Robert Kiyosaki, the business guru behind the bestseller “Rich Dad Poor Dad”, has warned of the “biggest crash in history,” and believes most assets including real estate would plummet. However, he foresees the impending crash as a buying opportunity and is particularly bullish on some assets if Donald Trump wins in the 2024 US Presidential elections.

Here’s what Robert Kiyosaki, who has co-authored two books with Trump, is predicting and what other experts have to say about his recommendations.

Robert Kiyosaki Predicts a Crash Followed by a Big Bull Market

In a tweet earlier this month, Kiyosaki warned, “Technical charts indicate biggest crash in history coming. Prices of real estate, stocks, bonds, gold, silver, & Bitcoin crash.” However, he believes that the crash would present great bargain buying opportunities and predicts a bull market to begin in late 2025.

BOOM GOiNG BUST:

Technical charts indicate biggest crash in history coming. Prices of real estate, stocks, bonds, gold, silver, & Bitcoin crash.

GREAT NEWS: Good time to buy bargains will follow.

Technical charts indicate major long term bull market cycle will…

— Robert Kiyosaki (@theRealKiyosaki) July 3, 2024

According to Kiyosaki, “This bull market cycle is the boom gold, silver, & Bitcoin investors have been waiting for.” In that tweet, Kiyosaki gave some extremely bold price targets on these assets. He said that while gold and silver could respectively rise to $15,000 and $110 per ounce, Bitcoin can “easily” rise to $10 million. The best-selling author particularly seems bullish on the cryptocurrency as his target price implies an upside of nearly 15,000%.

While he did not spell out a timeline for these lofty target prices, in a more recent tweet, he predicted that by August 2025, gold will rise to $3,300 per ounce and silver will hit $79. He expects Bitcoin to rise to $105,000 by that time. In the near term, Kiyosaki seems the most bullish on silver, expecting its price to rise 2.5x over the next year.

Why GOLD, SILVER, BITCOIN will rise in price when TRUMP becomes President again.

Trump wants a weaker dollar so America will begin export more than import. With a weaker dollar jobs will come back and assets will go up in price.

Trump is going to drill, drill, drill for oil…

— Robert Kiyosaki (@theRealKiyosaki) July 23, 2024

Kiyosaki also provided his rationale for predicting such a massive upside in these assets and said that he believes that, as President, Trump would want a weaker dollar as it would help the country increase exports. To be sure, in his first tenure, Trump did try to address the ballooning US fiscal deficit which he believes arises out of a stronger currency, and also lashed out at China, particularly for keeping its currency artificially low.

In a recent interview with Bloomberg, he said, “We have a big currency problem” and talked about devaluing the greenback. His VP, JD Vance, has similar views about the dollar and he revealed that he even wonders “if the reserve currency status also has some downsides.” Incidentally, Vance also supports the cryptocurrency ecosystem in the US and his views on digital assets are in sync with Trump’s.

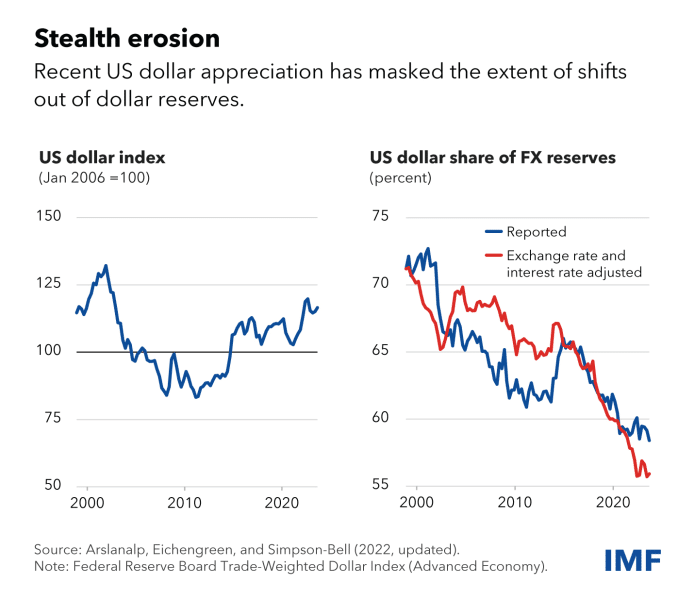

Dollar’s Status as a Reserve Currency Is Anyways Under Pressure

While the US dollar has been the de facto global reserve currency since the end of World War 2, that status has been under pressure and a recent report from the IMF highlights the trend of de-dollarization. According to the report, the dollar’s share of the global forex reserves is now just above 55% while the corresponding figure at the beginning of the century was over 70%. The IMF termed the falling share of the dollar in the global reserves as “stealth erosion.”

