It is rare to see agreements among Democratic and Republican candidates these days. However, one topic seems to have drawn the attention of both Kamala Harris and Donald Trump lately and it has become a talking point among workers and economists alike.

The two presidential candidates who are racing for the country’s top political seat are both proposing to eliminate taxes on tips.

Even though workers and voters have obviously cheered for this, concerns have already been brought up by lawmakers, pundits, and economists who believe that this policy change could have severe fiscal consequences without substantially helping service workers. Here’s what you need to know.

The Proposals: Trump and Harris Advocate for Tax-Free Tips

Former US President Donald Trump was the first presidential candidate to float the idea of eliminating taxes on tips during a campaign rally that took place in June. Reports highlighted that Trump was inspired by a conversation with a Las Vegas waitress who complained about this topic.

Also read: 3 Post-Tax Season Tips

“To those hotel workers and people who get tips, you are going to be very happy, because when I get to office we are going to not charge taxes on tips, people making tips,” Trump told supporters at a rally. “We’re going to do that right away, first thing in office.”

The proposal has now become a central part of Trump’s efforts to convince working-class voters that he is their best option. In states like Nevada where the service industry is huge, this could have a major impact on the local economy.

Harris Pledges to Fight for Minimum Wage Increase and No Taxes on Tips

Meanwhile, in a striking turn of events, the current Vice President and Democratic candidate Kamala Harris announced that she would also support this move during a speech at the University of Nevada.

“It is my promise to everyone here, when I am president, we will continue to fight for working families, including to raise the minimum wage and eliminate taxes on tips for service and hospitality workers,” Harris told the crowd.

A campaign official provided further details about the policy proposed by Harris and said that her administration “would work with Congress to craft a proposal that comes with an income limit and with strict requirements to prevent hedge fund managers and lawyers from structuring their compensation in ways to try to take advantage of the policy.” This is an incredibly important note as the potential for this kind of a loophole is one of the main critiques of Trump’s proposal.

The official emphasized that Harris would push for the proposal alongside an increase in the minimum wage (which Trump does not support).

Trump’s campaign has accused Harris of stealing the idea, with Trump posting on social media: “This was a TRUMP idea – She has no ideas, she can only steal from me.” The Harris campaign maintains that their proposal is distinct, with additional provisions like income limits.

Tips Can Account for a Large Percentage of Workers’ Compensation in Some States

To understand the implications of the proposals, it’s important to check how tips are currently treated and taxed. Under IRS guidelines, all tips exceeding $20 per month must be reported as taxable income.

Employers are required to withhold income taxes, Social Security taxes, and Medicare taxes on reported tips. In fiscal year 2018, Americans reported $38 billion in tip income to the federal government. On average, this amounted to a little bit over $6,000 in tip income for every taxpayer who reported tips.

Also read: TurboTax Kept the Government from Developing Free Tax Filing Software for Decades

For many service workers, especially those in states with the lowest minimum wages for tipped employees, tips can make up a significant portion of their total income. According to estimates from the National Employment Law Project, tips can account for more than half of hourly earnings for some servers.

The Fiscal Impact: Eliminating Tips on Taxes Could Result in Over $200 Billion in Lost Revenue

While eliminating taxes on tips may seem like a straightforward way to boost take-home pay for service workers, economists and analysts have raised several concerns.

One of the primary concerns is the potential hedge fund loophole where massive financial institutions reclassify fees as tips to pay even less in taxes than they are already. Another is the potential loss of federal revenue. Estimates of the fiscal impact of this policy change vary.

The Tax Foundation estimates that eliminating taxes on tips would cost at least $107 billion over a decade. Meanwhile, the Center for a Responsible Federal Budget (CRFB) provides a higher estimate, projecting that Harris’ proposal to exempt tip income from federal income taxes and raise the minimum wage would increase deficits by $100 billion to $200 billion over the next decade. However, if Harris proceeds with Biden’s proposed tax hikes on corporations, this deficit could easily be wiped out.

