Crypto arbitrage has gained popularity among traders who are eager to explore new ways to make money in this space without incurring significant risks.

This approach takes advantage of price differences across various exchanges primarily to turn an easy profit. In this article, we’ll explore some of the fundamentals of this activity, how it works, and how much money successful traders can make from it.

Understanding Crypto Arbitrage: The Basics

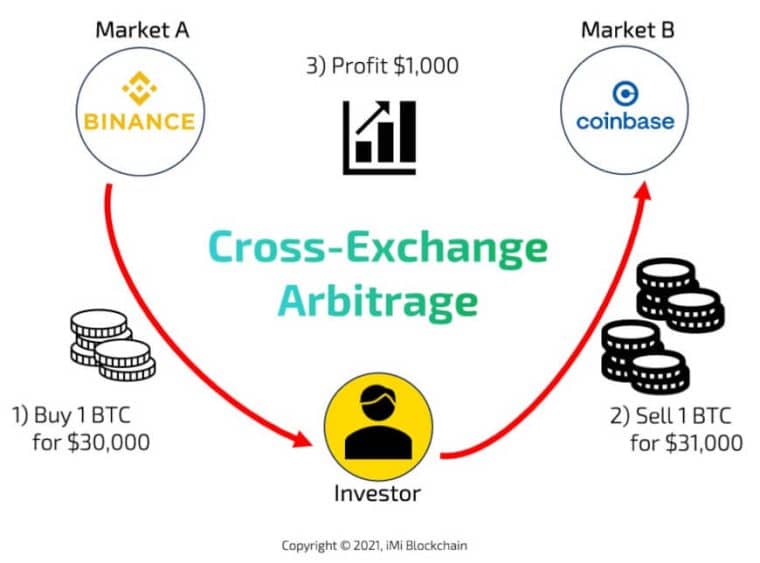

Arbitraging is about exploiting price differences for digital assets across various crypto exchanges and markets. The concept is that traders can purchase an asset at a lower price in one location and sell it at a higher price in another, pocketing the difference—provided that trading costs and fees are low enough to make this possible.

This strategy plays an important role in the crypto markets as it increases their efficiency when it comes to price discovery.

Arbitrage is not a new idea in financial markets. In traditional finance, chances for arbitrage are usually rare and brief because skilled traders quickly spot and take advantage of price differences between markets, helping to align prices. However, the cryptocurrency market, which is relatively new and often less efficient, can offer more frequent opportunities for arbitrage.

How Crypto Arbitrage Works

Traders who engage in arbitraging typically keep an eye on the price of certain assets across various crypto exchanges to identify price discrepancies. Once they notice an exploitable gap, they calculate the potential profit of arbitraging by estimating the trading fees and commissions they would incur if they make the trade.

This process is repeated as many times as there are advantageous opportunities in the marketplace.

Speed is crucial in crypto arbitrage, as price differences often disappear quickly. Most traders use automated crypto trading bots to increase their ability to capitalize on all available opportunities.

Types of Crypto Arbitrage

Crypto arbitrage can be categorized differently depending on the approach. Simple arbitrage involves buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another, directly profiting from the price difference.

Meanwhile, triangular arbitrage occurs within a single exchange and involves trading three different cryptocurrencies to exploit any discrepancies in the exchange rates between the pairs.

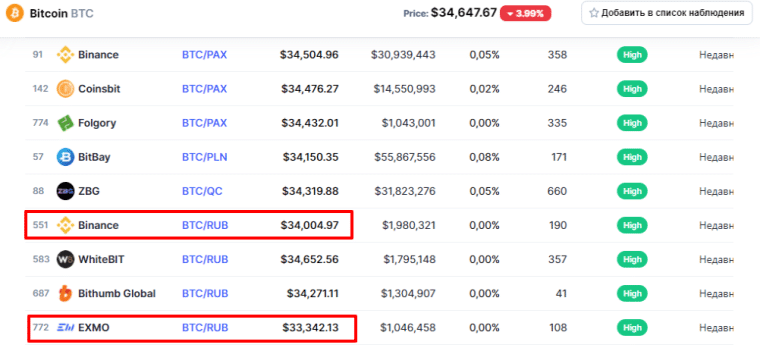

Spatial arbitrage, on the other hand, takes advantage of price differences across different geographic regions and leverages the fact that cryptocurrency prices can vary significantly between countries due to local demand, regulatory differences, and market conditions.

Finally, statistical arbitrage relies on complex mathematical models and algorithms to identify and exploit price inefficiencies, often involving multiple trades across various assets and exchanges.

