The merger with Kroger and Albertsons has been in limbo ever since it was announced in October 2022. While the two companies and some observers argue that the merger would help the combined entity better compete with giants like Walmart and Amazon, many others believe that it would lead to greatly decreased competition (for both workers and customers), price gouging, and loss of jobs.

Here are the observations made by experts on both side of the divide, and what could the merger mean for consumers.

For context, in late 2022 Albertsons and Kroger announced a $25 billion merger which was set to be the largest ever deal in the US retail sector. The deal has faced opposition from some states and the Federal Trade Commission (FTC) who argue that the merger, if it goes through, would lead to higher prices for consumers.

FTC Has Blocked The Merger Between Kroger and Albertsons

In addition to the FTC’s objections, the proposed merger faces widespread opposition from consumer advocates, labor unions, and food industry groups who argue that concentrated ownership in the grocery sector could undermine competition and negatively impact stakeholders from consumers to workers.

Many towns only have a Kroger and an Albertsons, which could become extremely problematic if the merger goes through. The stores would no longer have to compete with each other, allowing them to jack up prices (and depress wages) as consumers would have to leave town to reach a different grocery chain.

To get the regulatory approval for the deal, Kroger and Albertsons took several steps, and in April they announced an expanded divestiture plan agreeing to sell 579 stores to rival C&S Wholesale Grocers.

The Brick-and-Mortar Retail Industry Is Going Through Turmoil

The brick-and-mortar retail industry is going through turmoil, to say the least. Thousands of stores get closed every year and the pace of closures is only rising by the year. Many of the once iconic retail chains are struggling for survival amid the onslaught from ecommerce giants and delivery companies.

In 2018, Sears filed for bankruptcy while JC Penney did so two years later. Bed Bath and Beyond, once a darling for meme stock traders, has also liquidated. Earlier this year Macy’s announced that it would close a third of its remaining stores. The trend is not limited to the US and we see pretty much the same picture globally. Last month, British retail chain Burberry replaced its CEO and suspended its dividend amid poor sales.

To be sure, size does matter in the retail industry and it helps in economies of scale as well as better negotiating prices with suppliers. Albertsons incidentally pointed out that Walmart – which is the largest retail chain in the country – can sell some products below prices that it can buy wholesale.

On their part, Kroger and Albertsons argue that a merger between them would be in the best interest of consumers. Kroger attorney Matthew Wolf argued in his opening statement that a merger would lead to lower prices by between 10%-12% for many goods in Albertsons as they are priced higher than what they sell at Kroger stores. Most antitrust experts aren’t convinced, however, and expect to see competition decrease all over the country if the deal isn’t blocked, leading to higher prices and lower wages.

Price Gouging in the Retail Industry

Price gouging by retail giants (namely grocery stores and food companies) is already a hot-button issue in the US. Experts realized that companies piggybacked on high inflation to raise the prices of groceries more than their fair value. Because we all have to buy food, we don’t have much choice but to suck it up and pay up.

Rising grocery prices have been such a major problem for Americans that the topic made its way into the 2024 presidential election campaign with Kamala Harris vowing to ban price gouging.

There's a lot of evidence that has come out since Kamala Harris released her plan on pricing power. I hope she's using it on the trail!

— Matt Stoller (@matthewstoller) August 28, 2024

At a rally in North Carolina, Harris – who is the vice president of the current administration – said that if she is elected as the next US president, she will strive to bring down prices of daily use goods.

“We all know that prices went up during the pandemic when the supply chains shut down and failed. But our supply chains have improved, and prices are still too high,” said Harris, pointing at the clear evidence of corporate price gouging.

However, Donald Trump has criticized the economic policies mooted by Harris calling them “Soviet-style” controls. It’s important to note that a ban on price gouging is not “soviet-style price controls.” It would simply make sure that companies can’t artificially jack up prices on essential goods during times of emergency and more than 30 states already have price gouging bans on the books.

The situation isn’t as clear cut as it may seem, however, as some Democrats are accepting generous donations from grocery chains and even some Republicans have joined in the criticism of grocery price gouging.

