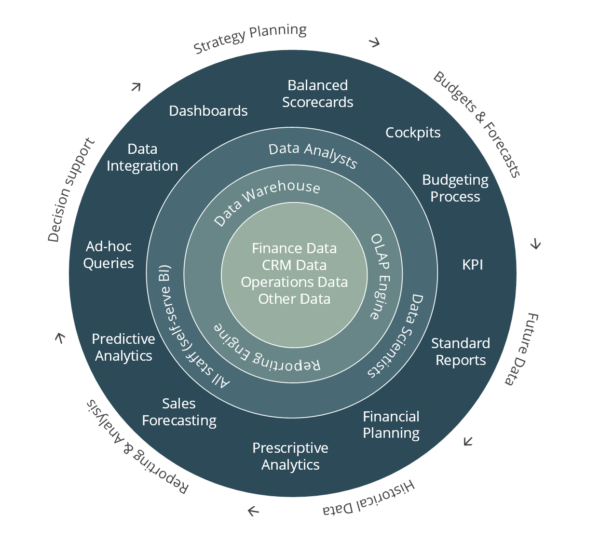

BI emerged in the 1960s as a way of sharing information across an organization, but the advent of computer technology transformed and expanded this role. The Big Data Revolution has transformed entire industries and modern BI covers so much more now, including data mining, reporting, querying, data preparation and statistical analysis.

The Business Intelligence department are collectors of data. They use a wide range of tools, applications and methodologies to bring in valuable data organizations can use to make smart business decisions. They pride themselves on impartial measuring and accurate reporting.

Business Intelligence goes beyond just business analytics. Business analytics is one subset of BI, but there’s much more to it. This department brings in a huge amount of data from multiple sources, structuring it and defining it so that it can be used in practical ways.

Every business produces data – no matter what you are selling. BI creates a comprehensive view of the data within an organization, while using that data to drive change, adapt to the market, eliminate inefficiencies and more.

The finance department as an agent of change

The finance department can be a powerful agent of change for the entire organization. This makes the CFO and the BI department a perfect match: a powerful combination that can elevate a company to the next level.

As a CFO, the Business Intelligence department is your way of bringing more value to the organization by having lots of high-quality data and knowing how to use it. A strong relationship with BI is what allows a CFO to do something more effectively with the data collected, enabling them to elevate their role from accountant to strategic advisor. There is a relatively old, but still relevant white paper written by Wayne Eckerson that is worth having a look at.

It’s almost as if the powerful amount of data BI brings in will “supercharge” the position of CFO, presenting them an opportunity to do more than just accounting.

How Business Intelligence enhances the role of the CFO

A Chief Financial Officer who is actively working with a Business Intelligence department will be of much more value to an organization than the old-fashioned typical “accountant” CFO. Rather than just keeping track of the numbers, BI can help a CFO do so much more.

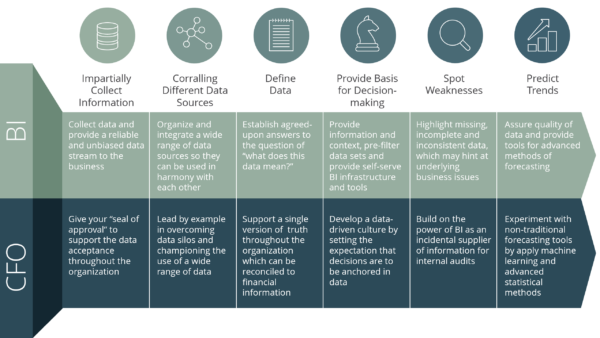

Here are a few of the ways BI can enhance the role of the CFO:

1. Impartially collecting information

Companies need an unbiased stream of data that comes with no particular agenda or filter.

The role of the BI department is not primarily to analyze or interpret the data. Instead, first of all it collects as much data as possible in a totally impartial way. This unbiased stream of data that comes with no particular agenda or filter is crucial for a company.

Sometimes when those who are collecting data have motivations behind their search, they tend to discover data that supports the ideas they were trying to prove. This often happens naturally – and those who are guilty of it might not even be aware of it. We are all guilty of confirmation bias in some situations and we need to work on overcoming it.

