Apple has announced an important upgrade to its operating system that would allow third-party developers to access the Near Field Communication (NFC) module of its mobile devices.

As a result, other applications aside from Apple Pay could be used to make contactless payments with iPhones and iPads including Web3 applications that allow customers to use digital assets during checkout.

Apple Ends Decade of NFC Exclusivity

For over a decade, Apple has restricted access to the iPhone’s NFC chip, allowing only its Apple Pay service to use the technology for contactless payments. This walled-garden approach has faced criticism and regulatory pressure, particularly from the European Union, which has pressured the company to open up the hardware for other developers to access it to push for increased competition in the mobile payments space.

In a surprise announcement, Apple revealed it will open up NFC access to third-party developers with the upcoming iOS 18.1 software update, which is expected to be rolled out in the fall season of 2024. This change will allow alternative payment apps to compete directly with Apple Pay by leveraging the iPhone’s secure contactless payment capabilities.

While Apple’s announcement did not specifically mention how this move would favor the crypto ecosystem, the implications for the crypto industry were immediately apparent to industry observers.

Circle CEO Hints at USDC Tap-to-Pay Feature

Jeremy Allaire, CEO of Circle, the company behind the popular USDC stablecoin, quickly highlighted the potential impact of Apple’s decision on crypto payments. In a series of tweets, Allaire suggested that tap-to-pay functionality for USDC on iPhones could be “incoming soon.”

“Tap to pay using USDC on iPhones incoming soon. Wallet devs, start your engines,” Allaire wrote on August 14, 2024, in a social media post on X.

re: my iPhone NFC USDC post….

Lots of chatter and questions about my tweet. A bit more clarity so that people don't make this into something it is not. Why is tap to pay using USDC on iPhones incoming soon, and what does it mean for Wallet devs to get going?

– Circle has…

— Jeremy Allaire – jda.eth / jdallaire.sol (@jerallaire) August 14, 2024

He clarified that Circle has no direct relationship with Apple. However, the NFC upgrade allows Web3 and crypto wallets to leverage the company’s technology to facilitate transactions. This could enable a scenario in which an iPhone wallet that supports USDC can make payments with a simple tap.

How Crypto Tap-to-Pay Could Work

Allaire outlined a practical scenario that described how USDC payments would function by using the newly accessible NFC technology:

- A point-of-sale system or another device communicates transaction details (e.g. payment amount, recipient address) to the iPhone via NFC.

- The iPhone’s crypto wallet app receives this information and prompts the user to confirm the payment.

- The user authenticates the transaction using FaceID or another method.

- The wallet app initiates a blockchain transaction to transfer the USDC payment.

“This will open up a powerful pathway for direct to merchant USDC payments,” Allaire explained. He added that the technology could also be used for other digital assets like NFTs and other stablecoins.

Crypto Solutions Could Tap into a Huge Market

The integration of crypto payments into Apple’s vast ecosystem could have far-reaching implications for the adoption and use of digital assets. Apple has over 1 billion active iPhone users globally. This would significantly increase the total addressable market (TAM) of crypto payment solutions.

Analysts suggest that enabling tap-to-pay functionalities for stablecoins like USDC could significantly boost transaction volumes on networks like Ethereum, where many stablecoins are currently issued. This increased activity could, in turn, drive up demand for ETH and have a positive impact on its price.

Also read: Earn Interest on Stablecoins – Anchor Protocol Alternatives

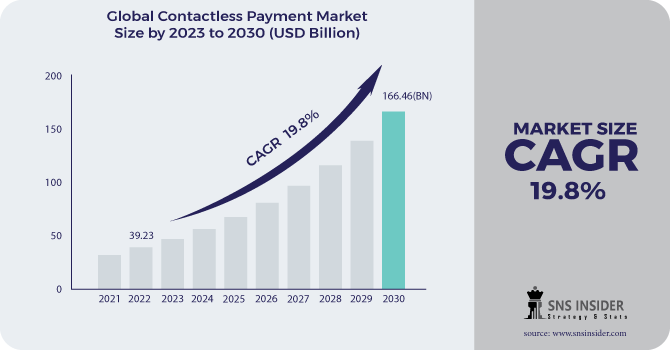

The potential for crypto to tap into the growing contactless payments market is substantial. According to a report by SNS Insider, the total transaction value for global contactless payments is expected to triple within the next six years to $166 billion.

