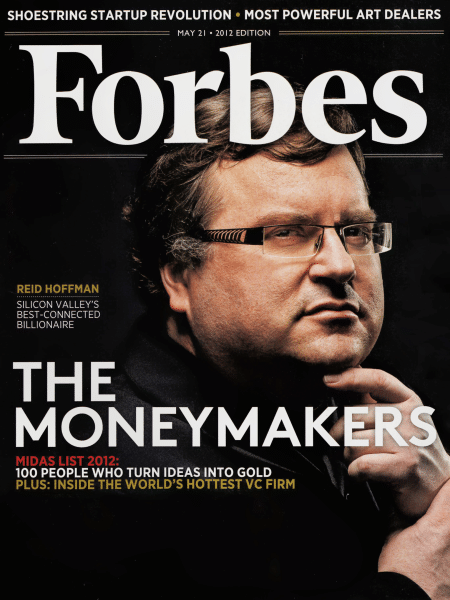

Reid Hoffman, the American internet entrepreneur who co-founded LinkedIn and invested in Facebook early, is unsurprisingly a very rich man these days.

In 2024, Reid Hoffman’s net worth is estimated at $3 billion.

Hoffman created a business empire for himself by founding not only LinkedIn but several other companies over the years. His strategic investments in promising brands have made his fortune skyrocket even further, making him one of the most prolific angel investors today.

Keep reading to find out how Reid Hoffman accumulated such wealth and which investments propelled him to billionaire status.

How Much is Reid Hoffman Worth in 2024?

Reid Hoffman’s net worth in 2024 is estimated at $3 billion, and his wealth continues to grow thanks to his involvement in key technology ventures and investments.

Here is a breakdown of his main income sources:

- LinkedIn stock sale: $2.8 billion from Microsoft’s acquisition of LinkedIn.

- Facebook stock: $75 million from early investments.

- Stake in OpenAI and Inflection AI: Undisclosed, but highly valuable due to his foundational involvement.

- Other investments: Includes investments in companies like Airbnb and various AI startups.

- Philanthropy & other ventures: Significant donations and contributions, including major donations to the Chan Zuckerberg Initiative.

Reid Hoffman’s Net Worth Breakdown:

Reid Hoffman’s net worth continues to grow substantially each year, which is unsurprising given his influential, prominent status in the tech industry.

According to our research, his fortune mostly stems from his stake in LinkedIn, but his other investments and income streams also keep piling up millions into it every year.

Below you will find a detailed breakdown of the earnings, investments, and major assets of the LinkedIn co-founder and venture capitalist.

| Asset or Income Source | Contribution to Net Worth |

| LinkedIn stock sale | $2.8 billion |

| LinkedIn salary | Unknown |

| Stake in OpenAI | Unknown |

| OpenAI director salary | Unknown |

| Stake in InflectionAI | Unknown |

| UofT’s Faculty of Information investment | $2.45 million |

| Facebook stock | $75 million |

| Other investments | Unknown |

| Total Net Worth | $3 billion |

7 Fun Facts about Reid Hoffman

- LinkedIn Mastermind: Hoffman co-founded LinkedIn in 2002, launching one of the world’s largest professional networks, now with over a billion users.

- PayPal Mafia: As part of the “PayPal Mafia,” Hoffman worked with other tech luminaries like Elon Musk and Peter Thiel.

- Author: He has written several bestselling books including Blitzscaling and The Start-up of You.

- Philanthropy: Reid and his wife Michelle joined The Giving Pledge, committing to donate the majority of their wealth to charitable causes.

- Early Facebook Investor: He invested in Facebook when it was still a small startup, making his stake worth over $75 million today.

- AI Pioneer: Hoffman is heavily invested in AI, including co-founding Inflection AI and being an early investor in OpenAI.

- Podcast Host: Reid hosts the popular podcast “Masters of Scale,” interviewing top entrepreneurs and leaders.

