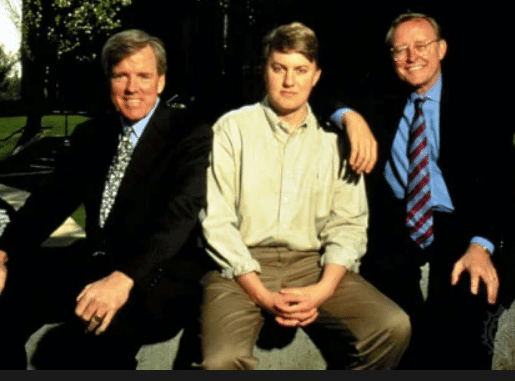

Marc Andreessen is a prolific American businessman, serial entrepreneur, and venture capitalist who co-authored Mosaic, the first widely used graphical web browser. Andreessen is also the cofounder and general partner of the venture capital firm Andreessen Horowitz, popularly known as a16z.

With an estimated net worth of $2.3 billion, Marc Andreessen is among the richest Silicon Valley entrepreneurs.

Let’s explore his career, net worth, and life story to see what insights we can learn from the legendary VC and entrepreneur who cofounded multiple companies like Netscape Communications and now hunts for startup companies with his venture capital firm.

How Much is Marc Andreessen Worth in 2024?

- Net Worth: Estimated at $2.3 billion in 2024, largely derived from his stake in Andreessen Horowitz.

- Andreessen Horowitz: Co-founded in 2009, the venture capital firm manages assets worth $42 billion and has invested in companies like Facebook, Airbnb, and Slack.

- Netscape: Co-created the Mosaic web browser and later co-founded Netscape Communications, which went public in 1995.

- Real Estate: Owns a substantial real estate portfolio, including a $177 million Malibu compound, making it one of the most expensive properties in California.

- Board Seats: Serves on the boards of Meta, Coinbase, and several other tech companies.

- Awards and Recognition: Named in the Time 100 list in 2012 and awarded the Queen Elizabeth Prize for Engineering in 2013 for his contributions to the internet.

6 Interesting Facts about Marc Andreessen

- Andreessen co-authored Mosaic, the first widely used graphical web browser, during his time at the University of Illinois.

- He was featured on the cover of Time magazine in 1996 following Netscape’s successful IPO.

- Marc Andreessen is known for his bold investments, including controversial ones like backing WeWork’s founder Adam Neumann’s new venture Flow.

- He owns one of the most expensive homes in California, a $177 million Malibu compound.

- Andreessen Horowitz, his venture capital firm, is known for its investments in pioneering companies like Facebook, GitHub, and Twitter.

- He has a keen interest in artificial intelligence and continues to invest heavily in AI startups.

Marc Andreessen’s Net Worth Breakdown

Since most of Andreessen’s assets are held privately and not through a publicly traded company, calculating his exact net worth is impossible.

However, we have been able to collect plenty of public information surrounding his various sources of income, investments, assets, and business ventures to build a strong estimate, which we break down here for you.

| Asset or Income Source | Contribution to Net Worth |

| Andreessen Horowitz stake | $1.5 billion |

| Real estate portfolio | $300 million |

| Other investments and personal assets | $500 million |

| Earnings from boards and other engagements | $50 million |

| Total Net Worth | $2.3 billion |

Early Life of a VC Titan

Marc Andreessen was born in Cedar Falls, Iowa on on July 9, 1971, but was raised in New Lisbon, Wisconsin. His father Lowell Andreessen worked for a seed company while his mother Patricia worked for Land’s End, a catalog retailer.

He became interested in computers at a young age and created his first computer program, a virtual calculator for his math homework, in sixth grade. The program was saved on the school’s computer but was lost when the janitor turned off the power to the building.

In the following year, Andreessen’s parents bought him his first computer, a TRS-80 from Radio Shack and he learned BASIC programming from library books to write video games for the new PC.

Andreessen went to the University of Illinois at Urbana–Champaign and graduated with a bachelor’s degree in computer science in 1993. He interned twice with IBM at Austin when he was still an undergraduate.

While at the University of Illinois, Andreessen spent considerable time at the National Center for Supercomputing Applications (NCSA).