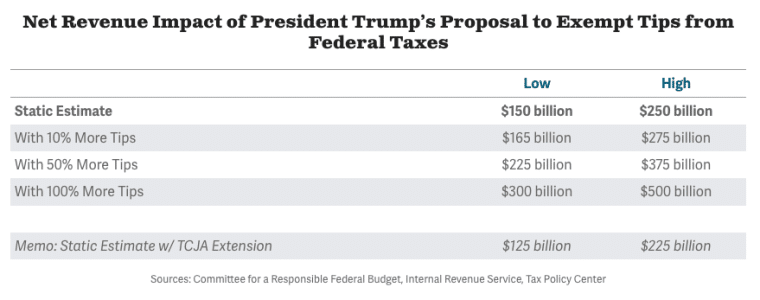

The CRFB also estimates that Trump’s proposal to eliminate all federal taxes on tips could cost up to $250 billion during this same period.

Steve Rosenthal, a senior fellow at the Urban-Brookings Tax Policy Center, described the idea as “bad” policy, citing concerns about equity, efficiency, and revenue. “The revenue on this proposal to exempt tips from taxation is something like a couple hundred billion over a 10-year period,” he said. “That’s a big number for Congress to swallow.”

Critics argue that exempting tips from taxation could create unfair disparities between tipped and non-tipped workers performing similar jobs. Andrew Lautz, associate director for the Bipartisan Policy Center’s economic policy program, raised this concern:

“Are we to say that someone making $18 an hour at a fast food job, versus someone making $18 an hour inclusive of tips at a sit-down restaurant, that those workers should be treated differently from a tax perspective?”

Pundits argue that it doesn’t make sense to favor tipped jobs over other low-income jobs and that a simple minimum wage hike would be a better way to help Americans struggling to pay their bills.

Other experts claim that this policy could incentivize employers to shift more compensation to tips to take advantage of the tax benefits. Many states still have extremely low minimum wages for tipped jobs (as low as $2.13 per hour) and this could make it even worse, leading to lower base wages and less stable income for workers.

Also read: IRS Overhauls Crypto Tax Reporting: Here’s What You Need to Know

Implementing a tax exemption for tips could also prove to be administratively complex. Rosenthal highlighted potential difficulties: “How are we going to tell who is receiving a tip, and when that tip crosses a line into wages?” he asked. “How will we prevent investment bankers, say, from getting tips? And if we impose income limits, well, wouldn’t we expect low-paid workers just to demand a tip rather than compensation?”

While the policy has generated significant attention, its impact may be more limited than it appears. An analysis by Yale University’s Budget Lab found that only about 4 million workers, or less than 3% of the overall workforce, regularly receive tips.

Furthermore, the analysis found that about 37% of tipped workers earn so little that they do not currently pay federal income taxes at all. This limits the potential benefit of the proposal for the lowest-earning service workers.

No Tax on Tips Act Has Some Bipartisan Support

Despite the economic concerns, the proposal has gained some bipartisan support in Congress. In July, Republican Senator Ted Cruz introduced the No Tax on Tips Act, which gained support from Democratic Senators Catherine Cortez Masto and Jacky Rosen from Nevada. A companion bill has been introduced in the House of Representatives.

The powerful Culinary Workers Union Local 226 in Nevada, which had initially called Trump’s proposal a “wild campaign promise”, has since come out in support of the general idea. The union endorsed Harris and her policy position, stating: “As the largest organization of working women in Nevada, the chance to elect the first woman president of the USA is both energizing and historic and we are ready to make history together. Culinary Union has led the fight for over 30 years for fair taxation on tips and our union supports the ban on taxes on tips.”

The proposal to eliminate taxes on tips has emerged as a rare point of agreement between the Trump and Harris campaigns, reflecting the political appeal of policies aimed at boosting take-home pay for service workers.

As the campaign progresses, voters and policymakers will need to weigh the potential benefits of increased income for some service workers against revenue loss for the federal government and the potential unintended consequences the policy could have on the labor market. With both campaigns yet to release detailed policy proposals, the specifics of how such a change might be implemented and its true impact remain to be seen.