Latest News & Controversies

- Lina Khan Criticism: Recently, Hoffman sparked controversy when he suggested that if Kamala Harris wins the presidential election, she should fire Lina Khan, the FTC chair. This statement, made during an interview, caused backlash among leftist and antitrust circles, as Khan has been a strong advocate for regulating big tech.

- AI Involvement: Hoffman voluntarily stepped down as director of OpenAI in 2023 due to conflicts of interest, but he still holds investments in the company. His AI ventures continue to grow through his involvement in companies like Inflection AI

Early Life and Education

Reid Garrett Hoffman was born in Palo Alto, California, on August 5, 1967.

He was born to his father, William Jr., and his mother, Deanna, and spent most of his childhood in Berkeley. As a child, Hoffman was very passionate about tabletop roleplaying games.

At age 12, he started working as an editor at Chaosium, an Oakland-based game company, which allowed him to pursue this passion.

As for his education, Reid Hoffman studied epistemology at the progressive Putney School based in Vermont. After his graduation, he went on to attend Stanford University, graduating in 1990 with a Bachelor’s degree in Symbolic Systems and Cognitive Science.

Being an excellent student awarded Hoffman with a Marshall Scholarship to study abroad. He subsequently enrolled at Wolfson College in Oxford University, where he obtained his Master’s degree in Philosophy in 1993.

Hoffman’s Personal Life

Hoffman married Michelle Yee in 2004. The couple’s primary residence is in Seattle, Washington these days, and they do not have children. When asked about it, the Hoffmans shared that they decided not to have children, explaining:

“We both think children are delightful. For me, the projects I’m doing at a major scale in the world—the project is the major driver. For her, she’s pretty focused on the spiritual nature of life. It doesn’t have to be her own biology. As long as she can help people grow.”

Reid Hoffman Net Worth: Growing an Empire from the PayPal Mafia to LinkedIn

Reid Hoffman started working straight out of college, building up his success to a point where he could start building massively valuable companies. Let’s take a look at his progress over time.

Early Career Days

After college, Hoffman started interning at Inglenook, the Nappa Valley winery. When he obtained his Master’s Degree from Oxford University, he landed a job at Apple Computer in 1994.

At Apple Computer, Hoffman worked on eWorld, the company’s early attempt at an online service. After AOL bought eWorld in 1966, he left the company and started working at Fujitsu.

It didn’t take Hoffman long to gather enough funds to start his first company, which he called SocialNet.com.

Hoffman’s First Company SocialNet.com

Reid Hoffman started his first business in 1997. SocialNet.com was a company that matched up people with similar interests and offered online dating services.

Even though the business was a success, his focus would soon shift elsewhere. Hoffman landed a board seat on the board of directors of PayPal as the company was being founded. Fast forward to 2000, and he left SocialNet.com to become PayPal’s COO, working on business development and external relationships.

To this day, he is recognized as a key member of the so-called PayPal Mafia, working alongside Peter Thiel, Elon Musk, and Max Levchin.

At a certain point, Reid Hoffman was promoted to executive vice president of PayPal, a position he held until he left the company to work on LinkedIn.

The Birth of LinkedIn

In December 2002, Hoffman co-founded LinkedIn with two of his colleagues from SocialNet, with whom he worked at Fujitsu. The platform officially launched on May 5, 2003, becoming one of the first online social networks focused on business. One of the early investors in the company was Peter Thiel, the founder of Palantir and a member of the PayPal mafia.

Reid Hoffman was the company’s chief executive officer for the first years since LinkedIn’s operations. He remained in this position for four years, after which he became chairman and president of products. In 2009, he became the executive chairman of LinkedIn, a position he still holds to this day.

The new platform has grown substantially since its founding and, by the end of 2014, it counted over 332 million members. Today, it has over 1 billion members in over 200 countries worldwide, making it the world’s largest professional networking site.

During the company’s IPO in 2011, Hoffman owned a stake worth $2.34 billion, after an eight-year wait for the initial public offering.

The LinkedIn Acquisition

On June 13, 2016, Microsoft proposed to acquire LinkedIn for $26.2 billion. They eventually agreed on the sale. At this point, Reid Hoffman owned 14.5 million shares in the business, making his stock worth $2.8 billion. He subsequently became a Microsoft board member as part of the contract, on March 14, 2017.