Co-Creating Mosaic Web Browser

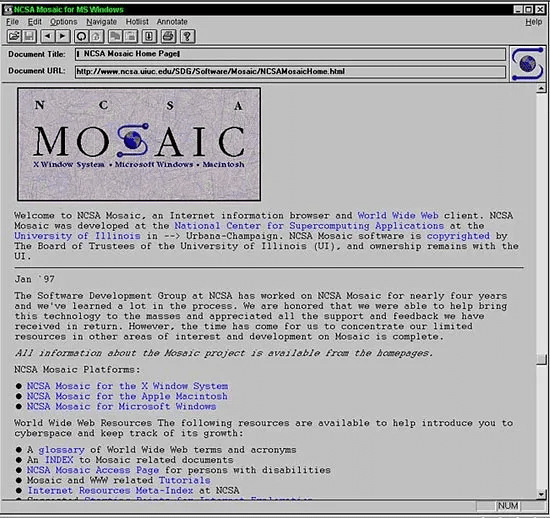

Along with Eric Bina, Andreessen co-created the Mosaic web browser which was the first graphical web browser.

The duo took about three months for the development and according to Andreessen, “We just tried to hurry and get it out there – initially to a limited group of ten or twelve alpha and beta testers.”

Soon, the project started gaining traction, and several companies approached NCSA to commercialize the browser.

The number of people working on Mosaic rose to 20, but Andreessen wasn’t happy with how things were progressing and eventually decided to leave.

“There was no reason to remain there. The place was in decline compared to how it used to be, mainly due to the sudden influx of money,” said Andreessen, who then took a job at Enterprise Integration Technologies, a company in Palo Alto where he worked for about three months.

The next key phase in Andreessen’s career came when he met Jim Clark who founded the software company Silicon Graphics but was in the process of leaving it. A colleague introduced Clark to Mosaic and he was impressed so he quickly emailed Andreessen to set a meeting to explore working together.

A meeting soon happened but the duo took time to take things forward.

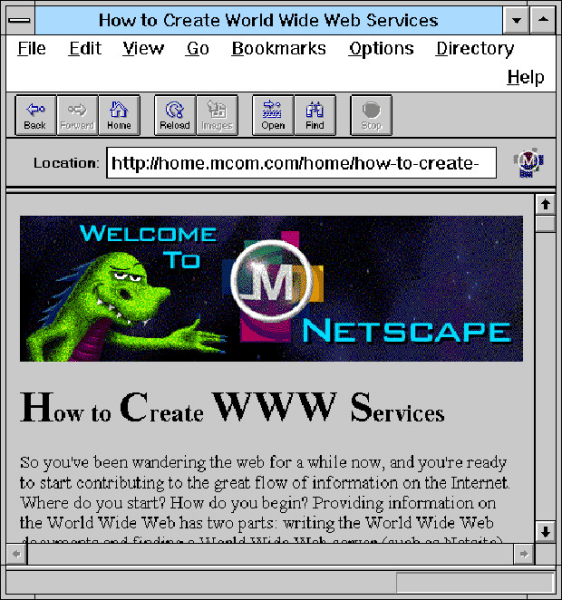

After much back and forth on how they would collaborate, Andreessen came up with the idea of a “Mosaic killer,” the revolutionary browser that would eventually be dubbed Netscape. They both flew to Urbana Champaign and hired the team that worked on Mosaic with Andreessen.

Eventually, Andreessen incorporated internet software company Mosaic Communications Corporation in April 1994 with Andreessen serving as vice president of technology.

Marc Andreessen: Changing the World With Netscape

Meanwhile, the University of Illinois, which was also trying to commercialize the Mosaic browser, wasn’t too happy with the company’s name and Andreessen renamed the company Netscape Communications while its browser was named Netscape Navigator.

Netscape went public in August 1995, just 16 months after it was formed.

The company capitalized on the “dot com boom” and offered the shares at $28 in the IPO, double the price it previously considered. Even the bumped-up price did not deter bulls and the stock went as high as $74.75 on its first trading day.

While it fell somewhat and closed at $58.25, it still gave the company – which was nowhere near profitability – a market cap of $3 billion.

The shares were trading at $174 by the end of 1995 which, in hindsight, should have warned of the massive crash was on the horizon.

The company, however, could not repeat its initial success as Microsoft’s browser quickly took over the market. Eventually, AOL acquired Netscape for $4.2 billion in early 1999. Andreessen became the chief technology officer at AOL but quit in just seven months.

Moving on to Found Loudcloud

After leaving AOL, Andreessen cofounded Loudcloud with Tim Howes, In Sik Rhee, and Ben Horowitz. The company which was later renamed Opsware was among the early cloud and software-as-a-service (SaaS) companies. Hewlett-Packard acquired Opsware for $1.6 billion in 2007 and Andreessen embarked on his next venture.

