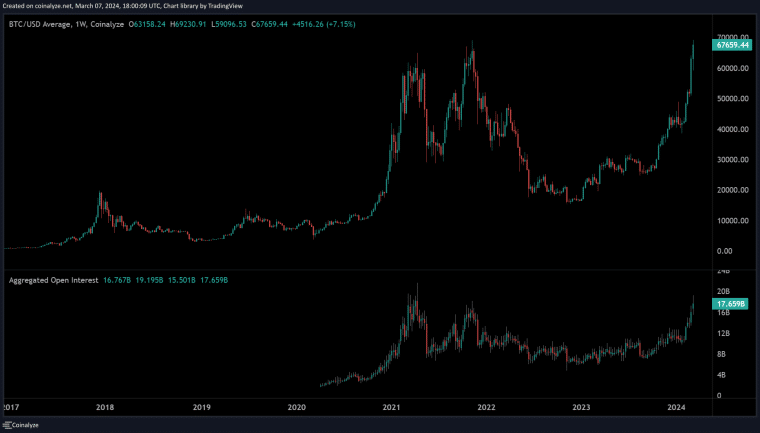

Bitcoin’s open interest has reached a new all-time high, marking a significant recovery from the crypto winter. This suggests that major volatility is on the horizon. With open interest rising in the markets and accumulation speeding up, Tesla’s possible return to Bitcoin investments could influence the narrative (and possibly the price) even more.

This confluence of factors heralds a period of heightened market activity, drawing parallels with past cycle trends while carving out new narratives in the crypto space.

Open Interest Signals Volatility Ahead in Bitcoin Markets

The surge in Bitcoin’s open interest to an all-time high is a critical indicator, mirroring the exuberance of the 2021 rally but also signaling potential market corrections.

This spike in trading activity, coupled with Bitcoin’s significant price appreciation, underscores a market brimming with optimism yet teetering on the edge of volatility.

Investors and traders are reminded of the cyclical nature of the crypto market, where periods of rapid gains often precede substantial volatility.

Tesla’s Bitcoin Wallet: A Bitcoin Market Catalyst?

While Bitcoin analysts are getting excited by the potential for massive volatility as open interest skyrockets, the crypto community seems to be more interested in Tesla. Speculation abounds about Tesla potentially increasing its Bitcoin holdings, a move that could have far-reaching implications for the entire crypto market for narrative purposes especially.

Analysts note that Tesla’s wallet is now holding about 11,509 BTC, an increase of 1,789 on the 9,720 BTC it reported during its last earnings report.

Tesla Bitcoin wallets identified and verified holding $770m $BTC.https://t.co/ZjwxZgHvNP pic.twitter.com/am14oExUfV

— MartyParty (@martypartymusic) March 7, 2024

Tesla’s historical interactions ($1.5bn buy in 2021) with Bitcoin have already demonstrated the significant impact of corporate adoption and retail excitement. They have had a major influence on the cryptocurrency’s valuation and investor sentiment in the past.

If these speculations hold true, Tesla’s renewed interest in Bitcoin could serve as a strong bullish signal, reinforcing the narrative of corporate acceptance and investment in digital assets amidst huge growth in spot Bitcoin ETFs.

Bitcoin spot ETFs now have over $50 billion AUM pic.twitter.com/f0aDCFhCNZ

— Will (@WClementeIII) March 7, 2024

The Altcoin Season: A Pending Phenomenon?

While Bitcoin captures headlines with its rally, the undercurrents in the altcoin market, particularly the surge in meme coins, hint at the burgeoning potential for an ‘altcoin season.’

The market is keenly observing Ethereum’s price movements and other altcoins, looking for signs that could confirm a broader market shift towards these alternative cryptocurrencies.

The biggest Altcoinseason in history is about to come.

And here is why:

The Spot #Ethereum ETF will get accepted in 76 days.

Institutional liquidity will flow into $ETH.

And this will cause the biggest Altcoin season ever seen in history. pic.twitter.com/dM9eiByLtt

— Crypto Rover (@rovercrc) March 7, 2024

Some traders suggest an anticipated ETH ETF approval by the Securities and Exchange Commission in just over 70 days could trigger major growth in altcoin markets, especially ERC-20 linked tokens.

The interplay between Bitcoin’s dominance and the burgeoning expectations of a major rally in altcoins will be a critical theme to watch in the weeks leading up to the next Bitcoin halving event. Some analysts like Benjamin Cowen believe that Bitcoin dominance will leg up again to 60% before anything resembling an alts season could begin but there is certainly no consensus in the community.

This means Bitcoin dominance is going higher https://t.co/YgzfdPNngv

— Benjamin Cowen (@intocryptoverse) March 6, 2024

The Bottom Line: Exercise Strategy and Caution

In this supercharged market landscape, the blend of peaking open interest, increased corporate influence through companies like Tesla, and the altcoin market’s latent potential paints a complex picture for investors.

The overarching message is one of cautious optimism, where strategy and vigilance are paramount, while an all-time high in open interest looms large, it could be the start of something far bigger.

Market participants are encouraged to monitor these developments closely and be cautious of the potential for a localized price correction, understanding that while the crypto market offers significant opportunities, it also comes with inherent risks.

Whether this leads to new all-time highs or a market correction, the unfolding story of Bitcoin news and the broader crypto market continues to captivate and challenge both seasoned investors and newcomers alike in the year of institutional adoption.