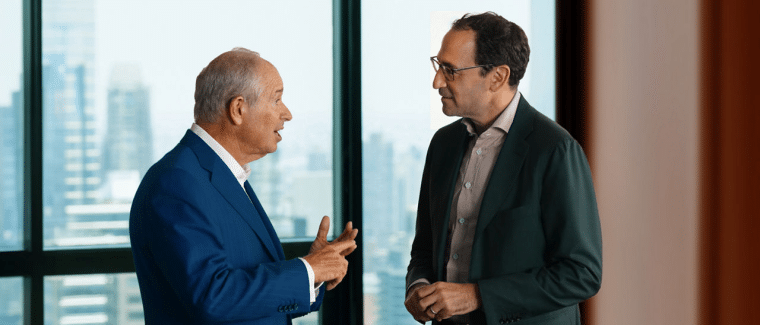

Stephen Schwarzman is the cofounder, chief executive officer, and chairman of Blackstone Group and is among the most respected names on Wall Street.

Schwarzman’s net worth is estimated at around $42 billion in 2024, which makes him among the top 50 richest people in the world.

Let’s dive into his career and net worth, exploring his life story to see what insights we can learn from the Wall Street legend who steered Blackstone to become one of the biggest alternative asset managers in the world with total assets over $1 trillion at the end of 2023.

How Much is Stephen Schwarzman Worth in 2024?

- Stephen Schwarzman’s net worth is around $42 billion in 2024.

- He co-founded Blackstone, a leading investment management firm.

- Schwarzman earns a substantial income from dividends and incentive fees.

- He has made significant contributions to education and philanthropy.

- Schwarzman is a prominent figure in finance, with a stake in Blackstone and other investments.

Stephen Schwarzman’s Net Worth Breakdown

Since most of Stephen Schwarzman’s wealth derives from his stake in Blackstone, a public company that he co-founded, his net worth is relatively easy to estimate.

He holds almost 232 million Blackstone shares and earns millions of dollars in dividends tied to his stake in the investment manager. In addition, he earns money through incentive fees and the share of fund profits that are known as carried interest.

Last year, he earned around $897 million from Blackstone though a vast majority of it (about $777 million) came in the form of dividends. Nevertheless, this is an absolutely astronomical salary, even for the financial giant.

Even so, his income fell from the previous year when he made a record $1.27 billion. Blackstone President Jon Gray, who is expected to take over as the CEO after Schwarzman, also earned $479.2 million in 2022 from Blackstone, of which $182.7 million was in the form of dividends.

Their massive earnings are a testimony to how absurdly large the compensation packages for the top brass in the private equity industry can be.

Here’s how Stephen Schwarzman’s net worth breaks down:

Income or Asset Source Contribution to Net Worth

| Asset or Income Source | Contribution to Net Worth |

| Stake in Blackstone | $29 billion |

| Stake in PJT Partners | $200 million |

| Stock and Blackstone Funds investments | $12.5 billion |

| Annual Blackstone income (including dividends) | $1 billion |

| Real estate investments | $200 million |

| Other personal assets | $100 million |

| Total Net Worth | $42 billion |

5 Fun Facts About Stephen Schwarzman

- Schwarzman’s first job was at his father’s dry goods store.

- He co-founded Blackstone with $400,000 in seed capital.

- Schwarzman has donated millions to educational institutions like MIT and Oxford.

- He signed the Giving Pledge, committing to donate the majority of his wealth.

- Blackstone is the largest owner of commercial property in the world.

Latest News & Controversies

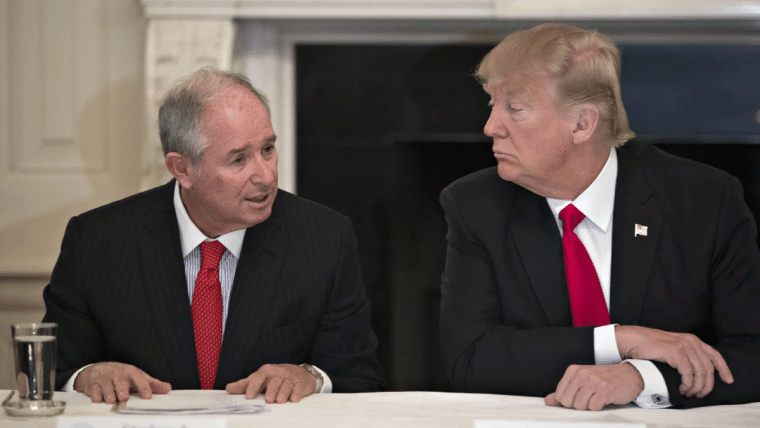

Stephen Schwarzman has recently been in the news due to his political involvement.

