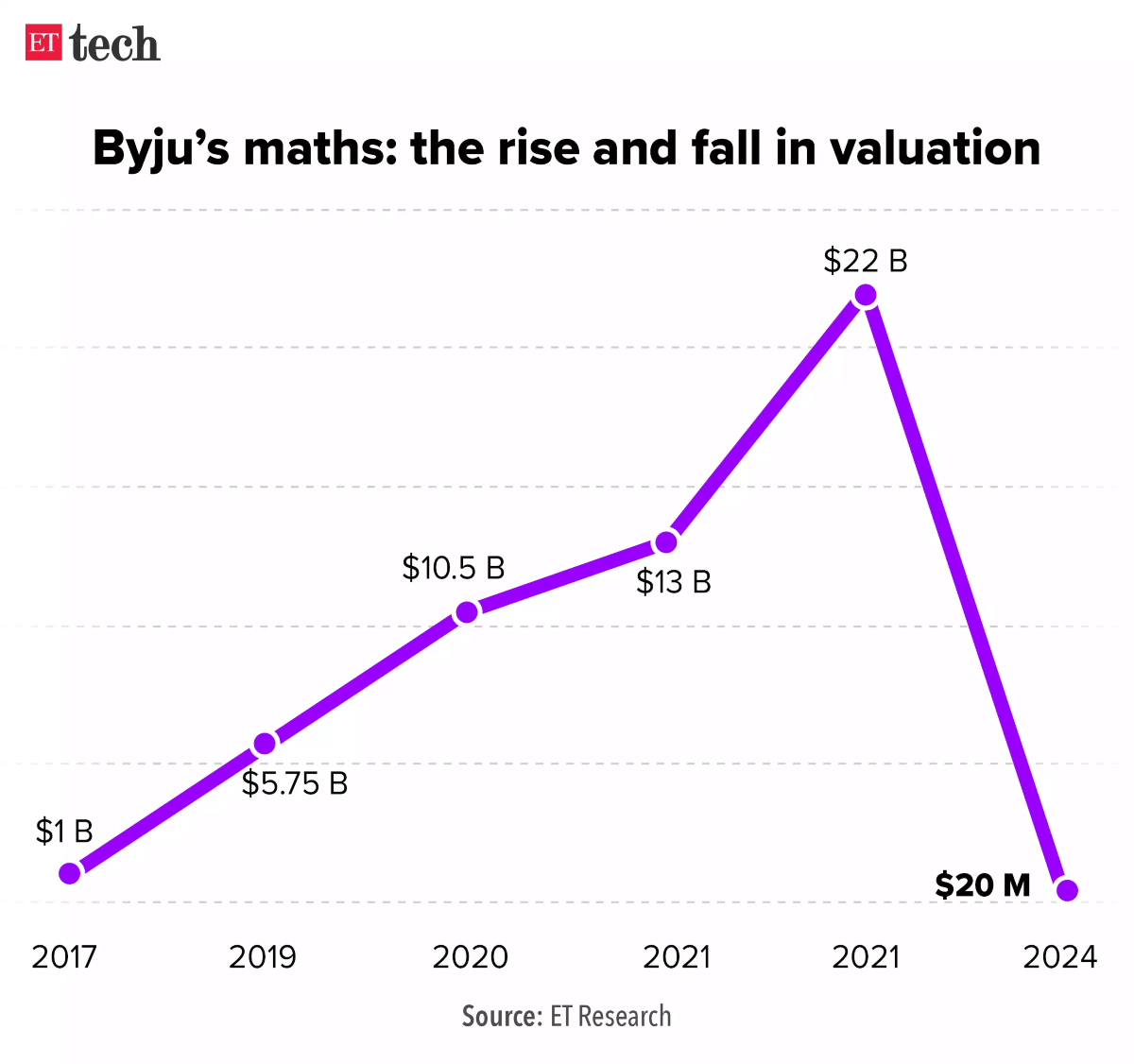

The startup world, outside of artificial intelligence (AI), has struggled over the past couple of years with many valuations plummeting far below previous highs. The trend looks far from over as HSBC believes that gargantuan edtech startup Byju’s which was once India’s most valuable startup with a peak valuation of $22 billion is now totally worthless.

HSBC estimates Prosus’ 10% stake in Byju’s is now worth nothing. In its note, HSBC said, “We assign zero value to Byju’s stake amid multiple legal cases and funding crunch.” It added, “Previously, we valued around 10 per cent stake in Byju’s by applying an 80 per cent discount to the latest publicly disclosed valuation.”

