Netflix (NYSE: NFLX) reported its Q1 earnings yesterday, revealing that it added a whopping 9.33 million subscribers in the quarter or roughly twice what the markets expected.

A crackdown on password sharing coupled with the launch of the ad-supported tier has helped the company return to growth after its subscribers fell in the first half of 2022.

However, Netflix said that beginning the first quarter of 2025, it won’t provide the quarterly subscriber numbers.

The announcement, reminiscent of the Chinese government’s decision to stop releasing many important economic figures recently, spooked investors who suspect it’s a sign of an impending slowdown in subscriber growth.

Here’s how Netflix’s password sharing crackdown changed the game for streaming and what lies ahead for the company as well as the streaming industry in general.

Netflix's password sharing crackdown is paying off as earnings beat Wall Street expectations https://t.co/dqHOaiGpQA

— Los Angeles Times (@latimes) April 18, 2024

Key Takeaways: Netflix Q1 Earnings and Password Sharing Crackdown

- Q1 2023 Growth: Netflix added 9.33 million new subscribers in Q1 2023, largely due to its crackdown on password sharing and the launch of an ad-supported tier.

- Subscriber Numbers Ending: Starting in Q1 2025, Netflix will stop providing quarterly subscriber updates, causing investor concerns about potential future growth slowdowns.

- Impact of Password Sharing Crackdown: Netflix’s efforts to limit password sharing led to the addition of millions of subscribers, many of whom were previously sharing passwords.

- Market Leadership: Netflix’s strategic moves continue to shape the streaming industry, influencing competitors like Disney and Amazon, though no other platform has fully followed its password crackdown approach yet.

- Stock Market Response: Despite stellar Q1 results, Netflix’s stock declined after the earnings report, possibly due to global economic concerns and investor reactions to the announcement regarding subscriber numbers.

Password Sharing: Is It Worth Annoying Your Customers?

Until recently, millions and millions of people simply used a friend or family member’s Netflix account because it didn’t do pretty much anything to stop password sharing until about 2021. In its Q1 2022 shareholder letter, the company said that according to its estimates, 100 million households watch Netflix on shared passwords.

Incidentally, Q1 2022 was the first quarter after almost a decade that Netflix lost streaming subscribers. The company admitted that it was finding it hard to grow subscribers, especially after strong growth in the previous two years when it saw a growth bump amid the COVID-19 lockdowns.

As was the case with many other companies, the growth during 2020-2021 was coming at the expense of future growth. Faced with falling subscriber growth, Netflix decided to crack down on password sharing and launched an ad-supported tier to attract new subscribers. While some analysts saw the move as a big risk that could alienate subscribers, others acknowledged that it would almost certainly bring in millions more subscribers and they were right.

Netflix’s Password Sharing Crackdown Couldn’t Have Gone Better

The password-sharing crackdown worked wonders for Netflix and last year it added almost 30 million subscribers. While we don’t have a credible way to check how many of these converted after the password-sharing crackdown, it would be fair to say that many of these were indeed watching its content through shared passwords.

In response to an analyst question on how many of the 100 million subscribers (who it estimates watched Netflix through shared passwords) have turned into paying subscribers, Netflix’s co-CEO Greg Peters refused to provide a number.

He instead said, “We really think about this more as developing more mechanisms, more effective ways to convert folks who are interacting with us, whether they be borrowers or folks that were members before that are coming back, we call them rejoiners or folks that have never been a Netflix member.”

$NFLX Netflix was trading at a 51 P/E going into this print.

They were up 30% YTD.

They could not afford to mess up.

They crushed earnings. 5M net new subs.

But then…decided they weren’t going to announce new memberships starting next year.

I listened to the entire call.… pic.twitter.com/DcyIufCzcW

— amit (@amitisinvesting) April 18, 2024

Are Other Streaming Giants Taking Notice?

Netflix has been pretty much setting the agenda for the streaming industry ever since it created the industry when it pivoted to streaming in 2o16. For instance, Disney too withdrew its long-term streaming guidance shortly after NFLX said that it wouldn’t provide streaming subscriber guidance.

Similarly, when NFLX launched its new ad-supported platform after having previously ridiculed the model earlier, Disney and Amazon also quickly followed suit.

So far, other major streaming companies haven’t resorted to a password-sharing crackdown, at least to the same extent as Netflix. That said, as streaming subscriber growth tapers down – Disney+ has lost millions of subscribers from the peak and Amazon Prime likely isn’t much different – companies might be forced to pivot to a password-sharing crackdown to grow their subscriber base.

NFLX Stock Dropped Despite Stellar Q1 Earnings Report

Despite a stellar beat on both the topline and bottomline estimates and shattering subscriber numbers, NFLX stock is trading lower today.