When the CFO accepts the data, this adds a lot of credibility to it. The CFO is discerning when it comes to data, so their acceptance of the data is a positive sign of its reliability to the rest of the company. When a BI department brings in data with the CFO’s seal of approval, you can rest assured that they are not looking for the right data to support a particular position. The data is totally impartial, scientific and fact-based.

The BI department provides the basis for clear and scientific answers to questions such as “Who are your most profitable clients? How did your sales team perform over the last quarter?” “How much revenue did your most recent marketing campaign generate?”

With the BI department in charge of bringing this data in, the finance department can focus its time and energy on analysing the data, rather than collecting it. Unhindered by the goals and motivations of each of the separate departments, the BI department then brings the information to each respective expert so they can decide what data is most important and what to do with it.

2. Corralling a wide range of data

CFOs have to lead by example in overcoming data silos and championing the use of a wide range of of data.

Having a bigger picture and a more robust set of data is extremely important when it comes to making business decisions. However, looking at a diverse range of data all at once can be confusing and overwhelming – unless you have a BI department to keep it organized.

The BI department collects data from multiple sources and brings it all together to make it more manageable. When the CFO works closely with BI, this results in a change of mind-set regarding how to use data in the finance department in general. They will see the value in combining all types of data – from financial to non-financial.

This will set a great example with the potential to ripple throughout the rest of the company. The team will start to think outside of the data silos of its particular department and combine data from all sorts of sources for decision-making.

This means that rather than having lots of separate sources of data, all the sources can be integrated and used in harmony with each other. Without the BI department to organize and make sense of this stream of diverse data, it would be overwhelming noise.

Without a strong BI strategy to bring this data together, it would remain siloed. For example, you might have web traffic data from Google Analytics, but no insight on how to use it to adjust your sales efforts or operations. This means missing out on valuable insights.

3. Clearly defining the data

As a CFO you have to support a single version of truth throughout the entire organization, and make sure that it can be reconciled to financial information.

When the BI department defines the data, it establishes agreed-upon answers to the question of “what does this data mean?” Everything is quantified and described clearly and therefore can be used more effectively, because all departments understand the data in the same way.

Without these definitions, the data can feel quite meaningless. Various departments within the business can use and interpret it in different ways, which is highly counterproductive and can lead to a lot of confusion.

It’s essential for the definitions to be the same throughout the entire company and for there to be one single version of truth. This is crucial for ensuring that the data filtering from the BI department to the rest of the company is widely accepted.

If you are collecting data, but you don’t know what that data means, you won’t be in a position to use it effectively. What often happens is that various departments come up with their own definitions, which is incredibly confusing and leads to misunderstandings.

For example, the definition of “active customer” needs to be the same in the marketing department as in the finance department – as well as everywhere else.

Only then will you be able to establish a company-wide definition of essential KPIs such as CLV/LTV (customer lifetime value) and ROAS (return on advertising spend). When this is achieved the data can be combined and collected across the company for effective decision-making, planning and budgeting.

Instead of arguing about what the numbers mean, the team can spend its time identifying issues and agreeing on strategies going forward.

4. Allowing for informed decisions

Develop a data-driven culture by setting the expectation that all decisions are to be anchored in data.

One of the most valuable roles of the Business Intelligence department is providing information and context, which allows the CFO to make smart, informed decisions. Without this context, the strategies you use to run your business are merely guesses – hopeful stabs in the dark.

For example, let’s imagine that the company is deciding whether to invest marketing resources into retaining existing customers or marketing to new customers. This strategy cannot be figured out simply by making assumptions or doing what other companies have done; you need to look at the numbers.

In order to make such a decision, there are some very important things to know. Let’s use the example of a SaaS business:

- How do you define the data underlying your most important customer metrics, such as new, active, reactivated, and churned customer? For example, is an active customer simply someone with an active account, or someone who spends a certain amount per month or uses your service a minimum number of times?

- How much does it cost to market to existing yet dormant customers and win back their business again?

- How much does it cost to bring a new customer through every step of the sales funnel and win their business?

- How much, on average, does the typical existing customer spend compared to a new customer?