Marc Andreessen Co Founded Andreessen Horowitz Venture Capital Firm

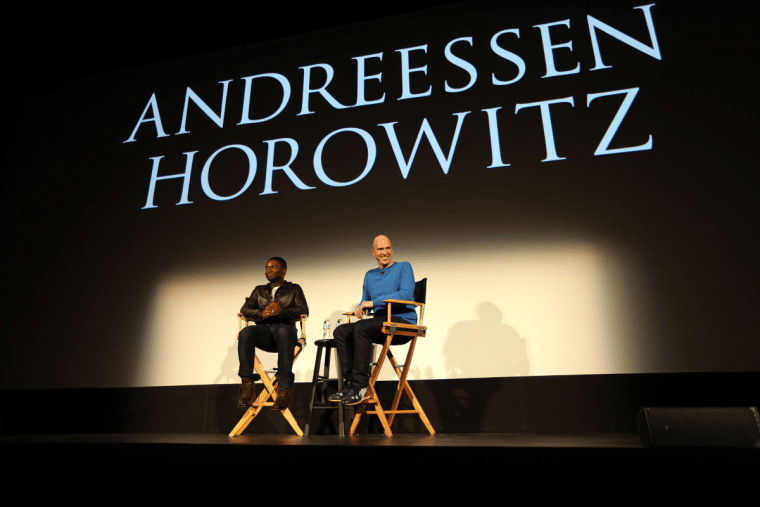

In 2009, Marc Andreessen and Ben Horowitz cofounded Andreessen Horowitz, also known as a16z, which is a venture capital firm that invests in companies backed by “bold entrepreneurs building the future through technology.”

The fund, which started with an initial capitalization of $300 million, is stage agnostic and invests in seed funding, venture capital financing, and growth-stage companies. A16z invests in a diverse spectrum of industries like artificial intelligence (AI), fintech, healthcare, consumer, crypto, infrastructure, and gaming.

The fund’s assets total $42 billion.

The company has an enviable track record with investments in companies like Facebook, Instacart, Github, Lyft, Pinterest Inc., Skype, Roblox, Slack Technologies Inc., Coinbase Global, and Wise.

Skype was among the company’s most rewarding investments as Microsoft acquired the company for $8.5 billion in 2011.

The firm currently has dozens of active investments under its belt. Here’s a brief list of some of the companies that Andreessen Horowitz is currently invested in.

- AI Companies: Given the current optimism towards AI, it’s no surprise that a16z is invested in several AI startups. These include Ambient.ai, Applied Intuition, Databricks, Shield AI, Zipline, and Zuma.

- Crypto companies: Bitski, Coinswitch, Fei Protocol, Lido, and Loop Crypto are some of the crypto companies that the venture capital company has backed.

- Gaming companies: In the gaming industry, the fund has invested in names like Azra Games, Endgame, Createra, and Lootrush.

Andreessen Horowitz is well known for its aggressive bets but not all of them have panned out. For instance, many crypto companies it backed, including OpenBazaar, Diem, and Basis, went bust in the 2022 crypto crash.

The VC firm also backed Flow, which is a residential real estate company founded by WeWork’s founder, Adam Neumann. It was a bold bet, to say the least, because Neumann was accused of mismanagement at WeWork and the company eventually filed for bankruptcy in the US.

Marc Andreessen’s Board Seats at Meta, eBay, and HP

Andreessen cofounded Loudcloud, which was later renamed Opsware and was sold to Hewlett-Packard for $1.6 billion.

Andreessen served on the board of Hewlett-Packard Co. from September 2009 to October 2015, and Hewlett Packard Enterprise Co. from November 2015 to April 2018. He was on eBay Inc’s board between September 2008 to October 2014 and currently, sits on the board of Meta Platforms (formerly Facebook).

Marc Andreessen’s Stirs Up Controversy at Meta

Andreessen’s time on the board of meta was rather controversial.

He was criticized for a professional conflict of interest as he allegedly coached Facebook founder and chief executive officer Mark Zuckerberg to win board approval for a new class of shares, despite being an independent board member who is supposed to represent stockholders.

Facebook shareholders filed a class action lawsuit to block this creation of a new class of non-voting shares. Zuckerberg eventually dropped the plan amid the furor over the proposed move that shareholders argued would lead to billions of dollars in losses.

Andreessen was at the center of a controversy yet again at Facebook when he said that anti-colonialism has been bad for India. He made his comments after the country blocked Facebook’s “Free Basics” service through which it intended to offer free internet access for some websites (including Facebook, of course).

