A Singapore court has sentenced Chinese national Lin Baoying to 15 months in jail in the infamous multi-billion-dollar money laundering case which marked the biggest such operation in the history of the Asian country.

She was the only woman among the ten foreigners arrested in August 2023 in raids led by Singapore’s Commercial Affairs Department. Lim is a Chinese national but holds passports from Cambodia, Turkey, and the Dominican Republic.

Singapore has been probing the case for months now and Lin is the eighth person to be sentenced in the case. Lin faced ten charges and pleaded guilty to three of these. The judge nonetheless took into consideration the other charges while awarding the 15-month sentence. However, since she was arrested in August, she has been credited for the time she has already spent in prison.

Lin was suspected of running an illegal gambling operation outside Singapore between 2015 and 2019. She then transferred the proceeds into Singapore and used forged documents to establish the source of these funds to banks.

Billion-dollar money laundering case: Woman gets 15 months' jail, forfeits S$154 million in seized assets https://t.co/RKEDzJmGLq pic.twitter.com/zwDuvBcjIs

— CNA (@ChannelNewsAsia) May 30, 2024

Authorities seized 170.5 million Singapore dollars (1 Singapore dollar is worth around 0.74 US dollars) worth of her assets and, after the judgment, forfeited around 90% of the money. Her assets were quite diversified and included cryptocurrencies like Bitcoin and Ethereum, real estate, luxury cars, physical cash, and a mix of local and foreign currencies in bank accounts.

Singapore’s Biggest Money Laundering Case

In August last year, the Singapore police arrested ten persons, none of whom were citizens or permanent citizens of the country, in a multi-billion dollar money laundering case. The police department acted when it received information about the alleged illegal activities of these individuals. These individuals allegedly used suspected forged documents which they used to fraudulently establish the source of funds in Singapore bank accounts.

In their release, the Singapore police department said, “Through extensive investigations and follow-up from intelligence – including the analysis of Suspicious Transaction Reports (STRs) – the Police identified a group of foreign nationals suspected to be involved in laundering the proceeds of crime from their overseas organized crime activities including scams and online gambling.”

Other Arrests in the Money Laundering Case

Apart from Lin, the following seven individuals have been jailed in the case:

- Su Wenqiang, a Cambodian national, was convicted and sentenced to 13 months in jail for two counts of money laundering. The state forfeited his assets worth 6 million Singapore dollars

- Su Haijin, a 41-year-old Cypriot national, was sentenced to 14 months for money laundering and resistance to lawful apprehension. Singapore forfeited around 165 million Singapore dollars worth of his assets.

- Chinese national Wang Baosen was sentenced to 13-month imprisonment for money laundering. The state forfeited all of the assets worth 8 million Singapore dollars seized from him.

- Su Baolin, a 42-year-old Cambodian national, was imprisoned for 14 months for money laundering and abetting another to make false representations. The country forfeited his assets worth 65 million Singapore dollars which was 90% of the assets seized.

- Zhang Ruijin, a Chinese national, was sentenced to 15 months for money laundering and forging documents. Singapore dollars 118 million worth of his assets were forfeited.

- Turkish national, Vang Shuiming, was sentenced to 13 months and six weeks’ imprisonment for money laundering and forging documents. Singapore forfeited his assets worth 179 million Singapore dollars which was 90% of assets seized from him.

- Chen Qingyuan, a 34-year-old Cambodian national, was sentenced to 15 months and had Singapore dollars 21.3 million worth of his assets forfeited in the case.

Su Jianfeng and Wang Dehai are the remaining two accused persons in the case and the charges against them are sub judice (under judicial consideration). All together, the scheme involved billions of dollars, making it the largest money laundering operation in the history of Singapore.

Singapore is a haven for the wealthy, with its low taxes, safety and stability.

Threatening to upend that carefully crafted image though is a $2.2 billion money laundering case that's seen authorities seize cash, cars and mansions https://t.co/b9rVa1fYb0 pic.twitter.com/k2Mmy9S5k1

— Bloomberg Originals (@bbgoriginals) May 5, 2024

Is Singapore Becoming a Home for White Collar Criminals?