The Dutch tech investor has invested $500 million in the company and is among the investors that are seeking to oust CEO Byju Raveendran, and his family members from Byju’s board. Previously, BlackRock – which owns around a 1% stake in Byju’s – also marked down Byju’s valuation to zero.

Byju’s Valuation Marked Down to Zero

Byju’s effectively becoming worthless is a major setback for the Indian startup ecosystem as it was valued at a mammoth $22 billion in 2022 making it the biggest startup in the country. However, it is hardly a surprise as investors like Prosus have been gradually marking down the company’s valuations for quite some time now.

Took about 5 years since I started criticising Byju openly before the rest of the world finally acknowledges that #Byju's is bankrupt !https://t.co/SzLxlHIe4w

— Dr Aniruddha Malpani, MD (@malpani) June 7, 2024

Last year, Byju’s investors marked down their valuations to $11 billion in March, $8 billion in May, and $5 billion in June. In November, Prosus cut the company’s valuation to below $3 billion.

In its earnings call in November last year, Prosus termed Byju’s a “problematic assets business in the portfolio.” It added, “We have reported a markdown in Byju’s carrying value, we do it from time to time reflecting the current circumstances and not the long-term view of the business. We have written down our stake in Byju’s by a further 315 million dollars.”

The company’s valuation received another jolt when it raised money through a rights issue earlier this year at an enterprise value in the range of $220 million-$250 million – which was just 1% of its peak valuation.

Now, HSBC believes that even the $250 million valuation is too high and that it should be marked down to zero. What once looked like a disruptive edtech company that looked set to transform the Indian education sector, is now fighting for survival as well as relevance.

What Went Wrong with Byju’s?

Byju’s was a darling for investors not too long ago during the COVID-19 pandemic as online education platforms quickly grabbed market share. China’s edtech crackdown of 2021 meant that foreign investors looking at investing in emerging market edtech companies now had fewer options to choose from.

