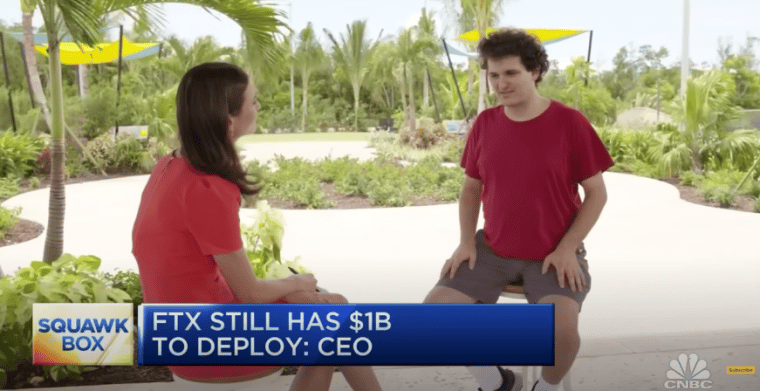

Sam Bankman-Fried, the head of the crypto derivatives exchange FTX, recently told CNBC that his firm may have approximately $1 billion to deploy for the acquisition of other companies in the space.

During the interview held in the Bahamas just outside the company’s offices, Bankman-Fried commented on the latest moves of his company during the so-called “crypto winter” including bailing out some prominent firms like the now-bankrupted Voyager Digital and BlockFi.

The goal behind these operations, according to the founder of FTX, was to provide a backstop for customers to make sure they were protected from the setback that bankruptcy would suppose.

In addition, Bankman-Fried was also aiming to stop “contagion from spreading through the ecosystem” as several firms were involved in dealings with the same troubled assets or entities such as the demised Singaporean crypto hedge fund Three Arrows Capital (3AC) and the now worthless cryptocurrencies that power the original Terra ecosystem.

The Voyager Digital Loan May Never Be Recouped

The head of FTX Global emphasized that his firm went into this with “a couple of billion” at hand to use for acquisitions and bailouts but the amount is now closer to a billion in “unencumbered assets” that it can still use for this same purpose. In addition, the founder of FTX commented that the firm remains a profitable endeavor.

For Bankman-Fried, not stepping in to help some of these companies during such a chaotic time would not be good for the ecosystem in the long run as customers should not have to worry about “unknown unknowns” when they operate in the crypto market.

In regard to the negotiations that resulted in a multi-million credit line extended to the bankrupted crypto exchange Voyager Digital, Bankman-Fried has little hope that his company can recover the $70 million that were immediately withdrawn from the facility but they were well aware of that risk when they accepted the terms of the deal.

However, when it comes to the deal they made with the crypto exchange BlockFi, the outlook of the transaction is more promising as the company has managed to dodge bankruptcy while FTX has the option to acquire the firm at around $250 million contingent on its ability to reach certain “performance triggers”.

FTX Is Now into Stocks and Has Entered Multiple New Markets

Earlier this year, FTX.US, the firm’s subsidiary in the United States, started to offer zero-commission stock trading services to compete with popular retail trading firms such as Robinhood.

The company managed to do this after completing the acquisition of Embed Financial Technologies, a transaction clearing platform, for an undisclosed amount.

The US subsidiary of FTX was recently valued at $8 billion during a funding round through which it picked up approximately $400 million to finance its expansion in the North American country.

FTX also acquired Bitvo Exchange to enter the Canadian market and Liquid Group in a bid to enter the Japanese markets.

Also read: How to Buy FTX Token (FTT) – Beginner’s Guide

Meanwhile, the company may also be exploring an acquisition that allows it to provide trading services to retail customers in the United States. Sources familiar with the matter told CoinDesk that Bankman-Fried’s firm could be looking to raise additional capital for financing such a transaction.

Thus far, FTX.US and its parent company have primarily catered to institutional investors due to the complex nature of the sophisticated instruments it offers – mainly options and futures. Hence, a move to the retail space makes sense to expand their customer base, the amount of assets in custody, and how much it generates in transaction-based revenues.

Other Related Articles:

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption