Even with many climate change efforts and President Biden strongly advocating for a shift from fossil fuels, Big Oil has seen record profits during his early years in office. Instead of the industry downturn some anticipated under a Democrat administration promoting a green agenda, companies like ExxonMobil and Chevron have recently reported their highest earnings ever.

The success was driven by a multitude of variables including Russia’s invasion of Ukraine, which disrupted global energy supplies last year. This made oil and gas prices spike and gave the companies leeway to raise prices even further. Rather than relief for American consumers, this instability allowed domestic producers to reap massive financial windfalls.

Political Gridlock Halts Climate Efforts

When sworn into office, Biden promised bold action on climate change. He rejoined the Paris Accords, paused new oil and gas leases on federal lands, and tried canceling the Keystone XL pipeline. However, sweeping climate legislation has stalled in Congress despite Democratic majorities. Even though Democrats control the Senate, they have been unable to pass much of note.

With a slim Senate margin requiring total party unity, opposition from West Virginian coal advocate Senator Joe Manchin has proven insurmountable. His skepticism of moving too fast to cut emissions aligns with broader reluctance from Republicans and some swing-state Democrats who have grown fearful of voter backlash. With a GOP-controlled House of Representatives, even getting a bill through the Senate would mean nothing unless at least a few House GOP members were convinced to support it with major concessions.

Despite the White House’s pleas, Capitol Hill remains polarized on aggressively transitioning from domestic oil, gas, and coal. Climate activists’ dreams have crashed against political reality and a stubborn legislative branch.

Big Oil Cashes in on Geopolitical Turmoil

While environmentalists mourn missed opportunities under Biden, industry leaders and investors in oil and gas stocks are celebrating. As punitive climate policies sputtered, share prices and profits across the fossil fuel sector have erupted.

Since the war began in February 2022, data from Global Witness indicates that the five largest oil companies in the world – Shell, Chevron, BP, ExxonMobil, and TotalEnergies have made a staggering total of $281 billion in profits.

Meanwhile, estimates from the Financial Times indicate that oil and gas companies are on track to outpace those numbers last year, with the top-10 operators producing over $300 billion in net profits in 2023 as the first three years of Biden’s presidency come to an end.

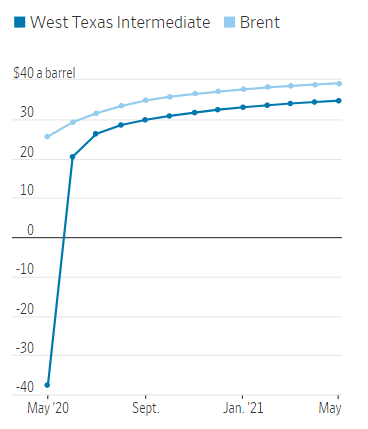

This bonanza traces directly back to spiking oil prices triggered by both Ukraine and Russia weaponizing energy against each other. Severe supply crunches lifted the global Brent benchmark to nearly $110/barrel in March 2022, just a couple of years after US crude oil producers had to pay to give it away for a short time during the pandemic.

Even though the market’s volatility has stabilized a bit lately, prices are still averaging around $80 per barrel.

Despite some economic headwinds, the oil and gas industry and its many moving parts – transporters, refiners, consulting firms, and engineering companies – all cashed in as demand remained inelastic while crude availability temporarily shriveled. These outsized returns proved so bountiful that share buyback programs abound alongside soaring dividends.

Top O&G Executives Defend Windfalls

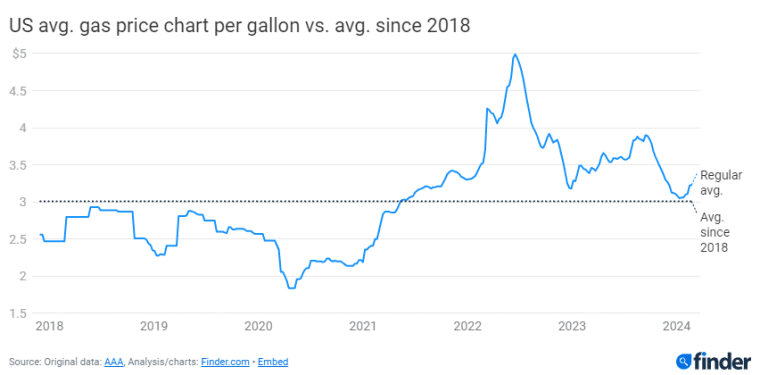

Unsurprisingly, White House criticism intensified as American families struggled with record gas prices while Big Oil counted profits. Biden himself condemned the profit margins as “outrageous,” assailing producers for capitalizing on geopolitical instability. Progressives in Congress have echoed this sentiment but they have done little if not nothing to stop it as of yet.

Industry leaders have pushed back vigorously in defense. They highlight how years of low margins forced scaled-back exploration right before the unforeseeable disruptions caused by COVID-19. They argued that investments require certainty around longer-term outlooks.

Most also note out that rising crude benchmarks, which lifted the entire sector, are dictated by global rather than domestic considerations. They believe that efforts to expand American capacity could never fully immunize consumers against international volatility.

Many have even accused Washington of disingenuous scapegoating given the complex and highly entrenched realities of the oil industry, many of which escape the influence of its top corporate players.