You must answer all of these questions before you can determine whether the ROI would be higher on marketing to existing customers versus new customers.

This information gives context to the decision, allowing all choices to be as informed as possible. CFOs have to lead by example to develop a data-driven culture: Decisions are to be based on actual facts and numbers, rather than doing things “because it’s how they’ve always been done” or based on gut feeling. For some ideas how to start, David Waller of Oliver Wyman recently wrote a good article on the 10 steps to creating a data-driven culture.

Also, it’s essential for BI to pre-filter with data sets that are safe to be used by others. This style of “self-serve BI” allows anyone to run the analyses themselves and not necessarily under the guidance of an analyst.

Instead of just feeding in meaningless data, the BI department helps to uncomplicate the data and deliver it in a way that makes it easier to use.

5. Spotting weaknesses

Business Intelligence can be your informal internal audit department.

It’s often true that stepping back and approaching a problem from a different angle can bring better insight and fresh ideas.

By collecting more robust data and looking at it from a bird’s eye view, the BI department is more likely to spot issues with the company that might not be apparent to each of the individual departments.

There may be weaknesses in your organization that are not readily visible from unusual reports. The robust and comprehensive data collected by the Business Intelligence department allows for this type of “full-picture” analysis.

Also, the BI department has the potential to spot missing, incomplete and inconsistent data. This often hints at weaknesses in a company’s controls and processes, which is very important.

This allows each department to make adjustments that could result in huge savings. You’ll be able to work proactively to prevent any weaknesses from causing problems before the end of the next financial period.

6. Predicting trends

Take your forecasts to the next level by applying machine learning algorithms and advanced statistical methods.

A truly effective CFO doesn’t just react to past data. They make predictions and intelligent guesses about what’s coming up next and then prepare themselves.

Rather than simply applying traditional approaches to forecasting, the complex data BI collects allows CFOs to use advanced methodologies to make projections for the future of the company and develop smart plans. Of course, it’s impossible to know the future with 100% certainty.

However, with the right data you can make smart informed guesses and be ahead of the curve. What about a forecasting model incorporating over 200 variables as described in a recent article by McKinsey? BI makes it possible! Without this aspect, many businesses remain reactive and lose their competitive edge, doomed to always fail to take advantage of the next smartest move.

The BI department can keep up with developments in the industry, monitor changes in the market and anticipate customer needs. BI will also help the company discover its relative strengths and weaknesses against its competitors and identify trends and market conditions.

Armed with this information, decision-makers can act swiftly and correctly and take a chance on potentially profitable opportunities.

How to get started with Business Intelligence

The position of the Chief Financial Office is evolving to encompass so much more, which makes it a very exciting time to be in this role. By using the power of a BI department, you can elevate the CFO’s role and bring more valuable, data-based insight to your company.

Not only will Business Intelligence help you deliver more value in the role of CFO, but it will also benefit the entire business.

A study by Nucleus Research revealed that an investment in analytics pays back $9 for every dollar spent. Such a phenomenal ROI is any CFO’s dream. These fantastic results are probably the most enticing reason for CFOs to get involved with the Business Intelligence department.

If you’re ready to bring a business intelligence department into your company, but you don’t know where to start, here are a few important pointers:

- The type of CFO who can make the most of a BI department is one who is analytical and tech savvy. They will place value in the data the BI department collects and go into the process with their eyes open.

- Start by defining your business strategy, as well as the key performance indicators that will help measure whether you have achieved the goals of that strategy.

- I recommend ensuring that the BI department and the CFO are located close to each other. For example, in my company I even moved the BI and finance departments so they were located on the same floor.

- Clearly define roles. Everyone should know who reports to whom and about what aspects of the business.

- Don’t be afraid to ask questions. After all, as a Finance Director it’s impossible to be the expert in everything, so don’t pretend you are. Instead, focus on being a competent partner to discuss these topics with. Work closely with the BI department and be inquisitive – so that you can fully understand what they are doing and how to apply it to your goals. They are at the crossroads of business and tech, and their expertise can be an incredibly valuable resource.

(An extended version of this article previously appeared on LinkedIn as “Business Intelligence and the CFO”.)