A federal court has started to hear the first arguments of the case against a proposed merger between supermarket giants Kroger and Albertsons valued at $24.6 billion that has faced opposition from regulators.

The result of the trial, which started on September 2, could have a significant impact on food prices, competition in the grocery retailing industry, and the future of the thousands of workers who are currently employed by the two companies.

The Proposed Merger: A Game-Changer in the Grocery Industry

The Kroger-Albertsons merger was announced two years ago and aimed to create the largest supermarket chain in the history of the United States by combining the infrastructure and operations of the two businesses.

Kroger, a company based in Ohio, runs 2,800 stores across 35 US states including brands like Smith’s and Harris Teeter. Meanwhile, Albertsons – the owner of Safeway markets – is headquartered in Idaho and owns around 2,300 stores. Combined, the two corporations employ over 700,000 people.

The Federal Trade Commission (FTC) immediately opposed the transaction. They believed that it would eliminate competition and propel grocery prices higher than they already are once the merger was finalized. They have good reason to worry as the resulting entity would control much of the grocery retail market in America.

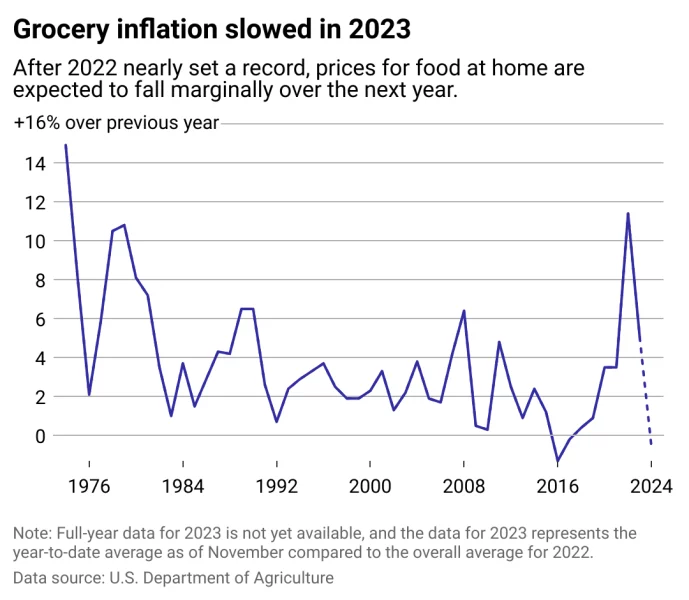

“This supermarket mega merger comes as American consumers have seen the cost of groceries rise steadily over the past few years. Kroger’s acquisition of Albertsons would lead to additional grocery price hikes for everyday goods, further exacerbating the financial strain consumers across the country face today,” commented Henry Liu, the Director of the FTC´s Bureau of Competition, in a press release issued by the regulator in February this year.

The agency aims to block the merger first through a preliminary injunction while a formal case moves forward in court.

Susan Musser, the FTC’s chief trial counsel, stated in her opening arguments, “This lawsuit is part of an effort aimed at helping Americans feed their families.”

The FTC argues that the two companies compete directly in 22 states and this dynamic is beneficial to consumers as they have to offer the best prices, quality, service, infrastructure, and private label products possible to sway customers.

Defense Says that Prices Will Go Down as Soon as the Merger is Completed

However, the two companies have presented contrasting perspectives, claiming that the outcome will be positive for consumers and workers alike.

1. Competition Among Retail Giants is More Intense than it Seems

Kroger and Albertsons´ lawyers claim that the FTC´s complaint fails to acknowledge the changes that the grocery sector has been undergoing in the past two decades including the significant growth of other chains like Walmart and Costco whose presence has expanded widely across America.

Albertsons attorney Enu Mainigi argued: “Consumers are blurring the line of where they buy groceries,” he presented evidence that Albertsons’ target customers are spending the majority of their budget on other grocery stores like Dollar General.

2. Kroger’s CEO Promises to Lower Prices Immediately

In a bold claim, Kroger CEO Rodney McMullen testified: “The day that we merge is the day that we will begin lowering prices.” It isn’t exactly clear why they would lower prices as they would dominate dozens of small and medium-sized markets across the US with no major competitors for miles and miles.

He emphasized that Albertsons’ prices are already 10% to 12% higher compared to those of his company and that, if the merger goes through, they would immediately work to bring them down to retain its customers.