Philanthropy

Hoffman has been substantially involved in philanthropy over the years. He has served on several boards including Kiva, Endeavor, and the think tank New America.

In addition to this, Reid Hoffman serves on the advisory board of the MIT Media Lab and is chair of the advisory board for QuestBridge.

He has made the following donations over the years:

- Donated $250,000 in a matching grant in 2013 to Code to America

- Funded the $250,000 cash prize MIT Media Lab Disobedience Award in 2016

- Donated $20 million with his wife, Michelle Yee, to the Chan Zuckerberg Initiative and its Biohub initiative in 2016 (he also joined the board of the project)

- Offered to match any donations to the food bank at the Second Harvest of Silicon Valley during the COVID-19 pandemic up to $2 million in 2021

Hoffman and his wife both joined The Giving Pledge in May 2018, pledging to donate the majority of their wealth to philanthropic causes during their lifetime. This pledge is joined by major businesspeople and the richest people worldwide, including Carl Icahn, Rakesh Jhunjhunwala, and Michael Bloomberg.

Awards and Accolades

Reid Hoffman has won numerous awards over the years for his success as the co-founder and executive chairman of LinkedIn, his philanthropic endeavors, and his success in other industries. Here are his most prestigious awards and accolades over the years:

- 2011: Won the Ernst & Young U.S. Entrepreneur of the Year Award with Jeff Weiner

- 2012: Won the David Packard Medal of Achievement Award by Tech America

- 2012: Honored by the Global Philanthropy Forum and the World Affairs Council

- 2014: Named Presidential Ambassador for Global Entrepreneurship by President Barack Obama

- 2014: Awarded Distinguished Citizen Award by the Commonwealth Club of California

- 2014: Golden Plate Award by the American Academy of Achievement

- 2017: Appointed Honorary Commander of the Order of the British Empire for promoting UK business and social networking

- 2022: Vanderbilt Nichols-Chancellor’s Medal awarded after the commencement address at Vanderbilt University

- 2023: Sigillum Magnum awarded by the University of Bologna

Reid Hoffman in Politics

Hoffman has been very active in political circles, too. Since 2011, he has been a member of the Bilderberg Group, which gathers political leaders and experts from different industries for a closed-door annual conference.

In 2013, when the pro-immigration lobbying group FWD.us was first launched, Hoffman was officially listed as its co-founder.

A year later, he donated $500,000 toward the State Assembly campaign of David Chiu to help fund an independent expenditure committee for negative campaigning against the opponents. That same year, he donated $150,000 to the Mayday PAC.

In 2015, the Council on Foreign Relations elected him as their member, a position he still holds to this day.

In 2016, Hoffman contributed $220,000 to support the Democratic candidate Matt Dunne, who was running for governor of Vermont. In the same year, he created a card game intended to make fun of Donald Trump, the US presidential candidate, modeled after Cards After Humanity.

In 2018, The New York Times reported that the entrepreneur contributed $100,000 to an experiment that adopted political disinformation tactics on the social media Facebook, targeting Roy Moore voters during the 2017 special Senate race in Alabama. Later that month, Hoffman apologized, sharing that he was not aware of what the non-profit AET, in which he invested the money, was doing.

In the same year, he helped fund Alloy, donating $35 million to start the company which aimed to legally exchange data with super PACs. Alloy shut down in 2021.

Since 2022, Hoffman has donated over $1 million to support the campaigns of Kurt Schrader and Henry Cuellar. In October of the same year, he joined the independent advisory board for the US Department of Defense called the Defense Innovation Board.

Hoffman Sparks Outrage With Lina Khan Criticism

Hoffman was recently in the news for a large donation that he made to Kamala Harris’ presidential campaign. He spoke about the donation on CNN and, in the same interview, he also argued that Harris should fire FTC Chair Lina Khan if she wins the election.