The country’s telecom regulator blocked the project as it saw the service as a violation of net neutrality. Zuckerberg also criticized Andreessen for his comments and he later apologized for them.

Marc Andreessen’s Other Board Seats and Advisory Roles

Andreessen serves on the board of several companies that are part of Andreessen Horowitz’s portfolio,

These include:

- Coinbase;

- Applied Intuition;

- OpenGov;

- Carta;

- Dialpad;

- Flow;

- Golden;

- Samsara;

- Simple Things;

- Honor;

- TipTop Labs.

In addition, he is on the advisory board for Neom, the Saudi government’s ludicrously bold mega-city project. Notably, while some in the business world severed ties with the oil-rich kingdom after the murder of Jamal Khashoggi, Andreessen didn’t leave his role.

Saudi Arabia is reportedly in talks a16z for creating a mammoth $40 billion AI fund if you were wondering why Andreessen might have chosen to stay friendly with the Saudi royal family.

Marc Andreessen’s Real Estate Investments

In 2021, Andreessen paid $177 Million for a 13-structure Malibu Compound which made the the costliest real estate deal in California. He also owns a property in Escondido Beach which is valued at around $50 million.

Andressen owns an estate in Silicon Valley Estate which he listed for sale for nearly $33.5 million in March 2024. In addition, he bought a plot in Las Vegas for $36 million in 2021.

While we don’t have any publicly available information about his investments in stocks or cryptocurrencies, he likely has a sizeable portfolio, especially given his VC firm’s appetite for investment in cryptocurrencies and blockchain.

He was an investor in LinkedIn in his personal capacity, but Microsoft acquired the company in 2016.

Marc Andreessen’s Awards and Accolades

Andreessen has won several awards and accolades over his long and illustrious career.

These include:

- He made it to the cover of Time Magazine in 1996 after Netscape’s successful IPO

- In 1999, MIT Technology Review named him one of the top 100 innovators in the world under the age of 35

- Andreessen was named in the Time 100 list in 2012

- He was one of five Internet and Web pioneers awarded the inaugural Queen Elizabeth Prize for Engineering in 2013

What Can We Learn from Marc Andreessen’s Life

Today Marc Andreessen is among the most famous venture capitalists in the world and his VC fund has backed countless revolutionary companies. There is a lot that we can learn from the software engineer including his impressive risk-taking abilities and his determination to back bold founders.

While the aggression can also backfire at times, that’s just one of the many risks that VC industry players have to cope with.

In an interview with McKinsey, Andreessen cited the example of Thomas Edison and said that while he gets all the credit for discovering the lightbulb, he wouldn’t have been able to do so without the financial backing from J.P. Morgan.

He said, in the interview, “Somebody has to imbue credibility on a founder before everybody knows who they are. Somebody has to advance them the money when it’s not at all obvious that the idea is good. Somebody has to help them get to the world.”

There indeed is merit in his argument as some of the biggest companies of today were once ridiculed as unviable business ideas.

Andreessen advocated planning the day and in an interview that’s posted on a16z’s website, he said “I’m trying to have as “programmed” a day as I possibly can.” Andreessen added that he puts “everything” on the calendar including his sleep and free time.

He especially backs taking free time and calls it the “release valve.”

According to Andreessen, “you can work full tilt for a long time as long as you know you have actual time for yourself coming up. I find if you don’t schedule enough free time, you get resentful of your own calendar.” Finding free time is absolutely essential as constant hard work almost always leads to burnout and lower productivity.

In 2023, while appearing on the Lex Fridman Podcast, he advised young people to avoid “distraction” – a possible reference to social media, while using the other “spectacular” tools like AI that are available at their disposal.

For young persons who want to “stand out” from others, he advised, “you could get on a hyper-productivity curve very early on.”

If you are interested in learning more about Andreessen, this episode of the Lex Fridman podcast is a fantastic resource because he sat down to talk about countless topics for over three hours.

In 2011, Andreessen wrote his famous essay “Why Software Is Eating the World,” in which he argued how software would permeate different industries. In that essay, he wrote, “My own theory is that we are in the middle of a dramatic and broad technological and economic shift in which software companies are poised to take over large swathes of the economy.”

His words were indeed quite prophetic, and the pace of digital transformation that the global economy witnessed over the last decade has been unprecedented.

Cut to 2024, and Andreessen is among the biggest backers of AI and believes that the only way to receive manufacturing in the US is to build fully robotic factories and make them AI-enabled.