3. Synergies and Cost Savings Will Benefit Consumers

Kroger attorney Matthew Wolf also defended the merger by highlighting the potential synergies that come out of it: “The savings that come from the merger are obvious and intuitive. Kroger may have the best price on Pepsi. Albertsons may have the best price on Coke. Put them together, they have the best price on both.”

Kroger and Albertsons Propose to Sell Nearly 600 Stores to Appease Regulators

The two companies agreed to sell a significant number of stores – 579 to be exact – as part of a proposed deal that aimed to persuade the FTC to drop its lawsuit. The buyer would be C&S Wholesale Grocers, an independent supermarket chain based in New Hampshire that owns Piggly Wiggly and Grand Union stores.

Also read: 10 Retail Trends for 2024 – What You Need to Know to Stay on Point

The FTC is skeptical of this agreement as C&S executives discussed the merits of the deal internally and had no idea if the stores were in good shape to keep them afloat once they were acquired.

Kroger’s attorney countered that C&S has enough operational expertise to run these stores. Moreover, the acquisition would make them the eighth-largest supermarket chain in the United States if the merger is completed.

Impact on Workers and Price Gouging Concerns Persist

Another major concern from regulators is the impact that the merger will have on workers’ stability, wages, and benefits. The United Food and Commercial Workers International union has opposed the deal as they believe that the merged entity will offer reduced wages and benefits once the merger is completed.

Carol McMillian, a bakery manager at a Kroger-owned grocery store in Colorado, stated: “We can no longer stand by and allow corporate greed that puts profit before people. Our workers, our communities, and our customers deserve better.”

One of Albertsons’ lawyers contended that the deal is designed to make unions stronger as competitors in the industry have few unionized workers. But this argument falls a bit flat because many post-merger stores would have to compete for their workers much less than they did previously, likely allowing them to lower wages and benefits without losing their workforces.

Sky-High Grocery Prices Erode Consumers’ Finances

The debate over the Kroger-Albertsons merger emerges at a point when American consumers are feeling the sting of sky-high prices. A report from Groundwork Collaborative, a leftist think tank, provided evidence that families are paying a quarter more for groceries than they were before the COVID-19 pandemic.

Moreover, data analyzed by HelpAdvisor from the 2023 UC Census Household Pulse Survey showed that residents of California spend an average of nearly $300 per week on groceries – the highest amount in the country.

While the legal arguments play out in court, consumers are struggling to make ends meet in an inflationary environment.

San Leandro resident Alana Chand expressed her surprise at seeing cage-free eggs selling for around $8. However, despite her concerns, she continues to shop at Safeway due to its proximity and perceived safety compared to alternatives like Walmart.

Meanwhile, Oakland resident Ricardo Martinas has noticed price increases across various retailers, including Costco. While he finds Safeway’s prices slightly higher, his wife prefers the quality of their organic produce.

Kroger and Albertsons’ Sued the FTC and Disputed In-House Hearings

As the trial continues, US District Judge Adrienne Nelson is expected to hear from around 40 witnesses, including the CEOs of Kroger and Albertsons, to decide if there are merits that justify the issuance of a preliminary injunction.

If she does decide to temporarily block the merger, the FTC’s in-house hearings are scheduled to begin on October 1.

However, Kroger’s attorney, Matthew Wolf, has argued that the FTC’s internal administrative process is so lengthy and cumbersome that merger deals almost always fall apart before it’s completed.

Also read: Kamala Harris Proposes Federal Ban on Grocery Price Gouging: Would It Work?

In response, Kroger sued the FTC earlier this month, alleging that the agency’s internal proceedings were unconstitutional and requesting that the merger’s merits be decided in federal court.

The case has also drawn attention from state-level officials. The attorneys general of Arizona, California, the District of Columbia, Illinois, Maryland, Nevada, New Mexico, Oregon, and Wyoming have all joined the FTC’s lawsuit. Washington and Colorado have filed separate cases in state courts seeking to block the merger.

As the trial unfolds, the grocery industry, consumers, and regulators are closely watching to see how this potential mega-merger could reshape the American supermarket landscape. The outcome could have far-reaching implications for food prices, competition in the grocery sector, and the future of two of the nation’s largest supermarket chains.