Bluebell Capital Partners, a tiny London-based activist hedge fund, is ramping up its Sisyphean efforts to push oil giant BP to alter its strategic course on energy transition and climate goals.

In an explosive letter sent last October to BP’s leadership team, which includes its new CEO Murray Auchincloss, Bluebell argued that BP’s plan to rapidly cut fossil fuel production and pour billions into renewable energy has depressed its stock price and fails to align with reality.

The letter, signed by Bluebell co-founders Giuseppe Bivona and Marco Taricco, says that BP trades at a roughly 40% discount to peers like Chevron and ExxonMobil “primarily due to an ill-conceived strategy aimed at drastically shrinking BP’s core business”.

Bluebell also believes that BP’s projections of a major decline in oil and gas demand are “utterly unrealistic” and take aim at BP’s significant investments in areas like biofuels, EV charging networks, and hydrogen where returns are lower and “BP has no right to win”.

The activist fund instead wants BP to align its strategy closer to that of its big oil rivals. They suggest that the company should bolster share buybacks by $16 billion through 2030, add oil and gas output by 500,000 barrels per day, and cut planned spending on transition businesses by 60%.

Analysts See Strategy Sparking Heated Boardroom Debate

Market analysts say that while BP’s board continues to publicly back its strategic course, Bluebell’s campaign will likely spark intense internal debate over finding the right balance between low-carbon transition and BP’s core oil and gas business.

In an interview with CNBC, Bivona mentioned that BP has little chance in the clean energy industry. In addition, even though its goals to reach net zero emissions by 2050 are considered great for society and the environment, the odds are stacked against the company and its capacity to live up to those promises.

“I think it is very rational for a company to make as its base case a scenario which, actually is very, very unlikely to happen. And on that front, we are not asking BP to renege on its strategy, but to adapt its strategy to the reality”, the European activist investor further highlighted.

Other investors have argued that BP remains too focused on hydrocarbon projects that could turn into ‘stranded assets’ as the world moves to cut emissions.

Bluebell Claims that BP is Highly Undervalued Compared to Peers

Activist Bluebell Capital believes that BP’s aggressive strategy to shift from fossil fuels into renewables has resulted in the market appraising the oil and gas company 40% below its fair market value when compared to other firms of similar size within the industry.

Bluebell is challenging BP’s commitment to slash oil production by 25% and pour billions into biofuels, hydrogen, solar, wind, and electric vehicle infrastructure because its oil and gas business is much more profitable.

Their numbers appear to back these claims, with BP shares trading at a steep discount to US oil majors on most standard valuation metrics.

Bluebell highlights that BP’s 6.7 price-to-earnings ratio is far from fair compared to figures exceeding 12 times boasted by both Exxon and Chevron. The activist fund says that this gap has widened significantly since 2020 when BP unveiled its bold push into renewables under the leadership of its former CEO Bernard Looney.

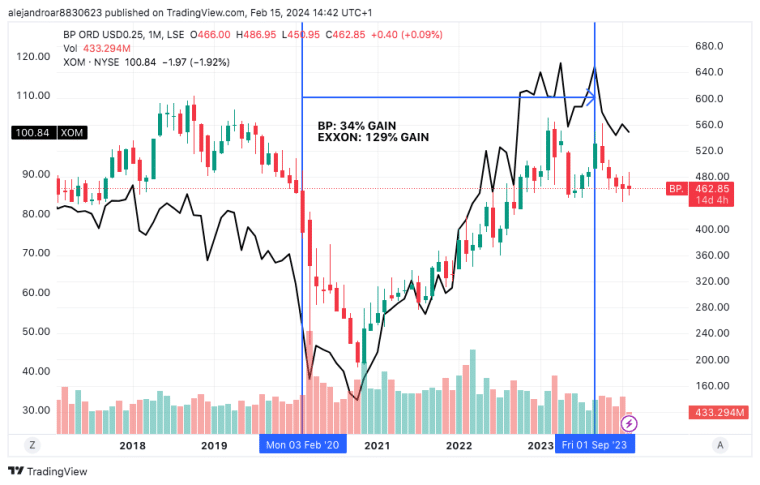

Moreover, the performance of BP’s share price has also lagged that of its rivals, with its common shares delivering gains of just 34% from February 2020 – the month when Looney was appointed – to the moment he resigned in September 2023. Shell, Chevron, and Exxon’s stock have produced gains of 45%, 79%, and 129% respectively to shareholders during that same period.

Looney stepped down last September after greenlighting over $25 billion in low-carbon energy projects from wind farms to electric vehicle charging networks. His interim replacement, Murray Auchincloss, has vowed to stay on the same path.

Oil Demand Seen Stronger Than BP Forecasts

Another pillar of Bluebell’s thesis is that BP has taken an overly pessimistic view in long-term oil demand. This contradicts outlooks from OPEC, Exxon, Shell and others.

BP estimates that crude demand should fall by over 2% this decade while rivals see growth amid the absence of much more aggressive climate policies. Bluebell believes that this gap explains BP’s rush to diversify while US majors continue to focus on developing their upstream units.

Also read: Best Green Investment Funds to Watch in 2024

BP has stood by its plans so far, stating that the strategy will deliver value over the long term. “We continue to make significant progress, remain focused on delivery, and are confident the strategy will grow the value of BP”, a spokesperson from the company said recently.

However, in February 2022 under former CEO Bernard Looney, BP did temper some climate targets, like only aiming for a 20% cut in oil and gas output this decade rather than the 40% Looney’s plan initially aimed for.

BP also watered down its ambitions in areas like electric vehicle charging infrastructure and fuel hydrogen production. This nod to oil and gas – after Looney’s shocking net-zero pledge in 2020 – has boosted BP shares by nearly 20% since they were announced.

BP Board Faces Growing Pressure to Ease Green Initiatives

Bluebell is ratcheting up pressure on BP’s board, saying that its strategy lacks credibility and requires six major correctives including CEO and director changes.

While BP’s leadership is still defending its plan, Bluebell believes that behind-the-scenes frictions are still high regarding how to balance energy transition goals with keeping shareholders happy. BP is required to do what is best for its shareholders, even though reducing oil and gas production may well help the planet recover from global warming faster.

Other investors have echoed similar concerns but Bluebell is the first ESG-focused investment fund to directly challenge BP’s green strategy with a campaign targeting its leadership.

Some analysts expect that BP’s board may eventually tilt back toward oil and gas in some form if enough pressure is exerted by investors.

With Bluebell showing no signs of backing down, BP is at a critical point over its future direction. For a company that has championed climate awareness, any backsliding won’t go unnoticed.