Each type of crypto arbitrage demands a certain skillset and knowledge to identify opportunities and execute the required trades.

How Much Money Can Be Made Out of Crypto Arbitrage?

The profits that traders can make out of arbitrage vary widely depending on market conditions, how large the discrepancies in prices are across exchanges and digital assets, and how the crypto market progressively evolves to become more efficient.

Arbitrage opportunities are, nevertheless, small in most cases and require substantial capital to generate meaningful returns.

For example, let’s say a trader identifies a 0.1% difference in the price of BTC at Coinbase compared to the price at which the digital asset is trading at Binance. The total amount that would need to be invested to generate $100 would be $100,000 – excluding fees.

That said, these opportunities may be available multiple times a day, which opens up the door for cumulative profits that are large enough to justify the time invested into this activity.

As with most other trading strategies, the time that is invested into learning and developing a successful and automated system will be the most influential factor in making money out of arbitraging.

It’s worth noting that as the cryptocurrency market matures, arbitrage opportunities may become less frequent and less profitable. A 2023 study by Tommy Crépellière, Matthias Pelster, and Stefan Zeisbergeral found that the magnitude of arbitrage profits has decreased significantly since April 2018 and has made it more difficult for investors to exploit these opportunities.

Risks Associated with Crypto Arbitrage

Although arbitraging is considered a low-risk activity compared to other strategies, it is still challenging and can produce losses if it is executed poorly. Even when you do everything right, there is always a risk of tremendous loss due to unforeseen circumstances like an exchange failing.

The natural volatility of the crypto market, which is significantly higher than that of other traditional markets, exposes assets to drastic changes in their price that can mess up even the most calculated trade.

Moreover, the risk of slippage is real if the market’s depth and liquidity are low as traders may be unable to find willing buyers or sellers for certain price levels – especially when they are pinned down to decimals.

Trading fees should also be considered as they can erase virtually all of the profits generated from a trade if they are not adequately calculated before the transaction is executed. Finally, technical issues like internet connectivity and software failures for automated bots can result in lost opportunities and failed executions.

Who Can Engage in Crypto Arbitrage?

In theory, anyone with access to multiple cryptocurrency exchanges can engage in crypto arbitrage. However, successful arbitrage trading typically requires extensive capital as traders need to execute several transactions that require a significant amount of money to generate meaningful profits.

Technical knowledge is also key to success. This includes a thorough understanding of cryptocurrency markets, trading platforms, and programming skills for those who will be using automated trading software.

Also read: Bitcoin Surge Enables Massively Profitable Arbitrage As Funding Rate Soars

In addition, trading should be acquainted with the most common risk management tools like stop-order and take-profit orders, position sizing, and portfolio diversification to avoid being wrecked in a single session.

Although sophisticated and experienced traders have the upper hand in this particular strategy, amateurs can still make it as long as they understand that there is a learning curve.

Recommendations to Amateur Arbitrageurs

To increase the odds of success, traders who are new to arbitraging should first learn as much as they can about the markets and arbitrage strategy. They can first rely on demo accounts to prove that they have the skillset and technical knowledge needed to take advantage of arbitrage.

Once they feel prepared, they can go through the application and vetting process required to open an account with multiple exchanges. This typically involves verifying your identity for centralized exchanges.

The amount of funds needed to engage in arbitraging is often higher compared to swing or day trading, meaning that anyone who wants to implement this strategy has to get ahold of at least $10,000 and rely heavily on leverage to have a chance to generate meaningful profits. Naturally, using leverage substantially increases the risk of devastating losses.

Ideally, new arbitrageurs should start small, placing relatively safe trades that offer little but safe upside rather than going for the riskiest opportunities, which typically involve exotic pairs and assets with low liquidity and market depth.

Also read: Binance.US Crumbles Following SEC Lawsuit

Traders should progressively analyze and learn from their past performance to improve their systems accordingly. This is how the odds of becoming a profitable arbitrageur will increase over time. It is also important to keep a record of transactions for tax purposes.

As more experience is gained, traders may want to rely on automated trading tools to increase their efficiency.

Crypto arbitrage presents an interesting opportunity for traders to potentially profit from price inefficiencies in the nascent cryptocurrency market. While this activity carries a lower risk compared to other trading strategies, it requires a specific skillset, in-depth knowledge of the market, and possibly some programming expertise.

As the cryptocurrency market continues to mature, traditional arbitrage opportunities may become less frequent and less profitable. However, innovative traders will likely develop new strategies to capitalize on market inefficiencies in specific segments like DeFi and gaming that may still offer enough upside potential.