Schwarzman, who previously distanced himself from Donald Trump after the 2020 election and its aftermath, has now announced that he will support Trump in the 2024 election. This decision marks a shift in his stance, driven in part by concerns over the economic and immigration policies of the current administration, as well as the rise of antisemitism in the U.S. He believes that these issues have necessitated a reevaluation of leadership.

He joins other prominent donors who are returning to support Trump after initially pulling back following the events of January 6, 2021.

In addition to his political activities, Blackstone continues to make headlines as it manages over $1 trillion in assets, making it the largest alternative asset manager globally. The firm has been involved in significant real estate and private equity deals, continuing to lead in various sectors, including infrastructure and credit investments.

Despite global economic challenges, Blackstone has maintained a strong performance, contributing to Schwarzman’s massive personal wealth, which is estimated at $42 billion in 2024

Early Life & Education

Schwarzman was born Stephen Allen Schwarzman in Philadelphia, Pennsylvania, on February 14, 1947. His father, Joseph Schwarzman, was a graduate of the Wharton School of the University of Pennsylvania and owned a dry goods store.

Schwarzman went to the Abington School District and in 1965 and later graduated from Abington Senior High School.

He subsequently attended Yale University and briefly served in the US Army Reserve. Schwarzman then pursued a Master’s in Business Administration from Harvard Business School and graduated in 1972.

Stephen Schwarzman Net Worth: Getting Started in Banking

Schwarzman began working with an investment bank Donaldson, Lufkin & Jenrette (which later merged with Credit Suisse in 2000) while still in college.

After his graduation, Schwarzman started working at Lehman Brothers and rose to the rank of managing director when he was only 31. He later became the Head of Global Acquisitions and Mergers at the company.

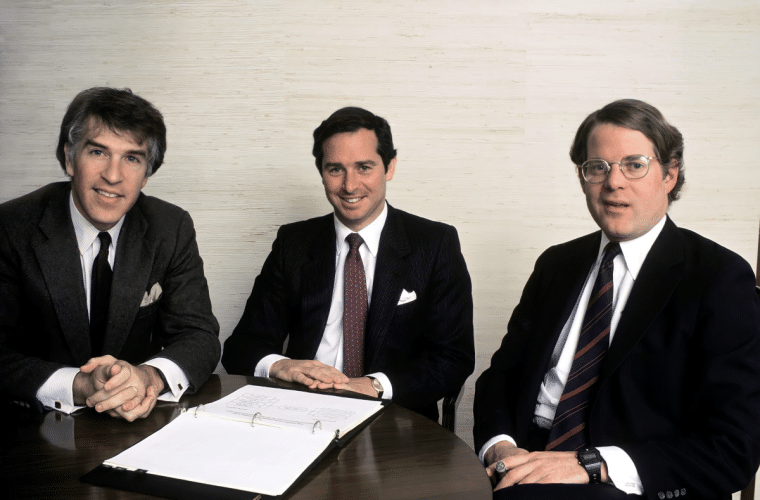

In 1985, along with Peter Peterson, his boss at Lehman Brothers, Schwarzman co-founded Blackstone.

Stephen Schwarzman Net Worth: Starting the Blackstone Group

Schwarzman and Peterson founded the company with just $400,000 in seed capital. The pair named it after themselves by combining “Schwarz,” which means black in German, and “Peter” (or Petra), which translates to rock or stone in Greek.