Would Kroger-Albertsons Merger Lead to More Price Gouging?

The antitrust hearing over the Kroger-Albertsons merger began earlier this week in the federal district court in Oregon as the FTC seeks a preliminary injunction to delay the deal. While both sides are presenting their side of the story, here are a few points to consider.

Firstly, US grocery prices are now on average 20% higher than what they were before the COVID-19 pandemic. While annualized inflation in the US has eased, paving the way for a possible Fed rate cut next month, the high inflation over the previous many quarters has meant that prices for most goods have settled at a much higher base.

While the margins for retail companies have also expanded between 2019 and 2023 – suggesting that there is some price gouging, the rise hasn’t been that high, and retail companies continue to work on low net margins. For instance, in the most recent quarter, Kroger’s net profit margin was only 2.1% while that of Albertsons was only 1%. Then again, margins can be gamed to a certain extent and Kroger has bought back hundreds of millions of dollars of its stock in the past 2-3 years.

Net margin is an easily gamed and irrelevant metric. Here's how Kroger compensates its executives. https://t.co/y8bw2RHp8S pic.twitter.com/o1MmaCtGla

— Matt Stoller (@matthewstoller) August 22, 2024

Kroger Executive Admitted to Some Price Gouging

Meanwhile, in his testimony to the Federal Trade Commission attorney, Kroger’s Senior Director for Pricing Andy Groff admitted that the company indeed raised prices for milk and eggs in excess of inflation levels. When you increase prices on the basics like eggs and milk, consumers don’t really have a choice so the regular mechanisms of capitalism don’t function as intended.

Kroger has meanwhile defended itself and said Groff’s comments were “cherry-picked” while adding, they don’t “reflect Kroger’s decades long business model to lower prices for customers by reducing its margins.”

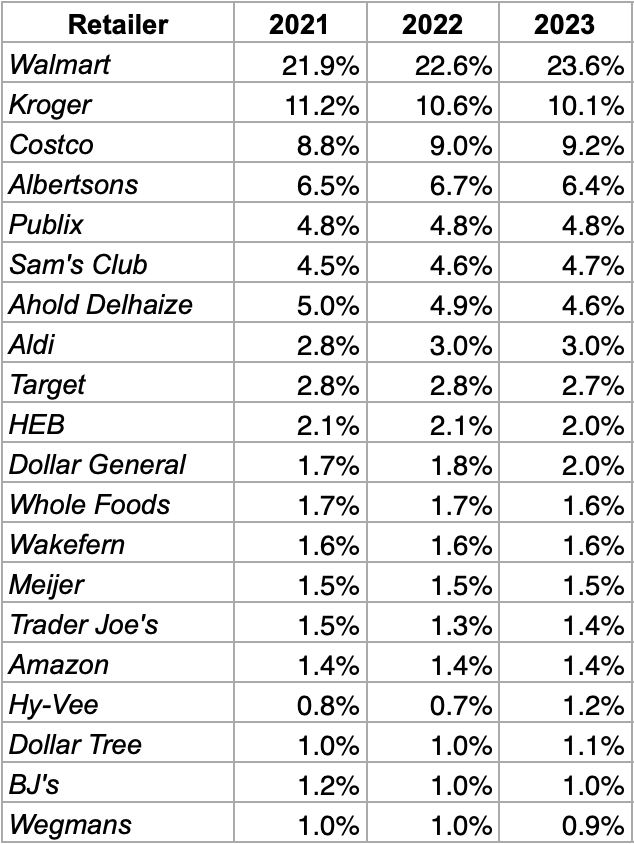

Another issue here is if Kroger and Albertsons merge, the merged entity along with Walmart would have a 43% share of the grocery market. Importantly, they would hold an even bigger 70% market share in scores of cities where they have a dominant presence.

Since competition is among the key drivers of the prices that these big grocery stores eventually sell products at, there are legitimate concerns that a Kroger-Albertsons merger might lead to higher prices.