This sparked outrage in antitrust and leftist circles as Khan has been historically effective in her antitrust pursuits so far. They argued that Hoffman was trying to use his money and influence to convince Harris to fire Khan for his own personal gain.

The Young Turks covered the controversy in a recent segment if you’re interested in learning more.

What Else Does Reid Hoffman Invest In?

Reid Hoffman’s net worth is mostly based on his sale of LinkedIn, but his career is far more diverse than a single business. The famed American internet entrepreneur is also an author, a prolific angel investor in Silicon Valley, and has founded other businesses as well.

Ventures in Artificial Intelligence

Hoffman is one of the major tech investors in the field of artificial intelligence. Let’s take a look at some of his major investments in AI companies.

OpenAI

Hoffman was a founding investor in several companies over the years, starting with the artificial intelligence research company OpenAI. The investors in this project also included Elon Musk and Peter Thiel, among others, who planned to commit a total of $1 billion to the project in the long term but invested an unknown, much smaller fraction of this amount in the first year of the project.

OpenAI was formed in December 2015 and around $130 million was spent until 2019. In 2019, the company distributed equity to employees and partnered with Microsoft, at the same time announcing an investment package of $1 billion into the company. In 2020, this same company announced the beginning of ChatGPT.

Today, OpenAI consists of the non-profit OpenAI and the for-profit subsidiary OpenAI Global. The ownership is currently divided between Microsoft, which holds a majority stake of 49%, and other stakeholders.

As for Reid Hoffman, he stepped down voluntarily as the OpenAI director in March 2023 after some conflicts. Even so, he reportedly still owns stock in the company, though the details are not disclosed to the public.

Inflection AI

In 2022, Hoffman co-founded a new startup called Inflection AI with Mustafa Suleyman. Suleyman and Hoffman have been long-time friends and Greylock partners. Today, Inflection AI is valued at $4 billion as a private company, but it is no longer in their ownership.

Microsoft previously acquired Inflection for $650 million with Suleyman becoming the CEO of Microsoft AI, filling the void between the hands-on role of Satya Nadella.

After the acquisition, Hoffman is an advisor to the company, though his remaining stake in it is undisclosed.

Other Investments in AI

As of May 2023, Hoffman and Greylock Partners, the investment group he is a part of, have invested in at least 37 artificial intelligence companies, including Tome.

Hoffman is also one of the backers of the joint venture between the Berkman Klein Center for Internet & Society and MIT Media Lab called Ethics and Governance of Artificial Intelligence Fund.

At Stanford University, he is a member of the board of the Stanford Institute for Human-Centered Artificial Intelligence, promoting the mission to advance AI research, policy, and education. Hoffman helped launch the institute’s Hoffman-Yee Research Grants to fund teams of researchers in the AI industry.

He also helped the University of Toronto’s Faculty of Information by investing $2.45 million in 2018 to endow a chair that studies AI and its impact on our lives.

Other Investments

When PayPal was sold to eBay and Reid Hoffman was already a major name in the technology world, he became one of the most prolific angel investors in Silicon Valley. According to the late Dave Goldberg, the former SurveyMonkey CEO, Hoffman is now ‘the person you want to talk to when you are starting a company’.

Hoffman joined Greylock Partners in 2009, starting his investment journey with Airbnb. He has also invested in companies like Flickr, Kongregate, Viki, TrialPay, Digg, Tagged, Edmodo, Coda, Entrepreneur First, and Blockstream, though the details of these haven’t been publicly disclosed. He has also been investing heavily in transportation technology companies such as Nauto, Nuro, Helon Energy, Convoy, Aurora, and Joby Aviation.

According to The Facebook Effect, David Kirkpatrick’s book, it was Reid Hoffman who arranged the meeting between Zuckerberg and Thiel, which led to the latter investing half a million into Facebook. Hoffman reportedly invested alongside him, making him an early investor in one of the most profitable companies with an investment of $37,500 in the first round of Facebook’s founding.

He reportedly still holds a stake in Facebook worth around $75 million and sold $36 million in shares at Facebook’s IPO.