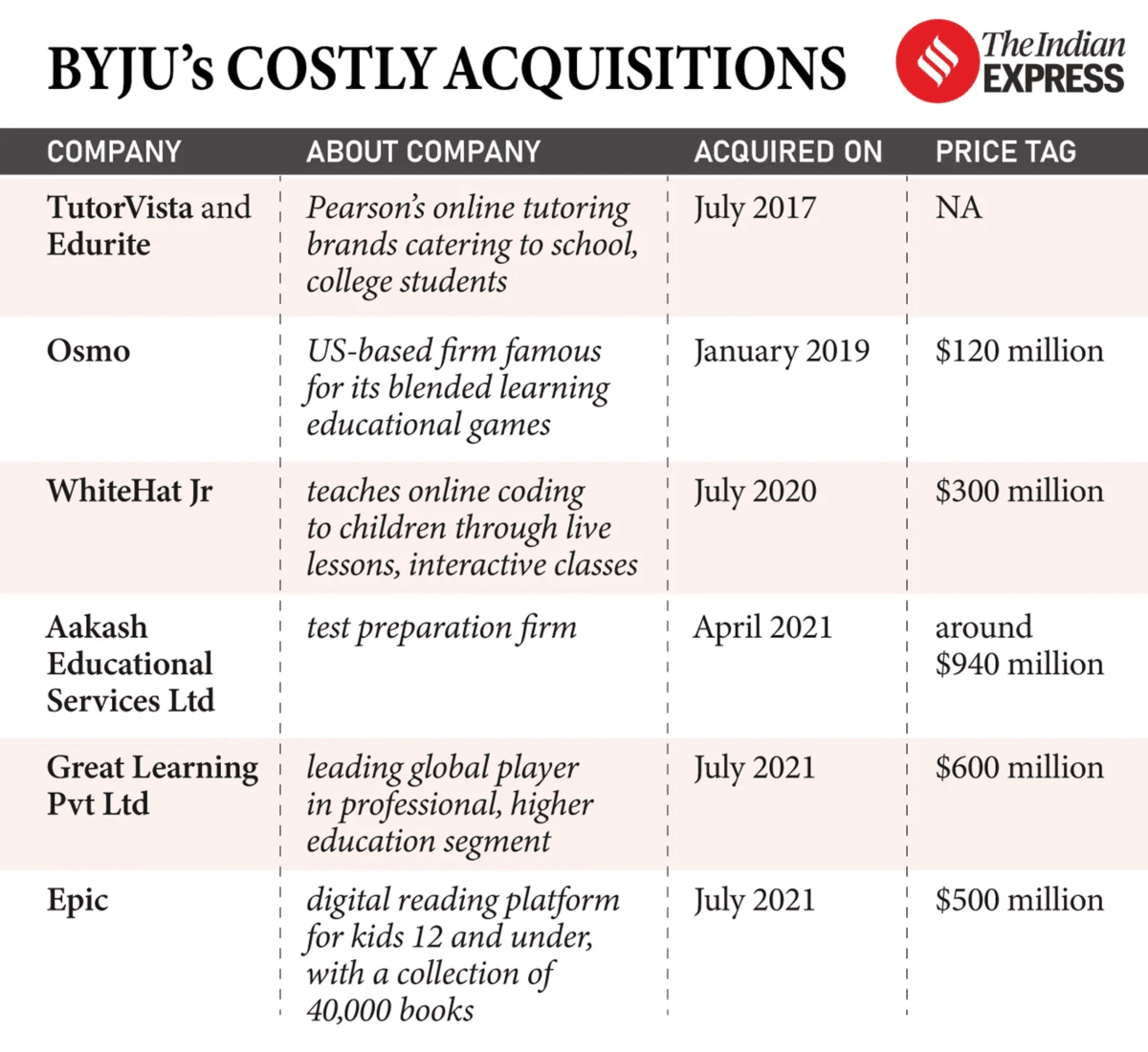

Byju’s sales expanded during the pandemic and millions of new learners joined the platform. However, the company made several wrong decisions and spent its cash on expensive acquisitions and brand deals.

For instance, it was the jersey sponsor of the Indian cricket team from 2019 to 2023, which cost it many millions of dollars. The company also signed up leading Indian celebrities as its brand ambassadors.

It was the official sponsor of the FIFA World Cup in Qatar in 2022 and is estimated to have spent around $40 million on the event. It also signed up Lionel Messi as the global brand ambassador of its social impact arm. Many raised eyebrows at these two deals as football is not a popular sports in India.

Expensive Acquisitions Were a Drain On the Company’s Finances

Striving to become an education powerhouse, Byju’s went on an acquisition spree and spent over $2.5 billion in acquiring education companies like WhiteHat Junior, Great Learning Private Limited, Aakash Educational Services, and US-based Osmo.

These acquisitions only added to Byju’s losses and WhiteHat Junior accounts for over a quarter of its losses. The company delayed the filings of fiscal year 2022 and eventually reported a $1 billion loss which was twice of the previous year.

Byju’s sales tactics were also questionable as many parents complained about being forced into expensive courses that they didn’t know were financed by debt. Also, the company had an aggressive culture, and sales personnel resorted to unethical sales practices, including making fraudulent sales under pressure from their bosses.

Edtech Sector’s Growth Nosedived After 2021

Like with online education companies in the US, Byju’s witnessed a slowdown as students shifted back to offline classes. Notably, the valuation of US edtech companies like Chegg has also plummeted. After losing students to offline classes they are now facing an exodus of students to artificial intelligence platforms like ChatGPT which seems like an existential threat to the sector unless of course players adopt AI more aggressively.

Byju’s has been facing one setback after the other over the last year. In July, Vivian Wu of the Chan Zuckerberg Initiative, G V Ravishankar of Sequoia Capital (now Peak XV Partners), and Russell Dreisenstock of Prosus resigned from the company’s board amid differences with the founder.

Deloitte also stepped down as Byju’s auditor at that time after the delay in filing the company’s financial reports.

Byju’s Faces Legal Proceedings

In November, The Enforcement Directorate (ED) of India issued a show cause notice to Byju’s and its founder Byju Raveendran for alleged violations of the country’s foreign exchange laws. The notice came after an ED investigation found that Byju’s contravened provisions under India’s Foreign Exchange Management Act (FEMA).

The problems have only worsened in 2024 with the company even struggling to pay the salaries of its employees. It defaulted on a $1.2 billion term loan from US-based lenders who then took it to bankruptcy court.

A majority of its lenders have now filed petitions to initiate involuntary Chapter 11 bankruptcy proceedings against three US-based guarantors for the term loan.

“As a result of Byju’s failed leadership and mismanagement, significant harm has been done to its businesses and the value of its assets. Shareholders and lenders of the company have seen the value of their investments deteriorate, employees and vendors have not been paid in a timely manner, and customers have suffered,” said the lenders in their statement earlier this week.

All said the valuation slump in Byju’s valuation and its getting marked down to zero by some investors is only the final nail in the coffin of the troubled edtech company. It would need nothing short of a miracle to sustain the business whose probability does not look good as things stand today.