In a startling revelation that has sent ripples across the cryptocurrency world, KuCoin (KCS), one of the world’s most prominent crypto exchanges, finds itself embroiled in serious legal turmoil after being hit with anti money laundering violations.

US federal prosecutors have charged KuCoin and its founders with violations of anti-money laundering (AML) laws, shining a spotlight on the exchange’s compliance practices and stirring conversations about broader implications for the crypto industry.

Unpacking the Charges Against KuCoin: What Has The Exchange Been Accused Of?

At the core of the allegations is KuCoin’s supposed defiance of the Bank Secrecy Act. Authorities assert that KuCoin, without registering with the Financial Crimes Enforcement Network (FinCEN), operated as a money-transmitting entity, neglecting essential AML and Know Your Customer (KYC) protocols.

This oversight purportedly turned KuCoin into a conduit for laundering illicit funds, with accusations that the exchange indirectly received over $3.2 million in cryptocurrency from the sanctioned crypto mixer, Tornado Cash.

The gravity of these charges is underscored by KuCoin’s significant user base, boasting over 30 million customers globally.

KuCoin’s overall assets have experienced a net outflow of approximately US$1.195 billion in the past 24 hours.

Let's try this now with one of the banks in 🇺🇲 and she how it goes.

Not the first time Kucoin is being stress tested and passing👏

— NurBrks (@NurBrks) March 27, 2024

The indictment paints a picture of an exchange that, until recently, operated without the stringent checks required to prevent financial crimes, raising questions about the due diligence processes within the crypto trading platforms.

Could the Kucoin Violations Reverberate Across the Crypto Ecosystem?

The legal scrutiny of KuCoin doesn’t exist in a vacuum; it echoes broader regulatory trends targeting crypto exchanges.

Muddying the waters, the US Commodity Futures Trading Commission (CFTC) also stepped into the fray, accusing KuCoin of failing to register as a futures commission merchant among other violations. Interestingly, the CFTC also labeled Litecoin a commodity in the documents but that’s a story for another day.

These actions underscore a tightening regulatory environment, aiming to align crypto operations with established financial market standards.

Many of the biggest and most well-known crypto exchanges globally are facing serious charges, fines, investigations, and increased scrutiny all at the same time. Coinbase and Binance, two of the largest exchanges in the world, are both being investigated by the SEC for supposedly selling unregistered securities (along with other accusations).

Coinbase was hoping that its charges would be dismissed by the court Wednesday, but they were not so lucky. While some of the charges were dropped, particularly those relating to Coinbase Wallet, the judge decided that the SEC could move forward to sue Coinbase over the alleged sale of unregistered securities.

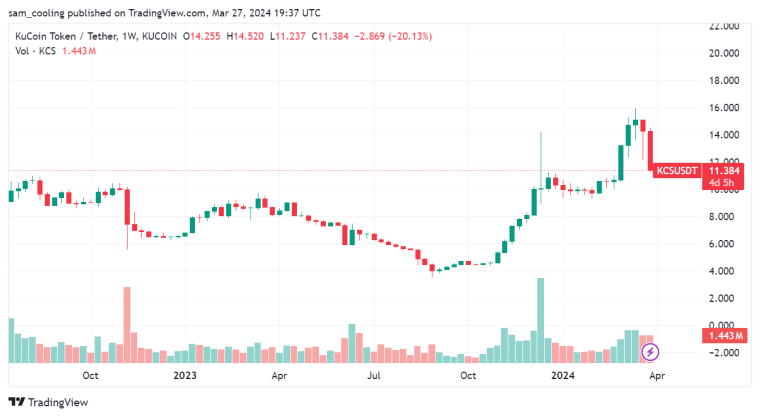

KuCoin was the next major exchange to be hit with major investigations and the market reaction was swift and palpable, with KuCoin’s native token (KCS) dipping by 5% post-announcement.

(KCSUSDT)

This development is a stark reminder of the interconnectedness of regulatory actions and market dynamics, emphasizing the crypto market’s sensitivity to legal and compliance narratives.

Looking Beyond KuCoin: A Sector-Wide Call for Regulatory Compliance

KuCoin’s predicament serves as a cautionary tale for other exchanges, underscoring the imperative for robust AML and KYC frameworks.

The crypto domain, known for its rapid innovation and dynamism, now faces a crucial juncture where compliance with regulatory mandates is not just recommended but essential for survival and growth..

The path forward for KuCoin and its peers is fraught with challenges yet brimming with opportunities to redefine industry standards.

By embracing compliance as a cornerstone of operations, crypto exchanges can mitigate risks and secure their place in the future of finance, all while maintaining the spirit of innovation that defines the crypto sphere.