Gautam Adani, the founder and chairperson of Adani Group, cannot escape from controversy for long. In the most recent case, a New York Federal Court indicted the billionaire along with other defendants in a massive fraud case. As expected, Adani Group shares tanked today following the news.

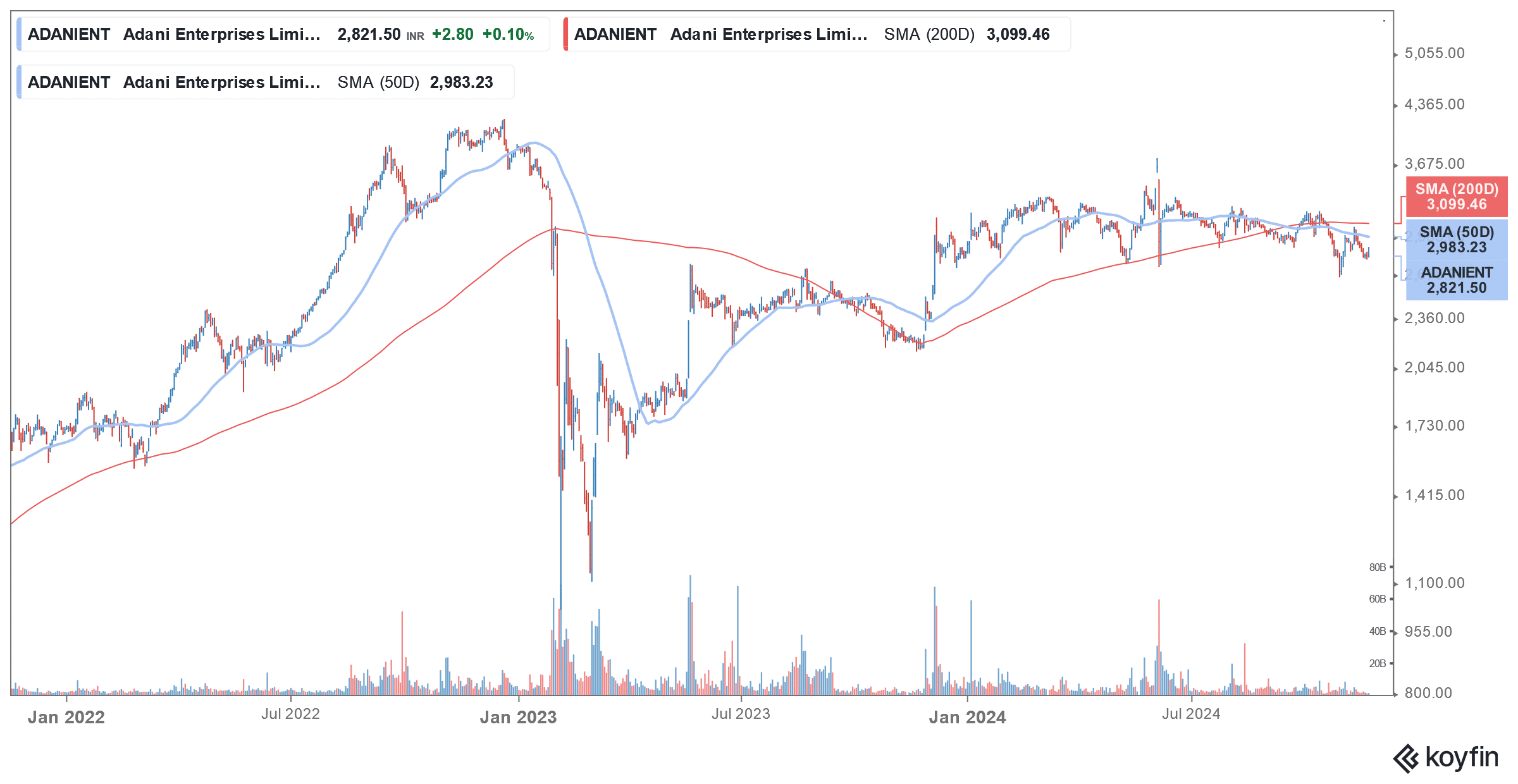

Investors are feeling quite a bit of déjà vu as the stock crashed last year after the US short-seller Hindenburg Research slammed the Adani Group in a scathing report. Back then, the allegations were mostly dismissed as biased as they came from a short seller who stood to benefit tremendously from the crash in Adani Group shares. Today’s crash is likely much more serious and may hamper the company for many years.

https://twitter.com/moneycontrolcom/status/1859438031301660775

US Court Indicts Adani Along With Seven Executives

The Brooklyn federal court has indicted Gautam Adani along with other company executives over charges of wire fraud, securities fraud, and violations of the Foreign Corrupt Practices Act (FCPA). The prosecutors allege that Gautam Adani personally met government officials to secure multi-billion-dollar renewable energy contracts for his companies by paying bribes.