In 2023, Hoffman announced that he would no longer serve as Greylock’s general partner for upcoming funds. He subsequently invested in California Forever, the company developing a planned city in Solano County in California.

Last but not least, Hoffman is Chairman of the venture capital firm Village Global. The famed investor joined the venture capital firm after he stepped back as general partner of Greylock Partners.

“The magic of Silicon Valley has always been about the power of a network,” he shared. “Village Global is simply one of the best networks in tech — a network that helps early-stage founders build massive companies.”

Authorship

In addition to being one of the top tech investors and a famous venture capitalist, Hoffman is also a bestselling author. To date, he has authored the following:

- “The Start-up of You: Adapt to the Future, Invest In Yourself, and Transform Your Career”, a Wall Street Journal and New York Times bestseller published in 2012 and co-authored with Ben Casnocha

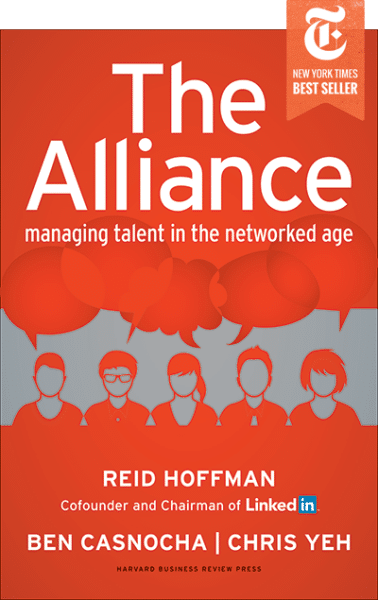

- “The Alliance: Managing Talent in the Networked Age”, another New York Times bestseller published in 2014 and co-authored with Ben Casnocha and Chris Yeh.

- “Blitzscaling: The Lightning-Fast Path to Building Massively Valuable Companies”, published in 2018 and co-authored with Chris Yeh.

- “Masters of Scale: Surprising Truths from the World’s Most Successful Entrepreneurs”, published in 2021 and co-authored with June Cohen and Deron Triff

- “Impromptu: Amplifying Our Humanity Through AI”, written by Hoffman with GPT-4

Hoffman is also a guest teacher on the free Stanford University class called “Blitzscaling” after his book.

Podcasts

In 2017, Hoffman decided to diversify his career even further, launching his first podcast called “Masters of Scale”. His episodes have featured famous people such as:

- Sara Blakely from Spanx

- Brian Chesky from Airbnb

- fashion designer Tory Burch

- Beth Ford from Land O’Lakes

- Reed Hastings from Netflix

- Arianna Huffington from the Huffington Post

- Former President Barrack Obama

The podcast is produced by WaitWhat, the company led by June Cohen and Deron Triff, and hosted by Reid Hoffman himself.

In March 2023, Hoffman partnered with his chief of staff, Aria Finger, to host a second podcast called “Possible”, which won two Webby awards.

What Can We Learn from Reid Hoffman’s Story?

Reid Hoffman’s journey from his early days in Palo Alto, California, to becoming a billionaire entrepreneur and investor offers numerous valuable lessons. His story demonstrates the importance of innovation and strategic thinking in building a business empire.

As the co-founder of LinkedIn, Hoffman’s vision transformed the landscape of professional networking, creating the world’s first online social network dedicated to business development and business professionals. The platform’s success underscores the significance of fulfilling unmet needs in the market.

Moreover, Hoffman’s entrepreneurial spirit didn’t stop at LinkedIn. He co-founded several other companies, making impactful investments in various sectors, including online dating with Socialnet.com.

His investments in early-stage startups like Facebook and Airbnb highlight the power of networking, as well as the potential of high-risk, high-reward ventures.

Hoffman’s ability to leverage his experiences from his time at PayPal and other ventures, along with his continuous adaptation, teaches us the importance of innovation, resilience, and visionary leadership. Finally, his philanthropic efforts and contributions to AI research and policy reflect a commitment both to ethical growth and the broader impact of technology on society.