Rich Greenfield of Lightshed Ventures termed the price action as a “kneejerk reaction.” He drew an analogy with Netflix, which had previously stopped providing subscriber guidance beginning with its Q4 2022 earnings.

Greenfield highlighted that two of Netflix’s biggest quarters in terms of subscriber additions indeed came since it stopped providing guidance for subscriber numbers. He also stressed that Netflix is expected to generate $6 billion of free cash flows even as streaming rivals like Paramount and Disney continue to burn cash.

Greenfield isn’t too perturbed by Netflix raising its credit facility from $1 billion to $3 billion and said that the company might be doing so for “flexibility.”

He does not expect Netflix to gun for a major acquisition and said that it was never its “playbook” and the company built the business from “scratch.” He however added that Netflix might pursue small acquisitions in gaming.

It’s also important to remember that the Middle East is on the brink of a regional war between Israel and Iran, which kept the stock market down at open today and may have helped push NFLX further down.

Is the Password-Sharing Boom Over for Netflix?

Some analysts believe that Netflix has juiced most subscribers that it could through the password-sharing crackdown. Benchmark analyst Matthew Harrigan, who has a “sell” rating on the stock is apprehensive about Netflix’s valuations and says it is more of a “media company” than a “tech company.”

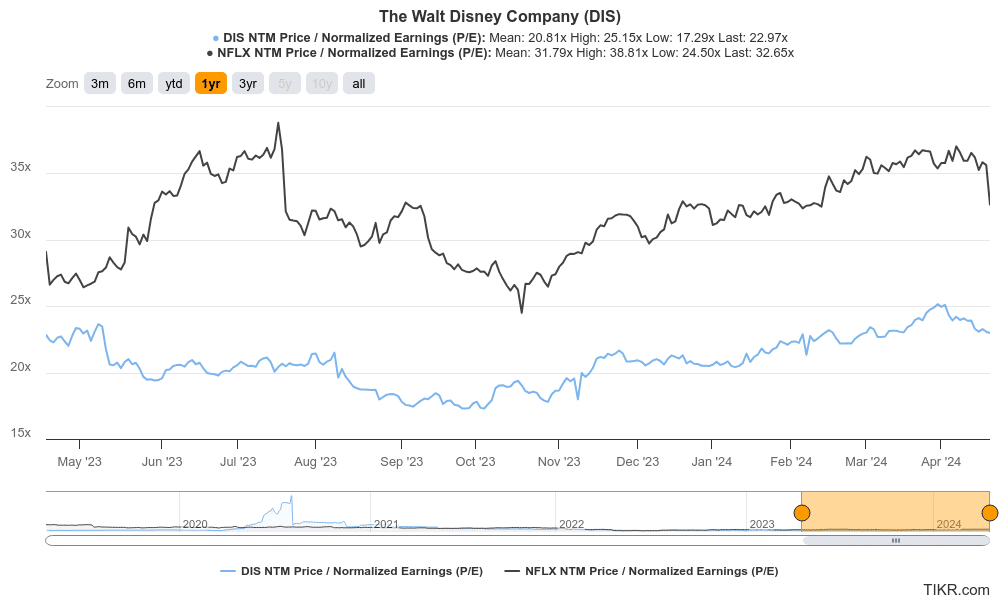

Markets indeed have different valuation paradigms when it comes to tech companies and they trade at a much higher valuation. For instance, Netflix trades at a next 12-month (NTM) PE multiple of 32x, which is significantly higher than media giant and streaming rival Disney, which trades at just about 23x.

Meanwhile, Netflix has proved its mettle over the last year and millions of new subscribers joining the platform (including many who watched Netflix through shared passwords) it’s a testimony to the company’s value proposition.

As Bloomberg Intelligence Senior Media Analyst Geetha Ranganathan probably best summed up, “To a great extent, the streaming wars are kind of over. I think Netflix has kind of won it.”

Netflix Eyes Advertising, Gaming, and Live Streaming Next

While the subscriber gains from the password-sharing crackdown boom might soon taper down – advertisement, games, and live streaming could be the next growth drivers for Netflix. According to Netflix, it has a very strong inventory of advertisements and the supply outstrips demand. Previously, Netflix said that advertisements would be a key driver of its revenues in 2025 and beyond.

It also has a $5 billion deal with World Wrestling Entertainment (WWE) and it plans to double down on gaming to make its value proposition all the more irresistible for consumers.

To sum it up, given its strong content slate, decent growth outlook, and profitable and free cash flow generating operations, it’s not surprising that Netflix is commanding a premium over other streaming companies, most of which are burning cash.