They allegedly paid a bribe of $250 million to secure the contract which would generate a profit after tax of $2 billion over its 20-year tenure. According to the indictment, Gautam Adani, Sagar Adani, and Vneet S. Jaain lied about the bribery as they went on to raise capital from US and international investors.

“Gautam S. Adani and seven other business executives allegedly bribed the Indian government to finance lucrative contracts designed to benefit their businesses. Adani and other defendants also defrauded investors by raising capital on the basis of false statements about bribery and corruption, while still other defendants allegedly attempted to conceal the bribery conspiracy by obstructing the government’s investigation,” stated FBI Assistant Director in Charge James E. Dennehy.

As expected, the Adani Group has denied all these allegations and said, “The Adani Group has always upheld and is steadfastly committed to maintaining the highest standards of governance, transparency and regulatory compliance across all jurisdictions of its operations. We assure our stakeholders, partners and employees that we are a law-abiding organisation, fully compliant with all laws.”

Implications of the Indictment

Adani Group shares plummeted today with the flagship Adani Enterprises falling by almost 23%. Shares of Indian public sector banks, which have significant exposure to the Adani Group, also plummeted.

After the indictment, Adani Green Energy canceled plans to raise nearly $600 million through dollar-denominated bonds. Listed bonds of the group also fell today amid the risk-off environment towards the Indian conglomerate. The indictment is a big blow to the company, especially since it had been seeking foreign investment to cut its debt and fund its growth.

Shares of US-based GQG Partners, which is among the biggest backers of Adani Group and has invested in group companies, crashed 25% today in Australia. The Rajiv Jain-led company is now reviewing its investments in the group.

Gautam Adani’s net worth also fell by over $10 billion today as the value of his shares tanked. A Reuters report said that arrest warrants have been issued against him and Sagar Adani and prosecutors are expected to present them to foreign law enforcers.

Notably, the warrant might lead to the freezing of Adani’s assets and might restrict his international travel. The next step after the indictment would be the arraignment stage where the judge will communicate the charges to the accused and decide whether to grant them bail. The case will proceed to the jury trial if the accused people decide to plead “not guilty.”

Hindenburg Accused Adani Group of Fraud

Meanwhile, it’s not the first time that the Adani Group has been accused of wrongdoing. Last month, a court in Kenya canceled a $736 million deal between Adani Energy Solutions and the state-owned Kenya Electrical Transmission Company (KETRACO), arguing that the agreement was “a constitutional sham”. Previously, there were also protests in the country over plans to lease an airport to the Adani Group

https://twitter.com/DonaldBKipkorir/status/1859434193471615090

In 2023, Hindenburg Research accused the Group of engaging in a “brazen stock manipulation and accounting fraud scheme over the course of decades.” Among others, it alleged that Gautam Adani’s brother Vinod Adani used a network of offshore shell entities to invest in Indian-listed shares of Adani Group without due disclosure.

The short seller firm alleged they did this with the intention for money laundering and stock price manipulation as these offshore entities held a big chunk of the public float of Adani Group shares. The report also found that Adani Group is shockingly overleveraged. After the allegations, the Group took several actions to cut its burgeoning debt pile, including raising cash through a private placement of shares.

The Adani Group is also facing allegations of over-invoicing of the coal that it imported and sold to state utilities in India. Documents secured by the watchdog Organized Crime and Corruption Reporting Project (OCCRP) earlier this year revealed that it passed off low-quality coal as high-grade. In the process, it not only allegedly overcharged utilities and, by extension, consumers who end up paying a higher power tariff, but also worsened India’s pollution problem.

India’s Second Richest Man Has Been Close to Narendra Modi

In its report, the OCCRP added, “While not definitive, the data adds strong new evidence to over-invoicing allegations against the politically powerful Adani Group, which is perceived as close to Prime Minister Narendra Modi and is India’s largest importer and private producer of coal.”

Notably, Adani’s apparent proximity to Modi and the ruling Bhartiya Janta Party (BJP) has been an issue opposition parties have been raising for quite some time. Adani, who is the second richest Indian owns several ports and airports in the country (which some allege the billionaire was able to acquire using his political connections) and his wealth has exploded exponentially in Modi’s tenure.

Gautam Adani has been accused of quid pro quo dealings many times over the years. For example, in 2022, he purchased the popular NDTV news channel which was quite critical of Modi and his BJP. Many of the key people at NDTV have since left the channel and it is now visibly soft on the ruling BJP.

Indian Authorities Have Been Allegedly Soft on Adani

Meanwhile, Indian authorities, including the market watchdog SEBI (Securities and Exchange Board of India) have allegedly been quite soft on Adani, even following the Hindenburg allegations. To be sure, even the country’s Supreme Court backed the inaction.

However, the opposition has been demanding a JPC (joint parliamentary committee) to investigate the issues related to the group. After Adani’s indictment in the US, India’s leading opposition party Congress has said that its demand for a JPC is vindicated and even called for the billionaire’s arrest.