Crypto prices experienced a significant downturn in the first two days of this week. The world’s largest digital asset, Bitcoin (BTC), experienced drops of 2.2% and 5.2% on Monday and Tuesday respectively and moved below the $60,000 mark again.

Although this morning the price of BTC is recovering some of its lost territory with gains of 1.1% thus far in early crypto trading activity, August has not been a good month for cryptos as BTC alone – a thermometer for the whole market – accumulates a 7% drop.

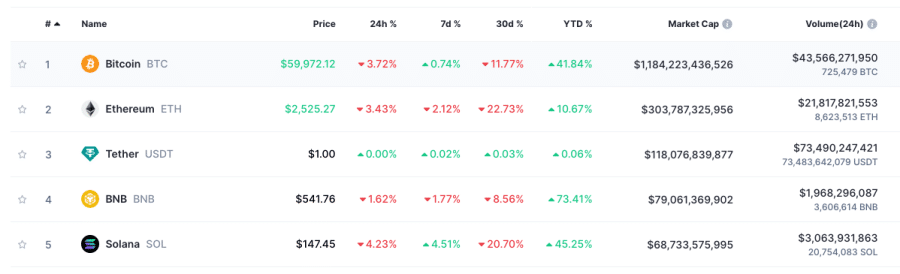

Meanwhile, the hardest-hit crypto among the 10 largest on the CoinMarketCap list has been Ether (ETH). The native token of the smart contracts network, Ethereum, has seen its price decline by 25% in the past 30 days.

Similarly, Dogecoin (DOGE), the leading meme coin in the space, has also seen its price retreat by 22.5% during this same period as market participants appear to be adopting a more conservative approach and reducing their exposure to the riskiest assets.

The fact that BTC’s drop is milder than these two and also lower than that of Solana (SOL) indicates a flight-to-quality move from investors following the meme coin craze seen in the first semester of the year.

Why are BTC and Crypto Prices Diving?

Arkham Intelligence data indicates that BTC whales have moved approximately 2,300 BTC tokens to Kraken. These transfers are commonly interpreted as bearish signals as they indicate interest in disposing of these assets.

Moreover, the crypto trading platform Celsius has reportedly repaid around $2.5 billion worth of crypto assets to its more than 250,000 creditors since the year started. This increased liquidity could have hurt the market as it bolster the available supply of various tokens without demand forces being necessarily prepared to digest them.

It is also worth noting that the crypto market has been increasing its correlation with the performance of the well-known tech-heavy Nasdaq 100 index. The market is putting all of its hopes on Nvidia, the chipmaker whose stock has been propelled lately as its products are in high demand due to the AI boom.

Also read: What Is the Best Way to Trade Bitcoin Futures?

Most analysts appear to be expecting that the company’s top and bottom lines for the second quarter of 2024 will beat expectations as Nvidia’s customers have reportedly ramped up their spending on chips to keep up with the demand for their advanced AI models.

Any negative surprise on that end could plunge the stock. Thus far in August, and ahead of its Q2 2024 earnings report, Nvidia stock accumulates a 10% gain. Meanwhile, it has produced total gains of 159% since the year started.

“It’s the most important stock in the world right now,” stressed EMJ Capital analyst Eric Jackson, who also claimed that disappointing results from the company headed by Jensen Huang could pose “a major problem for the whole market.”

Lastly, some market participants noted that the crypto retracement accelerated when news broke of a revised indictment against former President Donald Trump in his criminal election interference case. This political uncertainty may have contributed to a risk-off sentiment among traders.

Most Analysts See Short-Lived Sell-Offs as Great Buying Opportunities

Countless analysts have already weighed in on what’s going on with the market these days. Steven Lubka from Swan Bitcoin commented that these kinds of moves are usually great opportunities as they occur as part of a natural deleveraging process and do not indicate fundamental weaknesses in the market’s situation or trend.

He expects markets to buy the dip on Bitcoin, while Ethereum may continue to struggle until investors have a reason to be positive about the asset again.

Meanwhile, Bartosz Lipiński from the crypto trading platform Cube.Exchange commented that traders are hesitant to assume higher risks in what is a relatively uncertain scenario. Various factors, including the Federal Reserve’s upcoming interest rate decision and the November presidential election, are clear sources of concern for market participants who are not entirely sure of what the outcomes of these events will be.

