The electric vehicle (EV) market is experiencing significant changes compared to two years ago as falling prices, slower adoption rates, and multiple challenges faced by manufacturers, car rental companies, and consumers have impacted its growth.

According to the latest data from the Kelley Blue Book (KBB), the average price paid for a new EV stood at $56,371 by the end of June. Compared to June 2023, this represented a 2.5% yearly drop.

Meanwhile, the figure also indicates a significant decline compared to the all-time high of $66,997 recorded by EV prices in June 2022.

What is Causing EV Prices to Drop?

No single element can be pinpointed to explain this trend. Hence, this is a summary of the most notable variables that have conspired to push down the price of EVs in America:

- Tesla’s Price Cuts: As the market leader with approximately 50% of EV market share in the United States, Tesla’s aggressive price reductions have sparked a price war among competitors.

- Increased Competition: With more automakers entering the EV market, competition has intensified lately, putting downward pressure on prices.

- Falling Battery Costs: Lithium prices have dropped quickly in 2023 following a significant spike the previous year. This has contributed to reducing the production cost of EVs.

- Government Incentives: The return of generous EV tax credits for Tesla (TSLA) models and other manufacturers has made EVs more affordable for many consumers.

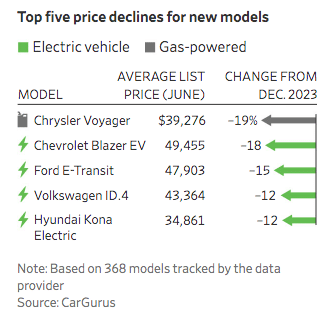

While the average EV price is still higher than that of their fossil fuel powered counterparts, many popular models are becoming more affordable than ever. Here’s a breakdown of starting MSRPs for the 5 cheapest models that are currently available:

- Chevrolet Bolt: $27,495

- Hyundai Kona: $34,861

- Tesla Model 3: $40,240

- Hyundai IONIQ 5: $41,450

- Volkswagen ID.4: $43,364

Price Drops Cause Headaches to Both Consumers and Car Rental Companies

EV sales have kept growing lately. Data from the KBB indicated that EV sales in the second quarter of 2024 saw an 11% increase compared to the previous three months. A total of 330,000 electric vehicles were sold in the United States during this period – a quarterly record.

However, one of the most significant challenges facing the EV industry is the rapid depreciation of electric vehicles, particularly in the used car market. According to data from EV battery analysis and research firm Recurrent, used EV prices for leading models had fallen 27% year-over-year as of early 2024. The firm reported that some models were sold for around $10,000.

This steep decline in resale value has created problems for both consumers and rental car companies.

First, consumers who purchased EVs at higher prices are seeing their vehicles lose value at alarmingly high rates in the resale market. Meanwhile, rental car companies, such as Hertz, have scaled back their plans to acquire large EV fleets due to faster-than-expected depreciation.

This also creates financial issues for companies like Hertz whose depreciation projections now have to be revised as the car’s salvage value has declined significantly since they were purchased.

Hertz Took Heavy Losses on Their EV Bet

In 2021, Hertz announced that it was reshaping its fleet and that EVs would soon account for a fifth of it. The company bought 100,000 Teslas from Elon Musk and soon got burned and was forced to put up many of those vehicles for sale and faced significant losses as a result.

Some Tesla Model 3s were sold for as little as $20,000, which was less than half their purchase price. During the first quarter of 2024, Hertz reported a mind-blowing net loss of $392 million, partially caused by a $195 million depreciation charge associated with the disposal of around 10,000 EVs.

Jeremy Robb, a senior director at Cox Automotive, notes: “Last year was really marked in terms of price declines… That burns people that already bought [an EV]. Unless you leased [your EV], you’ve lost a lot of money on your asset, and that’s going to put a very bad taste in your mouth.”