Ultimately, politicians face the difficult burden of reconciling the public’s anger over high energy costs with corporate deference to market forces largely beyond their direct control.

Shareholders are Winning while Customers Are Struggling

Nonetheless, doubts linger regarding exactly how executives have channeled their exceptional recent returns. Those skeptical of Big Oil question if there has been enough focus on moderating prices through greater output.

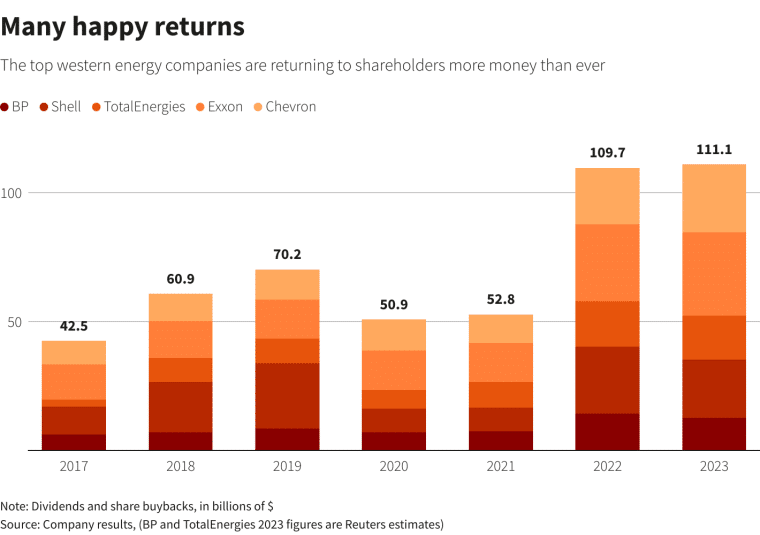

They compare relatively restrained increases in new investment so far against the tens of billions being funneled toward dividends and buybacks instead. Shareholders are likely the biggest winners here (aside from the executives getting unthinkably large bonuses).

In 2022 alone, calculations run by the Institute for Energy Economics and Financial Analysis (IEEFA) indicate that $104 billion were spent by oil and gas companies to fund dividends and share buybacks – both corporate actions aimed directly at compensating shareholders directly.

Critics also highlight the continued gap between domestic diesel inventories versus pre-pandemic levels, arguing that more refining capacity brought online could help restrain transportation costs spilling over into consumer goods.

If more resources flowed toward operational enhancements to limit price pressures, grumblings around misaligned incentives might soften.

For now, households straining under energy cost burdens have seen far less relief compared to shareholders who are taking a deep swim in larger and larger pools of cash. That irritation seems unlikely to abate given forecasts for another huge year of Big Oil earnings in 2023 even if slightly below 2022’s pace.

Biden & Democrats are Floundering Politically

Beyond questions about how profits get allocated, the fiscal success of oil and gas also carries troublesome political overtones for Biden and his party, especially because voters are angry that gas prices continue to rise. Amidst their flailing legislative climate efforts, the industry they hoped to constrain is thriving and this plays directly into Republican’s messaging and rhetoric.

The more fossil fuel companies expand production and enrich investors at the cost of American families under Democratic leadership, supposedly hostile to their interests, the more scrutiny mounts around exactly what Biden’s climate agenda has actually achieved.

If contributions toward emissions reduction and hastening renewables adoption can’t be highlighted, the White House risks appearing captive to the far left while presiding over solid Big Oil returns. That’s a narrative that conservatives are already pounding away at as the 2024 election looms.

The dilemma speaks to the complex balancing act that the administration tries straddling between climate activists and traditional energy constituencies. While the GOP’s efforts to push forward a narrative regarding the supposed demise of the US’s energy independence post-Trump have found little acceptance, Biden himself is not keen on celebrating the oil and gas boom on his watch.

Managing External Forces Remains an Impossible Task for ‘Green’ Presidents

Ultimately, for Biden, his widely aggressive regulatory efforts targeting the oil and gas industry probably constitute the most feasible path forward in the absence of congressional support.

The President, therefore, faces lingering headwinds pursuing the transformative change he promised around America’s energy mix and emissions trajectory. Now, only a few months ahead of the election, climate action seems bogged down on numerous fronts.

Market forces and geopolitical winds will stay as unpredictable as ever. Over a decade of technological innovations has made US oil and gas output nimbler in responding to price signals, and producers have also continued to find new ways to secure greater and greater profits.

Perhaps if relief emerges on the global volatility that suppressed supply while boosting margins over the past year, Biden may generate solid enough growth and reinvestment data to balance his green positioning. That is if he manages to secure the country’s political top seat once again.

Yet, with America only slowly transitioning its fleet to EVs while still importing nearly half its daily consumption, complete energy independence won’t materialize overnight. Those betting on a rapid decline in fossil fuels look increasingly checked by the world’s geopolitical realities. For now, king crude still reigns and remains immune even to the most hostile political rhetoric.

With the Russia-Ukraine conflict still raging and OPEC’s readiness to manipulate the market to its advantage, no production boom can insulate Western economies completely from externally influenced price whims.

That leaves leaders like Biden touting long-term aspirations around renewables and carbon reduction with only no cards left to play.