If crypto payments can capture even a small fraction of this market, it could lead to a substantial increase in transaction volumes and mainstream adoption. The ability to easily make tap-to-pay purchases using stablecoins like USDC could be a key factor in driving this adoption.

“Less clicks, tapping, meeting users where they are—each one of those will be another small step that will accumulate into a singular moment —billions of people using public blockchains,” commented Idan Levin from the venture capital firm Collider VC.

USDC Stands to Gain if Crypto Payments Become Popular

As an Ethereum-based stablecoin, any increase in USDC usage directly impacts the Ethereum network. The ability to use USDC for everyday tap-to-pay transactions on iPhones could drive widespread adoption among consumers and merchants, leading to higher transaction volumes on Ethereum.

In 2024, the average daily trading volume for USDC has been around $8 billion. If USDC can capture a small portion of these nearly $170 billion in contactless payments by 2030, it could bring hundreds of millions in additional transaction volumes to the Ethereum ecosystem.

Meanwhile, the potential for seamless USDC payments on iPhones could spark increased interest among developers to create more apps and services leveraging Ethereum’s capabilities, particularly in decentralized finance (DeFi) and payments.

As of August 2024, Ethereum’s total value locked (TVL) in DeFi stands at $48.89 billion. The integration of USDC with Apple’s payment ecosystem could boost this TVL further, potentially positioning Ethereum for significant growth.

Moreover, increased demand for USDC and higher transaction volumes on Ethereum could have a positive impact on ETH prices. Each USDC transaction requires ETH for gas fees, which would result in higher demand for the network’s native cryptocurrency.

USDC is not the only stablecoin that would necessarily benefit from this change. Other similar assets like Tether (USDT) and Dai (DAI) could take advantage of the same situation to build solutions that allow users to tap on their crypto wallets to make contactless payments via their Apple devices.

Developers Will Be Screened by Apple Before They Can Launch These Payment Apps

Apple has stated that it will only work with authorized developers who “meet certain industry and regulatory requirements” and commit to its security and privacy standards. Crypto wallet developers would have to ensure that they can meet these requirements to be approved as an authorized third-party vendor.

Initially, Apple’s third-party NFC integrations will only be available in select countries: Australia, Brazil, Canada, Japan, New Zealand, the UK, and the US.

It is also worth considering that while the tap-to-pay system is familiar to many users, paying with cryptocurrencies still represents a significant step forward and it would probably have its learning curve. Wallet developers and crypto companies will need to create user-friendly interfaces and educate users on the benefits and use of digital assets for day-to-day transactions.

Moreover, while stablecoins like USDC are designed to maintain a static value, the crypto market is known for its volatility. In addition, there have been incidents in the past like the collapse of the Terra USD (UST) stablecoin that have undermined the credibility of this type of assets and their issuers.

Competition could also come from established payment providers and banks that will likely leverage Apple’s NFC to launch their own tap-to-pay solutions.

Despite these challenges, the crypto industry has reacted positively to the potential for iPhone-based crypto payments. Many see it as a significant step toward mainstream adoption of digital assets.

Wallet developers are now eagerly awaiting more details from Apple on the requirements and process for integrating their tools with the NFC chip. Circle’s Allaire advised developers to “start using the latest Apple iOS SDKs that support this and ready their apps for USDC Tap to Pay.”

Meanwhile, point-of-sale hardware companies and payment processors will need to upgrade their systems to support alternatives like USDC and USDT if they want to take advantage of this new payment method.