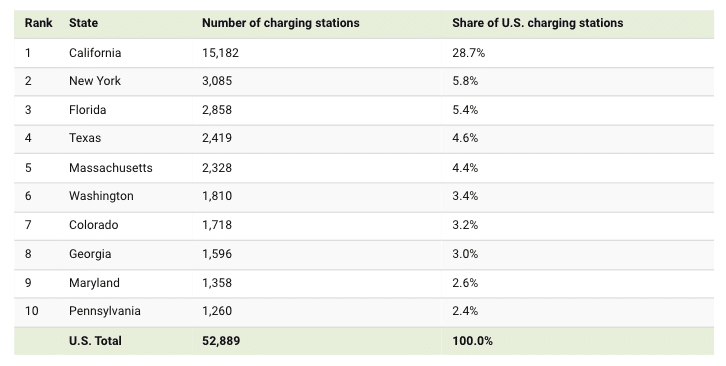

Infrastructure is Still Inadequate and Creates Issues for Consumers

The lack of adequate charging infrastructure remains a significant barrier to EV adoption in America. This issue is particularly pronounced in the rental car industry, where many airport locations don’t have enough charging stations to keep up with the needs of consumers and car rental companies.

Additionally, the complexity of how charging networks economics and business models work and their payment systems have confused renters who are relatively unfamiliar with how EVs work.

Also read: Bankrupt Fisker Selling Its EVs For as Low as $2500

Raghu Iyengar, an executive at Volkswagen of America, highlights the challenges: “Airports are notorious for being unfriendly for electric infrastructure development.” This has led to near-zero demand from rental companies for Volkswagen’s ID.4 electric SUV.

Many consumers are also unfamiliar with the unique aspects of EV ownership and operation. Rental car companies have found that providing adequate instruction to customers can be challenging. These have caused issues such as:

- Higher accident rates due to unfamiliarity with EV acceleration.

- Difficulties in locating and using public charging stations.

- Confusion over range management and charging requirements.

How Has the EV Industry Responded Thus Far?

Lower EV prices are great for consumers but automakers are struggling to make a profit. The industry is working hard to reduce prices but not in the way that it has happened thus far – which is mostly a response to lower demand.

Instead, the advancement of EVs and their increased adoption will depend primarily on manufacturers’ ability to produce more affordable cars, overcome infrastructure limitations, and educate consumers.

Steep Discounts to Cope with Lower Demand

Automakers and dealers are responding to slowing demand by offering steep discounts and attractive financing deals on EVs.

The biggest price drops in the first half of 2024 came from EVs according to data from CarGurus. The most heavily hit models included the Chevrolet Blazer and the Volkswagen ID.4 SUV.

Meanwhile, Ford’s F-150 Lightning, once a premium offering, is now selling for about $5,000 less than its gas-engine alternatives, according to J.D. Power data.

“The overall competitive landscape for electric vehicles is intensifying,” commented Stephanie Valdez from Cox Automotive.

Meanwhile, Eric Watson, VP of sales for Kia America, commented: “There’s a lot of manufacturers now introducing new electric vehicles and starting to produce them in volume.”

Strong Focus on Producing More Affordable Models

Various manufacturers are investing heavily in technology to be able to produce EVs priced below $30,000. Some large players in the industry like Stellantis and Tesla have already taken positive steps in this direction and could soon present consumers with more affordable alternatives.

In June this year, the head of Ford (F), Jim Farley said that the company could introduce a sub-$30K vehicle model in less than 3 years.

“You have to make a radical change as an [automaker] to get to a profitable EV. The first thing we have to do is really put all of our capital toward smaller, more affordable EVs,” he told CNBC.

Farley believes that the company’s EV strategy is critical to its long-term success as other players in the industry have already become profitable. In the case of Ford, its efforts recently led to a $1.32 billion loss produced by the EV unit.

Improving Charging Infrastructure and Consumer Education

Some rental car companies, such as Enterprise Mobility, are working to expand charging availability for their customers.

Mike Wilmering, a spokesman for Enterprise, stated: “We’re looking beyond how many chargers are available and working to identify power needs and access — both in our locations and the communities we serve. We want customers to have a great experience with EVs, and we’re keeping them at the center of our long-term strategy.”

To address the learning curve associated with EV rentals, companies are also developing more comprehensive customer education programs. Hertz, for example, now offers online information for EV renters and sends instructions by email.

The electric vehicle market in the United States is at a critical juncture. While prices have become more competitive and a wider range of models have become available, the industry faces significant challenges in terms of consumer adoption, infrastructure development, and financial sustainability.

The coming months and years will be crucial in determining if EVs can overcome these hurdles and become more widely accepted.

For the EV revolution to succeed, it will require continued innovation from manufacturers, supportive government policies, and a willingness from consumers to embrace this new technology.