Initially, Blackstone dedicated itself to mergers and acquisitions only but subsequently branched out to other verticals like private equity, direct lending, real estate, and alternative assets. Cut to 2024, and Blackstone has several laurels to its name. These include

- It is the global leader in traditional buyouts

- Blackstone is the world’s largest discretionary allocator to hedge funds

- It is the largest owner of commercial property in the world

- It is a major provider of credit for companies

Blackstone completed its IPO in 2007 and Peter Peterson retired from the company in 2008. While going public, Blackstone structured the company as a partnership. However, in 2019, it was restructured into a C-Corp structure.

The move was meant to address the valuation discount with traditional asset managers like BlackRock. Also, the Donald Trump administration’s decision to lower the US corporate tax rate to 21% from 35% helped aid the transition.

Incidentally, Schwarzman is a Republican (like essentially all financial industry executives) and was the chairman of Trump’s Strategic and Policy Forum – which the mercurial former President dissolved within a year.

However, Schwarzman is not supporting Trump in the 2024 elections and said, “America does better when its leaders are rooted in today and tomorrow, not today and yesterday.”

He added, “It is time for the Republican Party to turn to a new generation of leaders and I intend to support one of them in the presidential primaries.”

Stephen Schwarzman Net Worth: Other Assets and Investments

Stephen Schwarzman has invested in several stocks as well as Blackstone funds. At an industry conference in 2023, he said, “I own a lot of stock, and I invest in all of our funds, so the firm is my family office,”

He however has a nuanced view of cryptocurrencies and blockchain. While he was all praise for blockchain technologies – echoing the views of JPMorgan CEO Jamie Dimon – Schwarzman admitted that he does not understand cryptocurrencies.

However, he added, “If they could solve that problem, and also the problem of controlling the money supply, then it might be OK.”

Stephen Schwarzman Net Worth: Philanthropy

Stephen Schwarzman is an active philanthropist who has donated a ton of money to important charities across the world, but he’s far from done yet. In 2020, he signed the “Giving Pledge,” which was founded by Warren Buffett and Bill Gates.

Its signatories – currently over 240 – have committed to donating the bulk of their wealth within their lifetime.

The signatories are spread across 29 countries including billionaires like Ray Dalio, Elon Musk, Michael Bloomberg, and UK-based Indian “metal king” Anil Agarwal.

Here are some of the major philanthropic activities that Schwarzman has been associated with over the years:

- Schwarzman donated $100 million to expand the New York Public Library in 2008

- Schwarzman founded “Schwarzman Scholars” at Tsinghua University in Beijing in 2013

- Schwarzman donated $150 million to Yale University in 2015 to establish the Schwarzman Center

- In 2018, he announced a foundational $350 million gift to establish the MIT Schwarzman College of Computing, which would help the institute reorient students toward the risks and opportunities associated with artificial intelligence.

- In June 2019, he donated £150 million to the University of Oxford which, among others, helped create a new Center for Humanities

What Can We Learn from Stephen Schwarzman’s Life?

Naturally, the life of one of the most influential people in finance is one to study. We have much to learn from his successes as well as his mistakes. In his book, “What It Takes: Lessons in the Pursuit of Excellence” Schwarzman has offered several insights.

According to Schwarzman, instead of asking “What’s in this for me?” one should instead consider “How can I help?” as this leads to better collaboration and trust.

In an interview with Forbes, when asked what investing advice would he give to a 20-year-old, Schwarzman said, “Surround yourself with the smartest people you can find and set up a system that generates enormous proprietary data. Be patient. Don’t force an investment decision—only invest when you have enormous confidence that something will work.”

When asked about the key metrics investors should watch, he touted the macro environment as the first aspect the investors should understand. Next, he said that investors should look at the key drivers that would drive the company’s success.

He added, “And we look for what we call good neighborhoods, where there looks like there’s growth built in for that industry and for that company.” Schwarzman emphasized that the company should ideally not be in a highly cyclical industry.

He also lays a lot of emphasis on human resources and believes they are Blackstone’s strength. According to Schwarzman, there are no patents in the financial services industry.

Instead, he says, “Our success instead relies on the talent of our teams around the world, knit together by a shared mission to be the best in the world at what we do on behalf of our investors.”