According to some economists, the US government’s finances are in poor shape amid high spending and quantitative easing, especially since the COVID-19 pandemic. The country’s debt to GDP is now above 120% while the annual interest outgo is at $1 trillion. Among others, the unsustainable fiscal position coupled with the decline in US absolute national power has been driving countries to diversify their forex reserves beyond the US dollar.

US National Debt Might Be Reaching Unsustainable Levels

In February, Federal Reserve Chairman Jerome Powell told CBS’s “60 Minutes” that “The U.S. federal government is on an unsustainable fiscal path.” Powell acknowledged that the COVID-19 pandemic was a “special event” and called for unprecedented actions. Nevertheless, he stressed, “It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.”

Notably, even Kiyosaki listed the steep rise in US debt as among the reasons he believes gold, silver, and bitcoin would rise so sharply.

Do Experts Agree with Kiyosaki on Bitcoin?

Many experts agree that Bitcoin is likely to be one of the biggest beneficiaries if Trump is voted to power in 2024. Trump, who has vowed to be the “crypto president,f” said at this year’s Bitcoin Conference in Nashville that If “I am elected, it will be the policy of my administration, United States of America, to keep 100% of all the bitcoin the U.S. government currently holds or acquires into the future.”

While his comments fell short of the national bitcoin reserve that some believe he would establish, the digital asset nonetheless reacted positively to his speech and is approaching the $70,000 level.

You can check the video above for Trump’s full speech at the event.

Meanwhile, expert opinion is quite divided over cryptocurrencies. Some expect them to rise tremendously while others, like the legendary investor Warren Buffet, sees them as worthless.

Among those who are bullish on Bitcoin, the general belief is that the asset should move higher in the long term, and another Trump presidency could be particularly bullish. For instance, Fundstrat’s Tom Lee – who has been quite accurate with his market predictions of late – believes Bitcoin is on track to reach $150,000 which implies it doubles from here.

That said, cryptocurrencies like Bitcoin are inherently riskier and volatile than traditional assets. The market is also prone to regulatory heat as crypto regulations are still a grey area in many jurisdictions.

Can Gold Rise to Levels Kiyosaki Predicts?

When it comes to gold, experts are generally bullish – though most don’t go as far as Kiyosaki. Citi, for instance, believes gold prices would rise to $3,000 in the coming months while Goldman Sachs has a base case year-end forecast of $2,700 for the yellow metal.

In its May report, Goldman Sachs termed the rally in gold as “strange.” It added, “The traditional fair value of gold would connect the usual catalysts – real rates, growth expectations and the dollar – to flows and the price. None of those traditional factors adequately explain the velocity and scale of the gold price move so far this year. Yet that substantial residual from the traditional gold price model is neither a new feature nor a sign of overvaluation.”

Juerg Kiener, a market veteran and MD and CIO of Swiss Asia Capital (Singapore) Pte Ltd believes there would be a significant rerating of gold prices into 2028. He particularly sees buying by Chinese consumers as driving up gold prices as they are wary of the country’s real estate and stock markets as well as keeping their money in domestic banks many of which could be troubled due to their real estate exposure.

He is also bullish on Indian consumers’ appetite for gold. Notably, Kiener advised against investing in gold ETFs expressing apprehensions over their structure and actual gold ownership. He is bullish on gold mining stocks and finds them quite undervalued. He expects their earnings to rise significantly amid high gold prices.

Not Many Agree with Kiyosaki on Silver

When it comes to silver, not many experts seem to agree with Kiyosaki’s prediction that the metal’s price will nearly triple by August 2025. Unlike gold, silver has both a relatively stable demand and a stable supply, requiring major shifts in demand from manufacturing or investments for its price to increase so much.

However, the consensus view looks positive on silver, and UBS’s Precious Metals Strategist, Joni Teves, believes that silver is in a “good position to really outperform gold.”

Daniel Hynes, senior commodity strategist at ANZ is also bullish on silver and said, “Slower mine production growth and strong industrial demand suggest supply is lagging demand, which will keep the market in a structural deficit.”

Notably, silver is typically more volatile than gold, sometimes undergoing wild price swings, making it unsuitable for risk-averse investors who might find solace in gold given its low volatility.

Even a broken clock can be right two times a day

Robert Kiyosaki's track record is worse than a broken clock

— Dividend Growth Investor (@DividendGrowth) July 18, 2023

All said, Kiyosaki’s predictions should be taken with a pinch of salt and while he correctly predicted the Lehman crisis, he has been predicting market crash and “depression” for quite some time now. As things stand, far from a market crash or an economic depression, US stocks have risen to record highs while the Q2 2024 GDP data showed the world’s largest economy rising much faster than expected.