“Traders don’t like instability, and often go risk-off to cash in such environments,” he argued.

Meanwhile, analysts from Fairlead Strategies warned in the company’s latest report of a “seasonally weak period in September” and suggested “another two months of corrective price action.”

Similarly, analysts from Glassnode noted that Bitcoin may be aiming to reach an “equilibrium.” If that’s the case, these phases are usually followed by periods of “heightened volatility”.

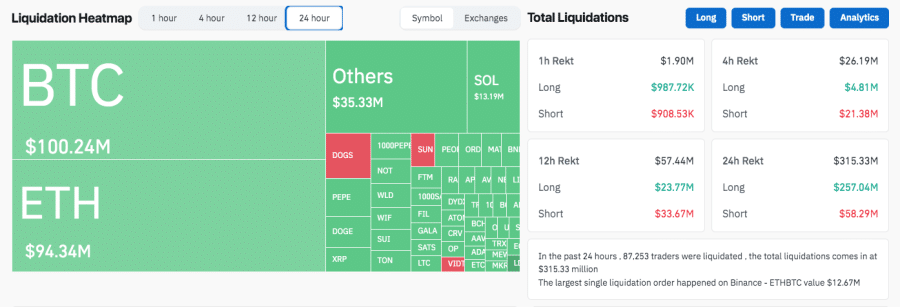

$190M in Long Positions Roasted in the Past 24 hours

Data from Coinglass reveals the extent of the sell-off indicating that over $170 million in long positions were liquidated in a single hour, the majority of which were BTC and ETH positions.

Meanwhile, in the past 24 hours, liquidations surged to a staggering total of $300 million. The bulk of this amount, however, evaporated during a four-hour window. Long positions were the most affected, accounting for roughly 65% of that total.

These liquidations partially explain the downward spiral seen on Monday and Tuesday.

Despite this recent weakness, the price of BTC is still up 42.1% so far in 2024 as the market reacted positively to key events like the April halving and the approval of BTC and ETH spot exchange-traded funds (ETF) in the United States.

Crypto investors at this point are mostly accustomed to these wild price swings and they most may already have the stomach to tolerate 10% drops in relatively short periods as digital assets are still susceptible to that kind of volatility.

In the case of Ether, its gains have been impacted primarily as the network’s ability to maintain its leadership in the smart contracts space has been questioned amid the rise of Solana – a much cheaper, scalable, and faster alternative.

Meanwhile, notable losers among the top-ranked crypto assets include Cardano, which has seen the value of its native token ADA drop by nearly 40% since the year started and Avalanche (AVAX), which has experienced a similar retreat of 36% retreat in 2024.

Global Developments Affecting the Crypto Market

Certain global developments may have also influenced the latest drop in crypto prices. This includes a report that Russia may be preparing to test how they could use BTC and crypto exchanges to complete cross-border transactions.

The Russian economy and businesses ability to pay their international partners has been crippled by sanctions. These trials are expected to commence in September and could open up new avenues for crypto usage for international trade.

Meanwhile, President Donald Trump and his pro-crypto agenda is also a key catalyst for the market. If his odds of winning increase beyond those of Kamala Harris, the market will likely react positively as the sector could see significant improvements in terms of regulations and government support under his leadership.

Finally, the head of the Federal Reserve signaled last week that the US central bank is now ready to start cutting interest rates. Although he did not say how many cuts they plan to make or their magnitude, this is a major catalyst for risky asset classes like crypto as liquidity will likely increase in the marketplace in the short term and funding conditions will be eased.

What to Expect for Crypto Prices in the Following Months

As the crypto market navigates through this spike in volatility, several factors may influence its future trajectory. Ongoing regulatory discussions and potential new policies could significantly impact the valuation of digital assets down the road.

Moreover, the continued interest from institutional investors may provide long-term support for major assets, especially those whose ETFs have already been greenlighted.

Upgrades and innovations in blockchain technology could also drive renewed interest in specific crypto projects. The Solana v. Ethereum case is a notable example of this as networks are now competing to attract as many developers as possible to strengthen their ecosystem and validate their value proposition.

While these sudden price drops are usually concerning for investors, most experts view this as a typical occurrence during bull markets. Despite the short-term turbulence, cryptocurrencies have shown resilience in 2024, with major assets still showing attractive yearly gains.