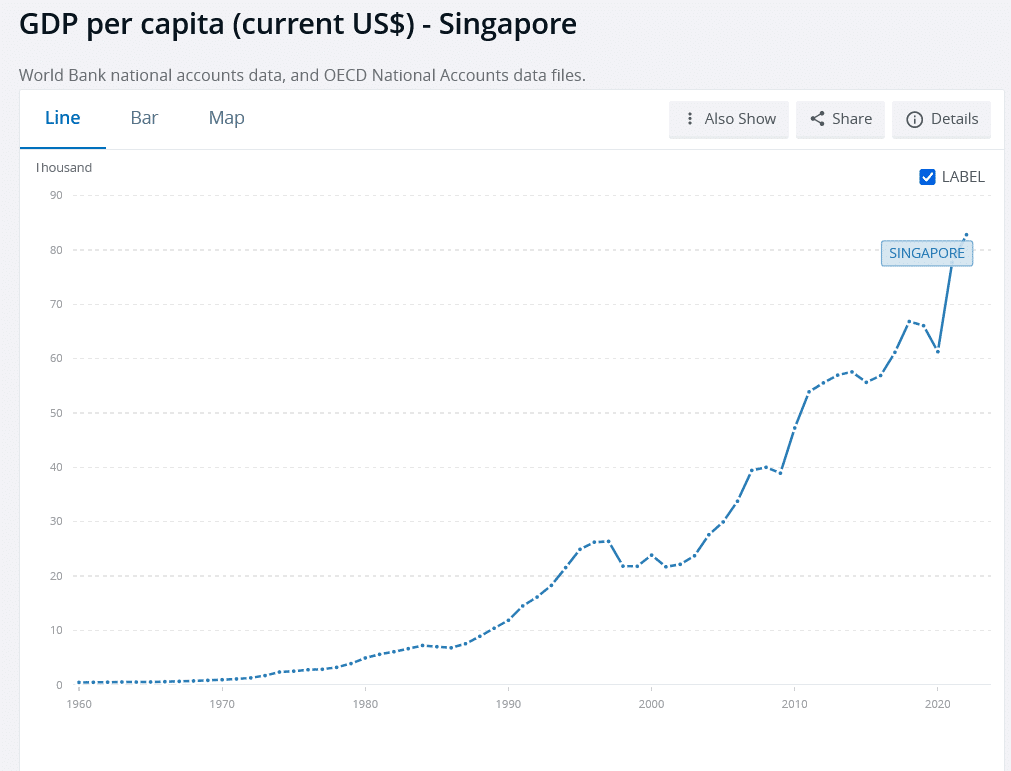

Singapore is now one of the richest countries globally with a per capita GDP at current prices of nearly $88.45 thousand which for context is slightly higher than the US. The tiny nation is the richest in Asia and has emerged as a global financial center.

Singapore is now famous as the “Switzerland of Asia” and several foreign businesses and wealth managers set up offices there given the investor-friendly laws. A report from KPMG said that over half of Asia’s family offices that manage private wealth have offices in Singapore.

Asset managers in Singapore attracted 435 billion Singapore dollars from investors in 2022 with the amount doubling in just five years.

Meanwhile, just as several leaks like the Panama Papers showed the inundation of illicit money into Swiss banks, even Asian Switzerland seems to be turning out to be the preferred destination for money laundering.

Accounting professor Kelvin Law from Singapore’s Nanyang Technological University told the BBC, “Massive amounts of money pass through Singapore’s banking system every day. Criminals can exploit this feature and disguise their money laundering activities among legitimate ones.”

Unfortunately, these kinds of massive schemes seem to be more common than you might think. Earlier this week, a court-authorized international law enforcement operation led by the US Justice Department arrested a 35-year-old Chinese national YunHe Wang from Singapore in a botnet attack that could easily be the biggest such scam ever affecting 19 million PCs across the world.

Singapore-based banks were also allegedly complicit in the 1MDB scam where billions of dollars were misappropriated from Malaysia’s state investment fund.